Does Insurance Pay For Vasectomy

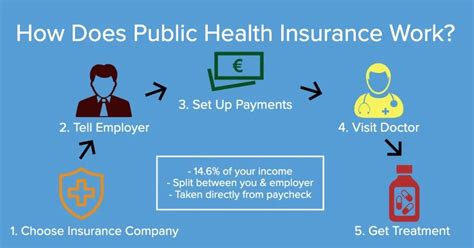

Vasectomy is a common surgical procedure for permanent male contraception, and many individuals may wonder whether their insurance coverage includes this procedure. The answer is not a simple yes or no; it depends on various factors, including the insurance provider, policy type, and even the state in which the procedure is performed. Let's delve into the intricacies of insurance coverage for vasectomies and explore the factors that influence whether this procedure is covered.

Understanding Insurance Coverage for Vasectomy

Insurance coverage for vasectomy can vary significantly. While some insurance plans may offer comprehensive coverage, others may provide limited or no coverage at all. Here's a breakdown of the key factors that influence whether insurance pays for a vasectomy:

Insurance Provider and Policy Type

Different insurance companies and plans have distinct policies regarding vasectomy coverage. Some insurance providers may classify vasectomy as a medically necessary procedure, especially if it is recommended for health reasons or as a treatment for a medical condition. In such cases, insurance may cover the procedure in full or with a minimal copay.

On the other hand, many insurance plans consider vasectomy an elective or cosmetic procedure, which means they may not provide coverage. These plans may require individuals to pay out of pocket for the entire cost of the procedure, including the surgeon's fees, anesthesia, and any associated medical expenses.

| Insurance Provider | Coverage Type |

|---|---|

| Blue Cross Blue Shield | Varies by plan; some cover as a medical necessity, others as elective. |

| UnitedHealthcare | Generally covers vasectomy as a preventative measure. |

| Aetna | Covers vasectomy if recommended by a physician; may require pre-authorization. |

| Cigna | Coverage varies; some plans include vasectomy as a covered benefit. |

State Laws and Regulations

Surprisingly, state laws play a significant role in determining insurance coverage for vasectomies. Some states have enacted legislation that requires insurance companies to cover vasectomy as a basic health benefit, ensuring that individuals have access to this form of contraception. These states recognize the importance of reproductive choice and aim to reduce financial barriers to family planning.

Conversely, there are states where insurance coverage for vasectomy is not mandated. In these regions, insurance providers have more discretion in deciding whether to include vasectomy in their covered benefits. This lack of standardization can create confusion and inconsistencies in coverage across different states.

Individual Policy Benefits and Limitations

Even within the same insurance provider, policy benefits can vary significantly. Some policies may offer comprehensive coverage for a wide range of medical procedures, including vasectomy. These policies often have higher premiums but provide peace of mind regarding unexpected medical expenses.

Alternatively, basic or low-cost insurance plans may have limited coverage for elective procedures. While they may cover essential medical services, vasectomy and other elective surgeries may be excluded from the benefits package. It is crucial for individuals to carefully review their policy documents and understand the scope of their coverage.

Pre-Authorization and Medical Necessity

In many cases, insurance companies require pre-authorization for vasectomy procedures. This means that before scheduling the surgery, individuals must obtain approval from their insurance provider. The insurance company will review the medical necessity of the procedure and decide whether it is covered under the policy.

Medical necessity is determined based on various factors, including the individual's medical history, current health status, and the recommendation of a qualified healthcare professional. If the procedure is deemed medically necessary, insurance is more likely to cover it. However, if it is considered elective, the individual may be responsible for the full cost.

The Cost of Vasectomy and Out-of-Pocket Expenses

The cost of a vasectomy can vary depending on several factors, including the location, the surgeon's expertise, and any additional medical services required. On average, the procedure can range from a few hundred to a few thousand dollars. Here's a breakdown of the potential out-of-pocket expenses:

- Surgeon's Fee: This can vary widely, typically ranging from $500 to $1,500 or more. It depends on the surgeon's experience and the complexity of the procedure.

- Anesthesia: Local anesthesia is often used for vasectomy, and the cost can be included in the surgeon's fee. However, if general anesthesia is required, it may incur additional expenses.

- Facility Fees: The surgical facility where the procedure is performed may charge a fee for the use of its facilities and equipment. These fees can vary significantly and may not be covered by insurance.

- Post-Procedure Care: Follow-up appointments and any necessary medications or treatments after the procedure may also incur costs. These expenses are typically not included in the initial procedure fee.

If insurance does not cover vasectomy, individuals may need to budget for the entire cost of the procedure. However, some insurance plans offer flexible spending accounts (FSAs) or health savings accounts (HSAs) that can be used to pay for out-of-pocket medical expenses.

Maximizing Insurance Coverage for Vasectomy

If you're considering a vasectomy and want to maximize your insurance coverage, here are some steps you can take:

- Review Your Policy: Carefully examine your insurance policy documents to understand the scope of coverage. Look for specific mentions of vasectomy or similar procedures and note any exclusions or limitations.

- Contact Your Insurance Provider: Reach out to your insurance company's customer service team to clarify any uncertainties regarding coverage. They can provide detailed information about what is and isn't covered under your policy.

- Obtain a Pre-Authorization: If your insurance requires pre-authorization, ensure you follow the necessary steps. Provide all the required medical information and documentation to increase the chances of approval.

- Consider Alternative Insurance Plans: If your current insurance plan does not cover vasectomy, you may explore alternative options. Some insurance providers offer specialized plans that include vasectomy as a covered benefit.

- Negotiate Costs: Discuss the procedure's cost with your healthcare provider. They may offer payment plans or discounts, especially if you are a regular patient or have a good relationship with the practice.

Conclusion: Navigating Insurance for Vasectomy

The question of whether insurance pays for vasectomy is not straightforward. It depends on a multitude of factors, including insurance provider policies, state regulations, and individual plan benefits. Understanding these factors and taking proactive steps to maximize coverage can help individuals make informed decisions about their reproductive healthcare.

While some may find themselves responsible for the full cost of the procedure, others may benefit from comprehensive insurance coverage. Ultimately, it is essential to prioritize your health and well-being and choose the option that best suits your needs and circumstances.

Frequently Asked Questions

Can I get a vasectomy if I don’t have insurance coverage?

+

Yes, it is possible to undergo a vasectomy without insurance coverage. You would need to pay for the procedure out of pocket, but many healthcare providers offer payment plans or discounts to make it more affordable.

Are there any alternative methods of male contraception besides vasectomy that insurance might cover?

+

Some insurance plans may cover other forms of male contraception, such as condoms or male hormonal contraceptives. It’s important to review your specific insurance policy to understand what is covered.

What if my insurance provider denies coverage for my vasectomy?

+

If your insurance provider denies coverage, you can appeal the decision by providing additional medical information or seeking assistance from patient advocacy groups. It’s worth exploring all available options to ensure fair consideration.

Can I switch insurance plans to find better coverage for vasectomy?

+

Yes, you can explore different insurance plans during open enrollment periods to find one that better suits your needs. Researching and comparing plan benefits can help you make an informed decision.

Are there any financial assistance programs available for vasectomy procedures?

+

Some healthcare providers and organizations offer financial assistance programs or sliding-scale fees for vasectomy procedures. These programs aim to make reproductive healthcare more accessible to those in need.