Nj Car Insurance Companies

When it comes to car insurance in New Jersey, residents have a wide range of options to choose from. The state is home to numerous insurance companies, each offering unique policies and coverage options to cater to the diverse needs of drivers. Understanding the landscape of NJ car insurance companies and their offerings is crucial for making informed decisions about your auto insurance coverage.

The Competitive Landscape of NJ Car Insurance

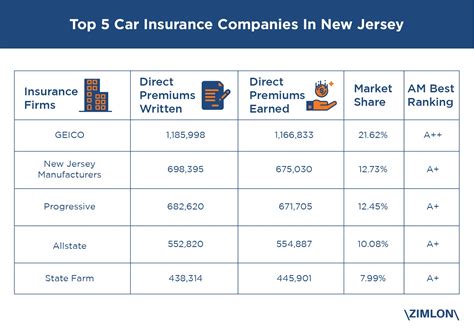

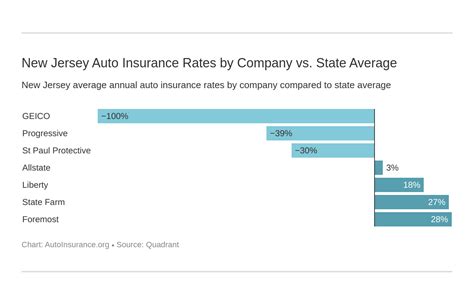

New Jersey’s insurance market is highly competitive, with a mix of national insurance carriers, regional companies, and even smaller, independent insurers. This competition benefits consumers, as it leads to a variety of insurance options, competitive pricing, and innovative coverage features. Here’s an overview of the key players in the NJ car insurance market:

National Insurance Carriers

Several national insurance giants operate in New Jersey, offering comprehensive car insurance policies to residents. These companies often have a strong brand presence and a wide range of coverage options. Some of the notable national carriers in NJ include:

- State Farm: State Farm is a well-known insurance provider, offering a range of auto insurance policies with personalized coverage options. They are known for their customer service and educational resources, helping drivers understand their insurance needs.

- GEICO: GEICO, or Government Employees Insurance Company, is a popular choice for many NJ drivers. They provide a user-friendly online experience, competitive rates, and a wide array of discounts for various driver profiles.

- Allstate: Allstate offers a Drivewise program that rewards safe driving habits with discounts. They also provide a range of additional coverage options, including rental car reimbursement and roadside assistance.

- Progressive: Progressive is renowned for its Name Your Price tool, allowing drivers to customize their coverage and premium. They also offer innovative features like Snapshot, which monitors driving habits to provide personalized rates.

- Esurance: Esurance is a tech-savvy insurance provider, offering a fully digital experience. They provide fast quotes, efficient claims handling, and a range of coverage options, making them a popular choice for tech-oriented drivers.

Regional Insurance Companies

New Jersey is also home to several regional insurance companies that focus specifically on the local market. These insurers often have a deep understanding of the unique needs and challenges of NJ drivers, and they provide tailored coverage options. Some notable regional insurers include:

- Pleasant Valley Insurance: Pleasant Valley Insurance is a trusted NJ insurer, offering personalized service and competitive rates. They provide a range of coverage options, including liability, collision, and comprehensive insurance, as well as additional endorsements for specialized needs.

- Encompass Insurance: Encompass is known for its comprehensive coverage options and dedicated customer service. They offer a range of discounts, including multi-policy discounts, safe driver discounts, and even discounts for having certain safety features in your vehicle.

- NJM Insurance Group: NJM is a leading insurer in the state, providing auto, homeowners, and business insurance. They are known for their exceptional customer service and claim handling, and they offer competitive rates and a range of coverage options tailored to NJ drivers.

Independent Insurance Agents

New Jersey has a strong network of independent insurance agents who work with multiple insurance carriers to find the best coverage for their clients. These agents can provide personalized advice and help you navigate the complex world of car insurance. Some benefits of working with an independent agent include:

- Access to a wide range of insurance carriers and policies.

- Personalized advice based on your specific needs and budget.

- Streamlined claims process and dedicated support.

- The ability to bundle policies for additional savings.

Understanding Car Insurance Coverage in NJ

Car insurance in New Jersey is a legal requirement, and all drivers must carry a minimum level of coverage to operate a vehicle on public roads. The state’s Minimum Liability Insurance requirements include:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability (per person) | 15,000</td> </tr> <tr> <td>Bodily Injury Liability (per accident)</td> <td>30,000 |

| Property Damage Liability | $5,000 |

While these are the state-mandated minimums, it's essential to note that many drivers opt for higher liability limits to provide better protection in the event of an accident. Additionally, NJ drivers can choose to add various optional coverages to their policies, such as:

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have enough insurance to cover the damages.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you're involved in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage protects against damages caused by non-collision events like theft, vandalism, or natural disasters.

Factors Influencing Car Insurance Rates in NJ

Like in any state, car insurance rates in New Jersey are influenced by a variety of factors. These factors help insurance companies assess the risk associated with insuring a particular driver and vehicle. Here are some key factors that can impact your car insurance rates in NJ:

Vehicle Type and Usage

The make, model, and year of your vehicle can significantly impact your insurance rates. High-performance cars, luxury vehicles, and sports cars often come with higher insurance premiums due to their increased risk of theft, higher repair costs, and more frequent involvement in accidents. Additionally, the primary use of your vehicle (commuting, business, pleasure) can also affect your rates.

Driver Profile

Your driving history is a crucial factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. On the other hand, a history of accidents, especially those where you were at fault, or traffic violations can result in higher rates. Other factors like your age, gender, and marital status can also influence your rates, as these demographics are statistically associated with certain driving behaviors.

Location

The area where you live and park your vehicle can impact your insurance rates. Urban areas with higher populations and traffic congestion often have higher rates due to increased risk of accidents and theft. Additionally, certain neighborhoods may have higher crime rates, which can also drive up insurance costs.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select can significantly affect your insurance premiums. Higher coverage limits and lower deductibles typically result in higher premiums, while lower coverage and higher deductibles can lead to more affordable insurance. It’s essential to find a balance that provides adequate protection without straining your budget.

Tips for Choosing the Right Car Insurance in NJ

With so many insurance companies and coverage options available in New Jersey, it can be challenging to choose the right car insurance policy. Here are some tips to help you make an informed decision:

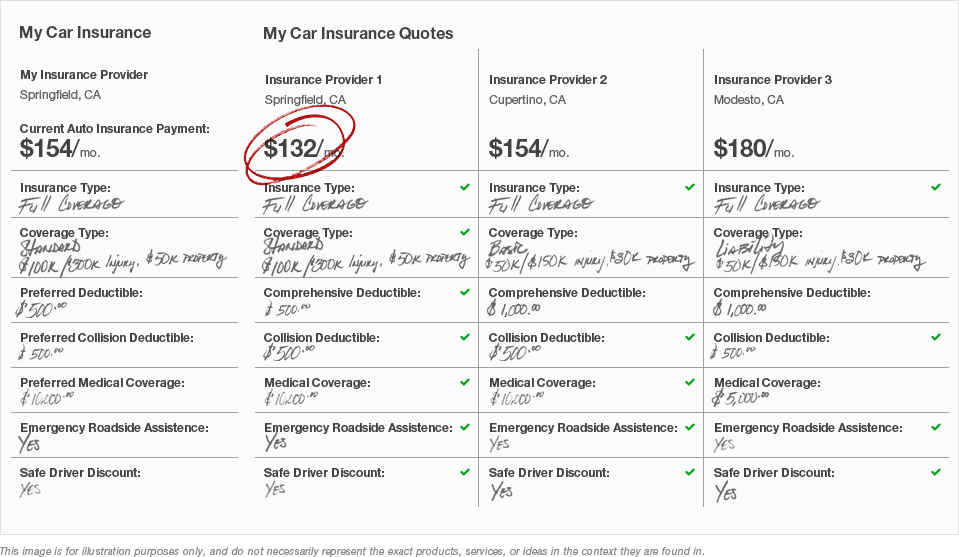

- Compare Quotes: Get quotes from multiple insurance companies to compare coverage and premiums. Online quote tools can be a convenient way to quickly gather quotes and compare options.

- Understand Your Coverage Needs: Assess your specific needs and the type of coverage that would provide the best protection for you and your vehicle. Consider factors like your driving habits, the value of your vehicle, and your financial situation.

- Explore Discounts: Many insurance companies offer a range of discounts, such as safe driver discounts, multi-policy discounts, and discounts for certain safety features in your vehicle. Ask about available discounts and see if you qualify for any.

- Consider Bundling Policies: If you need multiple types of insurance (e.g., auto, homeowners, renters), consider bundling your policies with the same insurer. Bundling can often lead to significant savings.

- Read Reviews: Research insurance companies and read reviews from current and former customers to get an idea of their customer service, claims handling, and overall satisfaction. This can help you choose a company that aligns with your expectations.

Conclusion: Navigating NJ’s Car Insurance Landscape

The world of car insurance in New Jersey can be complex, but with a thorough understanding of the options available and your specific needs, you can find the right coverage at the right price. Whether you choose a national insurance carrier, a regional company, or an independent agent, the key is to do your research, compare options, and select a policy that provides the protection you need without breaking the bank.

What is the average cost of car insurance in New Jersey?

+The average cost of car insurance in New Jersey can vary significantly based on individual factors such as driving history, vehicle type, and coverage limits. According to recent data, the average annual premium for a minimum liability policy in NJ is around 1,300, while a full coverage policy can cost upwards of 2,500. It’s essential to get personalized quotes to understand your specific premium.

Are there any insurance companies that specialize in providing insurance for high-risk drivers in NJ?

+Yes, there are insurance companies in New Jersey that cater specifically to high-risk drivers. These companies often have programs designed to help drivers with a history of accidents or violations. However, it’s important to note that insurance for high-risk drivers typically comes with higher premiums.

What are some common discounts offered by car insurance companies in NJ?

+Car insurance companies in New Jersey offer a range of discounts to help drivers save on their premiums. Some common discounts include multi-policy discounts (for bundling car insurance with other types of insurance), safe driver discounts, good student discounts, and discounts for certain safety features in your vehicle. It’s worth shopping around and asking about available discounts.