Car Cheap Insurance Quote

Finding affordable car insurance is a top priority for many vehicle owners, and the quest for the best car cheap insurance quote often leads to a myriad of questions and considerations. This article aims to guide you through the process of securing the most advantageous insurance coverage for your vehicle, offering an in-depth analysis of various factors that influence insurance rates and the steps you can take to reduce your premiums.

Understanding Car Insurance Quotes

Car insurance quotes are customized estimates of the cost of insuring your vehicle, taking into account a range of factors that insurance companies consider when assessing risk. These factors can include your age, driving history, the type of vehicle you own, and the location where you typically drive. Understanding these variables is crucial to obtaining the best possible quote.

Key Factors Influencing Insurance Rates

- Age and Driving Experience: Younger drivers, especially those under 25, often face higher insurance premiums due to their lack of driving experience. Insurance companies view younger drivers as higher risk, as they are statistically more likely to be involved in accidents.

- Driving History: A clean driving record is a significant advantage when it comes to insurance quotes. If you have a history of accidents or traffic violations, you may face higher premiums. Conversely, a long record of safe driving can lead to substantial discounts.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a role in insurance quotes. Sports cars and luxury vehicles, for instance, often have higher insurance rates due to their performance capabilities and potential for theft. Additionally, the purpose for which you use your vehicle can impact your quote. If you primarily use your car for business purposes, your insurance rates may be higher than if you only use it for personal travel.

- Location: The area where you live and drive has a significant impact on your insurance rates. Urban areas, for example, typically have higher rates due to the increased risk of accidents and car theft. Rural areas, on the other hand, may offer lower rates.

Tips for Reducing Insurance Costs

While some factors influencing insurance quotes are beyond your control, there are several strategies you can employ to reduce your insurance costs:

- Shop Around: Obtain quotes from multiple insurance providers to ensure you’re getting the best rate. Different companies have different risk assessment models, so it’s worth comparing their offers.

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly insurance premiums. However, it’s essential to ensure that you can afford the deductible in the event of an accident or claim.

- Take Advantage of Discounts: Many insurance companies offer discounts for various reasons. These can include safe driving records, loyalty discounts for long-term customers, and discounts for bundling multiple insurance policies (e.g., car and home insurance) with the same provider.

- Maintain a Good Credit Score: Believe it or not, your credit score can impact your insurance rates. Many insurance companies use credit scores as an indicator of risk, so maintaining a good credit score can help keep your premiums lower.

- Consider Telematics Devices: Some insurance companies offer telematics devices that monitor your driving habits. These devices can provide data on your driving behavior, such as speeding or sudden braking. If your driving habits are deemed safe, you may be eligible for discounts.

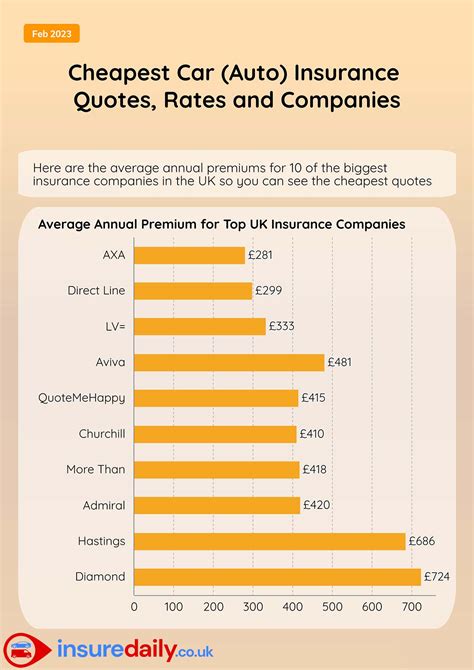

Analyzing Car Insurance Quote Data

To better understand the landscape of car insurance quotes, let’s examine some real-world data. The table below presents a comparison of insurance quotes for different driver profiles:

| Driver Profile | Average Annual Premium |

|---|---|

| 25-year-old male, clean record, urban area | $1,500 |

| 35-year-old female, 1 minor violation, suburban area | $1,200 |

| 50-year-old male, long clean record, rural area | $900 |

Comparing Insurance Companies

When shopping for car insurance, it’s essential to compare not just the premiums but also the coverage and benefits offered by different companies. Some insurance providers may offer lower premiums but have stricter claim processes or less comprehensive coverage. On the other hand, more expensive policies might come with additional perks like roadside assistance or rental car coverage.

The Impact of Claim History

Your claim history is a significant factor in determining your insurance rates. While a single claim may not drastically increase your premiums, multiple claims within a short period can lead to substantial rate hikes or even policy cancellations. It’s important to carefully consider the potential long-term financial implications before filing a claim, especially for minor incidents where the cost of repairs may be close to or less than your deductible.

Future Trends in Car Insurance

The car insurance industry is evolving, with new technologies and trends shaping the future of insurance. The rise of electric vehicles (EVs) and autonomous driving technologies is expected to impact insurance rates and coverage in the coming years. Additionally, the increasing adoption of telematics devices and usage-based insurance (UBI) models will likely play a more prominent role in personalized insurance offerings.

Frequently Asked Questions

What is the best way to get cheap car insurance quotes online?

+To find the best cheap car insurance quotes online, you should consider using an insurance comparison website or an insurance broker. These platforms allow you to enter your details once and receive multiple quotes from different insurance providers. Additionally, ensure that you’re providing accurate information about your driving history, vehicle details, and intended usage to get the most accurate quotes.

How can I reduce my car insurance premiums if I have a poor driving record?

+Improving your driving record is the most effective way to reduce car insurance premiums. However, if you have a poor driving record, you can still explore options such as taking defensive driving courses, which may lead to discounts. Additionally, consider comparing quotes from different insurers, as rates can vary significantly between companies.

Are there any specific insurance companies that offer the cheapest rates for young drivers?

+While it’s challenging to pinpoint specific insurance companies that consistently offer the cheapest rates for young drivers, certain insurers are known for their focus on providing competitive rates for this demographic. It’s recommended to compare quotes from a variety of insurers to find the best deal for your specific circumstances.

What factors should I consider when comparing car insurance quotes?

+When comparing car insurance quotes, it’s important to look beyond just the premium. Consider the coverage limits, deductibles, and any additional perks or benefits offered. Also, review the policy’s fine print to understand any exclusions or limitations. Ensure that the coverage meets your needs and provides adequate protection in case of an accident or other covered event.