No Physical Term Life Insurance

Revolutionizing Life Insurance: The Rise of No Physical Exam Term Life Policies

In the ever-evolving landscape of life insurance, a silent revolution has been taking place, offering a more accessible and streamlined approach to securing financial protection. Say hello to no physical exam term life insurance - a modern take on an age-old industry that's transforming the way we think about life cover.

Traditional life insurance policies have long been a cornerstone of financial planning, providing a safety net for families in the event of an untimely demise. However, the process of securing such coverage has often been a daunting task, involving extensive paperwork, medical examinations, and lengthy waiting periods. Enter the no-exam life insurance policy, a game-changer that's simplifying the journey to financial security.

The Evolution of No Physical Exam Life Insurance

The concept of no physical exam life insurance is not entirely new, but it's gaining momentum and becoming a preferred choice for many. This innovative approach to life cover has evolved to meet the changing needs and preferences of today's consumers, offering a faster, more convenient, and often more affordable way to secure life insurance.

Historically, life insurance applicants had to undergo a rigorous process that included medical check-ups, blood tests, and urine samples. These physical examinations, while necessary for risk assessment, could be invasive, time-consuming, and off-putting for many. Recognizing this, the insurance industry began exploring alternative methods, and the no-exam policy was born.

Streamlined Application Process

One of the most appealing aspects of no physical exam term life insurance is its simplified application process. Instead of scheduling appointments and undergoing medical tests, applicants can now provide basic health and lifestyle information online or over the phone. This digital approach not only saves time but also eliminates the anxiety associated with traditional medical exams.

| Application Type | Pros | Cons |

|---|---|---|

| Online Application | Convenient, quick, and accessible | May require some technical knowledge |

| Phone Application | Personalized assistance, no tech skills needed | Potentially longer than online process |

Moreover, the elimination of physical exams allows for a faster turnaround time. Policyholders can often receive their coverage within a matter of days, compared to the weeks or even months it might take with traditional policies. This swiftness is especially beneficial for those seeking immediate protection or facing time-sensitive financial commitments.

Enhanced Accessibility

No physical exam term life insurance has opened doors for individuals who might have struggled with the traditional application process. For instance, those with busy schedules or limited mobility now have a more convenient option. Additionally, this type of policy often caters to a broader range of health conditions, making it accessible to individuals who may have been declined or faced higher premiums in the past.

By removing the physical exam requirement, insurers can assess risk based on a more holistic view of an individual's health and lifestyle. This includes factors like family medical history, smoking status, and general health habits. As a result, more people can access life insurance, fostering a more inclusive financial safety net.

Understanding No Physical Exam Term Life Insurance

No physical exam term life insurance is a policy that provides financial protection to beneficiaries in the event of the policyholder's death, without the need for a medical examination. This type of insurance has gained popularity due to its convenience and accessibility, offering a quick and straightforward way to secure life cover.

Key Features and Benefits

One of the standout features of no physical exam term life insurance is its speed and ease of application. Policyholders can often secure coverage within a matter of days, compared to the lengthy processes associated with traditional life insurance. This is particularly advantageous for those who need immediate protection or face time-sensitive financial obligations.

- Simplicity: No medical exams or extensive paperwork are required, making the application process straightforward and stress-free.

- Flexibility: Policyholders can often choose from various coverage amounts and term lengths to tailor the policy to their specific needs and budget.

- Affordability: These policies are often more cost-effective than traditional life insurance, especially for healthy individuals who might not need extensive coverage.

- Wide Applicability: No physical exam term life insurance caters to a broad range of individuals, including those with pre-existing health conditions who may have struggled to secure coverage in the past.

How It Works

The application process for no physical exam term life insurance typically involves answering a series of health-related questions and providing basic personal information. Insurers use this information to assess the applicant's risk level and determine the premium. The questions may cover topics such as:

- General health and medical history

- Lifestyle habits (smoking, alcohol consumption, etc.)

- Occupation and recreational activities

- Family medical history

Based on the responses, insurers can quickly assess the applicant's risk and offer a suitable policy. This streamlined approach allows for a faster decision-making process, benefiting both the insurer and the policyholder.

Real-World Examples and Case Studies

To illustrate the impact and effectiveness of no physical exam term life insurance, let's delve into some real-world examples and case studies.

John's Story

John, a 35-year-old software engineer, wanted to secure life insurance but had a busy work schedule and a phobia of needles. Traditional life insurance applications seemed daunting, but he stumbled upon no physical exam term life insurance. Within a week of applying, he had his policy in hand, providing peace of mind without disrupting his daily life.

Sarah's Journey

Sarah, a 40-year-old mother of two, had always wanted life insurance but was concerned about the lengthy application process and the potential for denial due to her health history. However, with no physical exam term life insurance, she was able to secure coverage easily. The policy provided her family with the financial security she had always sought, and the simple application process was a breath of fresh air.

Michael's Experience

Michael, a 50-year-old small business owner, knew the importance of life insurance but had been putting off the application process due to the time and effort it required. When he learned about no physical exam term life insurance, he was intrigued. He was able to secure a substantial coverage amount without the hassle of medical exams, ensuring his business and family were protected.

Comparative Analysis: Traditional vs. No Physical Exam

To better understand the advantages of no physical exam term life insurance, let's compare it to its traditional counterpart.

| Traditional Life Insurance | No Physical Exam Term Life Insurance |

|---|---|

| Requires medical examination | No medical examination needed |

| Lengthy application process | Quick and streamlined application |

| Potential for denial or higher premiums due to health conditions | More accessible for individuals with pre-existing conditions |

| May involve extensive paperwork | Minimal paperwork required |

| Turnaround time can be several weeks or months | Coverage can be secured within days |

As the table illustrates, no physical exam term life insurance offers a more convenient, accessible, and often faster route to securing life cover. This modern approach to life insurance is a testament to the industry's ability to adapt and meet the changing needs of consumers.

Future Implications and Industry Insights

The rise of no physical exam term life insurance is not just a trend but a significant shift in the life insurance landscape. As more consumers embrace this streamlined approach, insurers are likely to further refine and enhance their offerings.

Expanding Accessibility

One of the key benefits of no physical exam policies is their ability to make life insurance more accessible. Insurers may continue to develop innovative ways to assess risk, potentially broadening the reach of these policies to even more individuals. This could include more sophisticated algorithms and data analytics to better understand and manage risk.

Technological Advancements

The digital revolution is transforming the insurance industry, and no physical exam term life insurance is at the forefront of this change. Insurers are investing in technology to streamline the application process further, improve customer experiences, and enhance overall efficiency. This could lead to even faster processing times and more personalized policies.

Educational Initiatives

As no physical exam term life insurance gains popularity, insurers and financial advisors may prioritize educational initiatives to ensure consumers understand the benefits and limitations of these policies. Clear and concise information can empower individuals to make informed decisions about their financial protection.

Conclusion

No physical exam term life insurance is revolutionizing the way we think about and access financial protection. Its streamlined application process, enhanced accessibility, and quick turnaround times are reshaping the life insurance landscape. As this innovative approach continues to evolve, it promises to make life cover more convenient, affordable, and accessible to all.

Can anyone apply for no physical exam term life insurance?

+

While this type of insurance is more accessible, it still has certain eligibility criteria. Generally, applicants must be between 18 and 65 years old and meet basic health requirements. Specific eligibility may vary between insurers.

What happens if I have a pre-existing medical condition?

+

No physical exam term life insurance is often more accommodating for individuals with pre-existing conditions. However, the specific coverage and premiums may vary based on the nature and severity of the condition. It’s best to consult with an insurance professional to understand your options.

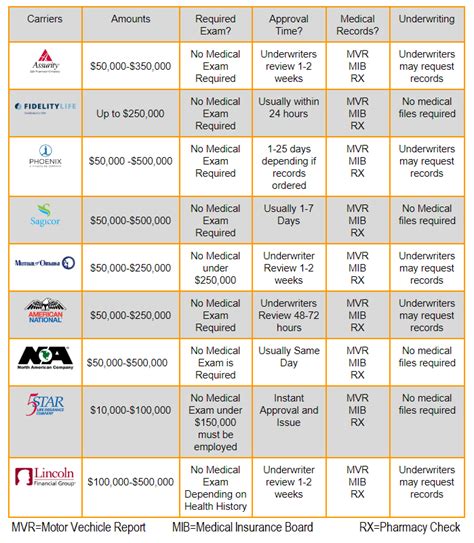

How much coverage can I get with no physical exam term life insurance?

+

The coverage amount can vary widely, typically ranging from $50,000 to several million dollars. The exact amount depends on factors like your age, health, lifestyle, and the insurer’s policies. It’s recommended to assess your specific needs and financial obligations when choosing a coverage amount.

Are there any drawbacks to no physical exam term life insurance?

+

One potential drawback is that these policies may have slightly higher premiums compared to traditional life insurance with a medical exam. Additionally, the coverage may have certain limitations or exclusions, so it’s essential to read the policy carefully and understand its terms.