Is Insurance Tax Deductible

Insurance is an essential aspect of financial planning and risk management, and its tax implications are a crucial consideration for individuals and businesses alike. In this comprehensive guide, we will delve into the intricacies of insurance tax deductibility, exploring the rules, regulations, and real-world examples to provide a clear understanding of how insurance premiums can impact your tax obligations.

Understanding Insurance Tax Deductibility

Tax deductibility of insurance refers to the ability to reduce one’s taxable income by claiming insurance premiums as an allowable expense. This practice can lead to significant tax savings, making it an attractive strategy for many taxpayers. However, the deductibility of insurance premiums is not universal and depends on various factors, including the type of insurance, the purpose for which it is purchased, and the tax jurisdiction.

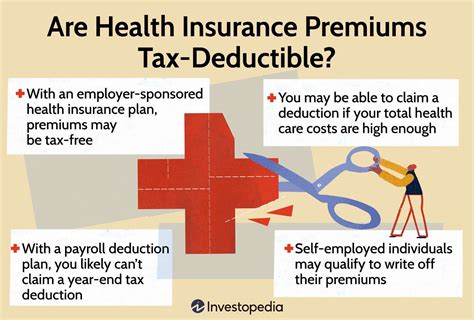

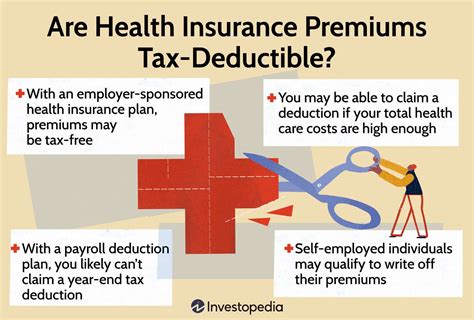

Health Insurance Tax Deductions

Health insurance premiums are often the most widely discussed and commonly deductible insurance expenses. In many countries, individuals can claim health insurance premiums as a medical expense deduction. This deduction is particularly beneficial for those with high medical expenses or those who purchase private health insurance plans. For instance, in the United States, individuals can deduct qualified medical expenses, including health insurance premiums, if they itemize their deductions and meet certain criteria.

| Country | Health Insurance Tax Deduction |

|---|---|

| United States | Allowable as a medical expense deduction for itemizers. |

| Canada | Premiums for private health insurance are generally not deductible, but some provinces offer tax credits. |

| United Kingdom | Private medical insurance premiums can be deducted for self-employed individuals or as a business expense. |

| Australia | Private health insurance premiums may be eligible for tax offsets, especially for low-income earners. |

Life Insurance and Tax

Life insurance premiums are generally not deductible as a personal expense in most jurisdictions. However, there are certain circumstances where life insurance premiums may be tax-deductible. For instance, if a business owner purchases life insurance as a key person insurance policy to protect the financial stability of the business in the event of their death, the premiums can be claimed as a business expense. Additionally, some countries offer tax incentives for specific types of life insurance, such as pension-linked policies or those with an investment component.

Business Insurance and Tax Benefits

Business owners have a broader range of insurance options that can provide tax benefits. Common types of business insurance that are typically tax-deductible include:

- General Liability Insurance: Covers legal expenses and damages for third-party claims, making it an essential expense for many businesses.

- Professional Liability Insurance (Errors and Omissions): Protects professionals like doctors, lawyers, and consultants from negligence claims, and the premiums are often tax-deductible.

- Property Insurance: Helps businesses recover from property damage or loss, and the premiums are usually tax-deductible as a business expense.

- Workers' Compensation Insurance: Required in many jurisdictions, and the premiums can be claimed as a business expense.

Tax Strategies for Insurance Premiums

Understanding how insurance premiums fit into your overall tax strategy is crucial. Here are some strategies to consider:

Itemizing Deductions

In jurisdictions where tax deductions are based on itemized expenses, it’s essential to keep track of all insurance premiums and other allowable expenses. This strategy can significantly reduce your taxable income, resulting in lower tax liabilities.

Maximizing Deductions with Business Insurance

Business owners can benefit from carefully selecting insurance policies that provide coverage for their specific risks while also offering tax advantages. By strategically choosing and structuring their insurance portfolio, business owners can optimize their tax savings.

Exploring Tax-Advantaged Insurance Products

Some insurance products, like certain types of life insurance or pension plans, offer tax advantages. These products can be an attractive option for individuals looking to maximize their tax savings while also achieving their financial goals.

Real-World Examples and Case Studies

Let’s explore some real-world scenarios to illustrate the impact of insurance tax deductibility:

Case Study: John’s Health Insurance Deduction

John, a self-employed professional in the United States, purchased a private health insurance plan with an annual premium of 6,000. As a high-income earner, John itemizes his deductions and qualifies for the medical expense deduction. By claiming his health insurance premium as a deduction, John reduced his taxable income by 6,000, resulting in substantial tax savings.

Case Study: Sarah’s Business Insurance Strategy

Sarah owns a small consulting firm and purchases various insurance policies to protect her business. She has general liability, professional liability, and workers’ compensation insurance. By claiming these premiums as business expenses, Sarah is able to reduce her business’s taxable income, lowering her tax obligations and increasing her profit margins.

Case Study: David’s Life Insurance Decision

David, a successful entrepreneur, is considering purchasing a life insurance policy with an investment component. This type of policy offers tax-deferred growth on the investment portion, providing David with a potential tax advantage. By carefully evaluating the tax implications and consulting with a financial advisor, David can make an informed decision about whether this insurance product aligns with his financial goals and tax strategy.

Future Implications and Considerations

As tax laws and regulations evolve, it’s essential to stay informed about any changes that may impact insurance tax deductibility. Here are some key considerations for the future:

- Changes in tax laws: Governments may introduce new legislation or amend existing laws, affecting the deductibility of insurance premiums.

- Technology and insurance: The rise of digital insurance platforms and innovative insurance products may impact tax strategies and the deductibility of certain premiums.

- International tax considerations: For individuals and businesses with cross-border activities, understanding the tax implications of insurance in different jurisdictions is crucial.

Conclusion

Insurance tax deductibility is a complex but vital aspect of financial planning. By understanding the rules, exploring real-world examples, and staying informed about tax strategies, individuals and businesses can make informed decisions to optimize their tax obligations while effectively managing their insurance needs. Remember, it’s always advisable to consult with tax professionals or financial advisors to ensure compliance and maximize potential savings.

Can I deduct health insurance premiums if I’m not self-employed?

+The deductibility of health insurance premiums for individuals who are not self-employed depends on the tax laws of your country. In some jurisdictions, premiums may be deductible if you meet certain criteria, such as having high medical expenses or purchasing private health insurance. It’s essential to review your country’s tax guidelines or consult a tax professional for specific advice.

Are there any limits to how much I can deduct for insurance premiums?

+Yes, there are often limits or thresholds on the amount of insurance premiums that can be deducted. These limits can vary based on the type of insurance, your income level, and the tax laws in your jurisdiction. It’s important to understand these limits to ensure you’re maximizing your deductions without exceeding any restrictions.

Can I deduct insurance premiums for my dependent family members?

+The deductibility of insurance premiums for dependent family members depends on the specific tax laws in your country. In some cases, you may be able to include the premiums for your dependents as part of your medical expense deductions or other allowable expenses. It’s advisable to review the guidelines or consult a tax professional for clarity.