Dave Ramsey Health Insurance

In today's fast-paced and often uncertain world, safeguarding our health and financial well-being is of paramount importance. This realization has led many individuals to seek comprehensive guidance on topics such as budgeting, investing, and insurance. One name that often comes up in discussions about financial health and stability is Dave Ramsey.

Dave Ramsey, a renowned American author, radio host, and financial guru, has built a reputation for advocating practical and conservative financial strategies. His popular Dave Ramsey Show offers listeners advice on a range of financial matters, including insurance. When it comes to health insurance, Dave Ramsey's philosophy leans towards a balanced approach, prioritizing both affordability and adequate coverage.

In this article, we will delve deep into the world of health insurance through the lens of Dave Ramsey's principles. We will explore his recommendations, the types of health insurance plans he favors, and the strategies he suggests for optimizing your health coverage. Whether you are a long-time follower of Dave Ramsey's financial wisdom or are new to his teachings, this guide will provide you with a comprehensive understanding of how to navigate the complex landscape of health insurance with confidence.

Understanding Dave Ramsey’s Philosophy on Health Insurance

Dave Ramsey’s philosophy on health insurance is rooted in his broader financial principles, which emphasize living within your means, eliminating debt, and building wealth through disciplined saving and investing.

When it comes to health insurance, Dave Ramsey advocates for a balanced approach. He believes that health insurance is a necessary expense, but it should not be a financial burden that compromises your overall financial health. He encourages individuals to choose plans that provide adequate coverage for their needs without overspending on premiums or unnecessary benefits.

Ramsey emphasizes the importance of understanding your health insurance options and making informed decisions. He suggests that individuals should not merely accept the default health insurance plan offered by their employer but should actively research and compare different plans to find the one that best suits their needs and financial situation.

Key Principles of Dave Ramsey’s Health Insurance Philosophy

- Prioritize Adequate Coverage: Dave Ramsey stresses the importance of having health insurance that covers the risks you’re most likely to face. This means understanding your personal health history, as well as the common health issues that affect people in your age group and demographic.

- Avoid Overpaying for Premiums: While adequate coverage is crucial, Ramsey warns against paying excessive premiums for benefits you’re unlikely to use. He suggests that individuals should carefully review their health insurance plans and consider whether they’re paying for features they don’t need, which could be a waste of money.

- Understand Your Out-of-Pocket Costs: Ramsey advises individuals to carefully examine their health insurance plans to understand their out-of-pocket expenses, including deductibles, copays, and coinsurance. These costs can significantly impact your financial health, especially if you face a sudden, unexpected health issue.

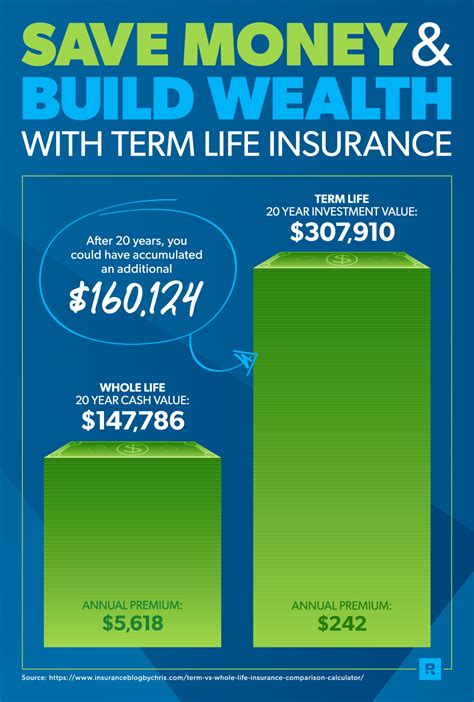

- Consider High-Deductible Health Plans (HDHPs): Dave Ramsey often recommends HDHPs, which typically have lower premiums but higher deductibles. He believes that, for many individuals, this trade-off is worth it, as it can lead to significant savings on premiums while still providing adequate coverage.

By following these principles, Dave Ramsey believes individuals can find health insurance plans that provide the necessary coverage without becoming a financial burden. This balanced approach ensures that your health and financial well-being are both protected.

Exploring Health Insurance Options: A Dave Ramsey Guide

When it comes to health insurance, Dave Ramsey encourages individuals to be proactive and well-informed. He believes that understanding your options and making thoughtful choices is crucial to ensuring you have adequate coverage without overspending.

Employer-Sponsored Health Insurance

For many individuals, their first point of contact with health insurance is through their employer. Most employers offer a range of health insurance plans as part of their benefits package. Dave Ramsey suggests that employees should not simply accept the default plan but should take the time to understand the different options available to them.

He recommends reviewing the summary plan description (SPD) provided by your employer, which outlines the benefits, costs, and limitations of each health insurance plan. This document is a valuable resource for understanding what is covered, what is not, and how much you can expect to pay in premiums and out-of-pocket expenses.

When comparing employer-sponsored health insurance plans, Dave Ramsey suggests focusing on the following key aspects:

- Premium Costs: How much will you pay monthly for the plan? Consider this in relation to your budget and overall financial goals.

- Deductibles and Out-of-Pocket Limits: Understand the amount you'll need to pay out of pocket before the insurance coverage kicks in, and the maximum amount you could potentially pay in a year.

- Coverage Benefits: Review what is covered by the plan, including hospital stays, doctor visits, prescription drugs, and any other specific health services you might need.

- Network of Providers: Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs.

Individual and Family Health Insurance Plans

If you're self-employed or your employer doesn't offer health insurance, you'll need to purchase an individual or family health insurance plan. Dave Ramsey advises individuals in this situation to shop around and compare plans from different insurers to find the best fit for their needs and budget.

He suggests using online tools and resources, such as healthcare.gov (for those in the United States) or similar platforms in other countries, to research and compare plans. These websites provide detailed information about various health insurance plans, including their coverage, costs, and network of providers.

When considering individual or family health insurance plans, Dave Ramsey recommends focusing on the following:

- Premium Affordability: Ensure that the plan's premium is within your budget and doesn't strain your finances.

- Comprehensive Coverage: Look for plans that offer coverage for a broad range of health services, including preventive care, hospital stays, and prescription drugs.

- Out-of-Pocket Costs: Understand the deductibles, copays, and coinsurance amounts. While lower premiums might be attractive, ensure that the out-of-pocket costs aren't prohibitively high.

- Network Flexibility: Consider whether you need a plan that allows you to see any doctor or specialist, or if you're willing to use a narrower network of providers for potentially lower costs.

By carefully considering these factors, Dave Ramsey believes individuals can make informed decisions about their health insurance, ensuring they have the coverage they need without paying more than necessary.

Maximizing Your Health Insurance Coverage: Dave Ramsey’s Strategies

Once you’ve selected a health insurance plan that aligns with Dave Ramsey’s principles of affordability and adequate coverage, the next step is to maximize the benefits of that plan. Dave Ramsey offers several strategies to ensure you’re getting the most out of your health insurance.

Understanding Your Plan’s Coverage and Benefits

One of Dave Ramsey’s key strategies is to thoroughly understand your health insurance plan. This means reading the policy documents, understanding the terms and conditions, and knowing what is and isn’t covered.

For instance, many health insurance plans have specific rules about pre-authorization or prior approval for certain procedures or treatments. Understanding these rules can help you avoid unexpected denials or additional out-of-pocket costs. Dave Ramsey suggests keeping a copy of your policy documents handy and referring to them whenever you have a health-related question or concern.

Managing Your Out-of-Pocket Costs

Another important aspect of maximizing your health insurance coverage is managing your out-of-pocket costs. Dave Ramsey advises individuals to keep a close eye on their deductibles, copays, and coinsurance amounts. He suggests setting aside money in a separate savings account specifically for these expenses, so you’re prepared when they come due.

Additionally, Dave Ramsey encourages individuals to shop around for the best prices on medical services, even when they're covered by insurance. For example, if you need a lab test or an MRI, call around to different providers to find the best price. This can help you save money, even with insurance, and potentially lower your out-of-pocket costs.

Utilizing Preventive Care Services

Preventive care is an essential part of maintaining good health, and many health insurance plans offer these services at little to no cost to the insured. Dave Ramsey stresses the importance of taking advantage of these services, as they can help catch potential health issues early, when they’re often more treatable and less costly.

Preventive care services typically include annual physical exams, immunizations, cancer screenings, and counseling services for various health issues. By utilizing these services, you can stay on top of your health, potentially avoiding more serious health issues down the line, and saving on healthcare costs in the long term.

Exploring Discounts and Negotiation Options

Dave Ramsey also advises individuals to be proactive in seeking discounts and negotiating better rates for healthcare services. Many healthcare providers offer discounts for paying in cash or for prompt payment. He encourages individuals to ask about these discounts and to negotiate prices, especially for non-emergency services.

Additionally, if you're facing a large medical bill, Dave Ramsey suggests reaching out to the provider's billing department to discuss your situation. Many providers are willing to set up payment plans or offer discounts for patients who demonstrate a commitment to paying their bills.

By implementing these strategies, Dave Ramsey believes individuals can maximize the benefits of their health insurance plans, ensuring they're getting the most value for their money while also maintaining their health and financial well-being.

The Future of Health Insurance: Dave Ramsey’s Insights

As the healthcare landscape continues to evolve, Dave Ramsey offers insights into how he believes the future of health insurance may unfold. While he acknowledges the complexities and challenges of the healthcare system, he also sees opportunities for individuals to take control of their health and financial destinies.

The Rise of Consumer-Driven Health Plans

Dave Ramsey predicts that consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), will become increasingly popular. These plans give individuals more control over their healthcare spending and can lead to significant tax advantages.

With an HSA, for example, individuals can contribute pre-tax dollars to a savings account that can be used to pay for qualified medical expenses. Any unused funds roll over year to year, allowing individuals to build a substantial health savings fund over time. Ramsey believes that HSAs, in particular, offer a powerful tool for individuals to manage their healthcare costs and save for future needs.

Embracing Technology and Telehealth

Dave Ramsey also foresees a growing role for technology in the healthcare industry, particularly with the rise of telehealth services. Telehealth allows individuals to access medical care remotely, often through video conferencing or secure messaging platforms. This can be especially beneficial for individuals in rural areas or those who have difficulty traveling to healthcare facilities.

Ramsey believes that telehealth can increase access to healthcare while potentially reducing costs. He encourages individuals to explore telehealth options, as they may offer a more convenient and affordable way to receive medical care for certain conditions.

The Importance of Health Literacy

Another key aspect of the future of health insurance, according to Dave Ramsey, is the need for increased health literacy. He believes that individuals must become more knowledgeable about their healthcare options, the costs associated with different treatments and procedures, and how to navigate the healthcare system effectively.

By increasing health literacy, individuals can make more informed decisions about their healthcare, potentially leading to better health outcomes and more efficient use of healthcare resources. Ramsey suggests that individuals should take the time to educate themselves about their health insurance plans, the healthcare system, and their own health needs and risks.

In conclusion, while the future of health insurance may present challenges, Dave Ramsey believes that individuals can take proactive steps to navigate these complexities. By embracing consumer-driven health plans, utilizing technology, and increasing their health literacy, individuals can take control of their healthcare and financial futures.

FAQs

What is Dave Ramsey’s stance on health insurance?

+Dave Ramsey advocates for a balanced approach to health insurance, prioritizing both affordability and adequate coverage. He encourages individuals to choose plans that provide necessary coverage without becoming a financial burden.

How does Dave Ramsey recommend selecting a health insurance plan?

+Dave Ramsey suggests a thorough review of plan options, focusing on premium costs, deductibles, coverage benefits, and network of providers. He encourages individuals to shop around and compare plans to find the best fit for their needs and budget.

What strategies does Dave Ramsey suggest for maximizing health insurance coverage?

+Dave Ramsey recommends understanding your plan’s coverage, managing out-of-pocket costs, utilizing preventive care services, and exploring discounts and negotiation options. These strategies can help individuals get the most value from their health insurance plans.

How does Dave Ramsey see the future of health insurance?

+Dave Ramsey predicts the rise of consumer-driven health plans, the increased use of telehealth services, and the importance of health literacy. He believes individuals can take control of their healthcare and financial futures by embracing these trends and becoming more health-literate.