Office Insurance Policy

When it comes to running a successful business, having the right insurance coverage is paramount. Office insurance is a crucial aspect of risk management for any organization, big or small. It provides protection against a wide range of potential risks and liabilities that could otherwise cripple a company financially. This comprehensive guide aims to delve deep into the world of office insurance, exploring its various facets, benefits, and considerations.

Understanding Office Insurance

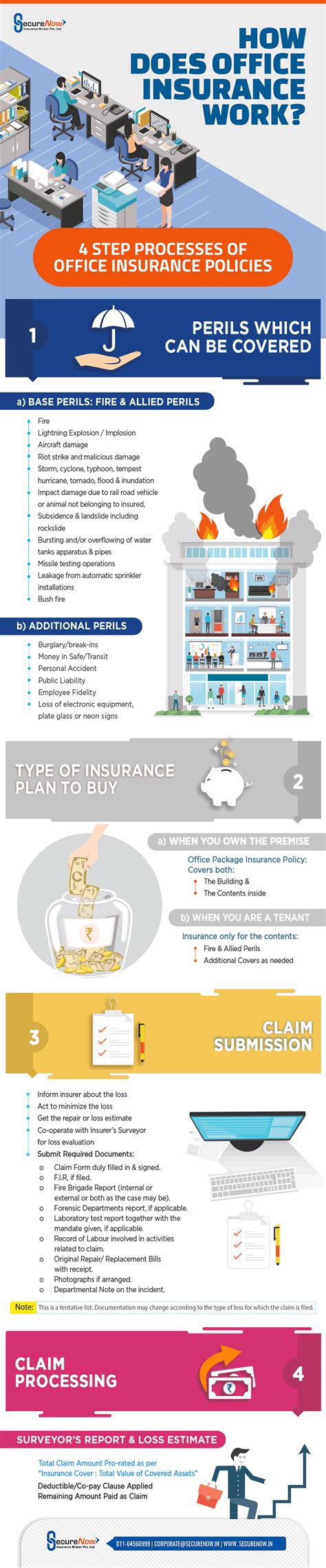

Office insurance, often referred to as commercial property insurance, is designed to safeguard businesses against losses stemming from various incidents that can occur within an office environment. It is a tailored insurance policy that covers a broad spectrum of potential risks, including but not limited to fire, theft, vandalism, natural disasters, and even cyber attacks. The primary goal of this insurance is to ensure that businesses can continue to operate seamlessly despite unforeseen circumstances that may cause physical or financial damage.

While the specific coverage and terms of an office insurance policy can vary depending on the provider and the business's unique needs, most policies encompass a standard set of features. These typically include protection for the physical office space, its contents, and the business's inventory. Additionally, office insurance often covers business interruption, which provides financial support during periods when the business cannot operate due to an insured event.

The Importance of Tailored Coverage

One of the key advantages of office insurance is its ability to be customized to meet the specific needs of a business. Every business is unique, with its own set of risks and vulnerabilities. A tailored office insurance policy can address these specific concerns, ensuring that the business is adequately protected. For instance, a business that deals with sensitive client data may require additional cyber insurance coverage, while a business located in a high-risk flood zone may need more comprehensive natural disaster coverage.

By working with an experienced insurance broker or provider, businesses can create a policy that fits their precise requirements. This process often involves a detailed assessment of the business's operations, potential risks, and financial capacity. The broker can then advise on the most suitable coverage, limits, and deductibles to ensure the business is protected without unnecessary financial strain.

Key Components of Office Insurance

Office insurance is a multifaceted solution, offering a range of coverages to address various potential risks. Let's explore some of the critical components of a typical office insurance policy.

Property Coverage

This is the foundation of any office insurance policy. Property coverage protects the physical office space, including the building itself and any permanent fixtures or improvements. It also extends to the contents of the office, such as furniture, equipment, and supplies. In the event of a covered loss, property coverage ensures that the business can repair or replace these items, enabling a swift return to normal operations.

Property coverage can be further tailored to meet specific needs. For instance, businesses with high-value items, such as specialized machinery or artwork, may require additional coverage to ensure full protection. Additionally, businesses located in areas prone to natural disasters may benefit from enhanced property coverage to address the unique risks associated with their location.

Business Interruption Coverage

A critical aspect of office insurance is business interruption coverage. This provision provides financial support to the business if it has to cease operations due to a covered loss. It can cover the costs of temporary relocation, additional expenses incurred during the interruption, and even lost income resulting from the shutdown. Business interruption coverage ensures that the business can maintain its financial stability and continue to meet its obligations, even when faced with significant challenges.

The scope of business interruption coverage can vary widely, depending on the business's needs and the terms of the policy. Some policies may provide coverage for a set period, while others may offer more extensive coverage, including protection against loss of reputation or customer confidence resulting from the interruption.

Liability Coverage

Liability coverage is an essential component of office insurance, protecting the business against claims of negligence or harm caused to others. This can include injuries to visitors or employees on the premises, as well as damage to third-party property. Liability coverage provides a financial safety net, covering legal costs, settlements, and any compensation awarded to the injured party.

For businesses that interact regularly with the public or have a high volume of visitors, such as retail stores or restaurants, liability coverage is especially crucial. It can help mitigate the financial impact of potential lawsuits, ensuring the business can continue to operate without being burdened by excessive legal fees or compensation payouts.

| Coverage Type | Description |

|---|---|

| Property Coverage | Protects the office space and its contents, ensuring repair or replacement after a covered loss. |

| Business Interruption Coverage | Provides financial support during periods when the business cannot operate due to a covered loss. |

| Liability Coverage | Protects the business against claims of negligence or harm caused to others, covering legal costs and compensation. |

Benefits of Office Insurance

Implementing a comprehensive office insurance policy offers a multitude of benefits, each critical to the long-term success and sustainability of a business.

Financial Protection

Perhaps the most obvious benefit of office insurance is the financial protection it provides. In the event of a covered loss, such as a fire or theft, the policy ensures that the business has the necessary funds to recover and rebuild. This financial support can be the difference between a temporary setback and a catastrophic failure, enabling the business to continue operations and maintain its market position.

Financial protection is especially crucial for small and medium-sized businesses, which often have limited resources to absorb significant losses. With office insurance, these businesses can have peace of mind, knowing that they are prepared for unforeseen circumstances and can focus on their growth and development without the constant worry of financial risk.

Peace of Mind

Beyond the financial aspect, office insurance provides a valuable sense of security and peace of mind. Business owners and managers can rest assured knowing that their operations, assets, and employees are protected against a wide range of potential risks. This peace of mind allows them to make strategic decisions and plan for the future without being hindered by concerns about potential losses.

With office insurance in place, businesses can focus on their core competencies, whether it's developing innovative products, expanding their market reach, or enhancing their operational efficiency. By offloading the burden of risk management to the insurance provider, businesses can optimize their resources and energies, leading to improved productivity and overall success.

Enhanced Reputation and Credibility

Office insurance can also play a role in enhancing a business's reputation and credibility. In today's competitive business landscape, customers and partners are increasingly discerning, often seeking assurance that the businesses they engage with are financially stable and well-managed. A comprehensive office insurance policy can provide this assurance, demonstrating a commitment to risk management and long-term sustainability.

Furthermore, having adequate insurance coverage can be a requirement for certain business transactions, such as contracts with government agencies or large corporations. By meeting these insurance requirements, businesses can open up new opportunities and partnerships, further bolstering their growth and market position.

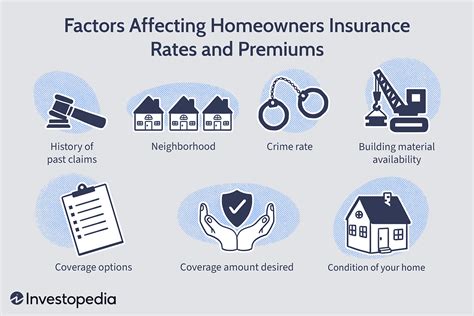

Considerations for Choosing Office Insurance

When selecting an office insurance policy, there are several key considerations to keep in mind to ensure that the chosen coverage aligns with the business's unique needs and circumstances.

Assessing Risk Profile

Every business has a unique risk profile, influenced by factors such as its industry, location, and operational practices. Before selecting an office insurance policy, it's essential to conduct a thorough risk assessment. This process involves identifying potential hazards and vulnerabilities that could impact the business, and then determining the likelihood and potential impact of these risks.

By understanding its risk profile, a business can tailor its insurance coverage to address these specific concerns. For instance, a business located in a flood-prone area may prioritize flood insurance, while a business that handles sensitive data may focus on cyber insurance. A comprehensive risk assessment ensures that the chosen policy provides adequate protection without unnecessary overcoverage.

Comparing Providers and Policies

The office insurance market is diverse, with a range of providers offering different policies and coverage options. It's crucial to compare multiple providers and policies to ensure that the chosen option offers the best value and coverage for the business's needs.

When comparing providers, consider factors such as their financial stability, reputation, and customer service record. A financially stable provider can ensure long-term support and continuity of coverage, while a reputable provider is more likely to have a strong understanding of the industry and its risks. Excellent customer service can be a vital asset when it comes to navigating the complexities of insurance claims and managing unexpected situations.

When comparing policies, pay close attention to the coverage limits, deductibles, and exclusions. Ensure that the policy provides sufficient coverage for the business's assets and potential liabilities. Consider the policy's terms and conditions, including any additional benefits or services that may be included, such as loss prevention resources or business continuity planning support.

Working with an Insurance Broker

For many businesses, especially those with complex risk profiles or unique insurance needs, working with an experienced insurance broker can be highly beneficial. An insurance broker acts as an intermediary between the business and the insurance providers, offering expert advice and guidance in selecting the most suitable policy.

Brokers have a deep understanding of the insurance market and can provide valuable insights into the various policies available. They can help businesses navigate the complexities of insurance terminology and coverage options, ensuring that the chosen policy aligns with the business's specific needs. Brokers can also advocate for their clients during the claims process, ensuring a fair and efficient resolution.

FAQs

What does office insurance typically cover?

+

Office insurance typically covers a range of potential risks, including fire, theft, vandalism, natural disasters, and even cyber attacks. It also often includes business interruption coverage, which provides financial support during periods when the business cannot operate due to a covered loss.

How do I choose the right office insurance policy for my business?

+

When selecting an office insurance policy, it’s crucial to assess your business’s unique risk profile, compare multiple providers and policies, and consider working with an experienced insurance broker. This process ensures that the chosen policy provides adequate coverage for your specific needs.

Can I tailor my office insurance policy to meet my business’s specific needs?

+

Yes, one of the key advantages of office insurance is its ability to be customized. By working with an insurance provider or broker, you can create a policy that addresses your business’s precise concerns, ensuring that you are adequately protected without unnecessary overcoverage.

What happens if I need to make a claim on my office insurance policy?

+

If you need to make a claim on your office insurance policy, the first step is to contact your insurance provider or broker. They will guide you through the claims process, which typically involves providing detailed information about the incident and any relevant documentation. It’s important to act promptly and follow the provider’s instructions to ensure a smooth and efficient claims process.

How often should I review and update my office insurance policy?

+

It’s recommended to review your office insurance policy annually or whenever there are significant changes to your business operations, assets, or liabilities. Regular reviews ensure that your coverage remains up-to-date and aligned with your evolving needs, allowing you to maintain adequate protection without unnecessary costs.