All State Home Insurance

In the ever-evolving landscape of insurance, one name has stood the test of time and has become synonymous with reliability and comprehensive coverage: Allstate Home Insurance. With a rich history spanning over 90 years, Allstate has solidified its position as a leading provider of home insurance solutions. This article delves into the intricacies of Allstate's home insurance offerings, exploring its unique features, the benefits it provides to homeowners, and the reasons why it continues to be a trusted choice for protection and peace of mind.

A Legacy of Trust: Allstate’s Journey in Home Insurance

Allstate Insurance Company, a subsidiary of the Allstate Corporation, has been a prominent player in the insurance industry since its inception in 1931. Founded by Sears, Roebuck, and Company, Allstate started as an auto insurance provider, offering innovative policies to drivers across the United States. Over the decades, Allstate expanded its horizons, recognizing the growing need for reliable home insurance coverage.

In 1957, Allstate made a significant move by acquiring the National Farmers Union Property & Casualty Company, marking its entry into the home insurance market. This acquisition not only expanded Allstate's reach but also infused it with a deep understanding of the unique needs of homeowners. Allstate's commitment to innovation and customer-centric approaches has since made it a household name, trusted by millions of policyholders.

The Allstate Advantage: Comprehensive Coverage and Customization

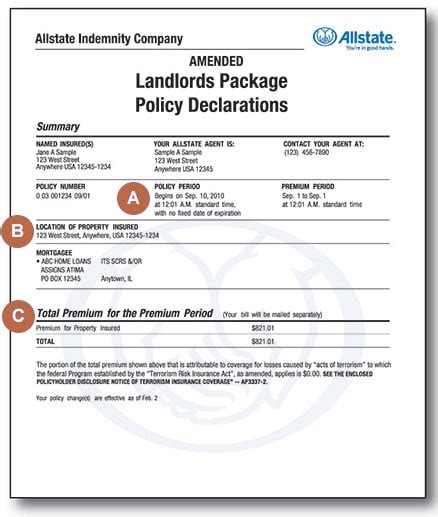

Allstate’s home insurance policies are renowned for their adaptability and ability to cater to a diverse range of homeowner needs. The company offers a comprehensive suite of coverage options, ensuring that policyholders can tailor their insurance plans to match their specific circumstances and preferences.

Coverage Options

Allstate’s home insurance policies provide protection against a wide array of perils, including fire, wind, hail, lightning, theft, and more. The company’s flagship Dwelling Coverage safeguards the physical structure of the home, while Personal Property Coverage protects the contents within. Additionally, Allstate offers Liability Coverage, providing financial protection against lawsuits stemming from injuries or property damage caused by the policyholder or their family members.

For homeowners with unique needs, Allstate provides specialized coverage options. These include Water Backup Coverage, protecting against damage from sewage or drain backup, and Identity Restoration Coverage, offering assistance in the event of identity theft. Allstate also offers coverage for Jewelry, Fine Arts, and Collectibles, providing an added layer of protection for valuable possessions.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of the home. |

| Personal Property Coverage | Covers the contents of the home, including furniture, electronics, and clothing. |

| Liability Coverage | Provides financial protection against lawsuits for injuries or property damage caused by the policyholder. |

| Water Backup Coverage | Covers damage from sewage or drain backup. |

| Identity Restoration Coverage | Offers assistance and coverage for identity theft incidents. |

| Jewelry, Fine Arts, and Collectibles Coverage | Provides specialized coverage for valuable possessions. |

Customizable Plans

Allstate understands that every homeowner’s situation is unique, and thus, it offers a range of customizable plans to suit different needs and budgets. Policyholders can choose from various levels of coverage, including Basic Form, Broad Form, and Special Form policies, each with distinct coverage limits and exclusions.

For homeowners seeking additional protection, Allstate's Endorsements and Optional Coverages provide an array of choices. These include Equipment Breakdown Coverage, which covers the cost of repairing or replacing broken home systems or appliances, and Ordinance or Law Coverage, which provides coverage for additional expenses incurred due to building code upgrades during home repairs.

Claims Process: A Seamless and Supportive Experience

Allstate’s dedication to customer satisfaction extends beyond its comprehensive coverage offerings. The company’s claims process is designed to be seamless and supportive, ensuring that policyholders receive the assistance they need during times of crisis.

Quick Response and Efficient Handling

In the event of a covered loss, Allstate’s claims team is readily available to assist policyholders. The company boasts a rapid response time, with dedicated claims adjusters assigned to each case. These adjusters work diligently to assess the damage, providing accurate and timely estimates to ensure that the claims process progresses smoothly.

Allstate's Claims Satisfaction Guarantee is a testament to its commitment to customer satisfaction. This guarantee ensures that if a policyholder is not satisfied with the service received during the claims process, Allstate will work to resolve the issue or allow the policyholder to cancel their policy and receive a full refund of their premium.

Additional Support and Resources

Allstate goes the extra mile to provide policyholders with valuable resources and support during the claims process. The company offers an online Claims Center, providing 24⁄7 access to claim status updates, helpful articles, and a dedicated helpline for additional assistance. Policyholders can also utilize the Allstate Digital Toolkit, which includes tools like a home inventory checklist and tips for preventing common household accidents.

The Allstate Advantage: Going Beyond Insurance

Allstate’s commitment to its customers extends beyond providing insurance coverage. The company actively engages in community initiatives and educational programs to empower homeowners and enhance their overall well-being.

Community Involvement and Giving Back

Allstate is deeply rooted in the communities it serves. The company’s Good Hands® Community initiative focuses on giving back to local communities through various programs. This includes supporting disaster relief efforts, sponsoring community events, and partnering with nonprofit organizations to address social issues. Allstate’s commitment to community involvement reflects its values and strengthens its bond with policyholders.

Educational Resources and Safety Initiatives

Allstate understands that knowledge is power, especially when it comes to homeownership. The company provides an extensive array of educational resources to help homeowners make informed decisions and take proactive steps to protect their homes. These resources include home maintenance guides, safety tips, and insurance guides, ensuring that policyholders are well-equipped to navigate the complexities of homeownership.

Additionally, Allstate actively promotes safety initiatives through its Safe Driving Programs and Home Safety Programs. These programs offer discounts and incentives to policyholders who take proactive steps to enhance their safety, such as installing home security systems or completing defensive driving courses.

A Trusted Partner: Allstate’s Reputation and Recognition

Allstate’s dedication to excellence and customer satisfaction has earned it a reputation as a trusted partner in the insurance industry. The company’s commitment to innovation, community involvement, and customer-centric approaches has garnered recognition from various industry bodies and consumer advocacy groups.

Industry Awards and Accolades

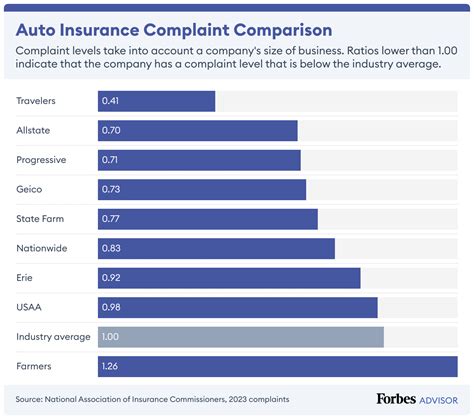

Allstate has been consistently recognized for its outstanding performance and commitment to customer service. The company has received numerous accolades, including the J.D. Power Award for Excellence in Customer Satisfaction, the National Association of Insurance Commissioners (NAIC) Consumer Complaint Ratio Award, and the Insurance Carrier of the Year Award from various industry publications.

Customer Testimonials and Feedback

Allstate’s reputation is further solidified by the positive feedback and testimonials received from its policyholders. Customers frequently praise Allstate for its responsive claims process, knowledgeable agents, and comprehensive coverage options. The company’s focus on customer satisfaction and its commitment to providing personalized service have made it a preferred choice for homeowners seeking reliable insurance coverage.

The Future of Home Insurance: Allstate’s Vision

As the insurance landscape continues to evolve, Allstate remains at the forefront, leveraging technology and innovation to enhance its services. The company’s vision for the future of home insurance revolves around three key pillars: personalization, digital transformation, and sustainable practices.

Personalization and Tailored Solutions

Allstate recognizes that homeowners have diverse needs and preferences. The company is committed to delivering personalized insurance solutions, leveraging data analytics and customer insights to offer tailored coverage options. By understanding individual risks and circumstances, Allstate aims to provide policyholders with the most suitable and cost-effective coverage plans.

Digital Transformation and Enhanced Customer Experience

Allstate embraces digital transformation to enhance the overall customer experience. The company is investing in innovative technologies, such as artificial intelligence and machine learning, to streamline processes, improve efficiency, and provide policyholders with convenient and accessible services. From online policy management to digital claims processing, Allstate is dedicated to making insurance more accessible and user-friendly.

Sustainable Practices and Environmental Responsibility

Allstate is committed to environmental sustainability and social responsibility. The company is actively working towards reducing its environmental footprint and promoting sustainable practices within the insurance industry. Allstate’s initiatives include investing in renewable energy sources, implementing energy-efficient practices in its operations, and supporting community projects focused on environmental conservation.

Frequently Asked Questions

What types of homes does Allstate insure?

+

Allstate offers home insurance coverage for a wide range of residential properties, including single-family homes, condominiums, townhomes, mobile homes, and rental properties. Whether you own or rent, Allstate has tailored policies to meet your specific needs.

How can I get a quote for Allstate home insurance?

+

Getting a quote for Allstate home insurance is straightforward. You can start the process online by visiting the Allstate website and providing some basic information about your home and desired coverage. Alternatively, you can connect with an Allstate agent in your area for a personalized quote.

Does Allstate offer discounts on home insurance premiums?

+

Yes, Allstate provides various discounts to help policyholders save on their home insurance premiums. These discounts include multi-policy discounts (bundling home and auto insurance), claims-free discounts, loyalty discounts, and safety discounts for homes equipped with security systems or fire prevention devices.

How does Allstate handle claims for catastrophic events like hurricanes or wildfires?

+

Allstate has a dedicated team to handle claims resulting from catastrophic events. In such situations, the company mobilizes additional resources and personnel to assist policyholders promptly. Allstate’s claims adjusters work closely with homeowners to assess the damage and guide them through the claims process, ensuring a seamless and supportive experience.

Can I add coverage for specific valuables, such as jewelry or art, to my Allstate home insurance policy?

+

Absolutely! Allstate understands the importance of protecting valuable possessions. You can add additional coverage for specific items like jewelry, fine art, or collectibles to your home insurance policy. This ensures that your valuable assets are adequately insured and protected against loss or damage.

In a competitive insurance market, Allstate Home Insurance stands out as a beacon of reliability and customer-centricity. With its rich history, comprehensive coverage options, and unwavering commitment to customer satisfaction, Allstate has earned its place as a trusted partner for homeowners across the United States. As the company continues to innovate and adapt to the evolving needs of policyholders, its legacy of trust and excellence is sure to endure for generations to come.