Business Insurance Quote Online

Securing a comprehensive business insurance policy is a crucial step for any entrepreneur or business owner. It provides protection against a wide range of risks and liabilities, ensuring the stability and longevity of your venture. In today's digital age, obtaining an insurance quote online has become a convenient and efficient process, allowing business owners to compare options and make informed decisions quickly. This article will delve into the intricacies of online business insurance quotes, exploring the factors that influence premiums, the coverage options available, and the steps involved in obtaining a quote that suits your unique business needs.

Understanding the Online Business Insurance Quote Process

The online business insurance quote process has revolutionized the way entrepreneurs and small business owners shop for insurance coverage. It offers a convenient and efficient alternative to traditional methods, allowing business owners to obtain multiple quotes from various insurers within a short timeframe. This process is not only time-saving but also provides a transparent view of the market, enabling business owners to make comparisons and choose the most suitable policy for their needs.

Key Factors Influencing Your Business Insurance Premium

The premium for your business insurance policy is determined by a variety of factors, each of which plays a significant role in assessing the risk profile of your business. These factors can be broadly categorized into two main groups: business-specific factors and external factors.

Business-Specific Factors

- Industry and Business Type: Different industries carry different levels of risk. For instance, a construction business will face higher risks compared to a software development company due to the nature of their operations.

- Business Size and Revenue: Larger businesses with higher revenues often require more extensive coverage, which can impact the premium.

- Business Location: The geographical location of your business can influence premiums. Areas with higher crime rates or natural disaster risks may result in higher insurance costs.

- Years in Business: Established businesses with a longer track record may benefit from lower premiums, as they are seen as more stable and less risky.

- Number of Employees: The size of your workforce can affect your premium. Larger employee counts may require more comprehensive coverage.

- Claims History: A history of frequent or large claims can increase your insurance premiums, as it indicates a higher risk profile.

External Factors

- Economic Conditions: Fluctuations in the economy can impact insurance premiums. During economic downturns, insurers may increase rates to offset potential losses.

- Insurance Market Competition: A competitive insurance market can drive down premiums as insurers strive to offer competitive rates to attract customers.

- Regulatory Changes: Changes in government regulations and policies can affect insurance premiums. For example, new laws mandating certain types of coverage can lead to increased costs.

Coverage Options: Tailoring Your Business Insurance Policy

Business insurance policies are not one-size-fits-all. They can be customized to meet the unique needs of your business, ensuring that you have the right coverage in place without paying for unnecessary extras. Here are some of the key coverage options available to business owners:

Liability Coverage

Liability coverage is a fundamental component of any business insurance policy. It protects your business against claims arising from accidents, injuries, or property damage that occur on your business premises or as a result of your operations. This coverage is essential for businesses that interact with the public or have customers on their premises.

Property Coverage

Property coverage protects your business's physical assets, including buildings, equipment, inventory, and furniture. It provides financial protection in the event of damage or loss due to perils such as fire, theft, vandalism, or natural disasters. Property coverage is particularly important for businesses that own their premises or have valuable assets.

Business Interruption Coverage

Business interruption coverage, also known as business income coverage, provides financial support to your business during periods when it is unable to operate due to covered perils. This coverage can help your business pay for expenses such as rent, salaries, and other ongoing costs while you recover from the disruption.

Cyber Liability Coverage

With the increasing reliance on digital technology, cyber liability coverage has become an essential component of modern business insurance. It provides protection against cyber threats such as data breaches, hacking, and identity theft. Cyber liability coverage can help your business manage the financial consequences of a cyber attack, including the cost of restoring data, notifying affected individuals, and covering legal expenses.

Professional Liability Coverage

Professional liability coverage, often referred to as errors and omissions (E&O) insurance, is designed to protect professionals against claims of negligence, errors, or omissions in the services they provide. This coverage is crucial for businesses in industries such as consulting, healthcare, legal, and accounting, where the potential for professional mistakes can lead to significant financial losses.

Workers' Compensation Coverage

Workers' compensation coverage is mandated by law in most states and provides benefits to employees who are injured or become ill as a result of their work. It covers medical expenses, lost wages, and rehabilitation costs, ensuring that your employees receive the care they need while protecting your business from potential lawsuits.

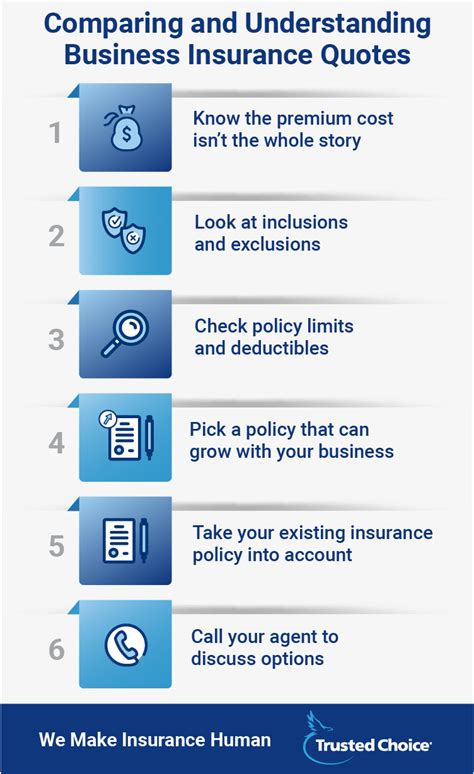

Steps to Obtain an Accurate Online Business Insurance Quote

Obtaining an accurate online business insurance quote requires a thoughtful and thorough approach. Here are the steps you should follow to ensure you get a quote that accurately reflects your business’s needs and risk profile:

- Understand Your Business's Risk Profile: Before seeking an insurance quote, take the time to assess your business's unique risks. Consider the nature of your operations, the location of your business, and any specific hazards or vulnerabilities that your business may face.

- Choose the Right Insurance Provider: Not all insurance providers offer the same level of service or the same coverage options. Research and compare different providers to find one that specializes in your industry or has a track record of providing comprehensive coverage for businesses similar to yours.

- Gather Essential Information: To obtain an accurate quote, you'll need to provide detailed information about your business. This includes your business's legal structure, annual revenue, number of employees, and the nature of your operations. Having this information readily available will streamline the quote process.

- Determine Your Coverage Needs: Assess the types of coverage your business requires. Consider the risks you face and the potential consequences if those risks were to materialize. This will help you identify the specific coverage options that are most relevant to your business.

- Compare Quotes and Providers: Once you've obtained quotes from several insurance providers, take the time to compare them carefully. Look at the coverage limits, deductibles, and any additional benefits or exclusions. Also, consider the reputation and financial stability of the insurance providers to ensure you're choosing a reliable partner.

- Review Policy Details: Don't just focus on the premium amount. Review the policy documents to understand the fine print and ensure that the coverage meets your expectations. Look for any exclusions or limitations that could impact your business's protection.

- Seek Professional Advice: If you're unsure about any aspect of the insurance quote or policy, don't hesitate to consult with an insurance broker or agent. They can provide expert guidance and help you navigate the complexities of business insurance to ensure you have the right coverage in place.

The Benefits of Online Business Insurance Quotes

Online business insurance quotes offer several advantages over traditional methods of obtaining insurance coverage. These benefits include:

- Convenience: You can obtain quotes from the comfort of your office or home, at any time that suits you. This flexibility is especially beneficial for busy business owners who may have limited time for insurance shopping.

- Speed: Online quotes are typically generated quickly, allowing you to compare multiple options and make a decision in a timely manner. This can be crucial when you're in the process of starting a new business or need to update your coverage.

- Transparency: Online quote platforms often provide detailed information about the coverage options and premiums, giving you a clear understanding of what you're getting for your money. This transparency can help you make more informed decisions.

- Comparison Shopping: With online quotes, you can easily compare multiple insurance providers and their offerings. This competitive environment can drive down prices and improve the quality of coverage, as insurers strive to offer the best value to potential customers.

- Personalization: Online quote platforms often allow you to tailor your coverage to your specific needs. You can choose the coverage options that are most relevant to your business, ensuring that you're not paying for unnecessary extras.

Conclusion

Obtaining a business insurance quote online is a straightforward and efficient process that can provide significant benefits to business owners. By understanding the factors that influence premiums and the coverage options available, you can make informed decisions to protect your business effectively. Remember to take the time to assess your business’s unique risks and compare quotes from multiple providers to ensure you’re getting the best value for your insurance needs.

What is the typical cost of business insurance?

+The cost of business insurance can vary significantly depending on factors such as the size and nature of your business, the industry you operate in, and the level of coverage you require. On average, small businesses can expect to pay between 500 and 1,000 per year for a basic liability policy. However, premiums can range from a few hundred dollars to several thousand dollars, or even more, depending on the specific needs and risks of your business.

Can I get business insurance for my home-based business?

+Yes, you can obtain business insurance for a home-based business. However, it’s important to understand that standard homeowners or renters insurance policies typically do not cover business-related risks. You will need to purchase a separate business insurance policy or endorse your existing policy to include business coverage. This will ensure that you have the necessary protection for your home-based business activities.

What happens if I need to make a claim on my business insurance policy?

+If you need to make a claim on your business insurance policy, the first step is to notify your insurance provider as soon as possible. They will guide you through the claims process, which typically involves submitting a detailed claim form and providing supporting documentation such as police reports, repair estimates, or medical records. The insurance company will then assess your claim and, if approved, pay out the agreed-upon amount as specified in your policy.