Nyc Car Insurance Companies

When it comes to navigating the complex world of car insurance in New York City, it's crucial to understand the unique challenges and opportunities that this bustling metropolis presents. With a diverse range of insurance providers offering various coverage options, choosing the right company can make a significant difference in your insurance experience and overall peace of mind.

The Complex Landscape of NYC Car Insurance

New York City, with its dense population and bustling traffic, presents a unique set of challenges for drivers and insurance companies alike. From navigating crowded streets to dealing with potential accidents and theft, NYC drivers face a distinct set of risks. This complexity extends to the insurance landscape, where providers must offer tailored solutions to meet the diverse needs of the city’s residents.

The high population density and busy streets of NYC often result in a higher frequency of accidents and traffic violations. This, coupled with the city's stringent parking regulations and potential for theft, creates a unique insurance environment. Insurance companies must account for these factors when calculating premiums, which can sometimes result in higher costs for NYC drivers.

Understanding Coverage Options

Car insurance coverage in NYC typically includes the standard options found across the country, such as liability, collision, and comprehensive coverage. However, due to the city’s unique risks, additional coverage options may be necessary to ensure adequate protection.

Liability Coverage

Liability coverage is a crucial aspect of any car insurance policy, as it protects you from financial losses if you are found at fault in an accident. In NYC, where accidents can occur more frequently due to heavy traffic and congested roads, having adequate liability coverage is essential. Most insurance providers recommend carrying higher-than-minimum liability limits to ensure sufficient protection.

| Type of Coverage | Minimum Required | Recommended |

|---|---|---|

| Bodily Injury Liability | $25,000 per person / $50,000 per accident | $100,000 per person / $300,000 per accident |

| Property Damage Liability | $10,000 | $25,000 or more |

Collision and Comprehensive Coverage

Collision coverage protects your vehicle in the event of an accident, while comprehensive coverage covers damage caused by non-collision events such as theft, vandalism, or natural disasters. In NYC, where the risk of theft and vandalism is relatively high, having comprehensive coverage is particularly important.

Additionally, NYC drivers may want to consider adding optional coverages such as rental car reimbursement or roadside assistance to their policies. These coverages can provide added peace of mind and financial protection in the event of an accident or breakdown.

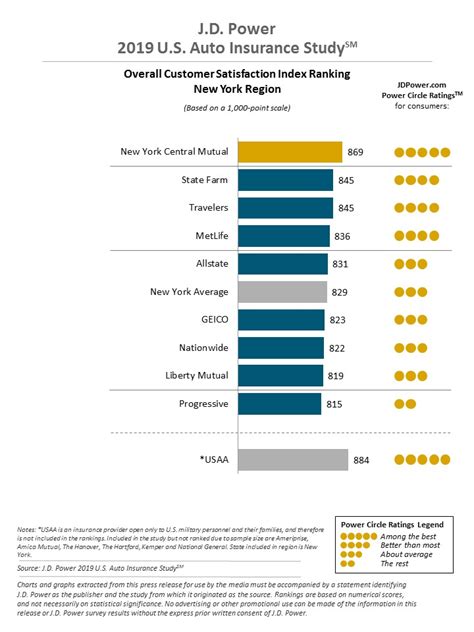

Top NYC Car Insurance Companies

The NYC car insurance market is highly competitive, with numerous providers offering a range of coverage options and unique features. Here’s an overview of some of the top insurance companies serving the NYC area, along with their key offerings and benefits.

State Farm

State Farm is one of the largest insurance providers in the country and offers a comprehensive range of car insurance policies. In NYC, State Farm provides customized coverage options to meet the unique needs of city drivers. Their policies typically include standard liability, collision, and comprehensive coverage, along with optional add-ons such as rental car reimbursement and roadside assistance.

State Farm is known for its excellent customer service and claims handling, making it a popular choice among NYC residents. They offer a dedicated mobile app for policy management and claims filing, providing added convenience for busy city dwellers.

GEICO

GEICO, an acronym for Government Employees Insurance Company, is another major player in the NYC car insurance market. With a focus on providing affordable coverage, GEICO offers a range of discounts to help NYC drivers save on their premiums. These discounts include multi-policy, good student, and safe driver discounts, among others.

GEICO's digital-first approach makes it particularly appealing to tech-savvy NYC residents. Their online platform and mobile app allow for easy policy management and claims filing, providing a seamless insurance experience.

Allstate

Allstate is a well-known insurance provider that offers a wide range of coverage options and unique features. In NYC, Allstate provides customizable car insurance policies that can be tailored to individual needs. Their policies include standard liability, collision, and comprehensive coverage, along with optional add-ons such as rental car reimbursement and roadside assistance.

Allstate's unique "Usage-Based Insurance" program, known as Drivewise, allows NYC drivers to potentially save on their premiums by monitoring their driving habits. This program uses a small device or a mobile app to track driving behavior, rewarding safe driving with discounts.

Progressive

Progressive is a leading insurance provider known for its innovative approach to car insurance. In NYC, Progressive offers a range of coverage options and unique features to meet the diverse needs of city drivers. Their policies typically include standard liability, collision, and comprehensive coverage, along with optional add-ons such as rental car reimbursement and roadside assistance.

Progressive's "Name Your Price" tool is particularly useful for NYC drivers looking for a specific coverage level. This tool allows users to set their desired premium amount and then helps them build a policy that meets their needs and budget.

Esurance

Esurance is a subsidiary of Allstate and offers a digital-first insurance experience. In NYC, Esurance provides a range of car insurance policies that can be easily managed and customized online. Their policies include standard liability, collision, and comprehensive coverage, along with optional add-ons such as rental car reimbursement and roadside assistance.

Esurance's digital platform allows NYC drivers to quickly and easily compare coverage options, obtain quotes, and manage their policies. Their "DriveSense" program also offers a usage-based insurance option, similar to Allstate's Drivewise, which can help drivers save on their premiums by monitoring their driving habits.

Factors to Consider When Choosing an Insurance Company

When selecting an insurance company for your NYC car insurance needs, there are several key factors to consider. These include coverage options, premiums, discounts, customer service, and digital tools and resources.

Coverage Options

Ensure that the insurance company you choose offers the coverage options you need. This includes standard liability, collision, and comprehensive coverage, as well as any optional add-ons that may be beneficial in NYC, such as rental car reimbursement or roadside assistance.

Premiums and Discounts

Compare premiums and available discounts to find the most affordable option. Many insurance companies offer a range of discounts, such as multi-policy, good student, and safe driver discounts. Additionally, usage-based insurance programs can provide opportunities to save by rewarding safe driving habits.

Customer Service

Look for an insurance company with a strong reputation for excellent customer service and claims handling. This is particularly important in NYC, where the potential for accidents and other incidents is relatively high. Having a responsive and helpful insurance provider can make a significant difference in the event of a claim.

Digital Tools and Resources

In today’s digital age, many insurance companies offer online platforms and mobile apps for policy management and claims filing. These tools can provide added convenience and efficiency, especially for busy NYC residents. Look for insurance providers that offer user-friendly digital platforms and mobile apps to enhance your insurance experience.

The Future of NYC Car Insurance

As technology continues to advance and the insurance industry adapts, the future of NYC car insurance looks promising. With the potential for further digitalization and the integration of new technologies, such as autonomous vehicles and advanced driver-assistance systems, the insurance landscape in NYC is likely to evolve significantly.

Insurance companies will need to stay abreast of these technological advancements and adapt their coverage options and pricing models accordingly. This may include offering specialized coverage for autonomous vehicles and incorporating data from advanced driver-assistance systems to better assess risk and provide more accurate premiums.

Additionally, the rise of shared mobility services, such as ride-sharing and car-sharing platforms, may also impact the NYC car insurance market. Insurance providers will need to develop innovative coverage options to accommodate the changing transportation landscape and ensure that drivers and passengers using these services are adequately protected.

How can I save money on my NYC car insurance premiums?

+There are several ways to save on your NYC car insurance premiums. Firstly, compare quotes from multiple insurance companies to find the most competitive rates. Additionally, take advantage of any available discounts, such as multi-policy, good student, and safe driver discounts. Consider enrolling in a usage-based insurance program, which rewards safe driving habits with potential premium savings. Finally, maintain a clean driving record and avoid accidents or traffic violations, as this can help keep your premiums low.

What additional coverage options should I consider for my NYC car insurance policy?

+In addition to standard liability, collision, and comprehensive coverage, NYC drivers may want to consider adding optional coverages such as rental car reimbursement and roadside assistance. These coverages can provide added peace of mind and financial protection in the event of an accident or breakdown. Additionally, given the relatively high risk of theft and vandalism in NYC, comprehensive coverage is particularly important to ensure adequate protection for your vehicle.

How can I improve my chances of getting a lower premium for my NYC car insurance policy?

+To improve your chances of getting a lower premium for your NYC car insurance policy, it’s important to maintain a clean driving record and avoid accidents or traffic violations. Additionally, consider enrolling in a usage-based insurance program, which monitors your driving habits and rewards safe driving with potential premium discounts. You can also shop around and compare quotes from multiple insurance companies to find the most competitive rates.