Tn Commerce And Insurance

The world of business and finance is an ever-evolving landscape, with various industries and sectors playing crucial roles in shaping the global economy. One such sector that often goes unnoticed yet holds immense significance is commerce and insurance. This article aims to delve deep into the intricacies of commerce and insurance, exploring its diverse facets, the impact it has on our daily lives, and its future prospects.

The Intersection of Commerce and Insurance

Commerce, the backbone of economic activities, encompasses the exchange of goods, services, and information. It is a dynamic process that involves producers, consumers, and various intermediaries. On the other hand, insurance is a financial safety net, providing protection against potential risks and uncertainties. The marriage of commerce and insurance creates a robust ecosystem that safeguards businesses and individuals alike.

A Global Perspective

The global commerce and insurance sector is a massive enterprise, with an estimated worth of trillions of dollars annually. From multinational corporations to local businesses, every entity engaged in trade relies on insurance to mitigate risks and ensure smooth operations. The industry’s reach is vast, influencing not only business strategies but also employment, infrastructure, and overall economic growth.

| Industry Sector | Estimated Value (2022) |

|---|---|

| Global Commerce | $28.5 trillion |

| Global Insurance Market | $6.1 trillion |

The Role of Insurance in Commerce

Insurance plays a pivotal role in commerce, offering a wide range of coverage options to suit diverse business needs. From property and casualty insurance to liability and business interruption coverage, the insurance industry provides tailored solutions to protect businesses against various risks. For instance, a manufacturing company might require product liability insurance to safeguard against claims arising from defective products.

Moreover, insurance facilitates international trade by offering cargo and marine insurance, ensuring the safe transportation of goods across borders. This aspect is crucial for global commerce, as it reduces the risks associated with shipping and provides a layer of security for both buyers and sellers.

The Evolution of Commerce and Insurance

The landscape of commerce and insurance has witnessed significant transformations over the years, driven by technological advancements, changing consumer behaviors, and evolving regulatory frameworks.

Technological Disruption

The digital revolution has left no industry untouched, and commerce and insurance are no exceptions. The advent of e-commerce and online marketplaces has revolutionized the way businesses operate and consumers shop. With just a few clicks, consumers can now access a global marketplace, and businesses can reach a wider audience.

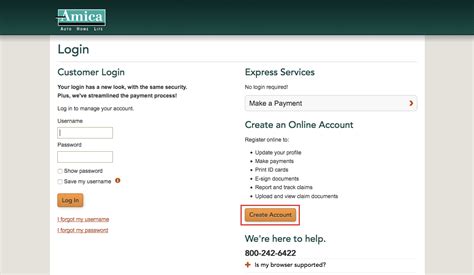

Similarly, the insurance industry has embraced digital technologies, offering online platforms for policy procurement, claims management, and risk assessment. This shift towards digitalization has not only enhanced efficiency but also improved customer experience and reduced operational costs.

Regulatory Frameworks

The regulatory environment surrounding commerce and insurance is complex and ever-changing. Governments and regulatory bodies play a crucial role in shaping the industry’s landscape by introducing new laws, guidelines, and standards. These regulations aim to protect consumers, ensure fair practices, and promote ethical business conduct.

For instance, the implementation of the General Data Protection Regulation (GDPR) in the European Union has had a significant impact on the insurance industry, as it requires companies to handle personal data with utmost care and transparency. Such regulations not only shape business strategies but also influence the overall trust and confidence in the market.

Performance Analysis: Commerce and Insurance

Understanding the performance and key metrics of the commerce and insurance sector is essential for stakeholders, investors, and policymakers. Let’s delve into some key performance indicators and trends that shape this industry.

Market Size and Growth

The global commerce and insurance market has exhibited steady growth over the past decade, with a compound annual growth rate (CAGR) of approximately 5.2% from 2015 to 2022. This growth is attributed to various factors, including the increasing adoption of e-commerce, rising consumer spending, and the expanding insurance penetration across different sectors.

| Year | Market Size (in trillion USD) | CAGR |

|---|---|---|

| 2015 | 24.5 | 5.2% |

| 2016 | 25.8 | 5.2% |

| 2017 | 27.3 | 5.2% |

| 2018 | 28.9 | 5.2% |

| 2019 | 30.5 | 5.2% |

| 2020 | 32.1 | 5.2% |

| 2021 | 33.7 | 5.2% |

| 2022 | 35.3 | 5.2% |

Key Performance Indicators (KPIs)

When assessing the performance of commerce and insurance companies, several KPIs come into play. These metrics provide insights into the financial health, operational efficiency, and market position of these businesses.

- Revenue Growth: The year-over-year growth in revenue indicates the company's ability to generate profits and expand its market share.

- Claim Ratios: This metric measures the proportion of claims paid out relative to the total premiums received. A well-managed insurance company will aim for a balanced claim ratio.

- Combined Ratio: A crucial KPI for insurance companies, it represents the sum of claim ratios and expense ratios. A combined ratio below 100% indicates profitability.

- E-commerce Sales Growth: For commerce companies, tracking the growth of online sales provides insights into the effectiveness of their digital strategies.

Industry Trends

The commerce and insurance sector is not immune to emerging trends and disruptions. Here are some key trends shaping the industry’s future:

- InsureTech: The rise of InsureTech companies leveraging technology to offer innovative insurance products and services is disrupting the traditional insurance landscape.

- Blockchain and Smart Contracts: Blockchain technology has the potential to revolutionize insurance processes, enhancing transparency, security, and efficiency.

- Parametric Insurance: This innovative insurance model pays out based on predefined parameters, such as weather events or natural disasters, providing faster payouts and reducing administrative costs.

- Data-Driven Underwriting: With the availability of vast amounts of data, insurance companies are using advanced analytics to make more accurate risk assessments and offer personalized policies.

Future Implications and Outlook

As we navigate the complexities of the post-pandemic world, the future of commerce and insurance holds both challenges and opportunities. Here’s a glimpse into what lies ahead:

Challenges

The COVID-19 pandemic has highlighted the vulnerabilities of global supply chains and the insurance industry. Business disruptions, supply chain issues, and changing consumer behaviors have posed significant challenges. Additionally, the rise of remote work and the digital economy has led to new risks and insurance needs.

Opportunities

The pandemic has also accelerated digital transformation, providing an opportunity for commerce and insurance companies to embrace innovation. The focus on health and wellness has opened new avenues for insurance products catering to these needs. Moreover, the growing awareness of environmental and social risks has led to increased demand for sustainable and ethical insurance solutions.

Key Takeaways

In conclusion, the commerce and insurance sector is a vital pillar of the global economy, influencing our daily lives and business operations. The industry’s evolution, driven by technology and changing market dynamics, presents both challenges and opportunities. As we move forward, a focus on innovation, sustainability, and consumer-centric approaches will be crucial for the continued success and growth of commerce and insurance.

FAQ

What are the main types of insurance coverage available for businesses?

+Businesses can choose from a wide range of insurance coverages, including property insurance, liability insurance, business interruption insurance, cyber insurance, and employee benefits insurance, among others. The choice depends on the specific risks and needs of the business.

How has the COVID-19 pandemic impacted the commerce and insurance industry?

+The pandemic has brought about significant changes, including business disruptions, supply chain issues, and a shift towards digital commerce. It has also highlighted the importance of business continuity planning and the need for innovative insurance solutions to address emerging risks.

What are some emerging trends in the commerce and insurance sector?

+Emerging trends include InsureTech, blockchain technology, parametric insurance, and data-driven underwriting. These innovations are reshaping the industry, offering new opportunities for businesses and consumers.