Cheap Insure

The concept of cheap insurance might seem like an oxymoron to many, especially when it comes to the complex world of financial protection and risk management. However, the insurance industry is evolving, and with the right knowledge and strategies, it is indeed possible to secure affordable coverage without compromising on essential benefits.

In this comprehensive guide, we delve into the world of cheap insurance, exploring the factors that influence insurance costs, the various types of insurance policies available, and most importantly, the expert tips and tricks to navigate the market and secure the best deals. Whether you're a young professional looking to insure your first car or a business owner seeking comprehensive commercial coverage, this article aims to empower you with the tools to make informed decisions and access affordable insurance solutions.

Understanding the Landscape of Cheap Insurance

Before diving into the strategies for obtaining cheap insurance, it’s crucial to grasp the fundamental aspects that shape the insurance landscape. Insurance is a critical tool for managing financial risks, providing individuals and businesses with a safety net against unforeseen events. However, the cost of insurance can vary significantly based on numerous factors, making it essential to understand these influences to navigate the market effectively.

Factors Affecting Insurance Costs

The cost of insurance is determined by a multitude of variables, each contributing to the overall premium. These factors can be broadly categorized into two main groups: personal or business-specific factors and market-related influences.

- Personal/Business Factors: These include age, gender, health status, occupation, driving record (for auto insurance), the value of assets to be insured, and the nature of the business (for commercial insurance). For instance, a young, male driver is typically associated with higher premiums due to statistical risk factors.

- Market Factors: These encompass the broader insurance market dynamics, such as competition among insurers, economic conditions, regulatory changes, and the overall demand for insurance coverage. For example, a highly competitive market can drive down prices as insurers vie for customers.

By understanding these factors, you can begin to tailor your insurance strategy to minimize costs while still securing adequate coverage. This involves a combination of smart shopping, negotiating skills, and an awareness of your rights and options as a consumer.

Types of Insurance and Their Costs

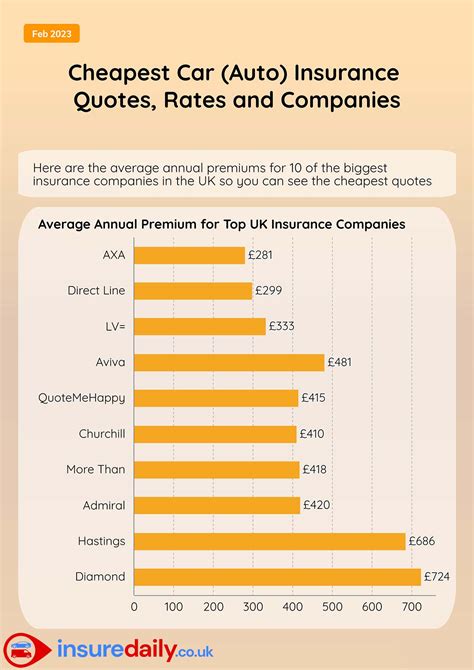

Insurance comes in various forms, each designed to address specific risks. The cost of these policies can vary widely, depending on the type of insurance, the level of coverage required, and the factors mentioned earlier. Here’s a glimpse into some common types of insurance and their associated costs:

| Type of Insurance | Average Cost |

|---|---|

| Auto Insurance | $500 - $1,500 annually |

| Homeowner's Insurance | $500 - $2,000 annually |

| Health Insurance | Varies widely based on coverage and provider; can range from a few hundred to several thousand dollars monthly. |

| Life Insurance | Term Life: $50 - $200 monthly; Whole Life: $100 - $1,000 monthly (varies based on coverage amount and term) |

| Business Insurance | Varies based on industry, business size, and coverage type; can range from a few hundred to several thousand dollars annually. |

These are rough estimates, and actual costs can deviate significantly based on individual circumstances. It's always advisable to obtain multiple quotes to understand the market rate for your specific needs.

Expert Strategies for Affordable Insurance

Securing cheap insurance requires a strategic approach. It involves a blend of research, understanding your options, and negotiating effectively. Here, we present a comprehensive guide to help you navigate the insurance market and find the best deals.

Research and Comparison

The first step towards cheap insurance is thorough research. Understand the type of insurance you need, the level of coverage required, and the factors that can influence your premium. Use online resources, speak to insurance agents, and compare quotes from multiple providers. Comparison shopping is crucial as it allows you to identify the best value for your money.

When comparing quotes, pay attention to the coverage details and not just the price. Ensure that the policies you're comparing offer similar levels of protection. Some insurers may offer lower premiums but with reduced coverage, which could leave you vulnerable in the event of a claim.

Online insurance comparison tools can be particularly useful, allowing you to quickly view quotes from various insurers in one place. These tools often provide a breakdown of coverage, deductibles, and other important details, making it easier to make an informed decision.

Bundle Policies for Discounts

Many insurance companies offer bundling discounts when you purchase multiple policies from them. For instance, if you have both auto and homeowner’s insurance, you might be eligible for a discount by bundling these policies with the same insurer. This strategy can lead to significant savings over time.

Additionally, consider the long-term benefits of bundling. When you have multiple policies with one insurer, it can streamline the claims process and provide a more seamless experience. It also ensures consistency in coverage, as the insurer is familiar with your needs and risks.

Negotiate for Better Rates

Negotiation is a powerful tool when it comes to insurance. Don’t be afraid to discuss your options and negotiate for a better rate. Insurance agents often have the discretion to offer discounts or negotiate terms, especially if you’re a loyal customer or have a good claims history.

When negotiating, highlight your loyalty to the insurer and any positive factors that make you a low-risk customer. For example, if you've been with the same insurer for years without making a claim, this can work in your favor. Also, be prepared to provide evidence or data to support your request for a lower premium.

Some insurers may offer loyalty discounts automatically, but it's always worth inquiring about additional savings. Don't hesitate to ask for a review of your policy and potential discounts, as this can lead to significant savings over the life of your insurance contract.

Utilize Technology and Online Resources

The digital age has revolutionized the insurance industry, making it easier than ever to access information and compare policies. Online insurance marketplaces and comparison websites provide a wealth of data, allowing you to quickly assess your options and make informed decisions.

Additionally, many insurers now offer online discounts or incentives for purchasing policies digitally. These discounts can range from a few percent to a significant reduction in your premium, so it's worth exploring these options.

Moreover, technology has enabled the development of usage-based insurance policies, particularly in auto insurance. These policies use telematics devices or smartphone apps to monitor your driving behavior, offering discounts to safe drivers. This pay-as-you-drive model can lead to substantial savings for those with a good driving record.

Consider Alternative Insurance Options

Traditional insurance policies aren’t the only option. There are various alternative insurance models that can provide coverage at a more affordable rate. For instance, mutual insurance companies are owned by their policyholders, often resulting in more competitive rates and better customer service.

Additionally, peer-to-peer insurance platforms are gaining traction. These platforms allow individuals to pool their resources and share risks, often resulting in lower premiums. While these models may not suit everyone, they provide an interesting alternative to traditional insurance and are worth exploring for those seeking innovative solutions.

FAQs

How can I lower my auto insurance costs as a young driver?

+As a young driver, auto insurance can be expensive due to statistical risk factors. To lower costs, consider taking a defensive driving course, which can lead to discounts. Maintain a clean driving record, as insurers reward safe driving. Explore usage-based insurance policies that offer discounts for safe driving habits. Finally, compare quotes from multiple insurers to find the best deal.

What are some ways to reduce the cost of health insurance?

+Health insurance costs can be reduced by shopping around and comparing plans. Look for plans with high deductibles, as they often have lower premiums. Consider Health Savings Accounts (HSAs) to save on taxes and cover out-of-pocket expenses. If eligible, enroll in government-sponsored programs like Medicaid or CHIP. Finally, maintain a healthy lifestyle, as insurers may offer discounts for wellness activities.

Are there any cheap insurance options for small businesses?

+Small businesses can access affordable insurance through various strategies. Shop around and compare quotes from multiple insurers. Bundle policies for discounts, and consider business insurance packages tailored to your industry. Explore group purchasing arrangements or buying groups, which can lead to lower premiums. Finally, maintain a strong risk management strategy to lower insurance costs over time.

In the quest for cheap insurance, knowledge is power. By understanding the factors that influence insurance costs, comparing policies, and utilizing various strategies, it’s possible to secure affordable coverage. Remember, insurance is a long-term investment in your financial security, and taking the time to find the right policy can pay dividends in the form of peace of mind and significant savings.