What Is Term Life Insurance And How Does It Work

Understanding Term Life Insurance: A Comprehensive Guide

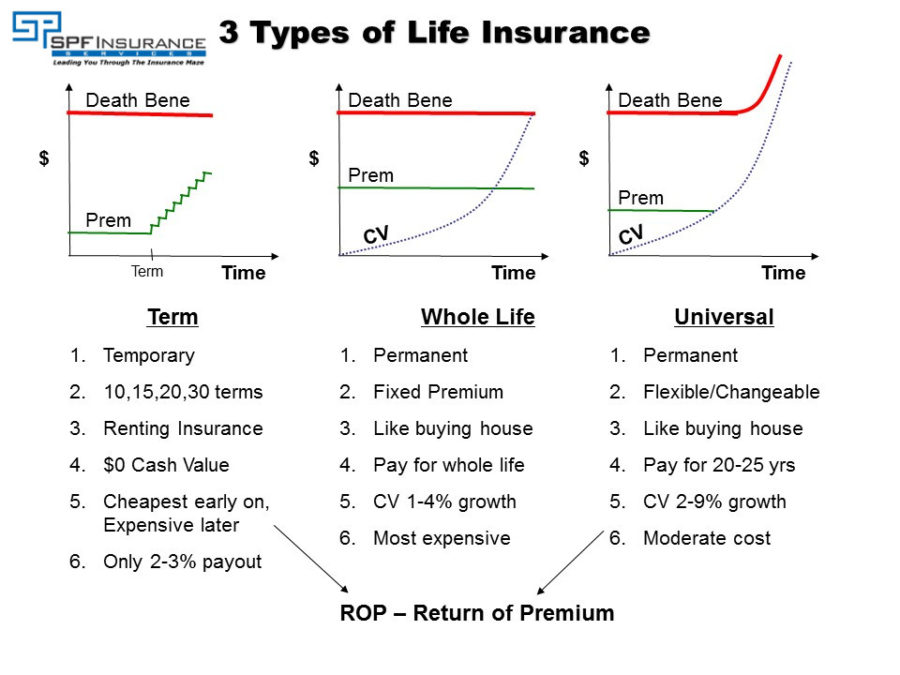

Term life insurance is a popular and straightforward form of protection that provides financial security to individuals and their loved ones during a specified period, known as the policy term. This article will delve into the world of term life insurance, exploring its mechanics, benefits, and how it can be a crucial component of your financial planning.

The Fundamentals of Term Life Insurance

Term life insurance is designed to offer coverage for a predetermined period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums to the insurance company, ensuring that their beneficiaries will receive a lump-sum payment (known as the death benefit) in the event of the policyholder's untimely demise.

One of the key advantages of term life insurance is its cost-effectiveness. Compared to other life insurance options, term policies often offer a more affordable premium, making it accessible to a wider range of individuals. This makes it an ideal choice for those seeking to secure their family's financial future without breaking the bank.

How Does Term Life Insurance Work?

When you apply for a term life insurance policy, the insurance provider will assess your health, lifestyle, and other relevant factors to determine the premium amount and the coverage level you qualify for. The premium is the regular payment you make to keep your policy active, and it remains the same throughout the term, providing you with predictable and manageable financial planning.

Once your policy is in force, you can rest assured that your beneficiaries will receive the agreed-upon death benefit if you pass away during the policy term. This benefit can be used to cover a wide range of expenses, including funeral costs, outstanding debts, daily living expenses, and even college tuition for your children. It provides your loved ones with the financial stability they need during a difficult time.

Key Features and Benefits

- Flexibility: Term life insurance policies offer a high degree of flexibility in terms of coverage periods and premium amounts. You can choose a term that aligns with your specific needs, such as covering your mortgage term or providing financial support for your children's education.

- Renewal Options: Many term life insurance policies provide the option to renew your coverage at the end of the term. While the premiums may increase with age, this allows you to extend your coverage for an additional term if needed.

- Convertibility: Some term policies allow you to convert your term coverage into a permanent life insurance policy without undergoing a new medical exam. This can be advantageous if your financial situation or family circumstances change over time.

- Affordable Protection: As mentioned earlier, term life insurance is known for its cost-effectiveness. The fixed premiums make it easy to budget for, and the death benefit provides a substantial financial safety net for your beneficiaries.

Real-World Examples and Scenarios

To illustrate the impact of term life insurance, let's consider a few hypothetical situations:

Protecting Your Family's Future

Imagine John, a 35-year-old married man with two young children. He purchases a 20-year term life insurance policy with a $500,000 death benefit. Unfortunately, John passes away unexpectedly a few years into the policy term. His family receives the full death benefit, which they use to pay off their mortgage, cover funeral expenses, and establish a trust fund for their children's education.

Securing Your Business

Sarah, a successful entrepreneur, purchases a 10-year term life insurance policy with a $1,000,000 death benefit to protect her business. If she were to pass away during the policy term, the death benefit would ensure the smooth continuation of her business, allowing her partner to buy out her share and keep the company operational.

Planning for Retirement

Michael, aged 55, decides to purchase a 15-year term life insurance policy with a $250,000 death benefit to provide financial security for his wife during his retirement years. This policy ensures that his wife will have the necessary funds to maintain her lifestyle and cover any potential medical expenses in his absence.

Performance Analysis and Industry Insights

Term life insurance has gained popularity due to its simplicity and affordability. According to industry data, over 70% of life insurance policies sold in the United States are term policies, highlighting their widespread adoption. The flexibility and customization options offered by term life insurance make it a preferred choice for individuals at various life stages.

| Term Length | Average Premium | Death Benefit Range |

|---|---|---|

| 10 Years | $25/month | $100,000 - $500,000 |

| 20 Years | $35/month | $250,000 - $1,000,000 |

| 30 Years | $50/month | $500,000 - $2,000,000 |

The table above provides a glimpse into the average premiums and death benefit ranges for different term lengths. It's important to note that these figures can vary based on individual health, lifestyle, and other factors.

Evidence-Based Future Implications

As life expectancy continues to rise and medical advancements improve, the demand for term life insurance is expected to remain strong. The flexibility and cost-effectiveness of term policies make them an attractive option for individuals seeking short-term financial protection. Additionally, the ability to convert term policies into permanent life insurance provides a seamless transition for those whose needs evolve over time.

FAQs

Can I increase my death benefit during the policy term?

+

In some cases, you may have the option to increase your death benefit without undergoing a new medical exam. This is known as a “guaranteed insurability option” and allows you to adjust your coverage as your needs change.

What happens if I outlive my term policy?

+

If you outlive your term policy, you will no longer have coverage, and your beneficiaries will not receive any death benefit. However, you can often renew your policy or convert it to a permanent life insurance policy.

Are there any tax implications with term life insurance?

+

The death benefit from a term life insurance policy is typically tax-free for your beneficiaries. However, it’s advisable to consult a tax professional to understand the specific tax implications in your jurisdiction.

Can I cancel my term life insurance policy?

+

Yes, you can cancel your term life insurance policy at any time. However, it’s important to note that you may not receive a refund for the premiums paid, and you will no longer have coverage.

How do I choose the right term length for my policy?

+

The term length you choose should align with your specific needs and financial goals. Consider factors such as your mortgage term, your children’s education timeline, and your retirement plans. Consulting a financial advisor can help you make an informed decision.