How Much Is Auto Insurance

Understanding auto insurance is essential for every vehicle owner, as it provides financial protection and peace of mind in various situations. The cost of auto insurance, however, can vary significantly based on numerous factors. This article aims to provide an in-depth analysis of the factors influencing auto insurance rates, offer practical tips for finding affordable coverage, and explore the impact of these costs on individuals and the broader economy. By delving into real-world examples and industry insights, we will empower readers to make informed decisions when it comes to auto insurance.

Factors Influencing Auto Insurance Rates

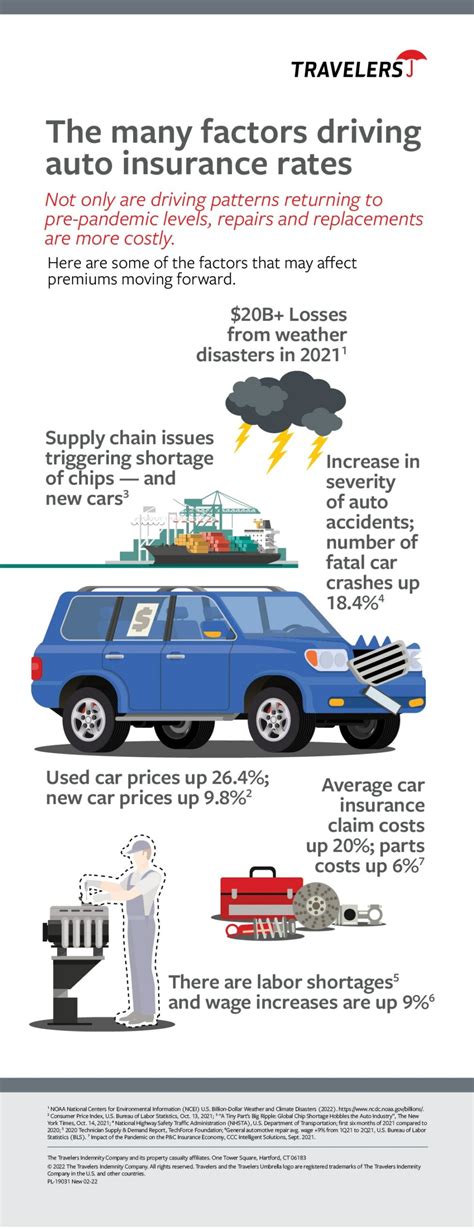

Auto insurance premiums are determined by a complex interplay of variables, each contributing to the overall cost. Let’s explore some of the key factors that insurance companies consider when calculating rates:

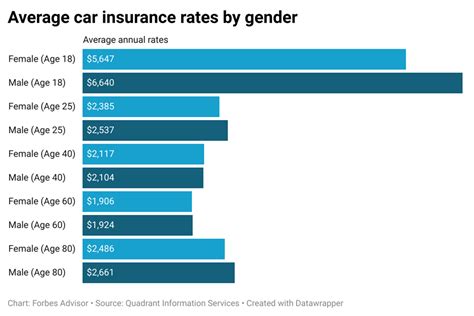

Driver’s Profile

The personal characteristics of the policyholder play a significant role in determining insurance rates. Factors such as age, gender, marital status, and occupation are commonly considered. For instance, young drivers, especially males, are often associated with higher rates due to their propensity for risk-taking. Similarly, individuals with hazardous occupations or those residing in high-crime areas may face elevated premiums.

Vehicle Type and Usage

The make, model, and year of your vehicle can significantly impact insurance costs. Sports cars and luxury vehicles, for example, tend to have higher premiums due to their association with increased risk and higher repair costs. Additionally, the primary use of the vehicle matters; a car used for business purposes may attract different rates compared to one used solely for personal travel.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sedan | $1,200 |

| SUV | $1,350 |

| Luxury Car | $2,100 |

| Sports Car | $2,500 |

The frequency of use also influences rates. A vehicle driven daily for commuting will likely have higher premiums compared to one used only occasionally.

Location and Driving History

The geographical location of the policyholder is a crucial factor. Areas with high accident rates, dense traffic, or frequent instances of vehicle theft often lead to higher insurance costs. Additionally, the driver’s individual history matters significantly. Insurance companies carefully assess past accidents, traffic violations, and claims made to determine the risk associated with insuring a particular individual.

Coverage and Deductibles

The level of coverage chosen by the policyholder directly affects the premium. Comprehensive plans offering collision, liability, and additional benefits will naturally be more expensive than basic coverage. Furthermore, the deductible amount selected plays a role. Higher deductibles can lead to lower premiums, as the policyholder agrees to bear more financial responsibility in the event of a claim.

Strategies for Affordable Auto Insurance

While auto insurance costs can vary, there are strategies that individuals can employ to find more affordable coverage. Here are some practical tips to consider:

Shop Around and Compare

Insurance rates can differ significantly between providers, so it’s crucial to compare quotes from multiple companies. Online comparison tools and insurance brokers can simplify this process. By gathering quotes from various insurers, you can identify the most competitive rates for your specific circumstances.

Review Coverage Levels

Evaluate your coverage needs and consider if you are paying for more than you require. Assess the minimum legal requirements in your region and determine if additional coverage is necessary based on your personal circumstances. Remember, while it’s essential to have adequate protection, overinsuring can be costly.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. Bundling can lead to significant savings, so it’s worth exploring this option, especially if you’re already a customer with a particular insurer.

Safe Driving Practices

Adopting safe driving habits can positively impact your insurance costs. Avoid traffic violations, practice defensive driving, and consider completing a defensive driving course, as some insurers offer discounts for completing such programs. Additionally, maintaining a clean driving record over time can lead to reduced premiums.

Explore Discounts

Insurance companies often provide a range of discounts to policyholders. These can include discounts for safe drivers, multi-car policies, good students, and even loyalty rewards for long-term customers. It’s worth discussing potential discounts with your insurer to see if you’re eligible for any savings.

The Impact of Auto Insurance Costs

The cost of auto insurance extends beyond individual policyholders, influencing the broader economy and society. Let’s explore some of these implications:

Economic Impact

Auto insurance costs can significantly affect personal finances. High premiums can strain household budgets, especially for lower-income individuals or those with multiple vehicles. The economic burden of insurance can lead to difficult financial decisions, potentially impacting overall economic growth and consumption patterns.

Social Implications

The availability and cost of auto insurance can also have social implications. In areas where insurance is prohibitively expensive, individuals may be less likely to purchase coverage, potentially leading to higher instances of uninsured drivers. This, in turn, can impact road safety and increase the financial burden on society as a whole through increased healthcare costs and potential legal issues.

Regulatory and Policy Considerations

The cost of auto insurance is a subject of ongoing regulatory and policy discussions. Governments and insurance regulators aim to strike a balance between ensuring affordable coverage for all and maintaining a profitable insurance industry. Changes in regulations, such as altering minimum coverage requirements or introducing reforms to address specific issues, can significantly impact insurance costs and the overall market.

Conclusion: Navigating Auto Insurance Costs

Understanding the factors that influence auto insurance rates and employing strategies to find affordable coverage is essential for every vehicle owner. By being proactive, comparing quotes, and adopting safe driving practices, individuals can make informed decisions to secure the coverage they need at a price they can afford. Additionally, recognizing the broader economic and social implications of insurance costs underscores the importance of a well-regulated and accessible insurance market.

How do I find the best auto insurance rate for my specific situation?

+Finding the best rate requires a personalized approach. Start by comparing quotes from multiple insurers to understand the range of rates available. Consider your specific needs and circumstances, such as your driving history, vehicle type, and desired coverage level. Don’t hesitate to negotiate with insurers or seek advice from insurance brokers who can guide you through the process.

What are some common mistakes to avoid when purchasing auto insurance?

+Common mistakes include not shopping around for quotes, assuming your current insurer offers the best rate, and neglecting to review your policy annually. It’s also important to understand the coverage you’re purchasing and ensure it aligns with your needs. Additionally, be cautious of policies with extremely low premiums, as they may offer insufficient coverage.

Are there any government initiatives to make auto insurance more affordable?

+Yes, governments often introduce initiatives to address insurance affordability. These can include reforms to reduce insurance fraud, initiatives to improve road safety, and changes to insurance regulations to promote competition and accessibility. Stay informed about these initiatives to understand how they may impact your insurance costs.