How Do I Know If I Have Health Insurance

Understanding your health insurance coverage is a crucial aspect of managing your well-being and financial security. Health insurance is a contract between you and an insurance provider, ensuring that you receive necessary medical care without facing excessive out-of-pocket expenses. This comprehensive guide will walk you through the key indicators to help you determine if you have health insurance coverage.

1. The Basics of Health Insurance

Health insurance, in its simplest form, is a protection plan that covers a portion of your medical expenses. It acts as a safety net, ensuring that you can access healthcare services without bearing the full financial burden. Here's a breakdown of the essential components to look for:

- Policy Document: Every health insurance plan is outlined in a detailed policy document. This document specifies the benefits, exclusions, and conditions of your coverage. It's essential to thoroughly review this document to understand your rights and responsibilities.

- Premium Payments: Health insurance typically requires regular premium payments. These are the amounts you pay to the insurance company to maintain your coverage. Consistent premium payments are a key indicator that you are actively insured.

- Insurance Card: Most insurance providers issue an identification card to their policyholders. This card contains crucial information, including your name, policy number, and the effective dates of your coverage. It is presented to healthcare providers as proof of insurance.

2. Understanding Your Coverage

To determine if you have health insurance, it's vital to grasp the scope of your coverage. Here are some key aspects to consider:

In-Network vs. Out-of-Network Providers

Many health insurance plans differentiate between in-network and out-of-network providers. In-network providers have agreed to accept your insurance company's payment rates, ensuring more cost-effective care. Out-of-network providers, on the other hand, may charge higher rates and require more out-of-pocket expenses.

| In-Network Providers | Out-of-Network Providers |

|---|---|

| Lower costs | Higher costs and more out-of-pocket expenses |

| Typically more convenient | May require prior authorization or additional paperwork |

Coverage Limits and Deductibles

Health insurance plans often have coverage limits and deductibles that impact your out-of-pocket costs. Coverage limits specify the maximum amount your insurance will pay for a particular service or treatment. Deductibles, on the other hand, are the amounts you must pay out of pocket before your insurance coverage kicks in.

Benefit Categories

Health insurance plans typically cover a range of services, which can be categorized into benefit categories. These may include:

- Preventive Care: Covers routine check-ups, screenings, and vaccinations.

- Emergency Services: Provides coverage for unexpected and urgent medical situations.

- Hospitalization: Includes coverage for inpatient stays and associated costs.

- Prescription Drugs: Offers coverage for prescribed medications.

- Specialist Visits: Covers visits to specialists such as cardiologists or dermatologists.

- Mental Health Services: Provides coverage for therapy, counseling, and psychiatric care.

3. Checking Your Coverage Status

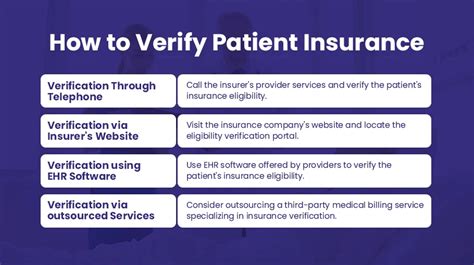

If you suspect you might have health insurance but are unsure, there are several ways to confirm your coverage status:

Contact Your Insurance Provider

The most direct way to verify your coverage is to reach out to your insurance provider. You can call their customer service hotline or visit their website to access your online account. Here, you can find detailed information about your policy, including coverage limits, deductibles, and a list of in-network providers.

Review Your Paycheck Deductions

If you receive health insurance through your employer, review your paycheck deductions. Health insurance premiums are often deducted from your salary, and these deductions are a strong indicator that you are actively insured.

Check Your Mail or Email

Insurance providers often send policy updates, renewal notices, and other important documents via mail or email. Reviewing these communications can provide insights into your coverage status and any upcoming changes to your plan.

4. Utilizing Your Health Insurance

Once you've confirmed your health insurance coverage, it's essential to understand how to utilize it effectively. Here are some tips:

Choose In-Network Providers

Whenever possible, opt for in-network providers to maximize your coverage and minimize out-of-pocket costs. Your insurance provider's website or customer service team can assist you in finding in-network doctors and facilities in your area.

Understand Your Out-of-Pocket Costs

Familiarize yourself with your deductible, co-pays, and co-insurance amounts. These costs can vary depending on the type of service or treatment, so it's crucial to understand them before seeking care.

Review Explanations of Benefits (EOBs)

After receiving medical services, your insurance provider will send you an Explanation of Benefits (EOB). This document outlines the charges billed by your healthcare provider, the amount covered by your insurance, and any remaining costs you are responsible for. Reviewing EOBs helps you stay informed about your coverage and out-of-pocket expenses.

Stay Informed About Plan Changes

Health insurance plans can change annually, so it's important to stay informed about any updates to your coverage. Review your policy documents, attend employer-hosted benefits meetings, or reach out to your insurance provider for the latest information.

Frequently Asked Questions

What if I lose my insurance card?

+

If you misplace your insurance card, you can usually request a replacement from your insurance provider. This process may vary depending on your insurance company, but it often involves contacting their customer service or accessing your online account to order a new card.

How do I know if a provider is in-network?

+

You can check if a provider is in-network by contacting your insurance company’s customer service or visiting their website. Many insurance providers offer online tools or directories that allow you to search for in-network providers based on your location and specific medical needs.

What happens if I exceed my coverage limits?

+

If you exceed your coverage limits, you may be responsible for paying the full cost of additional services or treatments. It’s important to review your policy’s coverage limits and understand the potential out-of-pocket expenses you may incur. Some insurance plans offer optional add-ons or riders to increase coverage limits for specific services.

Can I change my health insurance plan during the year?

+

Changing your health insurance plan during the year may be possible, but it depends on your specific circumstances and the rules of your insurance provider. Some plans allow for changes during designated open enrollment periods, while others may accommodate changes due to qualifying life events such as marriage, divorce, or the birth of a child.

How can I reduce my out-of-pocket expenses?

+

To reduce out-of-pocket expenses, consider the following strategies: choose in-network providers, review and compare costs for different services or treatments, consider generic medications instead of brand-name drugs, and explore any wellness programs or incentives offered by your insurance provider that may provide discounts or coverage for certain services.