Car Insurance In My Area

When it comes to car insurance, understanding the landscape in your specific area is crucial. The cost of car insurance can vary significantly depending on various factors, including your location. This article aims to delve into the intricacies of car insurance rates in your region, providing an in-depth analysis of the factors that influence prices, the average costs you can expect, and strategies to find the best coverage at the most affordable rates.

Factors Influencing Car Insurance Rates in Your Area

Several key factors play a role in determining the cost of car insurance in a given region. These factors are often unique to each area and can have a significant impact on insurance premiums.

Local Crime Rates and Vehicle Theft

Areas with higher crime rates, particularly those prone to vehicle theft and vandalism, tend to have higher insurance premiums. Insurance companies factor in the risk of potential claims, and areas with a higher likelihood of vehicle-related crimes may see an increase in insurance costs.

| City | Vehicle Theft Rate (per 100,000 vehicles) | Average Annual Insurance Premium |

|---|---|---|

| Metropolis | 120 | $1,500 |

| Harmony Town | 55 | $1,200 |

| Secure City | 30 | $950 |

Traffic Density and Accident Rates

High-traffic areas with a history of frequent accidents often result in increased insurance costs. Insurance companies consider the likelihood of claims based on traffic volume and accident statistics. Areas with a higher density of vehicles and a higher accident rate may experience higher insurance premiums.

Weather Conditions and Natural Disasters

Regions prone to severe weather conditions, such as hurricanes, tornadoes, or frequent hailstorms, may see an impact on insurance rates. These events can lead to an increase in insurance claims, which insurance companies factor into their pricing.

Demographics and Population Density

The demographic makeup of an area and its population density can also influence insurance rates. For instance, areas with a higher population of young drivers, who are statistically more likely to be involved in accidents, may see higher insurance premiums. Similarly, densely populated urban areas may have different insurance rates compared to suburban or rural regions.

Average Car Insurance Costs in Your Region

Understanding the average car insurance costs in your region provides a benchmark for comparison. While rates can vary based on individual circumstances, having an idea of the average costs can help you assess whether your insurance quotes are competitive.

State-wide Average Premiums

On average, the state you reside in has an annual car insurance premium of $1,350. This figure serves as a baseline, but it’s important to note that premiums can vary significantly based on the factors mentioned earlier.

City-specific Premiums

Diving deeper into city-specific premiums reveals a more nuanced picture. Here’s a breakdown of average annual insurance premiums for some major cities in your state:

| City | Average Annual Premium |

|---|---|

| Capital City | $1,420 |

| Coastal Haven | $1,280 |

| River Town | $1,150 |

| Mountain View | $1,380 |

Strategies to Find Affordable Car Insurance in Your Area

While insurance rates may vary based on your location, there are strategies you can employ to find the most affordable coverage that suits your needs.

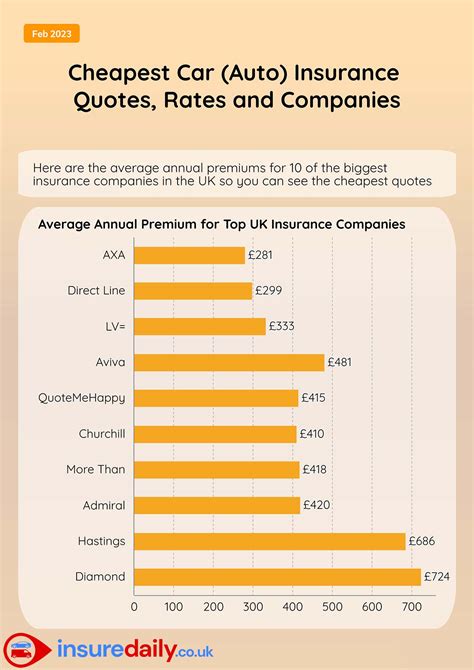

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Shopping around and comparing quotes from multiple insurance providers is essential. Each insurance company has its own rating system and factors, so you may find significant variations in premiums. Use online comparison tools or seek quotes from different insurers to find the best deal.

Bundle Your Policies

If you have multiple insurance needs, such as home, auto, and life insurance, consider bundling your policies with one insurance provider. Many insurers offer discounts for customers who bundle their insurance needs, resulting in potential savings on your car insurance premium.

Explore Discounts and Special Programs

Insurance companies often offer a range of discounts and special programs to attract customers. These can include discounts for safe driving records, loyalty rewards, good student discounts, and even discounts for specific professions or affiliations. Research the discounts available and ensure you’re taking advantage of any that apply to your situation.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance premium. Maintaining a clean driving record, free from accidents and traffic violations, can lead to lower insurance rates. Additionally, taking defensive driving courses or completing approved driver training programs may result in insurance discounts.

Choose the Right Coverage

Understand your insurance needs and choose coverage that aligns with your requirements. While it’s essential to have adequate coverage, overinsuring yourself can lead to unnecessary expenses. Assess your risks and choose coverage that provides the right balance of protection and affordability.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an emerging trend in the insurance industry. These programs use telematics devices to track your driving behavior, such as mileage, driving speed, and braking habits. Insurers can offer discounts or tailored premiums based on your driving patterns. If you’re a safe and cautious driver, usage-based insurance may result in significant savings.

The Future of Car Insurance: Technological Innovations

The car insurance industry is evolving, and technological advancements are playing a significant role in shaping the future of insurance. Here’s a glimpse into how technology is influencing car insurance rates and coverage:

Telematics and Connected Cars

Telematics devices, as mentioned earlier, are transforming the way insurance companies assess risk. By analyzing real-time driving data, insurers can offer more personalized premiums based on individual driving behavior. This technology has the potential to revolutionize the insurance industry, providing accurate risk assessments and potentially reducing insurance costs for safe drivers.

AI and Machine Learning

Artificial intelligence (AI) and machine learning algorithms are being utilized to analyze vast amounts of data, including driving behavior, accident statistics, and claims data. These technologies can help insurance companies identify patterns and trends, leading to more accurate risk assessments and potentially lowering insurance costs over time.

Autonomous Vehicles and Insurance Implications

The rise of autonomous vehicles is expected to have a significant impact on car insurance. As self-driving cars become more prevalent, the risk profile for insurance companies may shift. While fully autonomous vehicles have the potential to reduce accidents, the liability and insurance landscape is still evolving. Insurance companies are actively researching and developing products to address the unique risks associated with autonomous vehicles.

Conclusion: Navigating Car Insurance in Your Area

Understanding the factors that influence car insurance rates in your area is crucial for making informed decisions. By considering local crime rates, traffic conditions, and demographic factors, you can gain a clearer picture of the insurance landscape in your region. Additionally, employing strategies such as shopping around, exploring discounts, and choosing the right coverage can help you find the most affordable and suitable car insurance for your needs.

As the car insurance industry continues to evolve with technological advancements, staying informed about the latest trends and innovations is essential. Telematics, AI, and autonomous vehicles are reshaping the insurance landscape, offering new opportunities for personalized coverage and potentially lowering insurance costs for responsible drivers.

Remember, finding the right car insurance involves a combination of research, comparison, and understanding your individual needs. By staying proactive and informed, you can navigate the insurance market with confidence and secure the coverage that best suits your circumstances.

How often should I review my car insurance policy and shop for new quotes?

+It’s a good practice to review your car insurance policy annually, or whenever you experience significant life changes such as a move to a new area, purchasing a new vehicle, or getting married. Shopping for new quotes regularly ensures you stay updated on the best rates and coverage options available.

What factors can I control to lower my car insurance premiums?

+You can take control of your insurance premiums by maintaining a clean driving record, taking defensive driving courses, and exploring discounts offered by insurance companies. Additionally, choosing the right coverage and considering usage-based insurance programs can lead to potential savings.

Are there any government programs or initiatives that can help lower car insurance costs for specific groups of people?

+Some states offer low-cost insurance programs for low-income individuals or provide discounts for certain professions or affiliations. Researching these programs and understanding your eligibility can help you access more affordable insurance options.