Oriental Insurance

Welcome to an in-depth exploration of Oriental Insurance Company Limited, a prominent player in the Indian insurance landscape. With a rich history spanning decades, this company has carved a significant niche in the industry. In this article, we will delve into its origins, evolution, product offerings, and the impact it has had on the Indian insurance sector. By the end of this journey, you'll have a comprehensive understanding of Oriental Insurance's role and its future prospects.

A Historical Perspective: Oriental Insurance’s Origins and Growth

Oriental Insurance Company Limited, often simply referred to as Oriental Insurance, has its roots firmly planted in the soil of Indian history. Established in 1947, the same year India gained its independence, the company was initially a division of Oriental Fire and General Insurance Company Limited. This origin story gives it a unique place in the annals of Indian business history.

Over the years, Oriental Insurance witnessed a metamorphosis. In 1972, it underwent a significant transformation when the Indian government nationalized it, bringing it under the purview of the General Insurance Corporation of India (GIC). This pivotal move not only secured its place in the insurance industry but also positioned it as a key player in the country's insurance sector.

The company's growth trajectory has been nothing short of impressive. With a solid foundation and a forward-thinking approach, Oriental Insurance expanded its reach and product portfolio. By 2007, it had become a household name in India, known for its comprehensive insurance solutions. Today, it stands as a testament to the power of evolution and adaptation in the ever-changing insurance landscape.

Milestones and Achievements

Oriental Insurance’s journey has been marked by several significant milestones. One of the most notable achievements was its ISO 9001:2008 certification in 2011, a testament to its commitment to quality and customer satisfaction. This certification, along with its consistent growth and innovative product offerings, has solidified its position as a leading insurer in India.

| Milestone | Year |

|---|---|

| Inception as a division of Oriental Fire and General Insurance Company Limited | 1947 |

| Nationalization and inclusion in GIC | 1972 |

| ISO 9001:2008 certification | 2011 |

| Launch of innovative health insurance plans | 2015 |

Product Portfolio: A Comprehensive Overview

Oriental Insurance offers a wide array of insurance products, catering to the diverse needs of its customers. From health insurance to motor insurance, the company has established itself as a one-stop solution for all insurance requirements.

Health Insurance

In an era where health concerns are paramount, Oriental Insurance’s health insurance plans have gained immense popularity. The company offers a range of policies, including individual health insurance, family health insurance, and senior citizen health insurance. These plans provide comprehensive coverage, ensuring financial protection during medical emergencies. With innovative features like cashless treatment and pre- and post-hospitalization benefits, Oriental Insurance has set a new benchmark in the health insurance segment.

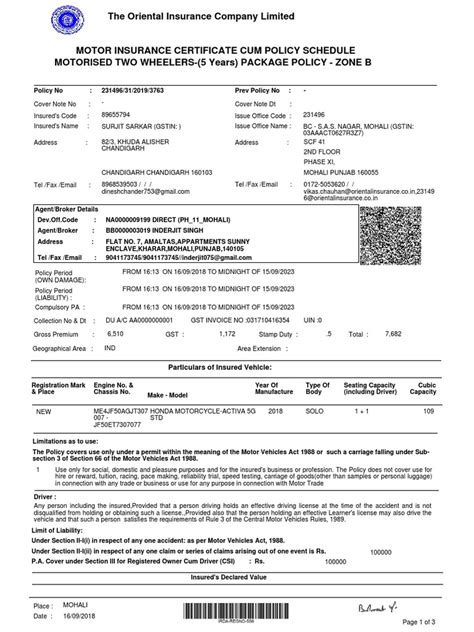

Motor Insurance

For vehicle owners, Oriental Insurance provides a comprehensive range of motor insurance policies. Whether it’s a car, two-wheeler, or commercial vehicle, the company offers customized plans. These policies not only comply with the legal requirements of the Motor Vehicles Act but also provide additional benefits like personal accident cover and roadside assistance. Oriental Insurance’s motor insurance plans have become synonymous with reliability and peace of mind for vehicle owners across India.

Other Insurance Offerings

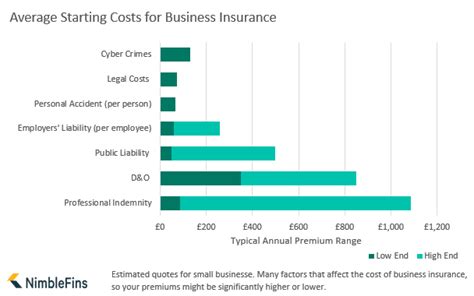

Beyond health and motor insurance, Oriental Insurance extends its expertise to a variety of other insurance domains. This includes home insurance, travel insurance, personal accident insurance, and even cyber insurance. Each of these products is tailored to address specific risks and provide tailored solutions. Whether it’s protecting your home from natural disasters or safeguarding your online identity, Oriental Insurance has a plan to suit every need.

Impact and Contributions to the Indian Insurance Sector

Oriental Insurance’s presence and contributions to the Indian insurance sector are profound. By offering innovative and customer-centric insurance solutions, the company has played a pivotal role in shaping the industry. Its impact can be seen across various domains, from driving market growth to enhancing consumer awareness and protection.

Market Growth and Penetration

With its extensive product portfolio and robust distribution network, Oriental Insurance has significantly contributed to the growth of the Indian insurance market. The company’s reach extends to both urban and rural areas, ensuring that insurance services are accessible to a wider population. This has played a vital role in increasing insurance penetration in the country, making insurance an integral part of financial planning for millions of Indians.

Consumer Awareness and Education

Oriental Insurance has been at the forefront of consumer awareness and education initiatives. Through its comprehensive marketing campaigns and educational programs, the company has empowered customers with the knowledge to make informed insurance decisions. This has not only increased insurance literacy but has also fostered a culture of financial responsibility and planning among Indians.

Industry Leadership and Innovation

Over the years, Oriental Insurance has established itself as a leader in the insurance industry. Its innovative product offerings and forward-thinking strategies have set new standards for the sector. The company’s ability to adapt to changing market dynamics and customer needs has positioned it as a trailblazer. From introducing digital platforms for policy management to offering personalized insurance plans, Oriental Insurance continues to redefine the insurance landscape in India.

FAQs

What are the key benefits of Oriental Insurance’s health insurance plans?

+

Oriental Insurance’s health insurance plans offer a range of benefits, including cashless treatment at network hospitals, coverage for pre-existing diseases, and access to a wide network of healthcare providers. These plans also provide comprehensive coverage for hospitalization expenses, including room and boarding, surgeon and specialist fees, and diagnostic tests.

How can I renew my motor insurance policy with Oriental Insurance?

+

Renewing your motor insurance policy with Oriental Insurance is a straightforward process. You can renew your policy online through their official website or mobile app. Simply log in to your account, select the “Renew Policy” option, and follow the instructions. Alternatively, you can visit the nearest Oriental Insurance branch or contact their customer support for assistance.

What makes Oriental Insurance’s home insurance plans unique?

+

Oriental Insurance’s home insurance plans are designed to offer comprehensive protection for your home and its contents. These plans cover a wide range of risks, including fire, natural disasters, theft, and even damage caused by riots or terrorism. Additionally, they provide optional add-ons like personal liability coverage and legal assistance, making them a comprehensive solution for homeowners.

How can I reach Oriental Insurance’s customer support for assistance?

+

Oriental Insurance provides multiple channels for customer support. You can reach their customer care team through their toll-free number 1800-103-0066 or send an email to customercare@orientalinsurance.co.in. Additionally, you can visit their official website or mobile app for online assistance and live chat options. Their customer support team is available to address your queries and concerns promptly.