Cheapest Best Auto Insurance

In the vast landscape of financial services, auto insurance stands out as a crucial aspect of vehicle ownership, offering financial protection and peace of mind. The search for the cheapest best auto insurance is a common endeavor for many car owners, and understanding the intricacies of this market is key to making an informed decision.

Understanding the Auto Insurance Landscape

Auto insurance is a complex industry, with numerous providers offering a range of policies tailored to different needs and budgets. The goal is to find the best coverage at the most affordable price, but this can be a challenging task given the multitude of options available.

The cost of auto insurance is influenced by a variety of factors, including the make and model of your vehicle, your driving history, and your geographical location. Additionally, the level of coverage you require, such as liability-only or comprehensive coverage, will also impact the price.

Factors Influencing Auto Insurance Costs

Understanding these factors is crucial in your search for the cheapest best auto insurance. Here’s a breakdown of some key influences:

- Vehicle Type: Sports cars and luxury vehicles often carry higher insurance premiums due to their higher repair costs and perceived risk.

- Driving Record: A clean driving record can lead to significant savings, while accidents and traffic violations may increase your insurance costs.

- Location: Insurance rates vary by state and even by city. Urban areas often have higher rates due to increased traffic and the potential for accidents.

- Coverage Level: Basic liability coverage is typically the cheapest option, but it offers limited protection. Comprehensive coverage, including collision and comprehensive coverage, provides more extensive protection but comes at a higher cost.

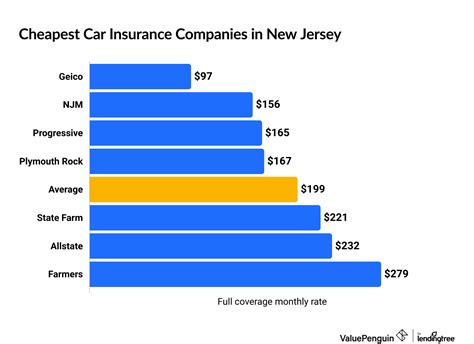

Comparing Insurance Providers

The market is filled with a plethora of insurance providers, each with its own unique offerings and pricing structures. Comparing these providers is essential to finding the best deal.

| Insurance Provider | Average Annual Premium | Key Features |

|---|---|---|

| Provider A | $1200 | Offers discounts for safe driving and loyalty. Provides 24/7 customer support. |

| Provider B | $1150 | Specializes in comprehensive coverage with additional benefits like rental car reimbursement. |

| Provider C | $1300 | Known for their customizable policies and flexible payment plans. |

When comparing providers, consider not just the price but also the quality of service, the range of coverage options, and any additional benefits or discounts they offer.

Strategies for Finding the Cheapest Best Auto Insurance

Navigating the auto insurance market to find the cheapest best option requires a strategic approach. Here are some tips to guide your search:

Research and Comparison

Start by researching and comparing multiple insurance providers. Online comparison tools can be a great resource, allowing you to quickly assess rates and coverage options from various companies.

Utilize Discounts

Many insurance providers offer discounts for various reasons, such as good driving records, loyalty, or even certain professional affiliations. Be sure to inquire about all available discounts when obtaining quotes.

Bundle Your Policies

If you also need homeowners, renters, or life insurance, consider bundling your policies with one provider. Many companies offer significant discounts for customers who bundle multiple policies, making it a cost-effective strategy.

Review Your Coverage Annually

Insurance rates and your personal circumstances can change over time. It’s a good practice to review your auto insurance policy annually to ensure you’re still getting the best deal. Don’t hesitate to shop around and switch providers if you find a better offer.

The Impact of Technological Advances

The auto insurance industry has been significantly influenced by technological advancements, particularly with the rise of telematics and usage-based insurance (UBI). These technologies allow insurers to gather real-time data about a driver’s behavior, which can lead to more accurate risk assessments and potentially lower premiums for safe drivers.

Usage-Based Insurance (UBI)

UBI policies, often referred to as “pay-as-you-drive” or “pay-how-you-drive” plans, use telematics devices or smartphone apps to monitor driving behavior. These policies can offer significant savings for safe drivers, as the insurance premium is directly linked to their actual driving habits and not just statistical averages.

Telematics and the Future of Auto Insurance

Telematics technology is expected to play an increasingly significant role in the auto insurance market. As more vehicles become equipped with advanced safety features and connected car technologies, insurers will have access to even more detailed data about driver behavior and vehicle performance. This data can be used to offer highly personalized insurance rates, further enhancing the accuracy and fairness of auto insurance premiums.

Conclusion: Making an Informed Choice

Finding the cheapest best auto insurance involves a comprehensive understanding of the market, your personal circumstances, and the various coverage options available. By researching, comparing, and staying informed about the latest industry trends and technological advancements, you can make a well-informed decision that suits your needs and budget.

Frequently Asked Questions

What factors can I control to reduce my auto insurance premiums?

+You can take steps to reduce your auto insurance premiums by maintaining a clean driving record, shopping around for the best rates, and considering higher deductibles. Additionally, safe driving practices and avoiding high-risk behaviors can lead to lower premiums over time.

How do usage-based insurance policies work, and are they a good option for me?

+Usage-based insurance policies use telematics to monitor your driving behavior, such as miles driven, time of day, and driving habits. These policies can be a good option if you’re a safe, low-mileage driver, as they can lead to significant savings. However, if you drive frequently or have a history of accidents, you may not see the same benefits.

What are some common discounts offered by auto insurance providers?

+Common discounts include safe driver discounts, loyalty discounts, multi-policy discounts (when you bundle auto insurance with other policies like homeowners or renters insurance), and good student discounts. Some providers also offer discounts for certain professions or membership in specific organizations.