Compare Car Insurance Comparison

Navigating the complex world of car insurance can be a daunting task, with numerous options and factors to consider. Fortunately, the emergence of car insurance comparison platforms has revolutionized the way drivers approach this essential financial decision. In this comprehensive guide, we will delve into the intricacies of car insurance comparison, exploring the benefits, key features, and best practices to help you make an informed choice. By understanding the ins and outs of these platforms, you can unlock significant savings and ensure comprehensive coverage tailored to your unique needs.

Understanding the Importance of Car Insurance Comparison

In today’s fast-paced and competitive insurance market, comparison is more than just a convenient tool; it’s a necessity. With a myriad of insurance providers offering varying policies, premiums, and coverage options, it’s crucial to have a comprehensive understanding of the landscape before making a decision. Car insurance comparison platforms act as a one-stop solution, empowering drivers to evaluate multiple options side by side, ensuring they make the most suitable choice.

By leveraging the power of comparison, drivers can uncover significant savings, identify the best-value policies, and ensure they are adequately covered for their specific circumstances. Whether you're a new driver seeking an affordable policy or an experienced motorist looking to optimize your coverage, understanding the key features and benefits of comparison platforms is essential.

Key Features of Car Insurance Comparison Platforms

Car insurance comparison platforms offer a wealth of features designed to streamline the process of finding the right policy. Here’s an overview of some of the most notable aspects:

Broad Coverage Options

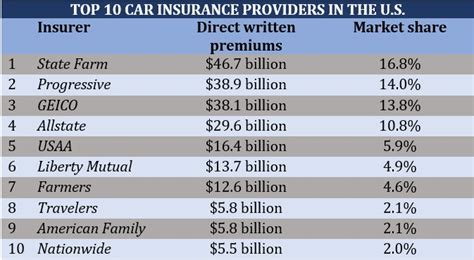

One of the primary advantages of these platforms is the extensive range of insurance providers and policies they present. From well-known national carriers to smaller, regional insurers, comparison platforms aggregate a vast array of options, ensuring you have access to a comprehensive selection.

By comparing policies from multiple providers, you can identify the ones that offer the best coverage for your specific needs. Whether you're seeking comprehensive, liability-only, or specialized coverage, these platforms provide a one-stop shop to explore and evaluate your options.

User-Friendly Comparison Tools

Car insurance comparison platforms prioritize user experience, offering intuitive and user-friendly interfaces. These tools are designed to make the comparison process straightforward and efficient. With just a few clicks, you can input your details and preferences, instantly generating a list of relevant policies and providers.

Advanced filtering options allow you to refine your search based on factors such as coverage limits, deductibles, and additional perks. This ensures that you can quickly narrow down your options to the policies that best align with your requirements.

Detailed Policy Information

Comparison platforms go beyond simply listing policies; they provide comprehensive information on each offering. This includes detailed explanations of coverage types, limits, and exclusions, ensuring you understand exactly what each policy entails.

Additionally, these platforms often feature helpful resources and guides, offering insights into the world of car insurance. From understanding common terminology to learning about specific coverage types, these resources empower you to make informed decisions and ask the right questions when speaking with insurance providers.

Real-Time Quotes and Savings

One of the most appealing aspects of car insurance comparison platforms is their ability to generate real-time quotes. By inputting your details and preferences, these platforms instantly provide estimated premiums for various policies. This not only saves you time but also allows you to quickly identify the most affordable options.

Moreover, comparison platforms often highlight the potential savings you can achieve by switching policies. By comparing premiums side by side, you can make an informed decision based on value, ensuring you find the best deal without compromising on coverage.

Personalized Recommendations

Advanced comparison platforms utilize sophisticated algorithms to provide personalized policy recommendations. By analyzing your specific needs, driving history, and preferences, these platforms suggest policies that are tailored to your unique circumstances.

This level of personalization ensures that you receive relevant and accurate suggestions, making the comparison process more efficient and effective. Whether you're seeking the most affordable option or prioritizing comprehensive coverage, these recommendations can guide you toward the policies that best meet your needs.

Best Practices for Maximizing Your Car Insurance Comparison

To make the most of car insurance comparison platforms and ensure you find the best policy for your needs, consider the following best practices:

Define Your Coverage Needs

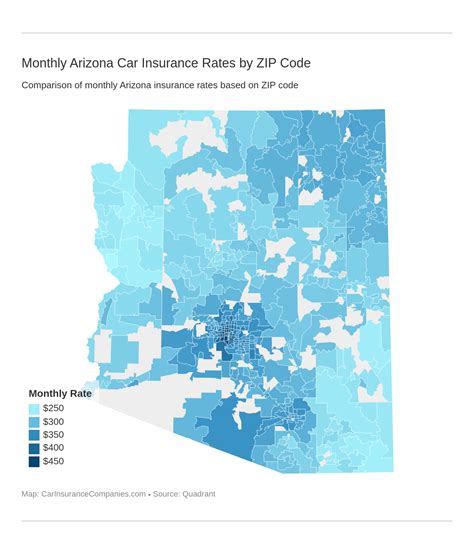

Before diving into the comparison process, take the time to assess your specific coverage needs. Consider factors such as your driving history, the value of your vehicle, and any additional coverage requirements you may have. By clearly defining your needs, you can more effectively filter and evaluate policies.

Research and Understand Coverage Types

Familiarize yourself with the different types of car insurance coverage available. Understand the distinctions between liability-only, comprehensive, collision, and specialized policies. This knowledge will empower you to make informed decisions and ask the right questions when comparing policies.

Compare Premiums and Coverage Limits

While premiums are an essential consideration, it’s crucial to balance them with coverage limits. Look for policies that offer adequate limits for liability, collision, and comprehensive coverage, ensuring you’re protected in various scenarios.

Comparison platforms often provide tools to help you visualize and compare coverage limits side by side, making it easier to identify the policies that provide the best value for your money.

Explore Additional Perks and Discounts

Car insurance providers often offer a range of additional perks and discounts to enhance their policies. These can include roadside assistance, rental car coverage, accident forgiveness, and loyalty discounts. When comparing policies, pay attention to these added benefits, as they can significantly enhance your overall coverage experience.

Read Reviews and Customer Feedback

While comparison platforms provide a wealth of information, it’s also valuable to consider real-world experiences. Read reviews and feedback from other customers to gain insights into the reliability, responsiveness, and overall satisfaction levels of various insurance providers.

Understanding how providers handle claims, customer service inquiries, and other interactions can help you make a more informed decision, ensuring you choose a reputable and trustworthy insurer.

Making an Informed Decision: The Benefits of Comparison

By embracing the power of car insurance comparison, you unlock a multitude of benefits. Here’s a summary of the key advantages:

- Significant Savings: Comparison platforms help you identify the most affordable policies, potentially saving you hundreds of dollars annually.

- Tailored Coverage: With a vast array of options, you can find policies that perfectly align with your specific needs and circumstances.

- Efficient Process: The user-friendly interfaces and real-time quote generation streamline the comparison process, saving you valuable time.

- Comprehensive Information: Detailed policy information and resources ensure you have a deep understanding of each offering, empowering you to make confident decisions.

- Personalized Recommendations: Advanced algorithms provide tailored policy suggestions, making the comparison process more efficient and effective.

Conclusion: Embrace the Power of Comparison

In the complex world of car insurance, comparison platforms emerge as invaluable tools, empowering drivers to make informed choices. By leveraging these platforms’ features and best practices, you can unlock significant savings, ensure comprehensive coverage, and navigate the insurance landscape with confidence.

Whether you're a new driver or a seasoned motorist, taking the time to compare policies is an essential step towards financial security and peace of mind. Embrace the power of comparison, and you'll be well on your way to finding the perfect car insurance policy for your unique needs.

How often should I compare car insurance policies?

+It’s recommended to compare car insurance policies annually or whenever your circumstances change significantly. This ensures you stay up-to-date with the latest offerings and can take advantage of any potential savings or improved coverage options.

Can I switch car insurance providers easily if I find a better deal through comparison?

+Absolutely! Switching car insurance providers is a straightforward process. Many comparison platforms offer tools to help you easily transfer your coverage to a new provider, ensuring a seamless transition.

Are there any hidden fees or charges associated with using car insurance comparison platforms?

+No, reputable car insurance comparison platforms are typically free to use. They earn revenue through commissions from insurance providers when you purchase a policy through their platform. However, it’s always a good idea to read the fine print and understand any potential fees or charges associated with the policies you’re considering.