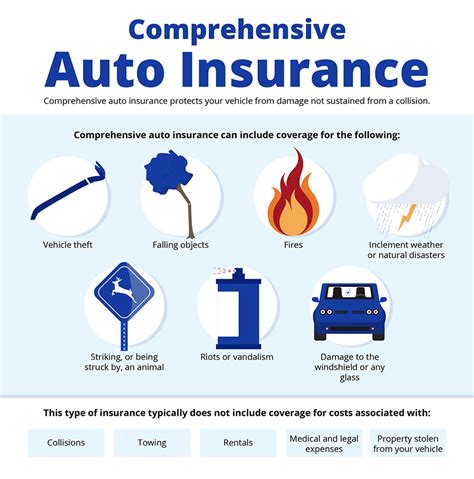

Comprehensive Auto Insurance Definition

Auto insurance, or car insurance, is a fundamental component of vehicle ownership, providing financial protection and peace of mind to drivers and vehicle owners worldwide. In the realm of automotive insurance, the term "comprehensive" carries significant weight, offering an all-encompassing level of coverage that extends beyond the basic liability protection. This article aims to delve into the intricacies of comprehensive auto insurance, exploring its definition, coverage, benefits, and real-world applications.

Understanding Comprehensive Auto Insurance

Comprehensive auto insurance is a specialized form of vehicle insurance designed to offer a wide range of coverage options. It goes beyond the standard liability coverage, which primarily protects against claims arising from bodily injury or property damage caused by the policyholder. Comprehensive insurance takes a more holistic approach, providing protection against various unforeseen events that can damage or destroy a vehicle.

This type of insurance is particularly beneficial for individuals who wish to safeguard their vehicles from potential risks that are not typically covered by basic liability policies. It offers a safety net against a broad spectrum of incidents, ensuring that policyholders are financially protected in the event of accidents, natural disasters, or other unforeseen circumstances.

Key Features and Coverage of Comprehensive Insurance

Comprehensive auto insurance typically includes the following key features and coverage elements:

- Collision Coverage: This aspect of comprehensive insurance covers damage to the insured vehicle resulting from collisions with other vehicles, objects, or animals. It provides financial assistance for repairs or replacement, ensuring that the vehicle is restored to its pre-accident condition.

- Comprehensive Coverage (Non-Collision): This is where the "comprehensive" aspect truly shines. It covers damage caused by events other than collisions, such as theft, vandalism, fire, falling objects, explosions, and natural disasters like hail, storms, or floods. This coverage ensures that policyholders are not left bearing the full financial burden of such events.

- Glass Coverage: Many comprehensive policies include coverage for windshields and other glass components of the vehicle. This can be particularly beneficial as glass damage is common and often expensive to repair or replace.

- Rental Car Reimbursement: In the event that the insured vehicle is damaged and requires repairs, comprehensive insurance may provide coverage for rental car expenses, ensuring that policyholders can maintain their mobility during the repair process.

- Personal Belongings Coverage: Depending on the policy, comprehensive insurance may also cover personal belongings within the vehicle, providing financial assistance for items damaged or stolen during an insured event.

| Coverage Category | Real-World Example |

|---|---|

| Collision Coverage | A driver collides with a deer on a highway. Comprehensive insurance covers the repairs needed to restore the vehicle. |

| Comprehensive Coverage (Non-Collision) | A vehicle is vandalized overnight. The policyholder's comprehensive insurance covers the cost of repairs and replacements. |

| Glass Coverage | A rock hits the windshield, causing a crack. Comprehensive insurance covers the cost of windshield replacement. |

| Rental Car Reimbursement | After an accident, the insured vehicle is in the shop for repairs. The policy covers rental car expenses during this time. |

| Personal Belongings Coverage | During a break-in, valuables are stolen from the vehicle. Comprehensive insurance provides coverage for these items. |

The Benefits of Comprehensive Auto Insurance

Opting for comprehensive auto insurance brings a host of benefits and advantages, ensuring that vehicle owners have the necessary protection in a wide range of scenarios. Here are some key benefits:

Financial Protection

Comprehensive insurance provides a safety net for policyholders, offering financial protection against a broad spectrum of risks. Whether it’s a collision, a natural disaster, or an act of vandalism, comprehensive coverage ensures that the policyholder is not left financially devastated.

Peace of Mind

Knowing that one’s vehicle is protected against a wide range of potential hazards brings a sense of peace and security. Comprehensive insurance allows drivers to focus on their journeys, confident that they are prepared for the unexpected.

Vehicle Preservation

Comprehensive insurance encourages regular vehicle maintenance and upkeep. With comprehensive coverage, policyholders are more likely to address minor issues promptly, ensuring their vehicle remains in good condition and minimizing the risk of more significant, costly repairs down the line.

Reduced Out-of-Pocket Expenses

In the event of an insured incident, comprehensive insurance minimizes the financial burden on the policyholder. Whether it’s a fender bender or a natural disaster, the insurance coverage helps cover the costs, reducing the need for significant out-of-pocket expenses.

Real-World Applications of Comprehensive Insurance

Comprehensive auto insurance has proven its value in countless real-world scenarios. Here are a few examples of how it has benefited policyholders:

Weather-Related Incidents

During a severe storm, a tree branch falls on a parked car, causing significant damage. The policyholder’s comprehensive insurance covers the cost of repairs, ensuring the vehicle is restored to its pre-storm condition.

Vandalism and Theft

A vehicle is vandalized, with the windows smashed and the stereo system stolen. Comprehensive insurance steps in to cover the cost of repairs and replacements, providing financial relief to the policyholder.

Wildlife Collisions

In a rural area, a driver collides with a large animal, resulting in substantial damage to the vehicle’s front end. Comprehensive insurance provides the necessary coverage to repair the vehicle, allowing the driver to get back on the road safely.

Fire and Explosion

An electrical fire damages a vehicle while it is parked in a garage. Comprehensive insurance covers the cost of repairs, including the replacement of damaged components and the removal of fire damage.

Choosing the Right Comprehensive Insurance

When selecting a comprehensive auto insurance policy, it’s crucial to consider various factors to ensure the best coverage for your needs. Here are some key considerations:

- Coverage Limits: Understand the coverage limits for different aspects of the policy, such as collision, comprehensive, and personal belongings coverage. Ensure that the limits align with the value of your vehicle and possessions.

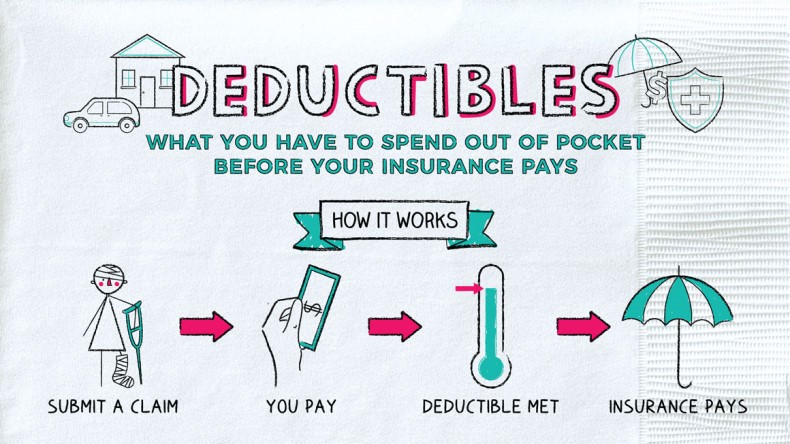

- Deductibles: Choose a deductible that balances affordability with financial protection. A higher deductible may result in lower premiums, but it means you'll pay more out of pocket if you need to make a claim.

- Policy Exclusions: Carefully review the policy exclusions to ensure you're aware of any incidents or situations that are not covered. This allows you to assess the policy's suitability for your specific needs.

- Additional Coverages: Explore optional coverages that may be beneficial, such as rental car reimbursement or roadside assistance. These add-ons can provide extra peace of mind and convenience.

- Provider Reputation: Research the reputation and financial stability of the insurance provider. Choose a company with a solid track record of prompt claim settlements and excellent customer service.

Conclusion: The Value of Comprehensive Coverage

Comprehensive auto insurance is an invaluable asset for vehicle owners, offering a comprehensive safety net against a wide range of potential risks. It provides financial protection, peace of mind, and the assurance that one’s vehicle is well-protected. By understanding the features, benefits, and real-world applications of comprehensive insurance, drivers can make informed decisions to ensure they have the coverage they need.

What is the difference between comprehensive and liability auto insurance?

+Liability auto insurance primarily covers claims arising from bodily injury or property damage caused by the policyholder. Comprehensive insurance, on the other hand, provides a broader range of coverage, including protection against collisions, non-collision incidents, theft, vandalism, and natural disasters. It offers a more comprehensive level of protection for the vehicle and its contents.

Is comprehensive auto insurance mandatory?

+While liability insurance is typically mandatory in most states, comprehensive insurance is not. However, comprehensive coverage is highly recommended, especially if you own a vehicle that has a high financial value or is particularly vulnerable to theft, vandalism, or natural disasters. It provides an added layer of protection beyond the legal requirements.

How much does comprehensive auto insurance cost?

+The cost of comprehensive auto insurance can vary significantly based on factors such as the make and model of your vehicle, your driving record, the coverage limits you choose, and your location. It’s best to obtain quotes from multiple insurance providers to find the most competitive rates for your specific circumstances.