Insurance For Business Car

In today's fast-paced business world, ensuring the safety and security of your assets is paramount. One often-overlooked aspect is the need for comprehensive insurance coverage for business vehicles. These vehicles are an integral part of many operations, from delivering goods to transporting employees, and proper insurance is essential to protect your business from potential financial pitfalls.

This article aims to delve into the world of business vehicle insurance, providing an in-depth analysis of the coverage options, the importance of adequate protection, and the benefits it brings to your enterprise. By the end of this exploration, you'll have a clearer understanding of why insurance for business cars is not just a legal requirement but a strategic necessity for any forward-thinking organization.

Understanding the Scope of Business Vehicle Insurance

Business vehicle insurance, also known as commercial auto insurance, is a specialized form of coverage designed to protect vehicles used for business purposes. This type of insurance goes beyond the standard personal auto insurance, as it takes into account the unique risks and liabilities associated with commercial operations.

The scope of business vehicle insurance can vary significantly depending on the nature of the business and the vehicles involved. For instance, a small delivery business might require coverage for a fleet of vans, while a corporate entity with a large workforce may need insurance for sedans used by executives and sales teams. Understanding the specific needs of your business is the first step in tailoring an insurance policy that provides adequate protection.

Key Components of Business Vehicle Insurance

- Liability Coverage: This is the cornerstone of any business vehicle insurance policy. It protects the business from claims arising from accidents caused by the insured vehicle. It covers bodily injury, property damage, and legal expenses, ensuring the business is financially protected in the event of a lawsuit.

- Physical Damage Coverage: This aspect of the policy provides coverage for the business vehicle itself. It includes collision coverage, which pays for repairs or replacement if the vehicle is damaged in an accident, and comprehensive coverage, which covers damage from non-collision events like theft, vandalism, or natural disasters.

- Medical Payments Coverage: In the event of an accident, this coverage pays for the medical expenses of the driver and passengers, regardless of who is at fault. It provides a safety net to ensure prompt medical attention without the burden of immediate out-of-pocket expenses.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the business and its employees if they’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. It ensures the business isn’t left footing the bill for injuries or vehicle repairs in such scenarios.

Each of these components can be tailored to the specific needs and risks of the business. For instance, a business with a large fleet might opt for higher liability limits to provide greater protection in the event of a catastrophic accident. On the other hand, a business with older vehicles might prioritize physical damage coverage to ensure the fleet remains roadworthy.

The Benefits of Comprehensive Business Vehicle Insurance

Investing in comprehensive business vehicle insurance brings a multitude of benefits, some of which are immediately apparent, while others offer long-term advantages for the stability and growth of the enterprise.

Financial Protection and Peace of Mind

One of the most obvious advantages is the financial protection it provides. In the event of an accident, the business is shielded from potentially devastating financial consequences. Liability coverage ensures the business isn’t held liable for extensive damages, while physical damage coverage helps replace or repair vehicles, maintaining business operations without interruption.

Moreover, business vehicle insurance offers peace of mind. Business owners and managers can focus on growing their operations without the constant worry of unexpected accidents or incidents that could derail their plans. Knowing that their fleet is adequately insured allows for a more strategic and forward-thinking approach to business management.

Compliance with Legal Requirements

In many jurisdictions, having adequate insurance coverage for business vehicles is not just a best practice but a legal requirement. Failure to comply can result in fines, legal issues, and even the suspension of business operations. By investing in comprehensive insurance, businesses not only protect themselves financially but also ensure they’re operating within the bounds of the law.

Enhanced Risk Management

Business vehicle insurance isn’t just about covering the aftermath of accidents. It’s also a powerful tool for risk management. Many insurance providers offer risk management services and resources that can help businesses identify and mitigate potential risks before they become costly problems.

These services might include driver safety training programs, fleet management tools, and data analytics to identify trends and areas for improvement. By actively managing risks, businesses can reduce the likelihood of accidents, improve driver safety, and potentially lower insurance premiums over time.

Brand Reputation and Customer Trust

In today’s competitive business landscape, maintaining a positive brand reputation is crucial. Customers, partners, and stakeholders expect businesses to operate ethically and responsibly. Having comprehensive insurance coverage demonstrates a commitment to safety and responsibility, which can enhance the business’s reputation and build trust with its various audiences.

Furthermore, in the event of an accident involving a business vehicle, having adequate insurance can help mitigate potential negative publicity. It shows that the business is prepared and responsible, which can help manage public relations and minimize the impact on the brand.

Case Studies: Real-World Examples of Business Vehicle Insurance

To illustrate the importance and benefits of business vehicle insurance, let’s explore a few real-world case studies.

Case Study 1: Delivery Business

Imagine a small bakery that has recently expanded its operations to include home deliveries. The bakery owns a fleet of five vans, which are used daily to deliver fresh bread and pastries to customers across the city. In the early hours of one morning, one of the vans is involved in a serious accident, causing significant damage to the vehicle and resulting in injuries to the driver and a pedestrian.

Without adequate business vehicle insurance, the bakery would be faced with a multitude of financial challenges. They would need to cover the cost of repairing or replacing the van, which could run into tens of thousands of dollars. Additionally, they would likely be liable for the medical expenses of the injured parties, potentially running into hundreds of thousands of dollars. The bakery might even face legal action, which could further exacerbate their financial woes.

However, with comprehensive business vehicle insurance, the bakery is protected. The insurance provider covers the cost of repairing the van, ensuring the fleet remains operational. The liability coverage takes care of the medical expenses and any legal fees, shielding the business from financial ruin. The bakery can continue its operations, delivering fresh goods to its customers and maintaining its reputation as a reliable and responsible business.

Case Study 2: Corporate Fleet

A large corporation with a workforce of over 1,000 employees maintains a fleet of 50 sedans for use by executives and sales teams. These vehicles are used extensively for business travel, attending meetings, and visiting clients. One day, while on a business trip, an executive is involved in a collision with another vehicle, causing significant damage to both cars and resulting in injuries to the executive and the other driver.

Without insurance, the corporation would face significant challenges. They would need to cover the cost of repairs for both vehicles, which could be substantial. Additionally, they would likely be held liable for the medical expenses of the other driver, potentially leading to a costly lawsuit. The corporation's reputation could also be damaged, especially if the incident receives media attention.

However, with a robust business vehicle insurance policy, the corporation is well-protected. The insurance provider covers the cost of repairs for both vehicles, ensuring the fleet remains in good condition. The liability coverage steps in to handle the medical expenses and any legal fees, preventing the corporation from incurring significant financial losses. The incident is managed professionally, and the corporation's reputation remains intact, allowing them to continue their business operations without disruption.

Future Trends and Innovations in Business Vehicle Insurance

As technology advances and business needs evolve, the landscape of business vehicle insurance is also changing. Here are some of the trends and innovations that are shaping the future of this industry.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track vehicle performance and driving behavior, is gaining traction in the insurance industry. This technology allows insurers to offer usage-based insurance policies, which tailor premiums based on actual driving data. Businesses with fleets can benefit from this, as it incentivizes safer driving practices and can lead to significant cost savings over time.

Connected Car Technology

The rise of connected car technology, which enables vehicles to communicate with each other and with infrastructure, is set to revolutionize business vehicle insurance. This technology can provide real-time data on vehicle performance, driver behavior, and even road conditions. Insurers can use this data to offer more accurate and tailored policies, potentially reducing premiums for businesses that adopt safer driving practices and maintain their vehicles well.

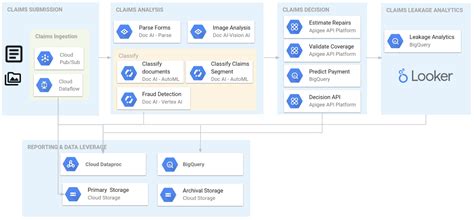

Artificial Intelligence and Machine Learning

AI and machine learning are being increasingly used in the insurance industry to analyze vast amounts of data and identify trends and patterns. These technologies can help insurers more accurately assess risks and price policies, leading to more competitive premiums for businesses. Additionally, AI-powered risk assessment tools can help businesses identify and mitigate potential risks, further enhancing their safety and security.

Enhanced Data Analytics

With the vast amounts of data being generated by vehicles and businesses, enhanced data analytics is becoming a powerful tool in the insurance industry. Insurers can use advanced analytics to understand risk profiles more accurately, tailor policies to specific business needs, and offer more personalized coverage. This can result in more efficient and cost-effective insurance solutions for businesses.

Conclusion: The Strategic Importance of Business Vehicle Insurance

In conclusion, business vehicle insurance is not just a legal requirement or a financial necessity; it’s a strategic asset for any business that relies on vehicles for its operations. It provides financial protection, peace of mind, and compliance with legal obligations. Furthermore, it enhances risk management, boosts brand reputation, and fosters customer trust.

As the business vehicle insurance landscape evolves with technological advancements, businesses have even more opportunities to tailor their insurance coverage to their specific needs and risk profiles. By staying informed about these trends and innovations, businesses can ensure they're getting the most comprehensive and cost-effective coverage possible, allowing them to focus on their core operations with confidence and peace of mind.

How much does business vehicle insurance typically cost?

+The cost of business vehicle insurance can vary significantly based on several factors, including the type of business, the number of vehicles in the fleet, the nature of operations, and the driving records of employees. On average, businesses can expect to pay between 1,000 and 5,000 per vehicle annually, but this can be much higher or lower depending on the specific circumstances.

What are some ways to reduce the cost of business vehicle insurance?

+There are several strategies businesses can employ to reduce their insurance premiums. These include implementing safe driving programs to improve driver behavior, regularly maintaining vehicles to reduce the risk of accidents and breakdowns, and using telematics technology to demonstrate safe driving practices and potentially qualify for usage-based insurance discounts.

What happens if a business vehicle is involved in an accident without insurance?

+If a business vehicle is involved in an accident without insurance, the business can face significant financial consequences. They may be liable for the cost of repairing or replacing the vehicle, as well as for any medical expenses and legal fees arising from the accident. Additionally, they may face legal action and penalties for operating an uninsured vehicle, which can further exacerbate their financial losses.