Auto Cheap Insurance

Finding affordable car insurance is a priority for many vehicle owners, as it can significantly impact their finances. In today's competitive insurance market, there are numerous options available, and understanding how to secure the best rates is essential. This article aims to provide an in-depth guide to getting cheap auto insurance, exploring various factors that influence premiums and offering strategies to minimize costs while maintaining adequate coverage.

Understanding Auto Insurance Premiums

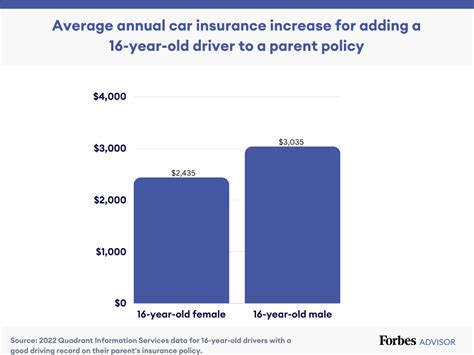

Auto insurance premiums are influenced by a multitude of factors, including individual risk profiles, vehicle type, location, and the specific coverage chosen. Insurance companies use complex algorithms to assess risk and determine premiums, taking into account a driver’s age, gender, driving record, credit history, and even their marital status.

Risk Assessment and Premium Calculation

Insurance providers use actuarial science to assess risk and set premiums. This involves analyzing historical data on accidents, claims, and traffic violations to predict future risks. Factors like the type of vehicle, its safety features, and the average cost of repairs also play a role in premium calculation.

| Risk Factor | Impact on Premium |

|---|---|

| Driving Record | Clean records often result in lower premiums, while violations and accidents can significantly increase costs. |

| Credit Score | Higher credit scores are associated with lower risk and thus, lower premiums. |

| Vehicle Type | Luxury cars, sports cars, and vehicles with higher repair costs generally attract higher premiums. |

| Location | Areas with higher accident rates or theft risks may have higher insurance costs. |

The Impact of Coverage Choices

The level of coverage chosen can greatly affect the overall premium. While it’s tempting to opt for the cheapest option, it’s crucial to ensure the coverage meets legal requirements and personal needs. Skimping on liability coverage, for instance, could lead to financial hardship if an accident occurs.

Strategies for Securing Cheap Auto Insurance

Securing affordable auto insurance involves a combination of smart choices and understanding the market. Here are some strategies to consider:

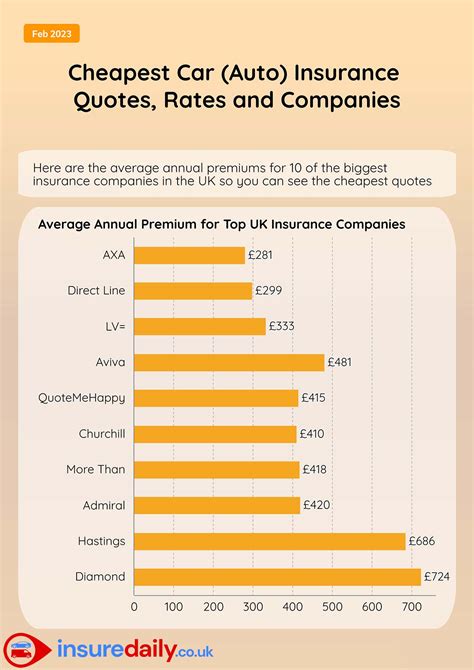

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online comparison tools can provide a quick and easy way to assess different options. Additionally, seeking recommendations from friends or family can help identify trusted insurers with competitive rates.

Utilize Discounts and Rewards

Insurance companies often offer a range of discounts and rewards to attract and retain customers. These can include discounts for safe driving records, loyalty rewards, multi-policy discounts (e.g., bundling car and home insurance), and even discounts for certain occupations or educational achievements.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Rewarding drivers with clean records for several years. |

| Multi-Policy Discount | Combining car insurance with other policies, like home or life insurance, often results in savings. |

| Student Discount | Some insurers offer discounts to students with good grades or those enrolled in certain courses. |

Consider Telematics-Based Insurance

Telematics-based insurance, also known as usage-based insurance, uses telematics devices to monitor driving behavior and set premiums accordingly. This type of insurance can be a good option for safe drivers as it rewards good driving habits with lower premiums. However, it may not be suitable for those who frequently drive in high-risk areas or have erratic driving patterns.

Opt for Higher Deductibles

Choosing a higher deductible can lower the premium, as it reduces the insurer’s financial risk. However, this strategy requires careful consideration, as a higher deductible means paying more out-of-pocket in the event of a claim. It’s a balance between saving on premiums and being able to afford the deductible if an accident occurs.

Maintain a Good Credit Score

Insurance companies often use credit scores as an indicator of risk. A higher credit score can lead to lower premiums, as it suggests a lower likelihood of making a claim. Maintaining a good credit score, therefore, can be a long-term strategy for securing cheaper auto insurance.

The Future of Affordable Auto Insurance

The auto insurance landscape is evolving, driven by technological advancements and changing consumer preferences. The rise of telematics and usage-based insurance is a significant development, offering a more personalized insurance experience. Additionally, the increasing popularity of electric vehicles and autonomous driving technologies may lead to new insurance products and pricing models in the future.

The Role of Technology in Insurance

Technology is transforming the insurance industry, with digital tools and data analytics playing a pivotal role. Insurers are leveraging advanced analytics to more accurately assess risk and set premiums. Additionally, the use of artificial intelligence and machine learning is expected to further enhance the efficiency and accuracy of insurance processes, potentially leading to more competitive pricing.

Emerging Insurance Models

The insurance market is witnessing the emergence of new models, such as peer-to-peer insurance and parametric insurance. These innovative models challenge traditional insurance structures and could potentially offer more affordable coverage options. However, their adoption and impact on the market remain to be seen.

Conclusion

Securing cheap auto insurance involves a comprehensive understanding of the factors that influence premiums and a proactive approach to shopping around and utilizing available discounts. While the insurance landscape is evolving, the fundamentals of risk assessment and coverage choices remain crucial. By staying informed and adapting to market changes, drivers can ensure they’re getting the best value for their insurance needs.

Can I get cheap auto insurance with a poor driving record?

+While a poor driving record can make it challenging to find affordable insurance, it’s not impossible. Some insurers specialize in high-risk drivers and offer competitive rates. Additionally, maintaining a clean record for a few years can lead to reduced premiums.

Are there any downsides to usage-based insurance?

+Usage-based insurance can be a double-edged sword. While it rewards safe driving with lower premiums, it can also result in higher costs for those who frequently drive in high-risk situations or have erratic driving patterns. Additionally, privacy concerns may arise with the use of telematics devices.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, especially after significant life changes like moving to a new area, getting married, or purchasing a new vehicle. Regular reviews ensure your coverage remains adequate and you’re taking advantage of any available discounts.