Marketplace Insurance Florida

Welcome to this comprehensive guide on the world of Marketplace Insurance in Florida, a crucial topic for anyone seeking affordable healthcare coverage in the Sunshine State. As we delve into the intricacies of Florida's insurance marketplace, we'll explore the key aspects that impact consumers' choices, from the unique healthcare landscape in Florida to the practical steps involved in navigating the enrollment process. This article aims to empower readers with the knowledge and tools needed to make informed decisions about their healthcare coverage.

Understanding Florida’s Insurance Landscape

Florida presents a distinct insurance landscape, shaped by its unique demographics, healthcare infrastructure, and state-specific regulations. With a population of over 21 million, Florida is home to a diverse range of residents, including a significant portion of retirees and individuals with pre-existing medical conditions. This demographic makeup influences the demand for specialized healthcare services and insurance plans.

The state's healthcare infrastructure includes a mix of public and private hospitals, clinics, and healthcare providers, each offering a range of services. From world-renowned research hospitals to community health centers, Florida's healthcare system caters to diverse needs. However, access to care can vary across regions, with rural areas often facing challenges in terms of provider availability and specialized services.

Florida's insurance market is regulated by the Florida Office of Insurance Regulation, which sets the standards and guidelines for insurance providers operating within the state. The state's insurance laws and regulations aim to protect consumers, ensure fair practices, and promote competition among insurers. Understanding these regulations is crucial for consumers to make informed choices and navigate the marketplace effectively.

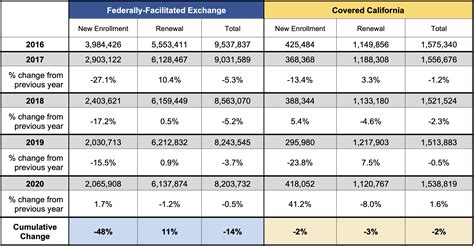

Key Statistics and Trends

According to the Florida Agency for Health Care Administration, as of 2022, approximately 3.5 million Floridians were enrolled in Medicaid, the state’s healthcare program for low-income individuals and families. This represents a significant portion of the state’s population, highlighting the importance of affordable healthcare options.

| Metric | Value |

|---|---|

| Florida's Uninsured Rate (2021) | 11.7% |

| Average Premium Increase (2023) | 4.4% |

| Number of Insurers on the Marketplace (2023) | 11 |

These statistics underscore the challenges faced by Floridians in accessing affordable healthcare coverage. The uninsured rate, although showing improvement, remains higher than the national average, indicating a continued need for accessible and affordable insurance options.

Navigating the Enrollment Process

Enrolling in a health insurance plan through Florida’s Marketplace involves a series of steps designed to ensure a smooth and efficient process. Here’s a detailed guide to help you through the journey.

Eligibility and Timing

Eligibility for insurance coverage through the Marketplace is primarily determined by income and household size. Individuals and families with incomes up to 400% of the Federal Poverty Level (FPL) may qualify for premium tax credits and cost-sharing reductions, making insurance more affordable. The FPL varies based on family size, with the 2023 threshold for a family of four set at $107,720.

Open Enrollment Period: The annual Open Enrollment Period for Florida's Marketplace typically runs from November 1st to December 15th. During this time, individuals can enroll in a new plan, switch plans, or make changes to their existing coverage for the upcoming year. Outside of this period, enrollment is generally limited to qualifying life events, such as marriage, birth of a child, or loss of other health coverage.

Comparing Plans and Choosing the Right One

Florida’s Marketplace offers a range of insurance plans from various carriers, providing consumers with choices to suit their specific needs and preferences. Plans are categorized into Metal tiers based on the actuarial value, which represents the percentage of total average costs for covered benefits that a plan is expected to cover.

- Bronze Plans: These plans typically have lower premiums but higher deductibles and out-of-pocket costs. They may be suitable for younger, healthier individuals who anticipate minimal healthcare needs.

- Silver Plans: Silver plans offer a balance between premiums and out-of-pocket costs. They often include cost-sharing reductions, making them more affordable for individuals eligible for subsidies.

- Gold Plans: Gold plans provide comprehensive coverage with higher premiums but lower deductibles and out-of-pocket costs. They are ideal for individuals with ongoing medical needs or those who prefer more financial predictability.

- Platinum Plans: Platinum plans offer the highest level of coverage with the lowest out-of-pocket costs. However, they come with the highest premiums, making them suitable for individuals with significant healthcare needs or those who can afford the higher monthly costs.

When comparing plans, consider factors such as the network of providers, prescription drug coverage, and any specific healthcare needs you or your family may have. Additionally, review the plan's benefits and exclusions, as well as any additional costs, such as copayments and coinsurance.

Applying and Completing Enrollment

To apply for insurance coverage through Florida’s Marketplace, you can visit the official website, HealthCare.gov, and create an account. The application process involves providing personal and household information, including income details. It’s essential to ensure the accuracy of the information provided, as it affects eligibility for subsidies and the plan options available to you.

Once you've selected a plan and completed the application, you'll receive confirmation of your enrollment. It's important to review your plan's summary of benefits and coverage to understand what is included and what you may need to pay out of pocket. Keep in mind that enrollment is not complete until you've paid your first premium, which typically coincides with the start of your coverage.

Maximizing Cost Savings

Florida’s Marketplace offers several strategies to help consumers reduce the cost of their healthcare coverage. By understanding these cost-saving measures, individuals can make the most of their insurance plans while minimizing out-of-pocket expenses.

Premium Tax Credits

Premium Tax Credits are a significant cost-saving tool available to individuals and families with incomes up to 400% of the FPL. These credits reduce the monthly premium cost of insurance plans, making coverage more affordable. The amount of the credit is determined by income, family size, and the cost of insurance plans in your area. The lower your income, the higher the premium tax credit you may qualify for.

Cost-Sharing Reductions

Cost-sharing reductions further reduce out-of-pocket costs for eligible individuals. These reductions lower deductibles, copayments, and coinsurance for individuals with incomes between 100% and 250% of the FPL. By decreasing these costs, cost-sharing reductions make healthcare services more accessible and affordable for those who need them most.

Special Enrollment Periods

Outside of the annual Open Enrollment Period, Florida’s Marketplace offers Special Enrollment Periods (SEPs) for individuals who experience qualifying life events. These events include marriage, divorce, birth or adoption of a child, loss of other health coverage, or changes in income that affect eligibility for subsidies. SEPs provide an opportunity to enroll in or change insurance plans outside of the regular enrollment period.

Making the Most of Your Coverage

Once enrolled in a health insurance plan, it’s essential to understand how to make the most of your coverage. By utilizing your benefits effectively and staying informed about your plan’s features, you can optimize your healthcare experience and minimize unexpected costs.

Understanding Your Plan’s Network

Health insurance plans typically have a network of providers, including doctors, hospitals, and other healthcare professionals. It’s crucial to understand which providers are in-network and which are out-of-network, as using in-network providers often results in lower out-of-pocket costs. Check your plan’s provider directory or contact your insurance company to verify the network status of your preferred providers.

Utilizing Preventive Care Services

Many insurance plans offer preventive care services at no cost to the member. These services include annual check-ups, immunizations, cancer screenings, and other preventive measures. Taking advantage of these services can help identify potential health issues early on and prevent more serious conditions from developing. It’s a cost-effective way to maintain your health and well-being.

Managing Chronic Conditions

If you have a chronic condition, such as diabetes or heart disease, your insurance plan may offer specialized programs or resources to help manage your condition effectively. These programs often include educational resources, support groups, and access to specialized healthcare providers. By actively participating in these programs, you can improve your health outcomes and potentially reduce the need for costly treatments or hospitalizations.

Future Outlook and Innovations

The landscape of healthcare insurance in Florida is continually evolving, driven by advancements in technology, changing regulations, and evolving consumer needs. As we look to the future, several key trends and innovations are poised to shape the marketplace.

Telehealth and Virtual Care

The rise of telehealth and virtual care services has transformed the way healthcare is delivered. With the increased adoption of digital technologies, Floridians can now access medical consultations, diagnostic services, and even prescription refills remotely. This trend is expected to continue, offering greater convenience and accessibility to healthcare services, particularly in rural areas.

Data-Driven Personalized Care

Advancements in data analytics and artificial intelligence are paving the way for more personalized healthcare experiences. By leveraging data-driven insights, insurance providers can offer tailored plans and services based on an individual’s unique health needs and risk factors. This approach has the potential to improve health outcomes and reduce costs by targeting interventions and preventive measures more effectively.

Integration of Social Determinants of Health

Recognizing the impact of social and environmental factors on health, insurance providers are increasingly integrating social determinants of health into their strategies. This involves addressing issues such as access to healthy food, safe housing, and transportation, which can significantly impact an individual’s overall well-being. By partnering with community organizations and leveraging data-driven insights, insurers can develop targeted interventions to improve health outcomes and reduce healthcare disparities.

Can I enroll in a health insurance plan outside of the Open Enrollment Period?

+Yes, you can enroll outside of the Open Enrollment Period if you experience a qualifying life event, such as marriage, birth of a child, or loss of other health coverage. These events trigger a Special Enrollment Period (SEP) during which you can enroll or change your insurance plan.

How do I know if I’m eligible for premium tax credits or cost-sharing reductions?

+Eligibility for premium tax credits and cost-sharing reductions is based on your income and household size. Generally, individuals and families with incomes up to 400% of the Federal Poverty Level may qualify. You can use the official Healthcare.gov website to determine your eligibility during the application process.

What happens if I miss the Open Enrollment Period and don’t have a qualifying life event for a Special Enrollment Period?

+If you miss the Open Enrollment Period and don’t have a qualifying life event, you may need to wait until the next Open Enrollment Period to enroll in a new plan or make changes to your existing coverage. However, if you qualify for Medicaid or the Children’s Health Insurance Program (CHIP), you can enroll at any time.