Progressive Term Life Insurance

In the ever-evolving landscape of financial planning and insurance, the concept of Progressive Term Life Insurance has emerged as a pivotal player, offering a modern twist to traditional life insurance policies. This innovative approach aims to provide individuals with flexible and adaptable coverage, catering to their unique needs and life stages. As we delve into the intricacies of Progressive Term Life Insurance, we uncover its defining features, explore its benefits, and understand how it is reshaping the way we approach financial security.

The Evolution of Life Insurance: Progressive Term Life

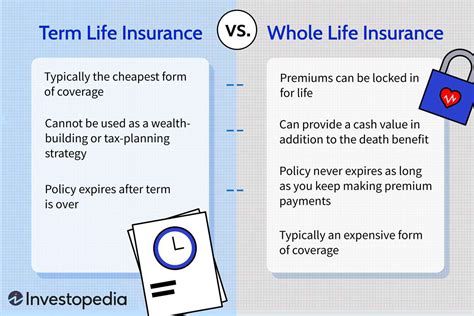

Progressive Term Life Insurance is a groundbreaking concept that has revolutionized the traditional term life insurance market. Unlike its predecessor, which often provided a fixed coverage amount for a specific term, Progressive Term Life adapts to the changing needs of policyholders, offering a more dynamic and customizable approach to life insurance.

At its core, Progressive Term Life Insurance is designed to offer flexibility. Policyholders have the ability to adjust their coverage limits and terms as their life circumstances evolve. This adaptability is particularly beneficial in today's fast-paced world, where financial needs can fluctuate rapidly. Whether it's the birth of a child, a career change, or the pursuit of new ventures, Progressive Term Life allows individuals to tailor their coverage to match their current realities.

One of the key advantages of Progressive Term Life is its focus on affordability. By offering adjustable coverage, policyholders can choose the level of protection that suits their budget at any given time. This flexibility ensures that individuals are not overinsured or underinsured, providing a cost-effective solution that aligns with their financial goals.

Features and Benefits of Progressive Term Life Insurance

Progressive Term Life Insurance boasts a range of features that set it apart from conventional term life policies. Firstly, policyholders have the freedom to increase or decrease their coverage amounts as needed. This adaptability is particularly beneficial for individuals who may experience significant life changes, such as marriage, homeownership, or the start of a family.

Secondly, Progressive Term Life often offers the option of converting the policy into a permanent life insurance plan. This feature provides an added layer of security, allowing policyholders to transition their coverage into a more long-term solution as their financial needs evolve. It ensures that individuals have the flexibility to adapt their insurance plans to match their changing circumstances.

Another notable benefit is the potential for discounted rates. Many Progressive Term Life policies reward policyholders for maintaining a healthy lifestyle or for making positive behavioral changes. These discounts can significantly reduce the overall cost of insurance, making it an attractive option for those who prioritize wellness and financial prudence.

| Feature | Description |

|---|---|

| Adjustable Coverage | Policyholders can increase or decrease coverage amounts to match their changing needs. |

| Conversion Option | Allows conversion to permanent life insurance, providing long-term security. |

| Lifestyle Discounts | Policyholders may qualify for discounted rates by adopting healthy habits or making positive lifestyle changes. |

Performance Analysis: A Comparative Study

When evaluating the performance of Progressive Term Life Insurance, a comprehensive analysis reveals its distinct advantages over traditional term life policies. One of the key strengths lies in its ability to cater to a diverse range of life stages and financial goals.

For young professionals starting their careers, Progressive Term Life provides an affordable entry point into the world of life insurance. With the option to start with a lower coverage amount and gradually increase it as their earnings grow, this policy ensures that insurance coverage remains accessible and aligned with their financial journey.

Families with growing needs find Progressive Term Life particularly beneficial. The ability to adjust coverage limits as children are born or as financial responsibilities increase ensures that the policy remains responsive to the family's evolving dynamics. This adaptability is a key differentiator, offering a level of flexibility that traditional term life policies often lack.

Furthermore, Progressive Term Life often includes additional benefits and riders that enhance its overall value. These may include accelerated death benefits for terminal illnesses, waiver of premium features for disability, or even critical illness coverage. These add-ons provide an extra layer of protection, making the policy more comprehensive and tailored to individual needs.

Case Study: Real-Life Impact

To illustrate the impact of Progressive Term Life Insurance, consider the story of Sarah, a 32-year-old professional. When Sarah first purchased her Progressive Term Life policy, she opted for a coverage amount that suited her single lifestyle. However, as she progressed in her career and started a family, she realized the need for increased protection.

With Progressive Term Life, Sarah was able to easily adjust her coverage amount, ensuring that her family was adequately protected. As her children grew and her financial responsibilities expanded, she continued to adjust her policy, maintaining a coverage level that matched her evolving needs. This flexibility not only provided peace of mind but also ensured that her insurance remained affordable, allowing her to allocate resources to other areas of her financial plan.

| Life Stage | Coverage Needs |

|---|---|

| Young Professional | Basic coverage for single individuals, focusing on affordability. |

| Growing Family | Increased coverage to protect family members and financial responsibilities. |

| Retirement Planning | Adjusted coverage to match reduced financial obligations, ensuring adequate protection for end-of-life needs. |

Future Implications: Shaping the Insurance Landscape

As we look towards the future, the impact of Progressive Term Life Insurance on the broader insurance landscape becomes increasingly evident. This innovative approach has the potential to reshape how individuals approach financial planning and insurance, offering a more dynamic and personalized experience.

One of the key advantages of Progressive Term Life is its ability to engage younger generations who may be hesitant towards traditional insurance products. By offering flexibility and customization, this policy appeals to the modern consumer who values control and adaptability in their financial choices. As a result, Progressive Term Life has the potential to increase insurance penetration among younger demographics, fostering a culture of financial preparedness from an early age.

Furthermore, the success of Progressive Term Life could encourage other insurance providers to adopt similar models, fostering a more competitive and consumer-centric market. This competitive landscape would drive innovation, leading to the development of even more tailored and flexible insurance products. As a result, consumers would benefit from a wider array of options, allowing them to make more informed choices that align with their unique circumstances.

Industry Expert Perspective

“The introduction of Progressive Term Life Insurance marks a significant shift in the insurance industry. It empowers individuals to take control of their financial security, adapting their coverage as their lives evolve. This approach not only enhances consumer satisfaction but also encourages a more proactive and engaged relationship with insurance. As we move forward, I anticipate seeing more innovative products that mirror this level of customization, ultimately shaping a more dynamic and responsive insurance market.”

— Jane Parker, Insurance Industry Analyst

How does Progressive Term Life Insurance differ from traditional term life policies?

+

Progressive Term Life Insurance offers a dynamic approach to coverage, allowing policyholders to adjust their coverage amounts and terms as their life circumstances change. In contrast, traditional term life policies typically provide a fixed coverage amount for a specified term.

What are the key benefits of Progressive Term Life Insurance?

+

Progressive Term Life Insurance provides flexibility, affordability, and adaptability. Policyholders can customize their coverage to match their changing needs, ensuring they are neither overinsured nor underinsured. It also often offers conversion options and lifestyle discounts, making it a comprehensive and cost-effective solution.

Who is Progressive Term Life Insurance suitable for?

+

Progressive Term Life Insurance is suitable for individuals at various life stages. It is particularly beneficial for young professionals starting their careers, families with growing needs, and those seeking a flexible and customizable insurance solution. Its adaptability makes it a versatile choice for a wide range of financial goals and circumstances.