Quotes For Homeowners Insurance Online

As a homeowner, one of the most important decisions you'll make is choosing the right homeowners insurance policy. With so many options available online, it can be challenging to navigate the process and find the best coverage at an affordable price. That's why it's crucial to understand the key factors that influence homeowners insurance quotes and how you can secure the most advantageous rates. In this comprehensive guide, we will delve into the world of homeowners insurance quotes, providing you with valuable insights and practical tips to ensure you get the coverage you need without breaking the bank.

Understanding Homeowners Insurance Quotes

Homeowners insurance quotes are tailored estimates provided by insurance companies to cover the risks associated with owning a home. These quotes take into account various factors to determine the level of coverage and the premium you’ll pay. By understanding the components that influence these quotes, you can make informed decisions and potentially save money on your insurance policy.

Factors Affecting Homeowners Insurance Quotes

Several key factors play a role in determining homeowners insurance quotes. These include:

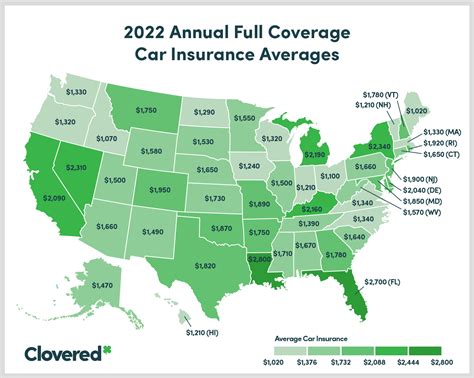

- Location: The geographical location of your home is a significant factor. Insurance companies consider the risk of natural disasters, crime rates, and local construction costs when assessing quotes.

- Home Value and Size: The value and size of your home impact the quote. Larger homes generally require more coverage, leading to higher premiums. Additionally, the materials used in construction and the age of the home can affect the quote.

- Coverage Options: The level of coverage you choose affects the quote. Standard policies typically cover the structure, personal belongings, and liability, but you can opt for additional coverage for specific risks like floods or earthquakes.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower premiums, but it’s essential to consider your financial situation and ability to cover potential costs.

- Claim History: Insurance companies review your claim history when providing quotes. A history of frequent claims may result in higher premiums or even difficulty finding coverage.

- Discounts and Bundling: Insurance companies often offer discounts for various reasons. These can include loyalty discounts, safety features like burglar alarms or smoke detectors, and even discounts for being a non-smoker.

For instance, if you live in an area prone to hurricanes or earthquakes, your insurance premiums may be higher due to the increased risk of property damage.

A newer home built with modern, fire-resistant materials may qualify for lower rates compared to an older home constructed with outdated materials.

Consider your needs carefully and discuss with your insurer to ensure you have the right coverage without overpaying.

A higher deductible may save you money in the short term, but it’s crucial to ensure you have the funds available if you need to make a claim.

Maintaining a clean claim record and only filing claims for significant incidents can help keep your premiums affordable.

Bundling your homeowners insurance with other policies, such as auto insurance, can also lead to significant savings. Discuss potential discounts with your insurer to take advantage of all available options.

Tips for Getting the Best Homeowners Insurance Quotes

Now that we’ve explored the factors influencing homeowners insurance quotes, let’s delve into some practical tips to help you secure the most advantageous rates:

Shop Around and Compare

Don’t settle for the first quote you receive. Take the time to shop around and compare quotes from multiple insurance companies. Online comparison tools can be incredibly helpful in this process, allowing you to quickly see the range of options available.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional perks or exclusions. Ensure you’re comparing similar policies to get an accurate understanding of the best value.

Consider Your Coverage Needs

Evaluate your specific coverage needs and consider the unique risks associated with your home and location. For example, if you live in a flood-prone area, standard homeowners insurance may not provide sufficient coverage. In such cases, you may need to consider additional flood insurance.

Discuss your coverage options with insurance professionals to ensure you have the right protection without paying for unnecessary add-ons.

Improve Your Home’s Safety

Insurance companies often offer discounts for homes equipped with safety features. Installing a burglar alarm, smoke detectors, and a sprinkler system can not only improve your home’s security but also reduce your insurance premiums.

Additionally, consider making home improvements to enhance its resilience against natural disasters. Strengthening your home’s structure and implementing disaster-resistant measures can lead to lower insurance rates.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your homeowners insurance premiums. Insurance companies use credit-based insurance scores to assess the risk of insuring a homeowner. Maintaining a good credit score can lead to lower premiums, as it indicates a lower likelihood of filing claims.

Focus on paying your bills on time, reducing debt, and regularly monitoring your credit report to ensure its accuracy.

Bundle Your Policies

If you have multiple insurance needs, such as auto, life, or health insurance, consider bundling your policies with the same insurer. Bundling can result in significant savings and simplify your insurance management.

Many insurance companies offer multi-policy discounts, so be sure to inquire about these options when discussing your insurance needs.

Understand Your Deductibles

While choosing a higher deductible can lower your premiums, it’s crucial to understand the financial implications. Ensure you have the funds available to cover the deductible in case of an emergency. It’s a delicate balance between saving money and being able to afford potential out-of-pocket expenses.

Consider setting aside an emergency fund specifically for insurance deductibles to prepare for unexpected incidents.

The Future of Homeowners Insurance Quotes

The insurance industry is evolving, and homeowners insurance quotes are no exception. With advancements in technology and data analytics, insurance companies are increasingly utilizing innovative methods to assess risk and provide more accurate quotes.

Emerging Technologies

Insurance companies are exploring new technologies to enhance the accuracy and efficiency of homeowners insurance quotes. These include:

- Satellite Imagery: Advanced satellite technology allows insurance companies to assess the condition and risks associated with homes remotely. This technology can identify potential hazards, such as roof damage or nearby fire hazards, without the need for physical inspections.

- Artificial Intelligence (AI): AI algorithms are being employed to analyze vast amounts of data, including historical claim records and real-time weather patterns, to predict risks and provide more precise quotes.

- Internet of Things (IoT): IoT devices, such as smart home sensors and cameras, provide real-time data on home conditions. Insurance companies can use this data to offer personalized quotes and monitor risks, potentially leading to lower premiums for homeowners who adopt these technologies.

Personalized Pricing Models

The traditional one-size-fits-all approach to homeowners insurance quotes is evolving. Insurance companies are moving towards more personalized pricing models that take into account individual risk factors and behavior.

By leveraging advanced analytics and machine learning, insurers can offer tailored quotes based on factors like your home’s energy efficiency, usage patterns, and even your driving habits (if you bundle auto insurance). This shift towards personalized pricing aims to reward responsible homeowners with more accurate and potentially lower premiums.

Telematics and Usage-Based Insurance

Telematics devices, which track driving behavior, are becoming increasingly common in auto insurance. However, this technology is now being explored for homeowners insurance as well. By installing sensors or cameras in your home, insurance companies can monitor usage patterns, such as water consumption or energy usage, and offer usage-based insurance rates.

For example, if you consistently demonstrate energy-efficient practices, you may qualify for lower premiums. This approach encourages homeowners to adopt more sustainable habits while potentially saving money on their insurance.

Conclusion

Securing the right homeowners insurance coverage at a competitive rate is a crucial aspect of responsible homeownership. By understanding the factors that influence homeowners insurance quotes and implementing the practical tips outlined in this guide, you can navigate the insurance landscape with confidence and find the best coverage for your needs.

As the insurance industry continues to innovate, embracing emerging technologies and personalized pricing models, homeowners can expect more accurate and tailored quotes. Stay informed, compare options, and take advantage of the evolving opportunities in the insurance market to ensure you’re getting the most value for your insurance dollar.

How often should I review my homeowners insurance policy and quotes?

+It’s recommended to review your homeowners insurance policy and quotes annually, or whenever you experience significant life changes, such as renovations, additions, or relocations. Regular reviews ensure your coverage remains adequate and that you’re not overpaying.

What should I do if I have difficulty finding affordable homeowners insurance?

+If you’re struggling to find affordable homeowners insurance, consider reaching out to an insurance broker who can help you explore options from multiple insurers. Additionally, review your coverage needs and consider reducing coverage for lower-value items or increasing your deductibles to lower premiums.

Are there any common mistakes to avoid when obtaining homeowners insurance quotes online?

+Yes, some common mistakes to avoid include providing inaccurate information about your home or its contents, failing to compare quotes from multiple insurers, and not reading the fine print to understand coverage limitations and exclusions. Take your time, be thorough, and seek professional advice if needed.