Ca Homeowners Insurance

Homeowners insurance is an essential aspect of protecting your biggest investment—your home. It provides financial security and peace of mind, covering a wide range of potential risks and liabilities associated with owning a home. This comprehensive guide will delve into the world of California homeowners insurance, offering expert insights and valuable information to help you navigate this critical aspect of homeownership.

Understanding California Homeowners Insurance

California, known for its diverse landscapes and unique weather patterns, presents a range of challenges when it comes to insuring homes. From earthquakes to wildfires, the state’s natural hazards require a comprehensive insurance approach. Let’s explore the key aspects of homeowners insurance in the Golden State.

Coverage Options and Customization

Homeowners insurance policies in California offer a variety of coverage options to cater to different needs. The basic policy, known as HO-3, provides protection for the structure of your home, your personal belongings, and liability coverage. However, the state’s specific risks often require additional coverage endorsements.

For instance, earthquake insurance is a crucial consideration for many California homeowners. While standard policies may offer limited coverage for earthquakes, separate policies or endorsements are available to provide more extensive protection. Similarly, wildfire coverage is essential for those living in fire-prone areas, ensuring your home and belongings are covered in the event of a wildfire.

Other common endorsements include water backup coverage, which protects against damage caused by backed-up sewage or drainage systems, and personal liability coverage, which can safeguard you from legal expenses and settlements if someone is injured on your property.

The Importance of Proper Valuation

Accurately valuing your home is a critical aspect of homeowners insurance. Underestimating the value can lead to insufficient coverage, while overestimating may result in higher premiums. Insurance professionals use tools like the Replacement Cost Estimator to determine the cost of rebuilding your home, taking into account factors such as construction costs, local building codes, and the size of your home.

Additionally, it’s essential to regularly review and update your home’s valuation. Over time, the cost of rebuilding may increase due to inflation and changing construction materials and techniques. Failure to update your coverage limits could leave you underinsured, leaving you to cover the difference out of pocket in the event of a total loss.

Factors Influencing Premiums

Homeowners insurance premiums in California can vary significantly based on a multitude of factors. Some of the key considerations include:

- Location: The specific area where your home is located plays a significant role. High-risk areas, such as those prone to earthquakes or wildfires, often command higher premiums.

- Construction Type: The materials and methods used to build your home can impact your premium. For instance, homes built with reinforced concrete may be considered more resistant to earthquakes and therefore command lower premiums.

- Home Age: Older homes may require more extensive coverage due to outdated electrical or plumbing systems, potentially leading to higher premiums.

- Claims History: Your personal claims history can influence your premiums. A history of frequent claims may result in higher rates or even difficulty finding coverage.

- Discounts: Many insurance companies offer discounts for safety features like burglar alarms, smoke detectors, and fire sprinklers. Additionally, bundling your homeowners insurance with other policies, such as auto insurance, can often result in significant savings.

Navigating the Claims Process

In the event of a covered loss, understanding the claims process is crucial. Here’s a step-by-step guide to help you navigate this potentially stressful situation.

Reporting the Claim

The first step is to promptly report the claim to your insurance company. Many providers offer 24⁄7 claim reporting hotlines, ensuring you can access assistance whenever needed. Be prepared to provide details about the incident, including the date, time, and cause of the loss.

Documentation and Evidence

Documenting the damage is essential. Take photos or videos of the affected areas, both inside and outside your home. These visual records will be invaluable when filing your claim. Additionally, gather any relevant documents, such as repair estimates, receipts for temporary accommodations, or medical bills if anyone was injured.

Working with Adjusters

Insurance adjusters play a critical role in the claims process. They will assess the damage and determine the value of your claim. It’s essential to cooperate fully with the adjuster and provide any requested information. Remember, they are there to help you navigate the process and ensure a fair settlement.

In some cases, you may disagree with the adjuster’s assessment. If this occurs, you have the right to request a re-inspection or seek an independent appraisal. Understanding your rights and being proactive in the claims process can help ensure you receive a fair settlement.

Resolving Disputes

Should you find yourself in a dispute with your insurance company, there are resources available to help. Many states, including California, have insurance departments or ombudsman offices that can assist with resolving conflicts. Additionally, seeking legal counsel may be necessary in more complex cases.

Choosing the Right Insurance Provider

With numerous insurance companies offering homeowners insurance in California, choosing the right provider can be challenging. Here are some factors to consider when making your selection:

Financial Strength

Opting for a financially stable insurance company is crucial. A strong financial rating indicates the company’s ability to pay claims, even in the event of a large-scale disaster. Look for companies with high ratings from reputable agencies like AM Best, Moody’s, or Standard & Poor’s.

Policy Features and Coverage Options

Compare the coverage options and policy features offered by different providers. Ensure that the policy covers the specific risks you face in your area, whether it’s earthquakes, wildfires, or other natural hazards. Additionally, consider the optional endorsements and additional coverages available to customize your policy to your needs.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Look for companies with a reputation for prompt and efficient claims processing. Online reviews and testimonials can provide valuable insights into the customer experience.

Consider the availability of resources like online claim reporting, policy management tools, and 24⁄7 customer support. These features can make a significant difference in how smoothly the claims process goes.

Price and Discounts

While price is an important consideration, it’s essential to balance cost with the other factors mentioned above. The cheapest policy may not offer the coverage or customer service you need. However, shopping around and comparing quotes can help you find a competitive rate.

Additionally, look for insurance companies that offer discounts. As mentioned earlier, safety features and policy bundling can result in significant savings. Some providers also offer loyalty discounts for long-term customers.

The Future of Homeowners Insurance in California

The insurance landscape is constantly evolving, and California is no exception. As the state faces increasing challenges from climate change and natural disasters, the industry is adapting to meet these new risks.

Innovative Risk Assessment

Insurance companies are investing in advanced technologies to improve risk assessment. This includes the use of satellite imagery, drones, and even artificial intelligence to analyze properties and identify potential hazards. These tools can help provide more accurate and detailed assessments, leading to fairer premiums.

Climate Change Adaptation

With the increasing frequency and severity of natural disasters, insurance companies are adapting their policies and practices to better manage these risks. This includes developing new coverage options and risk mitigation strategies to help homeowners better prepare for and recover from disasters.

For instance, some providers are offering incentives for homeowners to implement resilience measures, such as fire-resistant roofing or earthquake-proof foundations. These measures not only reduce the risk of damage but can also lead to lower premiums.

Community-Based Solutions

The insurance industry is also exploring community-based solutions to manage risks. This includes the development of micro-insurance schemes and community-based resilience initiatives. By pooling resources and sharing risks, communities can better protect themselves and reduce the financial burden on individuals.

Conclusion

California homeowners insurance is a complex but essential aspect of homeownership. By understanding the coverage options, valuation processes, and claims procedures, you can make informed decisions to protect your home and belongings. Additionally, staying informed about the evolving insurance landscape and the innovative solutions being developed can help you stay ahead of the curve and better manage the risks associated with owning a home in the Golden State.

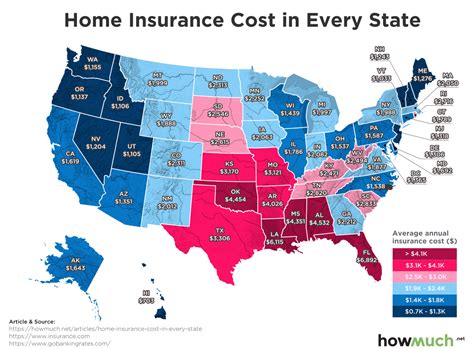

How much does homeowners insurance cost in California?

+The cost of homeowners insurance in California can vary widely based on factors such as location, home value, and coverage limits. On average, homeowners in California pay around $1,000 per year for basic coverage. However, premiums can range from a few hundred dollars to several thousand, depending on individual circumstances.

What is the difference between HO-3 and HO-5 policies?

+An HO-3 policy, also known as a Special Form policy, is the standard homeowners insurance policy. It covers the structure of your home, your personal belongings, and provides liability protection. HO-5, or Open Perils policies, offer broader coverage for personal belongings, covering all risks except those specifically excluded in the policy.

How can I lower my homeowners insurance premiums in California?

+There are several ways to potentially lower your homeowners insurance premiums. These include increasing your deductible, bundling your policies with the same insurer, maintaining a good credit score, and implementing safety features like smoke detectors and burglar alarms.