Auto Insurance Florida Companies

When it comes to auto insurance in Florida, residents and visitors alike have a plethora of options to choose from. With a diverse insurance market, understanding the intricacies and differences between companies can be a daunting task. This guide aims to provide a comprehensive overview of the auto insurance landscape in Florida, offering valuable insights to help you make informed decisions.

Understanding Auto Insurance in Florida

Florida’s unique geographic and demographic characteristics play a significant role in shaping its auto insurance market. With its sunny climate, diverse population, and extensive road network, the state presents a complex environment for insurers. This section will delve into the specific factors that influence auto insurance in Florida, offering a foundation for understanding the industry’s dynamics.

Florida’s Insurance Requirements

Florida is a no-fault state, which means that drivers are required to carry Personal Injury Protection (PIP) insurance. This coverage pays for medical expenses and lost wages up to the policy limits, regardless of who is at fault in an accident. Additionally, property damage liability (PDL) insurance is also mandatory. Here’s a breakdown of the minimum coverage requirements in Florida:

| Coverage Type | Minimum Requirement |

|---|---|

| Personal Injury Protection (PIP) | $10,000 per person |

| Property Damage Liability (PDL) | $10,000 per accident |

It's important to note that while these are the minimum requirements, many drivers opt for higher coverage limits to ensure adequate protection in the event of an accident.

Factors Influencing Auto Insurance Rates

Auto insurance rates in Florida are influenced by a multitude of factors, including:

- Location: Urban areas like Miami and Tampa often have higher rates due to increased traffic congestion and risk of accidents.

- Age and Gender: Younger drivers, especially males, tend to face higher premiums due to statistical risk factors.

- Vehicle Type: Expensive or high-performance vehicles may attract higher premiums.

- Driving Record: A clean driving record with no accidents or violations can lead to lower rates.

- Credit Score: Insurers in Florida often consider credit scores when determining rates, with higher scores generally resulting in lower premiums.

Understanding these factors can help drivers make informed choices when selecting an insurance policy.

Top Auto Insurance Companies in Florida

Florida’s auto insurance market is highly competitive, with a range of companies offering various coverage options. Here’s an in-depth look at some of the leading insurers in the state, including their unique offerings and customer satisfaction ratings.

State Farm

State Farm is one of the most recognizable names in the insurance industry, and its presence in Florida is substantial. With a focus on customer service and a wide range of coverage options, State Farm caters to a diverse range of drivers. The company offers standard auto insurance policies, as well as specialty coverage for classic cars and rideshare drivers.

State Farm's customer satisfaction ratings are consistently high, with a strong emphasis on personalized service. The company provides a user-friendly online platform for policy management and claims processing, making it convenient for customers to handle their insurance needs.

Geico

Geico, known for its catchy advertising campaigns, is another major player in Florida’s auto insurance market. The company offers competitive rates and a wide array of coverage options, making it a popular choice among drivers. Geico provides standard auto insurance policies, as well as specialized coverage for military personnel and federal employees.

One of Geico's standout features is its digital innovation. The company has invested heavily in technology, offering a seamless online experience for policyholders. From quick quotes to easy claims processing, Geico's digital platform is highly praised by customers.

Progressive

Progressive is a well-known insurer that has made its mark in Florida with its innovative approach to auto insurance. The company offers a range of coverage options, including standard policies, as well as specialized coverage for high-risk drivers and teen drivers. Progressive is particularly known for its Snapshot program, which uses telematics to monitor driving behavior and offer discounts based on safe driving habits.

Progressive's customer-centric approach extends to its claims process, with a dedicated team of claims specialists available 24/7. The company also offers a unique Name Your Price tool, allowing customers to set their desired coverage limits and receive tailored policy options.

Allstate

Allstate is a trusted name in the insurance industry, offering a comprehensive range of auto insurance products in Florida. The company provides standard policies, as well as specialized coverage for high-risk drivers and those with unique needs. Allstate’s unique features include its Drivewise program, which uses telematics to monitor driving behavior and offer discounts for safe driving.

Allstate's commitment to customer service is evident through its network of local agents. These agents provide personalized guidance and support, ensuring that customers receive the coverage that best suits their needs. Additionally, Allstate offers a range of discounts, including multi-policy and safe driver discounts.

USAA

USAA is a unique insurer, exclusively serving active military personnel, veterans, and their families. With a strong focus on military culture and values, USAA offers highly competitive auto insurance rates and specialized coverage tailored to the needs of military members. The company’s comprehensive policies include benefits such as rental car coverage and gap insurance.

USAA's dedication to its members is evident through its exceptional customer service. The company provides a dedicated team of military-trained specialists who understand the unique challenges faced by service members. USAA's mobile app and online platform also offer convenient policy management and claims processing.

Choosing the Right Auto Insurance Company in Florida

With so many options available, selecting the right auto insurance company in Florida can be a challenging task. Here are some key considerations to keep in mind when making your decision:

Coverage Options

Ensure that the insurance company offers the coverage options you need. Consider factors such as the value of your vehicle, your driving record, and any specific requirements you may have. Some drivers may benefit from specialized coverage, such as rental car reimbursement or roadside assistance.

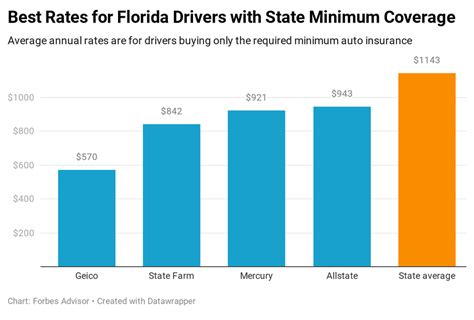

Premium Costs

Compare premiums across different companies to find the most competitive rates. Keep in mind that the cheapest option may not always be the best, as it’s important to balance cost with the level of coverage and customer service provided.

Customer Service and Claims Handling

Research the company’s reputation for customer service and claims handling. Look for online reviews and ratings to gauge customer satisfaction. A responsive and efficient claims process can make a significant difference in the event of an accident.

Discounts and Rewards

Inquire about the discounts and rewards programs offered by each insurer. Common discounts include multi-policy, safe driver, and good student discounts. Some companies also offer loyalty rewards or discounts for completing defensive driving courses.

The Future of Auto Insurance in Florida

The auto insurance industry in Florida is constantly evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of auto insurance in the state:

Telematics and Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining popularity. This innovative approach uses telematics devices to monitor driving behavior, offering discounts to safe drivers. With the increasing adoption of connected cars and smartphone apps, this trend is likely to continue, providing more personalized and data-driven insurance options.

Digital Transformation

Insurance companies are investing heavily in digital transformation to enhance the customer experience. From online quote comparisons to mobile claims processing, the insurance industry is embracing technology to streamline processes and improve efficiency. This digital shift is expected to continue, with insurers leveraging artificial intelligence and machine learning to further optimize their operations.

Increased Focus on Customer Experience

In a competitive market like Florida, customer experience will play a crucial role in differentiating insurers. Companies that prioritize personalized service, quick response times, and convenient digital tools will likely gain a competitive edge. The focus on customer-centric approaches is expected to intensify, with insurers aiming to build long-term relationships based on trust and satisfaction.

What are the average auto insurance rates in Florida?

+Average auto insurance rates in Florida vary based on several factors, including location, age, gender, and driving record. According to recent data, the average annual premium for a minimum coverage policy in Florida is around 1,200, while a full coverage policy can cost upwards of 2,000.

How can I get cheap auto insurance in Florida?

+To find cheap auto insurance in Florida, consider shopping around and comparing quotes from multiple insurers. Additionally, maintain a clean driving record, explore discounts, and opt for higher deductibles to lower your premiums.

What factors influence auto insurance rates in Florida?

+Auto insurance rates in Florida are influenced by factors such as location, age, gender, vehicle type, driving record, and credit score. Urban areas, younger drivers, high-performance vehicles, and poor credit scores generally result in higher premiums.

Can I bundle my auto insurance with other policies to save money?

+Yes, bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Many insurers offer multi-policy discounts, so it’s worth exploring this option.

What should I do if I’m involved in an accident in Florida?

+If you’re involved in an accident in Florida, the first step is to ensure your safety and the safety of others involved. Exchange contact and insurance information with the other driver(s), and report the accident to the police. Contact your insurance company as soon as possible to initiate the claims process.