Cost Of Business Insurance For A Small Business

In the realm of small business ownership, one of the most critical yet often daunting aspects is securing adequate insurance coverage. Business insurance is an indispensable tool for protecting your enterprise from various risks and liabilities, but the associated costs can be a significant concern for budding entrepreneurs. This comprehensive guide aims to delve into the intricacies of business insurance costs, offering a clear understanding of the financial commitment required and the factors influencing it.

Introduction: The Necessity of Business Insurance

For small business owners, the decision to invest in insurance is not merely a financial consideration but a strategic move to safeguard their venture and its future growth. Business insurance provides a safety net, offering protection against a wide array of risks, from property damage and liability claims to loss of income and employee injuries.

While the benefits of insurance are undeniable, the cost can be a significant barrier, especially for startups with limited financial resources. It is, therefore, imperative to have a comprehensive understanding of the factors that influence insurance premiums and the strategies to mitigate these costs without compromising on essential coverage.

Factors Influencing Business Insurance Costs

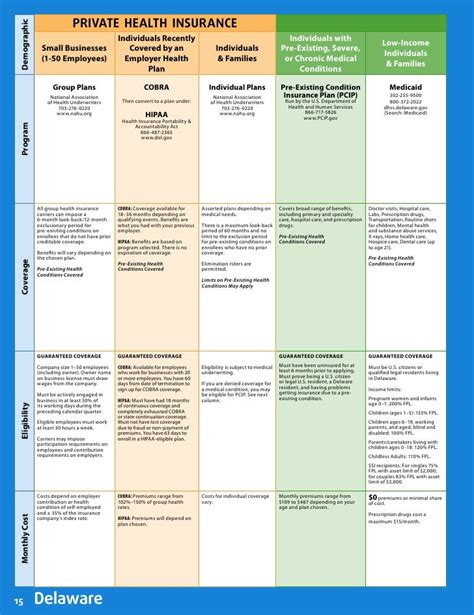

1. Type of Business and Industry

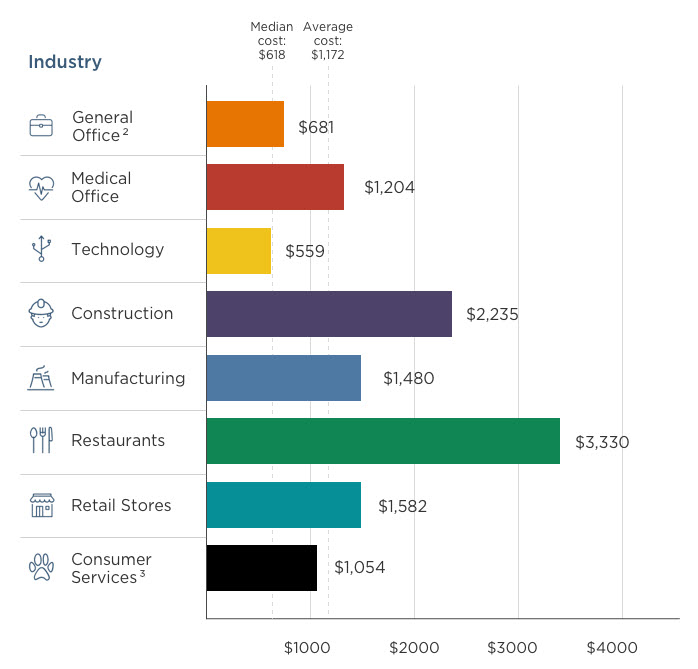

The nature of your business and the industry it operates in play a pivotal role in determining insurance costs. High-risk industries, such as construction or manufacturing, typically attract higher premiums due to the increased likelihood of accidents, injuries, or property damage. Conversely, low-risk businesses, like consulting or graphic design, may enjoy more affordable insurance rates.

2. Size and Location of the Business

The size of your business, measured by revenue, number of employees, or physical space, can also impact insurance costs. Larger businesses generally face higher premiums due to the increased scope of potential risks and liabilities. Additionally, the location of your business can affect insurance rates, with businesses in high-crime or disaster-prone areas often paying more.

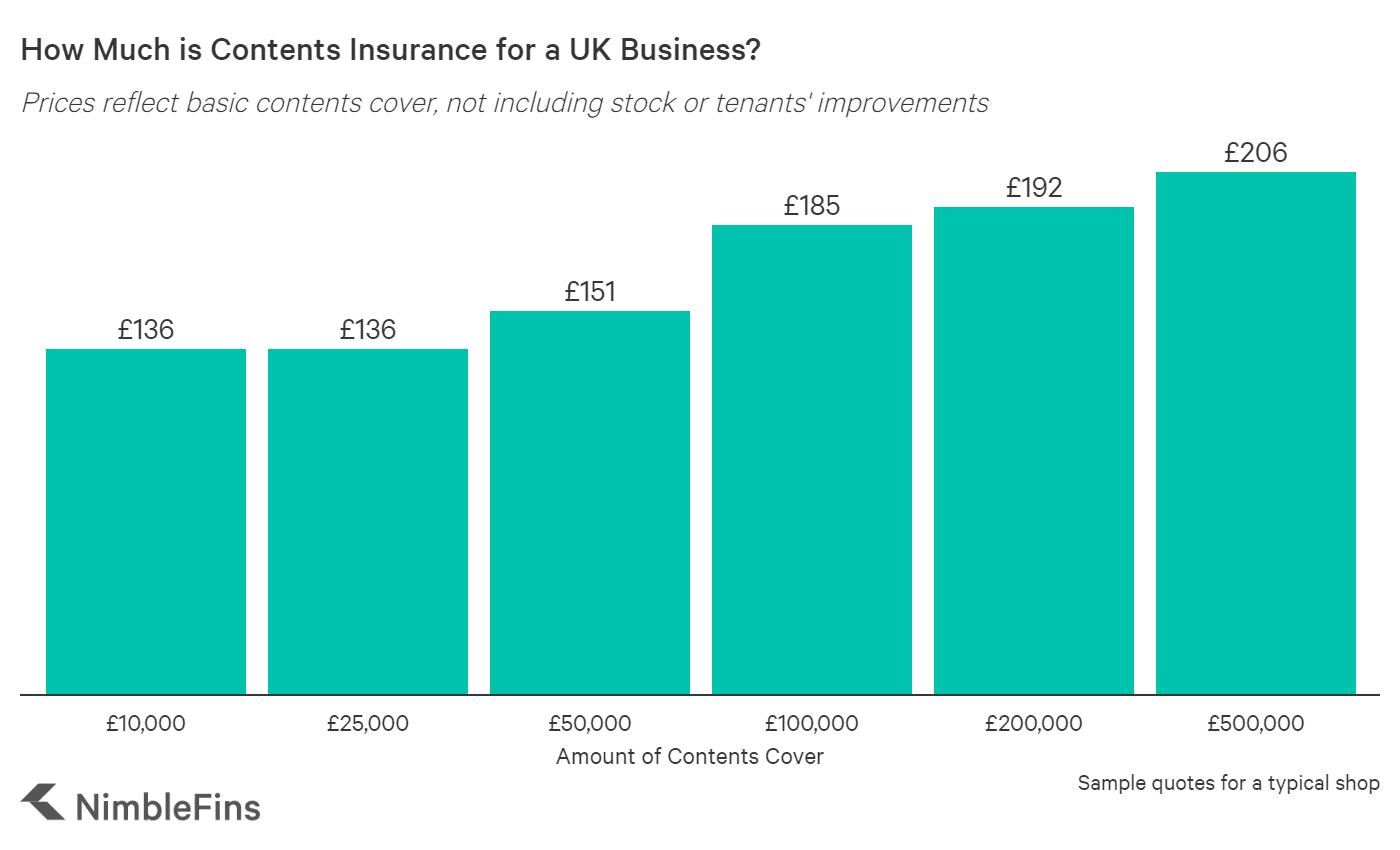

3. Coverage Requirements and Limits

The types of insurance coverage you opt for and the corresponding limits you set will significantly influence your overall insurance costs. Comprehensive policies that cover a wide range of risks, such as property damage, liability, and business interruption, will naturally be more expensive than basic coverage.

4. Claims History and Risk Management

Insurance companies assess your business’s risk profile based on its claims history and the measures you have in place for risk management. A history of frequent or costly claims can lead to higher premiums, as it indicates a higher likelihood of future claims. Conversely, implementing effective risk management strategies, such as safety protocols or employee training, can reduce insurance costs by demonstrating your commitment to minimizing risks.

5. Deductibles and Policy Terms

The deductible you choose for your insurance policy—the amount you agree to pay out-of-pocket before the insurance kicks in—can impact your premium. Generally, higher deductibles result in lower premiums, as they reduce the insurer’s potential liability. Similarly, the length of the policy term can affect costs, with longer terms often offering more favorable rates.

Strategies to Reduce Business Insurance Costs

1. Bundle Your Insurance Policies

One effective strategy to reduce insurance costs is to bundle multiple policies with the same insurer. Many insurance companies offer discounts when you purchase multiple types of coverage, such as property, liability, and business interruption insurance, from them.

2. Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple insurers. Each company has its own risk assessment methodology and pricing structure, so you may find significant variations in premiums for similar coverage.

3. Enhance Your Risk Management Practices

Implementing robust risk management practices can not only reduce the likelihood of claims but also make your business more attractive to insurers, potentially leading to lower premiums. This could involve regular safety audits, employee training on risk mitigation, and the adoption of advanced security systems or equipment.

4. Opt for Higher Deductibles

As mentioned earlier, choosing a higher deductible can result in lower premiums. While this strategy involves accepting a larger financial burden in the event of a claim, it can be a cost-effective approach for businesses with strong cash flow and a low risk of claims.

5. Review and Adjust Coverage Regularly

Your business’s insurance needs may change over time, so it’s important to review your coverage annually and make adjustments as necessary. This could involve adding or removing coverage, increasing or decreasing limits, or making other changes to better reflect your current business operations and risks.

Real-World Examples and Case Studies

Case Study 1: Small Retail Store in a Low-Risk Industry

A small retail store selling books and stationery in a suburban area has relatively low insurance costs. The business is considered low-risk due to its limited potential for accidents or injuries. The owner opts for basic coverage, including property and liability insurance, with a 1,000 deductible. The annual premium for this coverage is approximately 1,200.

Case Study 2: Construction Company Operating in a High-Risk Industry

A construction company specializing in commercial building projects faces significantly higher insurance costs due to the high-risk nature of its industry. The company needs a comprehensive insurance package, including coverage for property damage, liability, workers’ compensation, and business interruption. With a 5,000 deductible, the annual premium for this coverage could exceed 20,000.

The Impact of Business Insurance on Small Business Growth

Business insurance is not just a financial burden; it’s an essential investment in the long-term health and growth of your small business. By protecting your enterprise from various risks and liabilities, insurance allows you to focus on strategic business development without the constant worry of potential financial disasters.

While the cost of business insurance can be a significant concern, especially for startups, it’s important to view it as a necessary expense rather than an optional luxury. With careful planning, research, and the implementation of cost-saving strategies, small business owners can find affordable insurance solutions that provide the necessary coverage without breaking the bank.

Conclusion: A Balanced Approach to Business Insurance

In conclusion, understanding the cost of business insurance is crucial for small business owners to make informed decisions about their financial commitments. By recognizing the various factors that influence insurance premiums and adopting strategic approaches to mitigate these costs, entrepreneurs can ensure their businesses are adequately protected without incurring excessive expenses.

Remember, business insurance is not just about cost; it’s about peace of mind and the long-term success of your enterprise. With the right approach, you can navigate the complexities of insurance coverage and make it work for your unique business needs.

FAQ

What is the average cost of business insurance for small businesses?

+

The average cost of business insurance for small businesses can vary widely depending on various factors, including the industry, size of the business, and the specific coverage needed. As a general guide, small businesses can expect to pay anywhere from a few hundred to several thousand dollars annually for basic coverage. However, this can quickly escalate for high-risk industries or businesses with extensive coverage requirements.

How can I reduce the cost of my business insurance without compromising coverage?

+

There are several strategies to reduce business insurance costs while maintaining adequate coverage. These include bundling policies with the same insurer to access multi-policy discounts, shopping around for the best quotes, enhancing risk management practices to demonstrate a lower risk profile, opting for higher deductibles, and regularly reviewing and adjusting coverage to ensure it aligns with your current business needs.

What factors determine the cost of business insurance for a small business?

+

The cost of business insurance for small businesses is influenced by various factors, including the type of business and industry, size and location of the business, coverage requirements and limits, claims history, risk management practices, and the deductible and policy terms chosen. Each of these factors plays a role in determining the overall insurance premium.