Usaa Quote For Car Insurance

Getting an accurate quote for car insurance is a crucial step in ensuring you have the right coverage for your vehicle and your needs. In the United States, USAA is a well-known insurance provider that caters specifically to military members, veterans, and their families. With a reputation for offering competitive rates and comprehensive coverage, USAA has become a trusted choice for many in the military community. In this article, we will delve into the process of obtaining a USAA quote for car insurance, exploring the factors that influence the quote, and providing valuable insights to help you make an informed decision.

Understanding USAA’s Car Insurance Quoting Process

USAA’s quoting process is designed to be straightforward and efficient, allowing potential customers to obtain personalized quotes quickly. Here’s an overview of the steps involved and the key factors that impact your car insurance quote:

Step 1: Eligibility and Membership Verification

USAA’s insurance services are exclusively available to active-duty military members, veterans, and their eligible family members. To start the quoting process, you will need to verify your eligibility by providing proof of military service or family relationship. This step ensures that USAA can offer tailored coverage options specifically designed for the military community.

Step 2: Personal Information and Vehicle Details

Once your eligibility is confirmed, you will be guided through a series of questions to gather personal and vehicle-related information. This includes details such as your name, date of birth, driver’s license number, and the make, model, and year of your vehicle. Additionally, USAA may request information about your driving history, including any accidents, violations, or claims you have had in the past.

Step 3: Coverage Selection and Customization

USAA offers a range of coverage options to suit different needs and budgets. During the quoting process, you will have the opportunity to choose the level of coverage you require. This includes liability coverage, which is mandatory in most states and provides protection against bodily injury and property damage claims resulting from an at-fault accident. You can also opt for additional coverage types, such as:

- Collision Coverage: Covers damages to your vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision incidents, including theft, vandalism, and natural disasters.

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who does not have adequate insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident.

- Rental Car Reimbursement: Provides rental car coverage if your vehicle is inoperable due to a covered incident.

Step 4: Factors Influencing Your Quote

Several factors play a role in determining your car insurance quote with USAA. Understanding these factors can help you anticipate the cost of your coverage and potentially identify areas where you can save:

- Age and Driving Experience: Generally, younger drivers with less experience tend to have higher insurance rates. USAA may offer discounts for young drivers who have completed driver training programs or have a good academic record.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how you use it (e.g., daily commute, pleasure driving, business use), can impact your insurance rates. Safer vehicles with good safety ratings and lower theft rates may be more affordable to insure.

- Credit History: In many states, insurance providers are allowed to consider your credit score when determining your insurance rates. USAA may use this information to assess your financial responsibility and potential risk.

- Driving Record: A clean driving record with no at-fault accidents or violations can lead to lower insurance rates. Conversely, a history of accidents or traffic violations may result in higher premiums.

- Location and Mileage: Where you live and how many miles you drive annually can affect your insurance quote. Urban areas with higher traffic density and a history of accidents or theft may have higher rates.

- Discounts and Bundling: USAA offers a variety of discounts to help you save on your insurance premiums. These discounts can be based on factors such as good driving behavior, military rank, vehicle safety features, and more. Additionally, bundling your car insurance with other USAA policies, such as homeowners or renters insurance, can often lead to significant savings.

Benefits and Considerations of USAA Car Insurance

USAA car insurance offers several advantages that make it an attractive option for military members and their families:

Military-Focused Coverage

USAA’s deep understanding of the unique needs and circumstances of military personnel translates into tailored coverage options. They offer specialized discounts and benefits, such as deployment discounts and coverage for military-related situations like base housing or overseas assignments.

Competitive Rates

USAA is known for its competitive insurance rates. By leveraging their large membership base and efficient claims handling, they are often able to offer lower premiums compared to other providers. This can result in significant savings for policyholders.

Excellent Customer Service and Support

USAA prides itself on providing exceptional customer service. Their dedicated team of insurance professionals is highly trained to assist military members and their families with their insurance needs. USAA offers 24⁄7 customer support, ensuring prompt assistance in case of emergencies or claims.

Military Discounts and Benefits

In addition to competitive rates, USAA offers a range of military-specific discounts and benefits. These can include discounts for active-duty military, veterans, and their families, as well as discounts for certain military affiliations and ranks. USAA also provides coverage options for unique military situations, such as temporary storage of vehicles during deployments.

Claims Handling and Military Support

USAA’s claims handling process is designed with military members in mind. They understand the challenges faced by military personnel and their families, especially during deployments or relocations. USAA’s claims team works diligently to ensure a smooth and efficient claims process, providing support and guidance throughout the entire process.

Real-World Examples and Testimonials

To provide a more tangible understanding of the USAA car insurance experience, let’s explore some real-world examples and testimonials from policyholders:

Example 1: John, an Active-Duty Airman

"As an active-duty airman, I've had USAA car insurance for several years now. The quoting process was straightforward, and I was impressed by the range of coverage options available. USAA's military discounts made a significant difference in my monthly premiums, especially considering my deployment cycles. Their customer service has always been exceptional, and I've had a positive experience with their claims handling as well."

Example 2: Sarah, a Veteran and Mother of Two

"I chose USAA for my car insurance after my active-duty service ended. The quoting process was easy, and I appreciated the personalized attention I received. As a veteran with young children, I needed comprehensive coverage, and USAA offered me competitive rates. Their commitment to supporting military families extends beyond insurance, and I feel confident knowing that USAA has my back."

Example 3: Michael, a Navy Reserve Officer

"As a Navy Reserve officer, I value the flexibility and support USAA provides. When I'm deployed, I know my vehicle is covered, and I can focus on my mission without worry. USAA's deployment discounts and coverage for temporary storage have been incredibly helpful. Their understanding of military life makes them a trusted partner, and I highly recommend them to my fellow service members."

Performance Analysis and Industry Comparisons

To assess USAA’s performance and standing in the insurance industry, we can examine key metrics and compare them with other leading providers:

Customer Satisfaction and Ratings

USAA consistently ranks highly in customer satisfaction surveys and ratings. They have earned top marks for their customer service, claims handling, and overall value. Independent rating agencies, such as J.D. Power and AM Best, consistently recognize USAA for its outstanding performance and financial stability.

Claims Handling Efficiency

USAA’s claims handling process is renowned for its efficiency and promptness. They have invested in state-of-the-art technology and trained professionals to ensure a seamless experience for policyholders. Their dedication to quick and fair claims settlements has earned them praise from customers and industry experts alike.

Financial Strength and Stability

USAA is widely recognized for its financial strength and stability. Rating agencies such as AM Best and Standard & Poor’s have assigned USAA the highest ratings, indicating their ability to meet financial obligations and provide long-term stability. This financial strength ensures that policyholders can rely on USAA’s commitment to delivering on its promises.

Industry Comparisons

When compared to other leading insurance providers, USAA often stands out for its competitive rates, comprehensive coverage options, and military-focused services. While each insurance company has its own unique offerings, USAA’s dedication to serving the military community sets it apart. Their understanding of the specific needs and challenges faced by military personnel and their families gives USAA a distinct advantage in providing tailored insurance solutions.

Future Implications and Innovations

As the insurance industry continues to evolve, USAA remains committed to staying at the forefront of innovation and technological advancements. Here are some future implications and potential innovations we can expect from USAA:

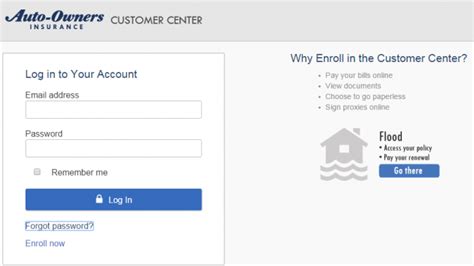

Digital Transformation and Enhanced Customer Experience

USAA has been at the forefront of digital transformation, leveraging technology to enhance the customer experience. They continue to invest in developing innovative digital tools and platforms, making it easier for policyholders to manage their insurance needs online. From seamless quoting processes to streamlined claims submissions, USAA is dedicated to providing a convenient and efficient experience.

Telematics and Usage-Based Insurance

USAA is exploring the potential of telematics and usage-based insurance to further personalize coverage and offer customized rates. By utilizing advanced technology to monitor driving behavior and habits, USAA can provide more accurate risk assessments and potentially offer discounts to safe drivers. This innovative approach could revolutionize the way insurance is priced and delivered.

Expanded Product Offerings and Partnerships

USAA is continuously expanding its product offerings to meet the evolving needs of its members. They are exploring partnerships with other industry leaders to provide a wider range of insurance and financial services. By leveraging these partnerships, USAA can offer even more comprehensive coverage options, ensuring that military members and their families have access to a diverse array of insurance solutions.

AI and Machine Learning Integration

USAA is harnessing the power of artificial intelligence (AI) and machine learning to enhance its operations and improve customer experiences. These technologies are being utilized to streamline processes, improve accuracy in risk assessments, and personalize insurance offerings. By leveraging AI, USAA can further optimize its quoting and claims handling processes, leading to faster and more efficient service delivery.

Conclusion

Obtaining a USAA quote for car insurance is a straightforward and rewarding process for eligible military members and their families. USAA’s commitment to serving the military community, combined with its competitive rates, comprehensive coverage, and exceptional customer service, makes it a top choice for many. By understanding the factors that influence your quote and leveraging the available discounts and benefits, you can tailor your coverage to your specific needs while enjoying significant savings.

As USAA continues to innovate and adapt to the changing insurance landscape, policyholders can look forward to even more efficient and personalized services. With its strong financial stability and focus on military support, USAA remains a trusted partner for those who have served or are currently serving our country. Whether you're an active-duty service member, a veteran, or a military family, USAA is dedicated to providing the coverage and support you deserve.

How do I verify my eligibility for USAA car insurance?

+To verify your eligibility, you will need to provide proof of your military service or your relationship to a military member. This can include a copy of your military ID, a DD Form 214 (discharge papers), or other official documentation. USAA’s eligibility requirements include active-duty military, veterans, and their eligible family members.

What discounts are available for USAA car insurance policyholders?

+USAA offers a variety of discounts to help policyholders save on their car insurance premiums. These discounts may include military rank discounts, good student discounts, safe driver discounts, vehicle safety discounts, and more. It’s worth exploring these options to see if you qualify for any additional savings.

Can I bundle my car insurance with other USAA policies to save money?

+Yes, bundling your car insurance with other USAA policies, such as homeowners or renters insurance, can often lead to significant savings. By combining multiple policies, you may be eligible for bundle discounts, further reducing your overall insurance costs. Contact USAA to discuss your options and explore the potential savings.