How Does Trip Insurance Work

Trip insurance, also known as travel insurance, is a valuable tool for travelers looking to protect themselves and their investments when planning a vacation or business trip. This comprehensive guide will delve into the intricacies of trip insurance, explaining how it works, what it covers, and why it is essential for anyone embarking on a journey.

In an increasingly unpredictable world, where unforeseen circumstances can disrupt even the most carefully planned trips, trip insurance offers a layer of security and peace of mind. From medical emergencies to trip cancellations, this insurance policy ensures that travelers are financially protected and can navigate unexpected situations with ease.

Understanding Trip Insurance Policies

Trip insurance policies are designed to cover a range of potential travel-related issues, providing coverage for various scenarios that may arise before or during a trip. These policies typically include:

- Trip Cancellation and Interruption: Covers the costs associated with canceling or interrupting a trip due to covered reasons, such as illness, injury, or severe weather conditions.

- Medical and Dental Coverage: Provides medical and dental assistance during the trip, including emergency treatment, hospitalization, and sometimes even repatriation if necessary.

- Baggage and Personal Effects: Offers compensation for lost, stolen, or damaged luggage and personal items during the trip.

- Emergency Evacuation: Covers the expenses of emergency evacuations due to medical emergencies or natural disasters.

- Trip Delay: Reimburses certain expenses incurred during an unexpected trip delay caused by covered events, such as flight cancellations or severe weather.

- Rental Car Coverage: Provides additional protection for rental cars, including collision damage waivers and liability coverage.

- Identity Theft Protection: Assists travelers in the event of identity theft while on their trip, helping to mitigate potential financial losses.

It's important to note that trip insurance policies vary widely, and the level of coverage depends on the chosen plan and the insurance provider. Some policies offer comprehensive coverage, while others focus on specific aspects of travel, such as medical emergencies or trip cancellations.

How Trip Insurance Works: A Step-by-Step Guide

To better understand the process, let’s walk through the steps of how trip insurance works, from purchasing a policy to making a claim.

Step 1: Choosing the Right Policy

When selecting a trip insurance policy, consider the following factors:

- Travel Destinations: Research the specific risks and challenges associated with your intended travel destinations. Some regions may have higher medical costs or a higher risk of certain incidents.

- Trip Duration: Longer trips may require more comprehensive coverage, especially if you plan to engage in adventurous activities or visit multiple countries.

- Travel Companions: If you are traveling with family or friends, ensure that everyone is covered by the same policy to simplify the claims process.

- Trip Purpose: Business trips and leisure vacations may have different insurance needs. Business trips often require additional coverage for equipment and liability.

- Existing Health Conditions: Pre-existing medical conditions may affect your eligibility for certain policies or require additional coverage.

Step 2: Understanding the Coverage

Once you have chosen a suitable policy, carefully review the coverage details. Pay attention to the following key aspects:

- Policy Limits: Understand the maximum amount the insurance provider will reimburse for each covered event.

- Exclusions: Familiarize yourself with the situations or events that are not covered by the policy. Common exclusions include acts of war, civil unrest, and certain pre-existing medical conditions.

- Deductibles: Determine the amount you must pay out of pocket before the insurance coverage kicks in.

- Benefit Period: Understand the duration of coverage, especially for medical emergencies and trip cancellations.

- Cancellation Penalties: Be aware of the cancellation penalties associated with your trip, as these may impact the amount you can claim.

Step 3: Purchasing the Policy

When purchasing a trip insurance policy, ensure that you provide accurate and complete information. Any misinformation or omission of relevant details may void your coverage.

Step 4: Emergencies and Claims

In the event of an emergency or an incident that requires you to make a claim, follow these steps:

- Contact the Insurance Provider: As soon as possible, notify your insurance provider about the incident. They will guide you through the claims process and provide the necessary forms and documentation.

- Gather Evidence: Collect all relevant documents, including medical reports, receipts, and any other evidence supporting your claim. Keep detailed records of all expenses incurred.

- Submit the Claim: Follow the instructions provided by your insurance provider to submit your claim. Ensure that you meet all deadlines and provide all the required information.

- Review and Follow-up: After submitting your claim, keep track of its progress. Insurance providers may require additional information or clarification. Respond promptly to any requests to avoid delays.

Step 5: Claim Resolution

Once your insurance provider has received and processed your claim, they will assess the validity and determine the amount of reimbursement. The resolution process may vary depending on the complexity of the claim and the insurance provider’s policies.

Keep in mind that trip insurance policies typically have specific time frames for making claims, so it's crucial to act promptly and adhere to the guidelines provided by your insurance provider.

Benefits of Trip Insurance

Trip insurance offers numerous advantages to travelers, providing a safety net for unexpected situations. Here are some key benefits:

- Financial Protection: Trip insurance protects your travel investments, covering expenses related to trip cancellations, interruptions, and delays.

- Medical Assistance: In the event of a medical emergency, trip insurance provides access to quality medical care and covers related expenses, ensuring your well-being during your travels.

- Peace of Mind: Knowing that you have comprehensive coverage allows you to focus on enjoying your trip without worrying about unforeseen circumstances.

- Luggage and Personal Item Protection: Trip insurance compensates for lost or damaged luggage, reducing the financial burden of replacing essential items.

- Travel Flexibility: With trip insurance, you can make last-minute changes to your travel plans without incurring significant financial penalties.

Common Misconceptions about Trip Insurance

Despite its benefits, trip insurance is sometimes misunderstood. Here are some common misconceptions clarified:

- Misconception 1: Trip insurance is only necessary for expensive trips. (False) - Trip insurance is beneficial for trips of all budgets, as it protects against unexpected costs and provides valuable peace of mind.

- Misconception 2: Trip insurance is only for medical emergencies. (False) - While medical coverage is a crucial aspect, trip insurance also covers trip cancellations, interruptions, and a range of other travel-related issues.

- Misconception 3: Trip insurance is too expensive. (Debatable) - The cost of trip insurance depends on various factors, including the level of coverage, trip duration, and destination. It is often more affordable than paying for unexpected expenses out of pocket.

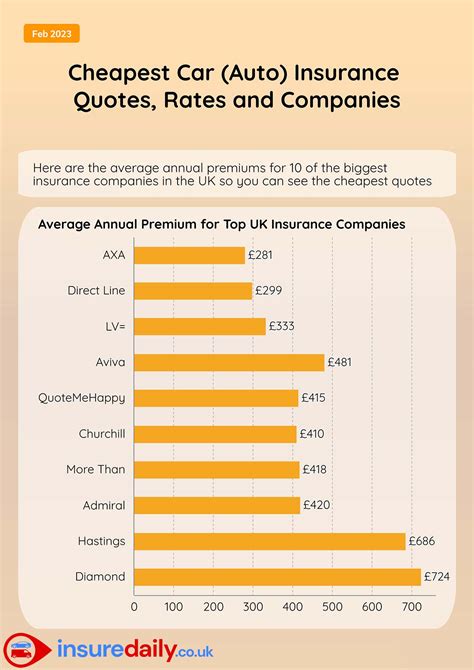

Comparing Trip Insurance Providers

When choosing a trip insurance provider, consider the following factors to ensure you select the best option for your needs:

- Reputation and Financial Stability: Opt for reputable insurance companies with a strong financial standing to ensure they can honor your claims.

- Policy Coverage and Limits: Compare the coverage and limits offered by different providers to find the policy that best aligns with your travel plans and potential risks.

- Claims Process and Customer Service: Research the claims process and customer service reputation of the insurance provider. Efficient and responsive customer service is essential during emergencies.

- Additional Benefits and Perks: Some insurance providers offer unique benefits, such as travel assistance services, concierge services, or enhanced rental car coverage.

- Price and Value: While cost is an important consideration, don't sacrifice coverage for a lower price. Assess the value and benefits provided by each policy.

Real-Life Examples and Success Stories

To illustrate the importance and effectiveness of trip insurance, let’s explore a few real-life scenarios where travelers benefited from having adequate coverage:

Scenario 1: Medical Emergency

John, a solo traveler on a European tour, suffered a severe injury while hiking in the Swiss Alps. His trip insurance policy covered the emergency evacuation, medical treatment, and even repatriation back to his home country. Without insurance, the medical expenses and travel arrangements would have been a significant financial burden.

Scenario 2: Trip Cancellation

Sarah and her family had planned a dream vacation to Disney World. Unfortunately, a family emergency arose just a week before their departure, forcing them to cancel the trip. Thanks to their trip insurance policy, they were reimbursed for their non-refundable deposits and avoided significant financial loss.

Scenario 3: Baggage Loss

David, a business traveler, had his luggage lost during a flight connection. His trip insurance policy covered the cost of purchasing essential items until his luggage was located and returned. This allowed him to continue his business trip without disruption.

Future of Trip Insurance

As the travel industry continues to evolve, so does the world of trip insurance. Here are some potential trends and developments to watch for:

- Digitalization: The rise of digital technologies is expected to streamline the trip insurance process, making it more accessible and convenient for travelers. Mobile apps and online platforms may become the primary channels for purchasing and managing policies.

- Customized Policies: Insurance providers may offer more tailored and customizable policies to meet the unique needs of different traveler profiles, such as adventure seekers or business travelers.

- Increased Coverage for Digital Risks: With the growing reliance on digital devices and online services during travel, insurance providers may expand their coverage to include cyber risks and data protection.

- Sustainable Travel Initiatives: As sustainability becomes a priority for travelers, insurance providers may incorporate eco-friendly initiatives into their policies, such as carbon offset programs or support for responsible tourism.

By staying informed about these trends, travelers can ensure they have the most up-to-date and relevant trip insurance coverage for their journeys.

Conclusion

Trip insurance is an invaluable tool for travelers, providing financial protection and peace of mind in an ever-changing world. By understanding how trip insurance works and choosing the right policy, travelers can embark on their adventures with confidence, knowing they are prepared for any unforeseen circumstances.

What is the difference between trip insurance and travel insurance?

+Trip insurance and travel insurance are often used interchangeably, but they can have slightly different meanings. Generally, trip insurance refers to coverage for a specific trip or vacation, while travel insurance may encompass a broader range of coverage, including medical emergencies, trip cancellations, and even travel-related services like concierge assistance.

Can I purchase trip insurance after my trip has started?

+In most cases, trip insurance policies must be purchased before your trip begins. Purchasing insurance after the trip has started is typically not possible, as the purpose of the insurance is to protect against unforeseen events that may occur during the trip.

What are some common exclusions in trip insurance policies?

+Common exclusions in trip insurance policies may include acts of war, civil unrest, pre-existing medical conditions, and intentional self-injury. It’s important to carefully review the policy’s exclusions to understand what is not covered.