Cure Auto Insurance

Cure Auto Insurance: Revolutionizing the Auto Insurance Industry with Innovative Coverage and Customer-Centric Services

In the world of auto insurance, Cure Auto Insurance has emerged as a trailblazer, offering a fresh and modern approach to traditional insurance practices. With a focus on innovation, customer satisfaction, and affordable coverage, Cure has swiftly gained recognition and trust among motorists across the United States. In this comprehensive article, we delve into the world of Cure Auto Insurance, exploring its unique features, services, and the impact it has on the insurance landscape.

The Birth of Cure Auto Insurance: A Visionary Approach

Cure Auto Insurance was founded with a clear mission: to disrupt the conventional auto insurance industry by providing straightforward, affordable, and comprehensive coverage tailored to the needs of modern drivers. The company’s visionaries recognized the evolving expectations of customers and the potential of technology to revolutionize the insurance experience.

A Fresh Perspective on Insurance: Cure’s founders brought a unique perspective to the industry, understanding that insurance should be accessible, transparent, and customer-centric. They aimed to create a brand that not only offered competitive rates but also prioritized the individual needs and preferences of policyholders.

Empowering Customers: From the outset, Cure Auto Insurance prioritized customer empowerment. The company’s online platform and mobile app were designed with simplicity and ease of use in mind, allowing customers to manage their policies, make payments, and access support with just a few clicks. This digital-first approach ensures that customers have control over their insurance journey, removing the complexities often associated with traditional insurance processes.

Innovative Coverage Options: Tailoring Policies to Individual Needs

One of the standout features of Cure Auto Insurance is its commitment to offering a wide range of coverage options, ensuring that every driver can find a policy that suits their specific circumstances. Whether you’re a young driver just starting out, a seasoned motorist, or a parent looking for family coverage, Cure provides tailored solutions.

Customizable Policies: Cure understands that every driver has unique requirements. Their customizable policies allow customers to choose the level of coverage they need, from basic liability to comprehensive packages that include additional benefits such as rental car reimbursement and roadside assistance. This flexibility ensures that policyholders only pay for the coverage they truly require.

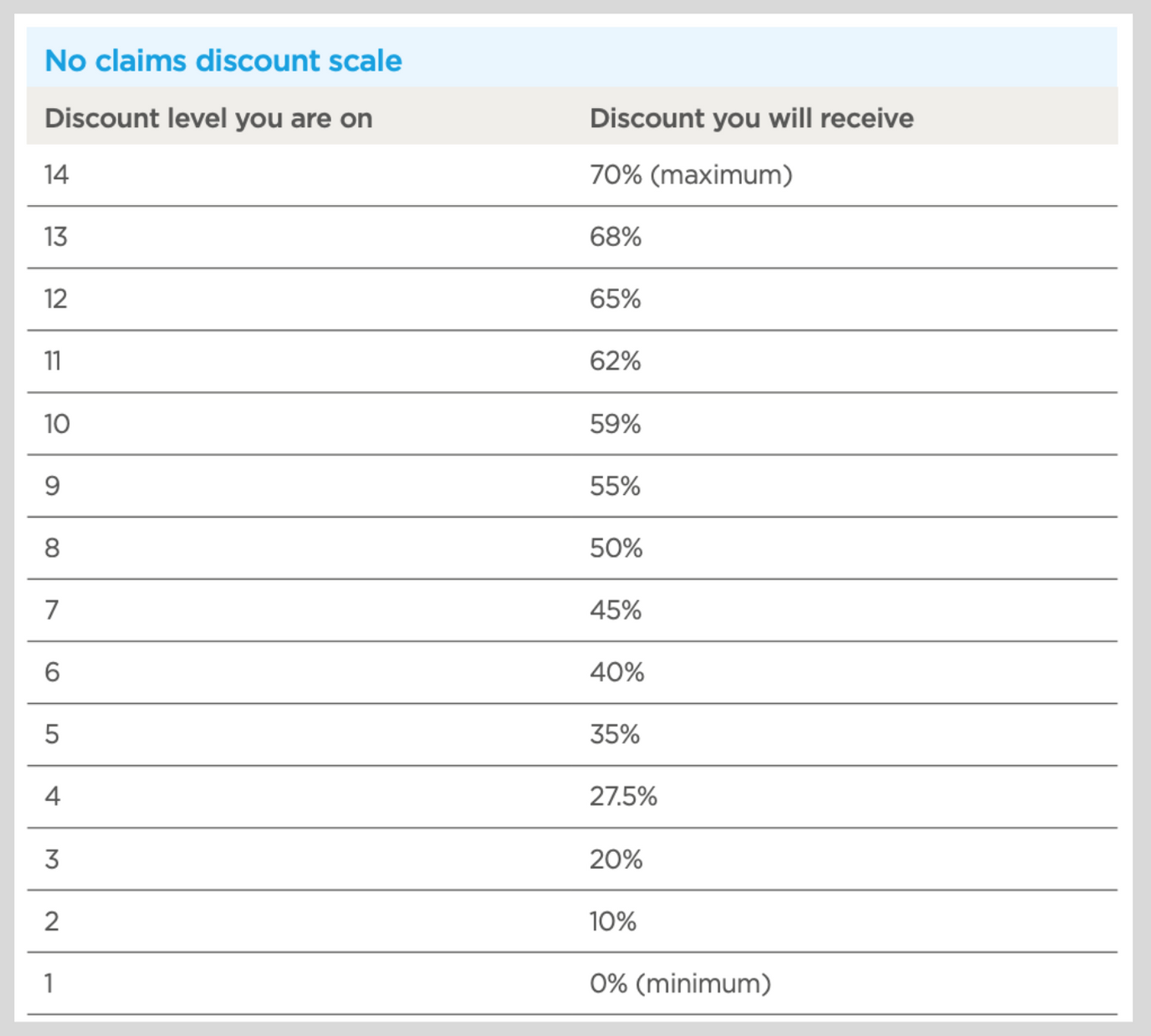

Discounts and Incentives: Cure Auto Insurance is known for its generous discounts and incentives, making insurance more affordable for a wider range of motorists. From safe driver discounts to multi-policy bundles, the company offers various ways to save on premiums. Additionally, Cure rewards customers for maintaining safe driving habits, with potential premium reductions for accident-free periods.

Specialized Coverages: Recognizing the diverse needs of its customer base, Cure has introduced specialized coverages to cater to specific demographics. For instance, they offer enhanced coverage for rideshare drivers, ensuring that individuals who utilize platforms like Uber or Lyft are adequately protected during their rideshare activities.

Technological Advancements: Streamlining the Insurance Experience

Cure Auto Insurance has embraced technology as a key driver of its success, utilizing digital tools to enhance every aspect of the insurance journey. From policy acquisition to claims processing, Cure’s innovative use of technology has transformed the customer experience.

Digital Onboarding: Cure’s online platform and mobile app streamline the policy acquisition process. Customers can obtain quotes, compare coverage options, and purchase policies entirely online or through the app. This digital onboarding process is not only convenient but also significantly reduces the time and effort required to secure adequate coverage.

Telematics and Usage-Based Insurance: Cure has integrated telematics technology into its offerings, allowing customers to benefit from usage-based insurance. By installing a small device in their vehicles, policyholders can provide real-time driving data, which is then used to calculate premiums based on actual driving behavior. This innovative approach rewards safe drivers with lower premiums, encouraging responsible driving habits.

AI-Powered Claims Processing: When it comes to claims, Cure leverages artificial intelligence (AI) to streamline the process. AI technology enables faster and more accurate claims assessments, ensuring that policyholders receive timely compensation for their losses. This efficient claims management system has significantly improved customer satisfaction and reduced the overall time taken to settle claims.

Customer-Centric Services: Going Beyond Traditional Insurance

Cure Auto Insurance’s commitment to customer satisfaction extends beyond its innovative coverage options and technological advancements. The company prides itself on delivering exceptional customer service, ensuring that policyholders receive the support they need throughout their insurance journey.

24⁄7 Customer Support: Recognizing that emergencies and queries can arise at any time, Cure offers round-the-clock customer support. Policyholders can access assistance via phone, email, or live chat, ensuring that they receive prompt responses to their concerns. This dedicated support system has earned Cure a reputation for excellent customer service.

Educational Resources: Understanding the importance of informed decision-making, Cure provides a wealth of educational resources on its website and through its mobile app. From articles on safe driving practices to guides on choosing the right coverage, these resources empower customers to make educated choices about their insurance needs.

Community Initiatives: Cure Auto Insurance believes in giving back to the communities it serves. The company actively participates in various community initiatives, supporting local charities and organizations. This commitment to social responsibility has fostered a sense of trust and loyalty among policyholders, who appreciate Cure’s dedication to making a positive impact beyond its core business operations.

Performance Analysis: A Track Record of Success

Since its inception, Cure Auto Insurance has experienced remarkable growth and success, solidifying its position as a leading auto insurance provider in the United States. Its innovative approach, combined with a focus on customer satisfaction, has yielded impressive results.

Industry Recognition: Cure’s achievements have not gone unnoticed by industry experts and customers alike. The company has consistently received high ratings and accolades for its services, including recognition for its exceptional customer support and innovative coverage options. These accolades serve as a testament to Cure’s commitment to excellence.

Financial Stability: Cure’s financial stability is a key indicator of its success. The company has maintained a strong financial position, enabling it to offer competitive rates and provide stable coverage to its policyholders. This financial strength ensures that Cure can weather market fluctuations and continue to deliver reliable insurance services.

Customer Satisfaction: Cure’s customer-centric approach has paid dividends in terms of customer satisfaction. The company boasts an impressive customer retention rate, with a large portion of its business coming from loyal, repeat customers. Positive customer reviews and feedback highlight Cure’s ability to exceed expectations and provide a superior insurance experience.

The Future of Auto Insurance: Cure’s Vision and Impact

As the auto insurance industry continues to evolve, Cure Auto Insurance is poised to play a pivotal role in shaping the future of insurance. With its innovative mindset and customer-centric ethos, Cure is well-positioned to meet the changing needs and expectations of motorists.

Expanding Coverage Options: Cure plans to expand its coverage offerings to include a broader range of specialized policies. From autonomous vehicle insurance to coverage for electric and hybrid cars, the company aims to stay ahead of the curve, ensuring that its customers have access to the latest and most relevant insurance solutions.

Enhancing Digital Capabilities: Recognizing the importance of a seamless digital experience, Cure is committed to continuously improving its online and mobile platforms. Future enhancements will focus on further streamlining policy management, claims processing, and customer support, ensuring that Cure remains at the forefront of digital innovation in the insurance industry.

Community Engagement: Cure’s commitment to community engagement will remain a cornerstone of its operations. The company aims to deepen its involvement in local initiatives, supporting causes that resonate with its customer base. By fostering a sense of social responsibility, Cure aims to build stronger connections with the communities it serves.

Collaborative Partnerships: Looking ahead, Cure envisions forming strategic partnerships with other industry leaders to enhance its services and reach. These collaborations will enable Cure to leverage complementary expertise, expanding its network and providing even greater value to its customers.

FAQ

How does Cure Auto Insurance determine premiums for its policies?

+Cure Auto Insurance uses a combination of factors to determine premiums, including the driver's age, driving record, and the type of vehicle insured. The company also offers discounts for safe driving habits and multi-policy bundles.

What sets Cure Auto Insurance apart from traditional insurance providers?

+Cure Auto Insurance stands out for its innovative approach, offering customizable coverage options, digital-first services, and a strong focus on customer satisfaction. The company's usage-based insurance and specialized coverages further differentiate it from traditional providers.

How can I obtain a quote from Cure Auto Insurance?

+You can easily obtain a quote from Cure Auto Insurance by visiting their website or using their mobile app. The online platform provides a seamless and user-friendly experience, allowing you to compare coverage options and secure a policy that meets your needs.

Does Cure Auto Insurance offer discounts for multiple policies?

+Yes, Cure Auto Insurance rewards customers who bundle their policies by offering generous discounts. You can save on your premiums by combining auto insurance with other coverages, such as homeowners or renters insurance.

How does Cure's usage-based insurance work, and what are the benefits for policyholders?

+Usage-based insurance from Cure utilizes telematics technology to track driving behavior. Policyholders can benefit from lower premiums by demonstrating safe driving habits. This approach encourages responsible driving and provides a more personalized insurance experience.

Cure Auto Insurance has undoubtedly left its mark on the auto insurance industry, challenging traditional norms and setting new standards for customer-centric services and innovative coverage. As the company continues to evolve and adapt to the changing landscape, its impact on the industry and the satisfaction of its policyholders are sure to grow. With its commitment to innovation and customer satisfaction, Cure Auto Insurance is well-positioned to remain a trusted and influential player in the world of auto insurance.