Best Property Insurance

When it comes to safeguarding your home and belongings, having the right property insurance is essential. In a world where unexpected events can occur, ensuring your assets are protected is a top priority. This article aims to guide you through the process of selecting the best property insurance, offering expert insights and comprehensive analysis to help you make an informed decision.

Understanding Property Insurance

Property insurance, often referred to as homeowners insurance or renters insurance, provides financial protection against various risks and perils associated with owning or renting a property. It serves as a safety net, covering damages to your home, personal belongings, and even liability claims that may arise.

The primary purpose of property insurance is to offer peace of mind and financial stability in the face of unforeseen circumstances. Whether it's a natural disaster, theft, or accidental damage, having the right coverage can make a significant difference in the aftermath of such events.

Factors to Consider When Choosing Property Insurance

Selecting the best property insurance involves careful consideration of several key factors. Here are some essential aspects to keep in mind:

Coverage Options

Different insurance providers offer a range of coverage options. It’s crucial to understand the specific risks you want to insure against. From natural disasters like hurricanes and earthquakes to more common issues such as fire, theft, and water damage, each policy may vary in its scope.

Consider the unique needs of your property and the potential hazards it faces. Some policies may provide broader coverage, while others might be more tailored to specific risks. Ensure that the coverage aligns with your requirements to avoid any gaps in protection.

Policy Limits and Deductibles

Policy limits dictate the maximum amount an insurance company will pay for a covered loss. It’s essential to choose limits that adequately reflect the value of your home and belongings. Underinsuring can lead to financial strain if a significant loss occurs.

Additionally, consider the deductibles associated with the policy. Deductibles are the amount you must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums, but it's crucial to strike a balance that ensures you can afford the deductible in case of an emergency.

Additional Coverage Options

Beyond the standard coverage, many insurance providers offer additional endorsements or riders to customize your policy. These options can provide protection for specific items or situations, such as jewelry, fine art, or personal liability for injuries sustained by guests on your property.

Assess your unique needs and consider adding these endorsements to enhance your coverage and provide the necessary protection for your valuable possessions.

Insurance Provider Reputation and Financial Stability

Choosing a reputable and financially stable insurance provider is vital. Research the company’s history, customer reviews, and financial ratings to ensure they have the resources to honor claims in the long term.

A reliable insurer will have a track record of prompt claim settlements and excellent customer service. Look for companies that prioritize transparency and have a solid reputation within the industry.

Comparing Property Insurance Policies

To make an informed decision, it’s essential to compare multiple property insurance policies. Here’s a step-by-step guide to help you through the comparison process:

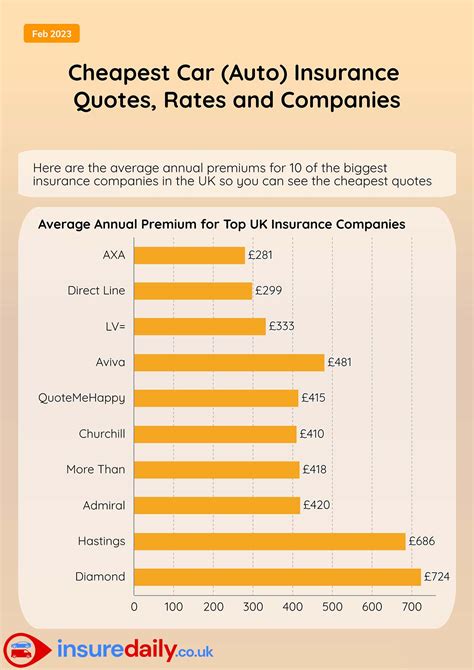

Obtain Quotes from Different Insurers

Start by requesting quotes from various insurance providers. Online quote tools and broker services can streamline this process, allowing you to gather multiple options in a short time.

Ensure you provide accurate and detailed information about your property and its contents to receive precise quotes. Compare the premiums, coverage limits, and any additional benefits offered by each insurer.

Review Policy Details and Exclusions

Pay close attention to the fine print of each policy. Understand the exclusions and limitations outlined in the insurance contract. Some common exclusions may include flood damage, earthquake coverage, or specific types of water damage.

If you have concerns or questions about certain exclusions, don't hesitate to reach out to the insurer for clarification. A clear understanding of what is and isn't covered is essential to avoid surprises during a claim.

Assess Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience as a policyholder. Research the insurer’s reputation for prompt and fair claim settlements. Look for online reviews and testimonials from current and past customers.

Consider contacting the insurer's customer support to gauge their responsiveness and professionalism. A company with a dedicated and knowledgeable customer service team can provide valuable assistance during the policy selection process and in the event of a claim.

Consider Additional Benefits and Discounts

Insurance providers often offer various benefits and discounts to attract customers. These can include multi-policy discounts, loyalty rewards, or discounts for specific safety features installed in your home.

Evaluate the additional benefits and discounts provided by each insurer. While these perks shouldn't be the sole deciding factor, they can enhance the overall value of the policy and provide savings in the long run.

Expert Tips for Choosing the Best Property Insurance

Here are some valuable tips from industry experts to help you make the right choice when selecting property insurance:

Understand Your Risks

Take the time to assess the unique risks associated with your property. Consider the location, environmental factors, and any specific hazards prevalent in your area. Understanding these risks will guide you in choosing the right coverage.

Bundle Policies for Savings

If you have multiple insurance needs, such as auto and home insurance, consider bundling your policies with the same insurer. Many providers offer discounts for multiple policies, providing significant savings over time.

Review Your Policy Annually

Property insurance needs may change over time due to factors like home improvements, changes in personal belongings, or shifts in the insurance market. Review your policy annually to ensure it aligns with your current needs and to take advantage of any new discounts or coverage options.

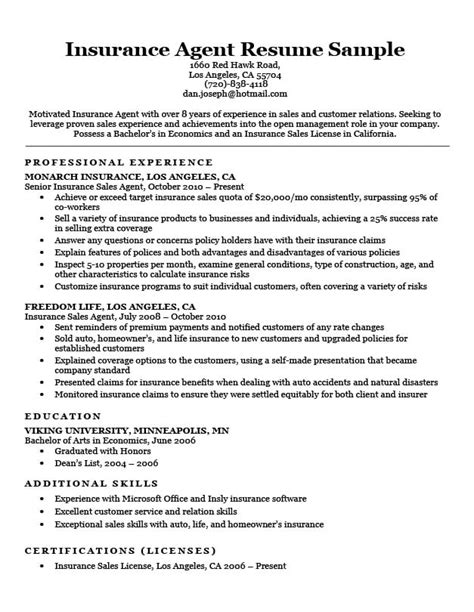

Seek Professional Advice

Consulting with an insurance broker or agent can provide valuable insights tailored to your specific circumstances. These professionals can help you navigate the complexities of property insurance and ensure you make an informed decision.

Case Study: Real-World Property Insurance Claims

To illustrate the importance of having the right property insurance, let’s explore a real-world case study. Imagine a homeowner, Ms. Johnson, who experienced a severe storm that caused extensive damage to her home.

Ms. Johnson had carefully chosen her property insurance policy, opting for a comprehensive coverage option that included protection against wind and hail damage. When the storm struck, she promptly filed a claim with her insurer.

The insurance company's efficient claims handling process ensured that Ms. Johnson received a fair and timely settlement. The policy's coverage limits were sufficient to cover the repairs, allowing her to restore her home to its pre-storm condition without financial strain.

This case study highlights the significance of selecting an appropriate property insurance policy that provides adequate coverage for the risks faced. It also underscores the importance of a reputable insurer with a proven track record of prompt claim settlements.

The Future of Property Insurance: Innovations and Trends

The property insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here are some emerging trends and innovations shaping the future of property insurance:

Digitalization and Data Analytics

Insurance providers are leveraging digital technologies and data analytics to enhance their services. From online quote tools to advanced risk assessment algorithms, digitalization streamlines the insurance process and improves accuracy.

Data analytics enable insurers to identify trends, predict risks, and personalize coverage options based on individual needs. This level of customization ensures that policyholders receive tailored protection.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data transmission, is gaining traction in property insurance. This technology allows insurers to monitor and assess risks in real-time, providing more accurate risk assessments and potentially lowering premiums for policyholders.

Parametric Insurance

Parametric insurance is an innovative approach that provides rapid payouts based on predefined parameters, such as wind speed or earthquake magnitude. This type of insurance offers a faster claims process and can be particularly beneficial in regions prone to natural disasters.

Smart Home Integration

The integration of smart home technology and property insurance is an emerging trend. Insurers are exploring ways to leverage smart devices and sensors to enhance risk assessment and offer personalized coverage options. Smart home systems can provide real-time data on potential hazards, allowing for more precise underwriting.

Conclusion

Choosing the best property insurance is a critical decision that requires careful consideration and research. By understanding your risks, comparing policies, and seeking expert advice, you can ensure you have the right coverage to protect your home and belongings.

As the property insurance industry evolves, staying informed about emerging trends and innovations will help you make the most of your insurance choices. Remember, having the right property insurance provides peace of mind and financial security, allowing you to focus on enjoying your home without worry.

What is the average cost of property insurance?

+The average cost of property insurance varies depending on factors such as location, property value, and coverage limits. According to recent data, the average annual premium for homeowners insurance in the United States is around $1,300. However, it’s essential to obtain quotes specific to your situation to get an accurate estimate.

How often should I review my property insurance policy?

+It is recommended to review your property insurance policy annually. This ensures that your coverage remains up-to-date and aligns with any changes in your circumstances or the insurance market. Regular reviews allow you to take advantage of new discounts or coverage options and make necessary adjustments.

What are some common exclusions in property insurance policies?

+Common exclusions in property insurance policies may include flood damage, earthquake coverage, war or civil unrest, intentional damage, and damage caused by pests or insects. It’s crucial to carefully review the policy’s exclusions to understand what is and isn’t covered.

Can I customize my property insurance policy to fit my needs?

+Absolutely! Many insurance providers offer customizable property insurance policies. You can tailor your coverage by selecting specific endorsements or riders that address your unique needs. For example, you can add coverage for valuable items like jewelry or fine art, or enhance your liability protection.

What should I do if I need to file a property insurance claim?

+If you need to file a property insurance claim, contact your insurance provider promptly. They will guide you through the claims process, which typically involves documenting the damage, providing supporting evidence, and working with the insurer’s claims adjusters to assess the extent of the loss. It’s essential to follow their instructions and provide accurate information to ensure a smooth claims process.