Find Cheap Insurance

In today's world, finding affordable insurance coverage is a top priority for many individuals and businesses. With rising costs and the need to protect our assets, it's crucial to explore strategies to secure the best insurance deals. This comprehensive guide aims to provide an in-depth analysis of the steps and considerations involved in discovering cheap insurance options.

Understanding the Insurance Landscape

The insurance industry is vast and complex, offering a wide range of policies to cater to diverse needs. From auto insurance to health insurance, homeowners’ insurance, and business insurance, the options can be overwhelming. Understanding the specific type of insurance you require is the first step towards finding a suitable and affordable policy.

Moreover, it's essential to grasp the key factors that influence insurance premiums. These factors include risk assessment, claim history, policy coverage, and demographic details. By familiarizing yourself with these aspects, you can make informed decisions when shopping for insurance.

Risk Assessment and Premium Calculation

Insurance companies assess the level of risk associated with insuring a particular individual or entity. This risk assessment determines the premium you’ll pay for your policy. Factors like age, gender, location, and occupation can impact your risk profile. For instance, younger drivers are often considered higher risk and face higher premiums for auto insurance.

Similarly, the type of coverage you choose and the limits you set can significantly affect your premium. Opting for higher deductibles or choosing a policy with narrower coverage may result in reduced premiums, but it's essential to strike a balance between cost and adequate protection.

| Insurance Type | Key Factors Influencing Premiums |

|---|---|

| Auto Insurance | Driving record, vehicle type, location, coverage limits |

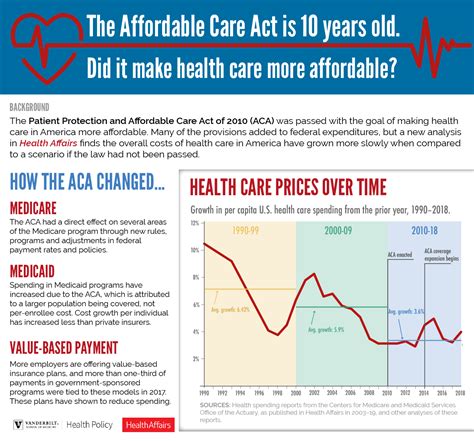

| Health Insurance | Age, pre-existing conditions, plan type (e.g., PPO, HMO) |

| Homeowners' Insurance | Location, home value, construction type, coverage limits |

| Business Insurance | Industry, revenue, number of employees, coverage type |

Shopping for Insurance: A Comprehensive Approach

Now that we’ve established a foundation of knowledge, let’s delve into the practical steps to find cheap insurance.

Assess Your Needs

Before beginning your search, clearly define your insurance needs. Consider the level of coverage you require, your budget, and any specific requirements based on your circumstances. For example, if you have a high-performance sports car, you’ll need specialized auto insurance coverage.

Compare Quotes

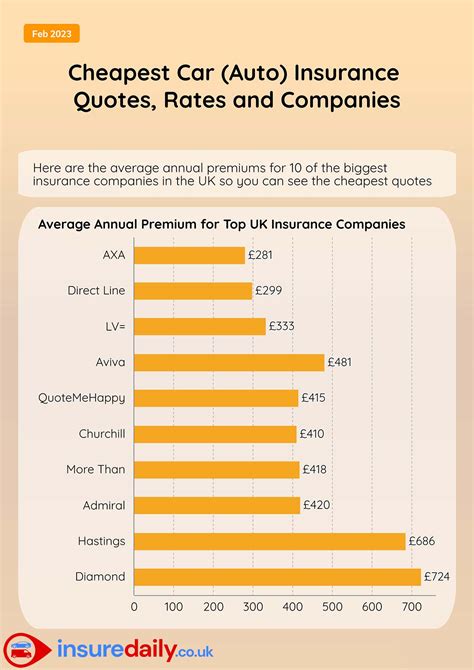

Obtain quotes from multiple insurance providers to compare prices and coverage. Utilize online tools and insurance brokers to gather a range of options. Ensure you’re comparing apples to apples by considering similar coverage limits and deductibles when evaluating quotes.

Explore Discounts and Bundles

Insurance companies often offer discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Bundle your insurance needs with a single provider to save on each policy.

- Safe Driver Discounts : Auto insurance providers may offer discounts for clean driving records.

- Loyalty Discounts: Long-term customers can often secure discounts for their loyalty.

- Occupational Discounts: Certain professions may qualify for reduced premiums.

- Homeowner Discounts: Homeowners may receive discounts based on the security features of their home.

Consider Alternative Insurance Options

Explore alternative insurance providers, including mutual insurance companies and regional insurers. These companies may offer more competitive rates, especially for niche insurance needs.

Review Your Policy Regularly

Insurance needs can change over time. Regularly review your policy to ensure it aligns with your current circumstances. This includes assessing whether you have the right coverage limits and whether you qualify for any new discounts.

The Impact of Technology on Insurance Costs

The rise of digital technology has transformed the insurance industry, offering new opportunities for cost savings.

Online Insurance Platforms

Online insurance platforms have emerged as a convenient and efficient way to compare insurance quotes. These platforms allow users to input their details once and receive multiple quotes from different providers, saving time and effort.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior, is revolutionizing auto insurance. Usage-based insurance policies, often referred to as pay-as-you-drive or pay-how-you-drive, offer discounts to safe drivers based on real-time data. This technology provides a more accurate assessment of risk, leading to potentially lower premiums for responsible drivers.

Digital Claims Management

Digital claims management systems streamline the claims process, reducing administrative costs for insurance providers. This efficiency can be passed on to customers in the form of lower premiums.

Conclusion: A Strategic Approach to Affordable Insurance

Finding cheap insurance requires a strategic and informed approach. By understanding the factors that influence premiums, shopping around for quotes, exploring discounts, and leveraging technology, you can secure the best insurance deals. Remember, the key to affordable insurance is a combination of adequate coverage and competitive pricing.

FAQ

What are the benefits of bundle insurance policies?

+Bundling your insurance policies with a single provider can result in significant savings. Insurance companies often offer multi-policy discounts, which means you’ll pay less for each policy when you bundle them together. This is particularly beneficial for homeowners who can bundle their homeowners’ and auto insurance policies, for example.

How do I know if I’m eligible for occupational discounts on my insurance premiums?

+Occupational discounts are offered by some insurance providers based on the assumption that certain professions have lower risk profiles. Common professions that may qualify for discounts include teachers, engineers, and military personnel. To find out if you’re eligible, contact your insurance provider or check their website for a list of qualifying occupations.

What is usage-based insurance, and how can it help me save on auto insurance premiums?

+Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, is a type of auto insurance policy that uses telematics technology to track your driving behavior. By installing a small device in your vehicle or using a smartphone app, your insurance provider can monitor factors like driving distance, time of day, and sudden stops. Responsible driving behavior can lead to lower premiums, as the insurance company gains a more accurate understanding of your risk profile.