Does Aarp Offer Health Insurance

For individuals aged 50 and above, the American Association of Retired Persons (AARP) has emerged as a trusted resource for a wide range of services and benefits, including health insurance. This comprehensive guide will delve into the various health insurance offerings provided by AARP, exploring their coverage, benefits, and how they can assist individuals in navigating the complex world of healthcare.

AARP’s Role in Healthcare

AARP, a non-profit organization, has played a pivotal role in advocating for the rights and well-being of older Americans since its inception in 1958. While it is commonly associated with membership benefits like discounts and access to services, its influence extends far beyond. AARP’s involvement in healthcare is particularly notable, as it strives to empower its members to make informed decisions about their health and well-being.

AARP Health Insurance Plans

AARP offers a diverse range of health insurance plans tailored to meet the unique needs of its members. These plans are designed in collaboration with leading insurance providers, ensuring comprehensive coverage and competitive pricing. Here’s an in-depth look at some of the key health insurance options available through AARP:

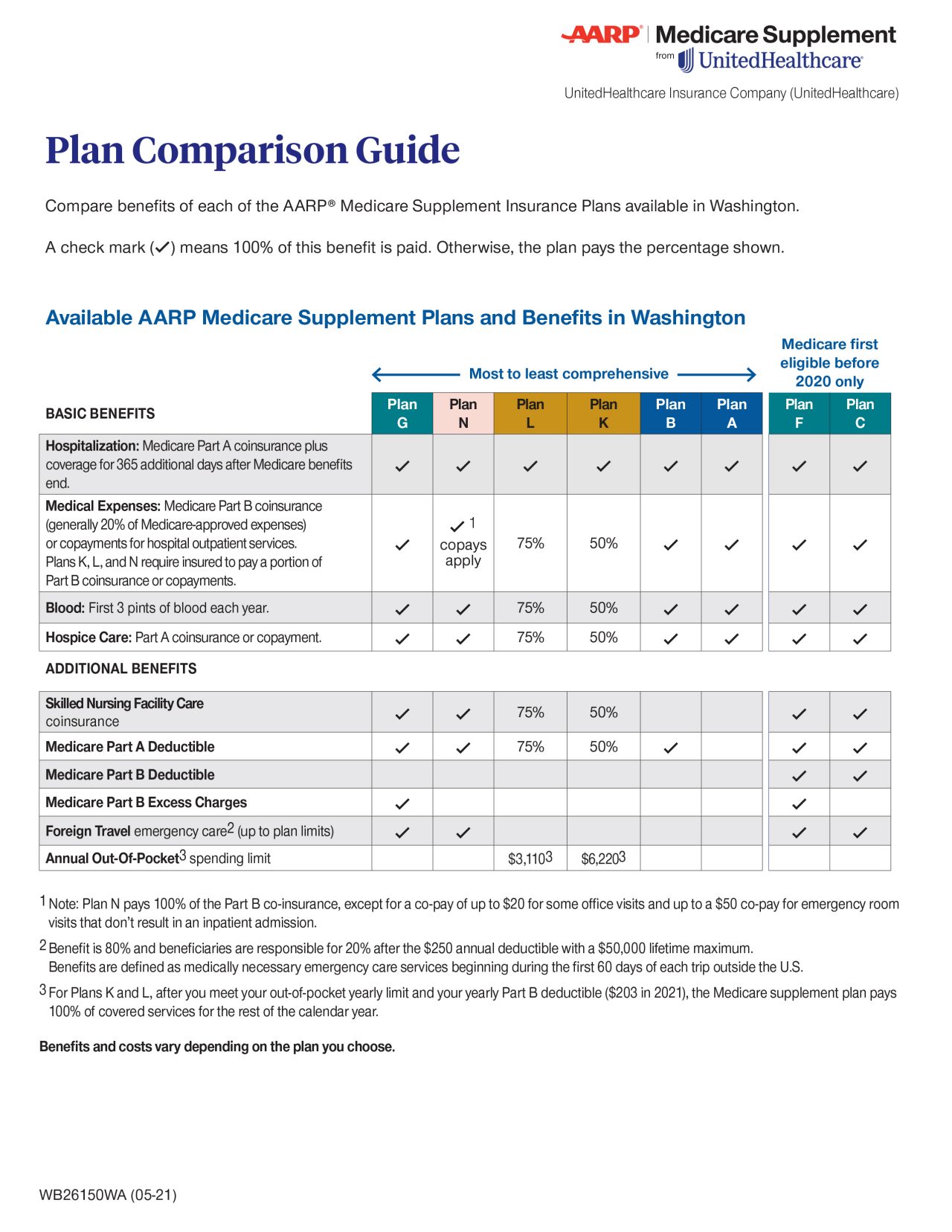

Medicare Supplement Plans (Medigap)

AARP understands the importance of Medicare for individuals aged 65 and above, as well as those with certain disabilities. To complement Medicare coverage, AARP offers Medigap plans, which are specifically designed to fill the gaps left by original Medicare. These plans cover a range of expenses, including co-payments, deductibles, and other out-of-pocket costs.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Covers basic Medicare Part A and Part B deductibles and co-payments. |

| Plan F | Comprehensive coverage, including Medicare Part A deductible, Part B deductible, and Part B excess charges. |

| Plan G | Similar to Plan F but with a Part B deductible coverage. |

Medicare Advantage Plans

AARP also offers a selection of Medicare Advantage plans, which are an alternative to original Medicare. These plans are provided by private insurance companies and often include additional benefits beyond what Medicare covers. AARP’s Medicare Advantage plans typically offer:

- Prescription drug coverage (Part D)

- Vision and dental care

- Fitness and wellness programs

- Hearing aid discounts

Dental and Vision Insurance

AARP recognizes the importance of maintaining good oral and eye health, especially as individuals age. To address this need, AARP provides dental and vision insurance plans, offering coverage for a range of services, including:

- Routine dental check-ups and cleanings

- Major dental procedures (e.g., root canals, crowns)

- Vision exams and eyeglasses or contact lens allowances

- Discounts on laser eye surgery

Prescription Drug Coverage

AARP understands the financial burden that prescription medications can place on individuals, especially those on multiple medications. To alleviate this burden, AARP offers prescription drug coverage plans that can be combined with Medicare Part D or other insurance plans. These plans provide discounts on a wide range of prescription drugs, helping members save on their medication costs.

Hospital Indemnity Plans

AARP’s Hospital Indemnity plans provide additional financial protection for members in the event of a hospital stay. These plans offer a fixed daily benefit amount for each day of hospitalization, helping to cover expenses not covered by traditional health insurance.

Benefits and Advantages of AARP Health Insurance

Choosing an AARP health insurance plan comes with several notable benefits and advantages. Here’s a closer look at some of the key advantages:

Wide Network of Providers

AARP health insurance plans are backed by a vast network of healthcare providers, ensuring that members have access to a wide range of medical professionals and facilities. This network includes primary care physicians, specialists, hospitals, and more, making it convenient for members to receive the care they need.

Comprehensive Coverage

AARP’s health insurance plans are designed to provide comprehensive coverage, ensuring that members have access to essential healthcare services. Whether it’s routine check-ups, specialized treatments, or emergency care, AARP plans aim to cover a broad spectrum of medical needs.

Affordable Premiums

AARP works closely with insurance providers to negotiate competitive premiums for its members. This means that AARP health insurance plans often offer more affordable options compared to similar plans on the open market. Additionally, AARP members may be eligible for discounts or special rates, further reducing the cost of coverage.

Customizable Plans

Recognizing that everyone’s healthcare needs are unique, AARP offers a variety of plan options to cater to different requirements. Members can choose from a range of deductibles, co-payments, and additional benefits to create a plan that aligns with their specific needs and budget.

Easy Enrollment and Support

AARP provides a seamless enrollment process, making it simple for members to sign up for the health insurance plan that best suits their needs. Additionally, AARP offers dedicated support services to assist members with any questions or concerns they may have throughout the enrollment process and beyond.

Making the Most of AARP Health Insurance

To ensure that you maximize the benefits of your AARP health insurance plan, here are some key considerations and tips:

Understand Your Coverage

Take the time to thoroughly review your plan’s benefits and coverage details. Understand what is covered, any exclusions or limitations, and any out-of-pocket costs you may incur. Being well-informed will help you make the most of your coverage and avoid unexpected expenses.

Utilize Preventive Care

AARP health insurance plans often cover a range of preventive care services, such as annual physicals, immunizations, and screenings. Taking advantage of these services can help detect potential health issues early on, leading to better health outcomes and potentially lower healthcare costs in the long run.

Choose In-Network Providers

To maximize your benefits and avoid unexpected costs, it’s generally best to utilize healthcare providers within your plan’s network. AARP’s extensive provider network makes it easier to find in-network options for your medical needs.

Explore Additional Benefits

AARP health insurance plans often come with additional benefits beyond basic medical coverage. These may include wellness programs, discounts on health-related products and services, or access to health coaching and support services. Taking advantage of these additional benefits can further enhance your overall well-being.

Stay Informed and Engaged

Healthcare policies and coverage can change over time. Stay up-to-date with any updates or changes to your plan, and regularly review your coverage to ensure it continues to meet your needs. AARP provides resources and support to help members stay informed and engaged with their healthcare options.

Conclusion

AARP’s health insurance offerings provide a valuable resource for individuals aged 50 and above, offering comprehensive coverage, affordable premiums, and a wide range of benefits. By choosing an AARP health insurance plan, members can access high-quality healthcare services while enjoying the peace of mind that comes with knowing they are well-protected. With AARP’s expertise and dedication to its members’ well-being, individuals can confidently navigate the complexities of healthcare and make informed decisions about their health.

Can I enroll in AARP health insurance plans if I’m not a member of AARP?

+Yes, you can enroll in AARP health insurance plans even if you’re not a member of AARP. However, AARP members often receive additional benefits and discounts on their health insurance plans.

What is the enrollment period for AARP health insurance plans?

+The enrollment period for AARP health insurance plans varies depending on the specific plan and your eligibility. Generally, there are open enrollment periods for Medicare plans, as well as special enrollment periods for certain life events. It’s best to consult AARP or your insurance provider for specific details.

Can I switch my health insurance plan if I’m not satisfied with my current coverage?

+Yes, you have the option to switch your health insurance plan if you find that your current coverage is not meeting your needs. However, it’s important to carefully review the terms and conditions of your existing plan and understand any potential penalties or fees associated with switching.