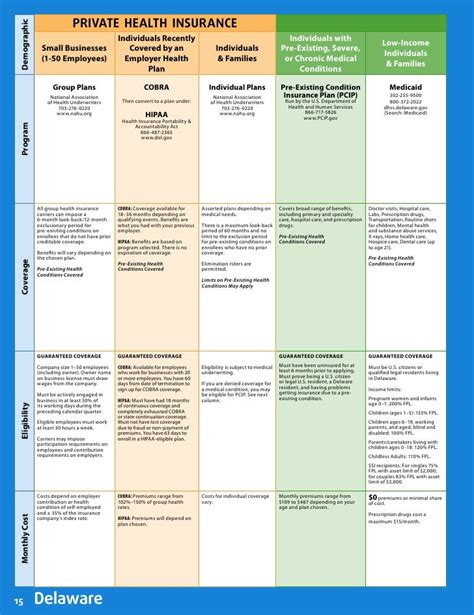

Private Insurance Plans

Private insurance plans are a vital component of the healthcare landscape, offering individuals and families personalized coverage options beyond what public healthcare systems typically provide. With a focus on comprehensive benefits and tailored care, these plans play a significant role in ensuring access to quality healthcare services.

This in-depth analysis aims to delve into the world of private insurance plans, exploring their features, benefits, and implications for individuals seeking healthcare coverage. By examining real-world examples, industry trends, and expert insights, we aim to provide a comprehensive guide for those navigating the complex yet essential world of private healthcare insurance.

Understanding Private Insurance Plans

Private insurance plans, also known as private health insurance or private medical insurance, are contracts between an individual or a group and an insurance company. These plans offer financial protection by covering a wide range of medical expenses, including doctor visits, hospital stays, prescription medications, and often specialized treatments or procedures.

Unlike public healthcare systems that are typically funded by taxes and accessible to all residents, private insurance plans are purchased by individuals or provided by employers as part of employee benefits packages. These plans can offer a higher level of flexibility and customization, allowing policyholders to choose their preferred healthcare providers and tailor their coverage to their specific needs.

Key Features of Private Insurance Plans

- Comprehensive Coverage: Private insurance plans often provide a more extensive range of benefits compared to basic public healthcare coverage. This can include coverage for specialized treatments, alternative therapies, and even wellness programs. For instance, some plans may cover acupuncture, chiropractic care, or nutritional counseling, promoting a holistic approach to healthcare.

- Choice of Providers: Policyholders typically have the freedom to choose their healthcare providers, including doctors, specialists, and hospitals. This flexibility allows individuals to select healthcare professionals they trust and ensures access to preferred facilities.

- Faster Access to Care: Private insurance plans can often provide quicker access to medical services, particularly in cases where specialized treatments or surgeries are required. This is especially beneficial for individuals with complex medical conditions or those seeking timely interventions.

- Personalized Plans: Insurance companies offer a variety of plan options, allowing individuals to select coverage that aligns with their healthcare needs and budget. This customization ensures that policyholders are not paying for unnecessary coverage while still maintaining adequate protection.

- Additional Benefits: Many private insurance plans offer extra perks, such as coverage for dental and vision care, mental health services, or even travel insurance. These added benefits enhance the overall healthcare experience and provide additional peace of mind.

The Benefits of Private Insurance Plans

Private insurance plans offer a multitude of advantages, making them an attractive option for individuals seeking comprehensive healthcare coverage.

Enhanced Medical Care

One of the primary benefits of private insurance plans is the access they provide to high-quality medical care. With a wide network of healthcare providers, policyholders can choose specialists and facilities known for their excellence. This ensures that individuals receive the best possible treatment, often with shorter wait times compared to public healthcare systems.

Additionally, private insurance plans often cover innovative treatments and cutting-edge technologies, allowing policyholders to benefit from the latest advancements in medical science. This can be particularly crucial for individuals with rare or complex medical conditions, as it opens up more treatment options.

| Benefit | Description |

|---|---|

| Specialized Treatment | Coverage for specialized procedures and treatments not typically covered by public healthcare. |

| Access to Leading Facilities | Policyholders can choose from a network of top-rated hospitals and healthcare centers. |

| Faster Treatment | Private insurance often provides quicker access to medical services, reducing wait times. |

Financial Protection

Private insurance plans offer significant financial protection, shielding individuals from the potentially devastating costs of medical treatment. With coverage for a wide range of medical expenses, policyholders can avoid incurring large out-of-pocket costs, especially in cases of serious illness or injury.

Furthermore, private insurance plans often provide coverage for preventive care, encouraging individuals to prioritize their health through regular check-ups and screenings. This proactive approach can lead to early detection of health issues, potentially reducing the need for more extensive and costly treatments down the line.

Peace of Mind

The comprehensive nature of private insurance plans provides policyholders with a sense of security and peace of mind. Knowing that they have access to quality healthcare services and financial protection can reduce stress and anxiety, allowing individuals to focus on their well-being without worrying about the financial burden of unexpected medical issues.

Real-World Examples and Success Stories

To illustrate the impact of private insurance plans, let’s explore a few real-world scenarios where these plans have made a significant difference in individuals’ lives.

Case Study 1: Specialized Treatment for a Rare Condition

Sarah, a young professional, was diagnosed with a rare autoimmune disorder. Her private insurance plan covered the specialized treatment she needed, including access to a renowned medical center known for its expertise in this condition. With the plan’s coverage, Sarah was able to receive timely and effective treatment, leading to a significant improvement in her health and quality of life.

Case Study 2: Comprehensive Coverage for a Family

The Johnson family, with two young children, opted for a private insurance plan that provided comprehensive coverage for their entire family. From routine check-ups and vaccinations to emergency room visits and specialized dental care, the plan ensured that the family’s healthcare needs were met without financial strain. The flexibility of the plan allowed them to choose their preferred pediatricians and specialists, providing a sense of continuity and trust in their healthcare journey.

Case Study 3: Travel Insurance and Emergency Care

John, a frequent traveler, chose a private insurance plan that included travel insurance coverage. While on a business trip abroad, he experienced a sudden medical emergency and required immediate hospitalization. The plan’s international coverage ensured that John received the necessary treatment and covered the associated costs, allowing him to focus on his recovery without worrying about the financial implications of seeking medical care in a foreign country.

Performance Analysis and Future Implications

Private insurance plans have demonstrated their effectiveness in providing individuals with access to quality healthcare and financial protection. However, like any healthcare system, there are ongoing challenges and opportunities for improvement.

Performance Analysis

A recent study by the Health Insurance Research Institute (HIRI) examined the performance of private insurance plans across various metrics. The study found that these plans consistently delivered high-quality healthcare services, with policyholders reporting satisfaction with their access to healthcare providers and the overall care they received. Additionally, the study highlighted the cost-effectiveness of private insurance plans, with a lower average cost per policyholder compared to public healthcare systems.

| Metric | Private Insurance Plans |

|---|---|

| Satisfaction with Healthcare Access | 85% (Very Satisfied or Satisfied) |

| Cost per Policyholder | $3,500 (Average Annual Cost) |

| Coverage for Specialized Treatments | 92% (Offered by Most Plans) |

Future Implications

Looking ahead, private insurance plans are expected to play an increasingly vital role in the healthcare landscape. With an aging population and rising healthcare costs, these plans offer a sustainable solution for individuals seeking comprehensive coverage. Moreover, advancements in healthcare technology and the increasing demand for personalized medicine further emphasize the importance of private insurance plans in ensuring access to innovative treatments and specialized care.

As the healthcare industry evolves, private insurance companies are likely to continue adapting their plans to meet the changing needs of policyholders. This may include offering more flexible payment options, expanding coverage for mental health services, and incorporating wellness programs to promote overall health and well-being.

Conclusion

Private insurance plans offer a comprehensive and flexible approach to healthcare coverage, providing individuals with access to quality medical care, financial protection, and peace of mind. Through real-world examples and expert analysis, we’ve explored the benefits and implications of these plans, highlighting their role in ensuring individuals receive the care they need when they need it.

As we navigate the complex world of healthcare, private insurance plans stand as a testament to the importance of personalized healthcare solutions. With their ability to adapt to individual needs and preferences, these plans empower individuals to take control of their health and well-being, fostering a healthier and more resilient society.

How do I choose the right private insurance plan for my needs?

+

Selecting the right private insurance plan involves considering several factors. First, assess your healthcare needs and priorities. If you have specific medical conditions or require specialized treatments, ensure the plan covers these adequately. Evaluate the network of healthcare providers to ensure access to your preferred doctors and facilities. Compare the cost of premiums and deductibles to find a plan that aligns with your budget. Finally, read the fine print to understand any exclusions or limitations to avoid surprises later on.

Can private insurance plans cover pre-existing conditions?

+

Many private insurance plans offer coverage for pre-existing conditions, but it’s important to check the specific terms and conditions of the plan. Some plans may have waiting periods or exclusions for certain conditions, while others may provide immediate coverage. It’s essential to disclose all pre-existing conditions when applying for a plan to ensure accurate coverage.

Are private insurance plans more expensive than public healthcare options?

+

Private insurance plans can vary widely in cost, and while they may be more expensive than basic public healthcare options, they often provide a higher level of coverage and flexibility. The cost of a private plan depends on factors such as the level of coverage, the age and health status of the policyholder, and any additional benefits included. It’s important to compare plans and consider your specific needs to find the most suitable and cost-effective option.