How Much Is Long Term Health Insurance

Long-term health insurance is a vital component of financial planning, offering individuals and families a safety net against the potentially devastating costs of prolonged illness or injury. However, the cost of this coverage can vary significantly based on several factors, including the type of plan, the age and health status of the insured, and the level of coverage desired. This article aims to provide a comprehensive guide to understanding the expenses associated with long-term health insurance, helping you make informed decisions about your healthcare future.

The Cost of Long-Term Health Insurance: A Comprehensive Overview

Long-term health insurance policies are designed to provide financial protection against the expenses associated with extended periods of illness or injury, typically lasting over 90 days. These policies cover a wide range of services, from in-home care and nursing home stays to specialized medical equipment and therapy services. The cost of these policies can be influenced by a multitude of factors, each playing a crucial role in determining the overall premium.

Factors Affecting the Cost of Long-Term Health Insurance

-

Age of the Insured: One of the primary factors influencing the cost of long-term health insurance is the age of the policyholder. Generally, younger individuals can expect to pay lower premiums as they are statistically less likely to require long-term care. As you age, the premiums tend to increase due to the higher probability of needing long-term medical assistance.

-

Health Status: The current and past health status of the insured individual is another critical factor. Pre-existing medical conditions or a history of chronic illnesses can significantly impact the premium. Some insurers may even decline coverage for certain high-risk individuals.

-

Coverage Level: The extent of coverage desired is a major determinant of the policy's cost. Policies offering more comprehensive benefits, such as coverage for a broader range of services or a longer duration of care, will typically have higher premiums.

-

Inflation Protection: Many long-term health insurance policies offer inflation protection, which accounts for the rising costs of healthcare over time. This feature can lead to higher premiums, but it ensures that the policy's benefits keep pace with increasing medical expenses.

-

Waiting Periods: Some policies have waiting periods, also known as elimination periods, during which the insured must pay for their own care before the policy starts covering expenses. Policies with shorter waiting periods are generally more expensive.

-

Location: The cost of long-term care and the availability of services can vary significantly by geographical region. Consequently, the location where the policyholder resides can impact the premium.

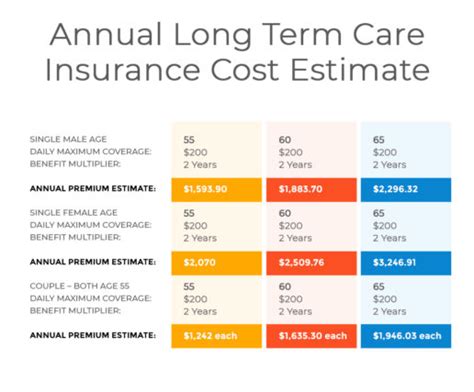

Example Premium Calculations

To illustrate the impact of these factors, let's consider an example of a 55-year-old individual, in good health, seeking long-term health insurance coverage. This individual is looking for a policy that covers a maximum of three years of care, with an inflation protection feature and a 90-day elimination period. The cost of this policy could range from $2,000 to $3,500 per month, depending on the specific coverage level and the insurer's rates.

| Coverage Level | Monthly Premium |

|---|---|

| Basic Coverage (1 year) | $2,000 |

| Intermediate Coverage (2 years) | $2,500 |

| Comprehensive Coverage (3 years) | $3,500 |

Strategies to Reduce Long-Term Health Insurance Costs

While the cost of long-term health insurance can be substantial, there are strategies to help mitigate these expenses. Here are some tips to consider:

-

Start Early: The younger you are when you purchase a policy, the lower your premiums are likely to be. Starting early can also provide more flexibility in choosing the right coverage for your needs.

-

Assess Your Needs: Carefully evaluate your potential long-term care needs and select a policy that provides the appropriate level of coverage without unnecessary extras. Overinsuring can lead to higher premiums.

-

Consider Shared Accommodation: Some long-term care facilities offer shared accommodation, which can be significantly cheaper than private rooms. If you're comfortable with this option, it can reduce your insurance costs.

-

Compare Insurers: Different insurers have varying rates and policy options. Shopping around and comparing quotes can help you find the best value for your money.

-

Understand Inflation Protection: While inflation protection is important to keep your benefits relevant over time, it can also increase your premiums. Consider your financial situation and decide if this feature is necessary for your policy.

-

Increase Your Elimination Period: Opting for a longer elimination period can reduce your premiums. However, this means you would have to cover more of your own expenses before the insurance kicks in.

The Future of Long-Term Health Insurance Costs

The cost of long-term health insurance is expected to continue rising in the future, driven by several factors. The aging population, increasing healthcare costs, and advancements in medical technology are all contributing to this trend. However, there are also efforts to make long-term care more affordable and accessible. These include government initiatives to provide financial support for long-term care, as well as innovations in the insurance industry aimed at reducing costs without compromising on coverage.

FAQs

What is the average cost of long-term health insurance per month?

+The average cost of long-term health insurance varies widely based on individual circumstances and the level of coverage desired. As an example, a 55-year-old in good health might pay between 2,000 to 3,500 per month for a comprehensive policy.

Are there any government programs that can help with the cost of long-term health insurance?

+Yes, there are government programs such as Medicaid and the Veterans Administration that can provide financial assistance for long-term care. These programs have specific eligibility criteria, and it’s important to understand these before applying.

Can I reduce my long-term health insurance premiums by sharing a room in a nursing home?

+Absolutely! Opting for shared accommodation in a long-term care facility can significantly reduce your insurance costs. This is because shared rooms are generally much cheaper than private rooms, and this cost savings can be reflected in your insurance premiums.

What is the difference between long-term health insurance and regular health insurance?

+Regular health insurance typically covers short-term illnesses or injuries, while long-term health insurance is designed to provide financial protection for extended periods of care, often lasting over 90 days. Long-term health insurance policies cover a broader range of services, including in-home care, nursing home stays, specialized medical equipment, and therapy services.

Can I purchase long-term health insurance if I have a pre-existing medical condition?

+Yes, it is possible to purchase long-term health insurance with a pre-existing condition. However, some insurers may decline coverage for certain high-risk individuals or impose waiting periods before coverage begins for certain conditions. It’s important to shop around and compare policies to find the best option for your specific circumstances.