Insurance Homeowners Quote

Securing your home with adequate insurance coverage is an essential step towards financial protection and peace of mind. With the diverse range of homeowners' insurance policies available, understanding the nuances and intricacies of quotes can be challenging. This comprehensive guide aims to demystify the process, empowering you to make informed decisions and obtain the best possible coverage for your residential property.

Understanding Homeowners’ Insurance Quotes: An In-Depth Overview

Homeowners’ insurance quotes serve as the foundation for safeguarding your home and its contents against a myriad of risks, including natural disasters, theft, and liability claims. These quotes provide an estimate of the cost of coverage tailored to your specific needs and the unique characteristics of your property. The quote-generation process involves a meticulous assessment of various factors to determine the level of risk associated with insuring your home.

Factors Influencing Homeowners’ Insurance Quotes

Numerous elements contribute to the formulation of homeowners’ insurance quotes, with the most prominent factors including the following:

- Location: The geographical location of your home plays a pivotal role in quote determination. Regions prone to natural disasters like hurricanes, earthquakes, or floods generally incur higher insurance costs.

- Construction Type: The materials and methods used in constructing your home impact its resilience against various risks. Homes built with sturdy materials and modern techniques may enjoy more favorable insurance rates.

- Age of the Property: Older homes may face higher insurance costs due to potential structural vulnerabilities or outdated electrical systems. Conversely, newer homes may benefit from reduced rates.

- Value of the Property: The overall value of your home, including its structural components and any valuable additions or upgrades, directly influences the insurance quote. Higher-value properties often require more extensive coverage.

- Contents Coverage: The value of your personal belongings, such as furniture, electronics, and jewelry, is a critical consideration in homeowners’ insurance quotes. Insurers may offer various coverage options to ensure your possessions are adequately protected.

- Liability Protection: This aspect covers potential legal claims resulting from accidents or injuries that occur on your property. The level of liability coverage you opt for will impact your insurance quote.

- Deductibles: The amount you agree to pay out of pocket before your insurance coverage kicks in is known as the deductible. Opting for a higher deductible can lower your insurance premiums.

- Additional Coverage: Certain valuable items or specific risks may require additional coverage. For instance, you may need separate coverage for high-value items like artwork or jewelry.

| Factor | Impact on Quote |

|---|---|

| Location | High-risk areas like flood zones or earthquake-prone regions may result in higher premiums. |

| Construction Type | Homes built with fire-resistant materials or equipped with modern safety features may qualify for lower rates. |

| Age of Property | Older homes may face higher costs due to potential structural issues or outdated systems. |

| Property Value | The higher the value of your home and its contents, the more comprehensive the coverage required, impacting the quote. |

| Contents Coverage | The value and nature of your personal belongings influence the level of coverage needed and the associated cost. |

| Liability Protection | Opting for higher liability limits will increase your insurance quote. |

| Deductibles | Choosing a higher deductible can lead to lower premiums, as you'll be covering more of the initial costs in the event of a claim. |

| Additional Coverage | Separate coverage for high-value items or specific risks can add to the overall cost of your insurance. |

Obtaining Multiple Quotes: A Comparative Analysis

To secure the best homeowners’ insurance coverage, it’s essential to obtain quotes from multiple insurers. This comparative approach allows you to assess various policies, understand the differences, and make an informed decision. Here’s a step-by-step guide to help you through the process:

Step 1: Identify Reputable Insurers

Start by researching and identifying a shortlist of reputable insurance companies that offer homeowners’ insurance in your area. Consider factors such as financial stability, customer satisfaction ratings, and the range of coverage options they provide.

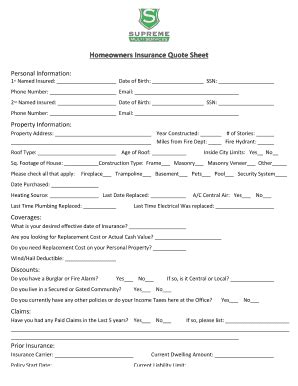

Step 2: Gather Essential Information

Before requesting quotes, ensure you have all the necessary information about your home and its contents. This includes details such as:

- The age and square footage of your home.

- The construction type and any recent renovations or upgrades.

- A comprehensive list of your personal belongings and their approximate values.

- Any unique features or potential risks associated with your property, such as proximity to bodies of water or the presence of valuable art collections.

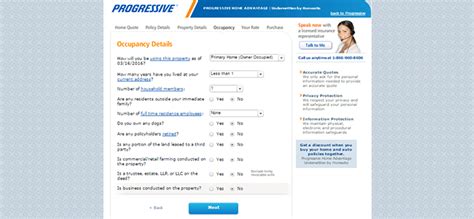

Step 3: Request Quotes

Reach out to the insurers on your shortlist and request quotes. Provide them with the detailed information you’ve gathered to ensure an accurate assessment of your insurance needs. Most insurers offer online quote tools or provide quotes over the phone.

Step 4: Analyze and Compare Quotes

Once you’ve received multiple quotes, it’s time to delve into a thorough analysis. Compare the following aspects to make an informed decision:

- Coverage Limits: Ensure that the policies offer adequate coverage for your home and its contents. Compare the limits for various perils, including fire, theft, and liability.

- Deductibles: Assess the deductibles across different policies. While higher deductibles may lower premiums, consider whether you can afford the out-of-pocket costs in the event of a claim.

- Additional Coverage Options: Some insurers may offer unique coverage enhancements or discounts. Evaluate these options to determine if they align with your specific needs.

- Policy Exclusions : Understand the exclusions in each policy. Certain risks or perils may not be covered, so ensure you’re aware of any potential gaps in coverage.

- Customer Service and Claims Process : Research the insurer’s reputation for customer service and claims handling. Positive reviews and a seamless claims process can provide peace of mind.

Maximizing Your Homeowners’ Insurance Coverage

Obtaining competitive quotes is just the first step towards securing optimal homeowners’ insurance coverage. To further enhance your protection and potentially lower your premiums, consider the following strategies:

Bundle Your Insurance Policies

Many insurers offer discounts when you bundle multiple policies, such as homeowners’ insurance with auto or life insurance. Bundling can not only save you money but also simplify your insurance management.

Implement Home Security Measures

Investing in home security systems, smoke detectors, and fire alarms can reduce the risk of theft and fire-related incidents. These measures often qualify you for insurance discounts, as they enhance the overall safety of your property.

Regularly Review and Update Your Policy

Your insurance needs may evolve over time due to changes in your home’s value, personal belongings, or family situation. Regularly review your policy to ensure it aligns with your current requirements. Update your coverage as necessary to avoid gaps or inadequate protection.

Understand Your Deductibles

While opting for a higher deductible can lower your premiums, it’s essential to choose a deductible amount you can comfortably afford in the event of a claim. A higher deductible may not be financially feasible for everyone, so strike a balance that suits your budget and risk tolerance.

Explore Discounts and Rewards

Insurance companies often offer discounts for various reasons, such as loyalty, seniority, or occupational affiliations. Inquire about available discounts and take advantage of any that apply to your situation.

Maintain a Good Credit Score

Your credit score can influence your insurance rates. Insurers may view individuals with higher credit scores as less risky, potentially leading to more favorable rates. Maintaining a good credit score can thus impact your insurance costs positively.

How often should I review my homeowners’ insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur in your home or personal circumstances. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

What happens if I don’t disclose all the necessary information when obtaining a quote?

+Failure to disclose relevant information can lead to invalidation of your policy in the event of a claim. Always provide accurate and complete details to ensure your coverage is legitimate.

Can I customize my homeowners’ insurance policy to fit my specific needs?

+Yes, most insurers offer customizable policies. You can choose coverage limits, deductibles, and additional endorsements to create a policy that suits your unique requirements.

Are there any potential drawbacks to opting for a higher deductible in my homeowners’ insurance policy?

+While a higher deductible can lead to lower premiums, it’s essential to ensure you can afford the out-of-pocket costs in the event of a claim. If you’re unable to pay the deductible, your claim may be denied, leaving you responsible for the entire cost of repairs or replacements.