Cheap Auto Full Coverage Insurance

Securing affordable auto insurance is a priority for many car owners, and full coverage insurance offers comprehensive protection. This article aims to guide you through the process of finding cheap auto full coverage insurance, shedding light on the factors that influence pricing and providing insights to help you make informed decisions. We'll explore the options available, the key considerations, and the steps to ensure you get the best value for your insurance needs.

Understanding Full Coverage Auto Insurance

Full coverage auto insurance is a comprehensive policy that provides protection against a wide range of risks and potential damages. It typically includes liability coverage, collision coverage, and comprehensive coverage, offering a robust safety net for vehicle owners. This type of insurance is essential for drivers who want to protect themselves financially in the event of accidents, theft, or other unforeseen circumstances.

Liability coverage is a critical component, safeguarding policyholders against claims arising from accidents they cause. It covers bodily injury and property damage expenses, providing a vital financial safety net. Collision coverage, on the other hand, protects against damages sustained when the insured vehicle collides with another vehicle or object. It covers repair costs or the replacement value of the vehicle, ensuring that drivers are not left with significant out-of-pocket expenses.

Comprehensive coverage is an equally vital aspect of full coverage insurance. It provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals. This coverage ensures that policyholders are not financially burdened by unexpected incidents that can occur off the road.

The Importance of Full Coverage

While full coverage insurance comes with a higher premium, it offers unparalleled peace of mind. Here are some key reasons why full coverage is a wise choice for many drivers:

- Comprehensive Protection: Full coverage insurance ensures that drivers are protected against a wide array of risks, providing a safety net for unexpected events.

- Financial Security: It offers financial security, covering repair or replacement costs for the insured vehicle, as well as liability expenses in the event of an accident.

- Peace of Mind: With full coverage, drivers can rest assured knowing they are adequately protected, reducing the stress and worry associated with potential accidents or damages.

- Legal Compliance: In many jurisdictions, full coverage insurance is a legal requirement, ensuring that drivers meet the necessary standards for vehicle ownership and operation.

Factors Influencing Full Coverage Insurance Costs

The cost of full coverage auto insurance is influenced by a multitude of factors. Understanding these factors is crucial when seeking affordable coverage. Here are some key considerations:

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining insurance costs. Insurers consider factors such as the make, model, and age of the vehicle, as well as its repair and replacement costs. High-end vehicles and newer models generally attract higher premiums due to their higher replacement and repair costs.

| Vehicle Type | Average Insurance Cost |

|---|---|

| Economy Car | $800 - $1200 annually |

| Mid-Range Sedan | $1200 - $1800 annually |

| Luxury SUV | $2000 - $3000 annually |

Driver Profile and History

Your driving history and personal profile are critical factors in insurance pricing. Insurers assess your driving record, including any accidents, violations, or claims made in the past. Additionally, factors such as age, gender, and marital status can influence premiums. Younger drivers and those with a history of accidents or violations often face higher insurance costs.

Location and Usage

The location where you reside and the usage of your vehicle also impact insurance costs. Insurance rates can vary significantly between states and even between different zip codes within the same state. Additionally, the purpose for which you use your vehicle, such as commuting, business, or pleasure, can affect your insurance premiums. Urban areas with higher traffic and accident rates generally result in higher insurance costs.

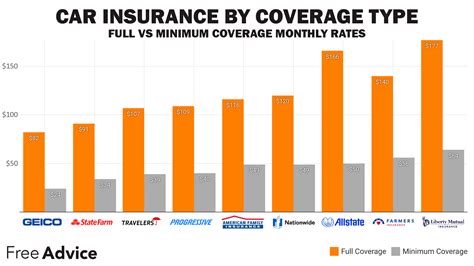

Insurance Company and Coverage Options

Different insurance companies offer varying coverage options and pricing structures. It’s essential to compare quotes from multiple insurers to find the most affordable option. Additionally, the coverage options you choose, such as deductibles, liability limits, and additional coverages, can significantly impact your premium. Higher deductibles and lower liability limits can lead to lower premiums, but it’s important to strike a balance between cost and adequate coverage.

Tips for Finding Cheap Full Coverage Auto Insurance

Finding cheap full coverage auto insurance requires a strategic approach. Here are some tips to help you secure the best rates:

Compare Multiple Quotes

Obtain quotes from multiple insurance providers to compare prices and coverage options. Online comparison tools can be a convenient way to gather quotes from various insurers quickly. Ensure that you’re comparing policies with similar coverage limits and deductibles to make an accurate assessment.

Bundling Policies

Consider bundling your auto insurance with other policies, such as homeowners or renters insurance. Many insurers offer discounts when you purchase multiple policies from them, known as a multi-policy discount. This can result in significant savings on your overall insurance costs.

Maintain a Clean Driving Record

A clean driving record is essential for keeping insurance costs low. Avoid accidents and violations, as they can significantly increase your premiums. Additionally, maintain a good credit score, as insurers often consider creditworthiness when calculating premiums.

Choose Higher Deductibles

Opting for higher deductibles can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While higher deductibles mean you’ll pay more in the event of a claim, it can result in substantial savings on your annual premium.

Explore Discounts

Insurance companies offer a variety of discounts to policyholders. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for vehicle safety features. Ask your insurer about the discounts they offer and ensure you’re taking advantage of all applicable discounts.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that allows insurers to track your driving habits and adjust premiums accordingly. This type of insurance can be beneficial for safe drivers, as it rewards good driving behavior with lower premiums. However, it may not be suitable for drivers with a history of accidents or violations.

Evaluating Full Coverage Auto Insurance Policies

When evaluating full coverage auto insurance policies, it’s essential to consider more than just the price. Here are some key factors to assess:

Coverage Limits and Deductibles

Review the coverage limits and deductibles of each policy. Ensure that the limits are sufficient to cover potential damages and liabilities. Higher limits provide more protection but may result in higher premiums. Similarly, consider the impact of different deductible amounts on your overall costs.

Additional Coverages

Look beyond the standard coverage options and explore additional coverages that may be beneficial. These can include rental car reimbursement, roadside assistance, or gap insurance. Evaluate whether these coverages are necessary for your specific needs and circumstances.

Reputation and Financial Stability of the Insurer

Research the reputation and financial stability of the insurance company. A reputable insurer with a strong financial standing is more likely to provide reliable and consistent coverage. Check customer reviews and financial ratings to ensure the insurer is trustworthy and capable of paying out claims.

Customer Service and Claims Process

Consider the insurer’s customer service reputation and the ease of the claims process. Efficient and responsive customer service can make a significant difference, especially during the claims process. Look for insurers with a track record of prompt claim handling and positive customer experiences.

Future Implications and Industry Trends

The auto insurance industry is evolving, and understanding future trends can help drivers make informed decisions. Here are some key considerations for the future:

Technology and Automation

Advancements in technology are expected to play a significant role in the future of auto insurance. Telematics and usage-based insurance are already gaining traction, allowing insurers to gather data on driving behavior and adjust premiums accordingly. Additionally, the rise of autonomous vehicles may lead to new insurance products and coverage options.

Regulatory Changes

Keep an eye on regulatory changes that may impact the auto insurance industry. Changes in state laws and regulations can influence insurance requirements and pricing structures. Stay informed about any upcoming changes that may affect your insurance costs or coverage options.

Emerging Risks and Coverages

As new technologies and risks emerge, insurance companies may introduce innovative coverage options. For example, with the increasing prevalence of electric vehicles, insurers may develop specific coverages to address unique risks associated with this technology. Stay updated on emerging coverages to ensure you have the necessary protection.

Personalized Insurance

The future of auto insurance is likely to see a shift towards more personalized policies. Insurers may develop sophisticated algorithms to assess individual risk profiles, allowing for more tailored coverage options and pricing. This trend towards personalized insurance may result in more accurate pricing and better-suited coverage for individual drivers.

Conclusion

Finding cheap auto full coverage insurance requires a combination of knowledge, research, and strategic decision-making. By understanding the factors that influence insurance costs, exploring various coverage options, and staying informed about industry trends, you can secure the best value for your insurance needs. Remember, full coverage insurance provides comprehensive protection, offering peace of mind and financial security for vehicle owners. Take the time to compare policies, evaluate your options, and choose the coverage that best suits your needs and budget.

What is the average cost of full coverage auto insurance?

+

The average cost of full coverage auto insurance can vary significantly based on individual circumstances and location. On average, full coverage insurance can range from 1,000 to 2,500 annually. However, it’s important to note that this is just an estimate, and actual costs can be higher or lower depending on various factors such as driving history, vehicle type, and coverage options.

How can I lower my full coverage insurance premiums?

+

There are several strategies to lower your full coverage insurance premiums. These include maintaining a clean driving record, choosing higher deductibles, bundling policies with the same insurer, exploring discounts, and considering usage-based insurance if available. Additionally, regularly reviewing and comparing insurance quotes can help you identify more affordable options.

What factors influence full coverage insurance rates?

+

Full coverage insurance rates are influenced by various factors, including the type and value of your vehicle, your driving history and personal profile, your location and usage, and the insurance company and coverage options you choose. Insurers assess these factors to determine the level of risk associated with insuring you and set premiums accordingly.

Is full coverage auto insurance mandatory?

+

Full coverage auto insurance is not mandatory in all states, but it is highly recommended. While liability-only insurance may be the minimum legal requirement, full coverage insurance provides comprehensive protection against a wide range of risks. It ensures that you are financially protected in the event of accidents, theft, or other unforeseen circumstances.

What additional coverages should I consider for full coverage insurance?

+

When evaluating full coverage auto insurance policies, consider additional coverages such as rental car reimbursement, roadside assistance, gap insurance, and coverage for specific risks like comprehensive and collision. These additional coverages can provide extra protection and peace of mind, but it’s important to assess your individual needs and choose coverages that are appropriate for your circumstances.