Georgia Medical Insurance Exchange

In the world of healthcare, understanding the various avenues for securing adequate medical coverage is essential. One such avenue is the Georgia Medical Insurance Exchange, a platform that plays a pivotal role in the state's healthcare landscape. This article delves into the intricacies of this exchange, exploring its functions, benefits, and impact on residents' access to healthcare.

The Role of Georgia Medical Insurance Exchange

The Georgia Medical Insurance Exchange, commonly referred to as Georgians for Affordable Health Care, serves as a crucial marketplace for residents to compare and purchase health insurance plans. Established in accordance with the Affordable Care Act (ACA), this exchange offers a streamlined process for individuals and families to find suitable health coverage options.

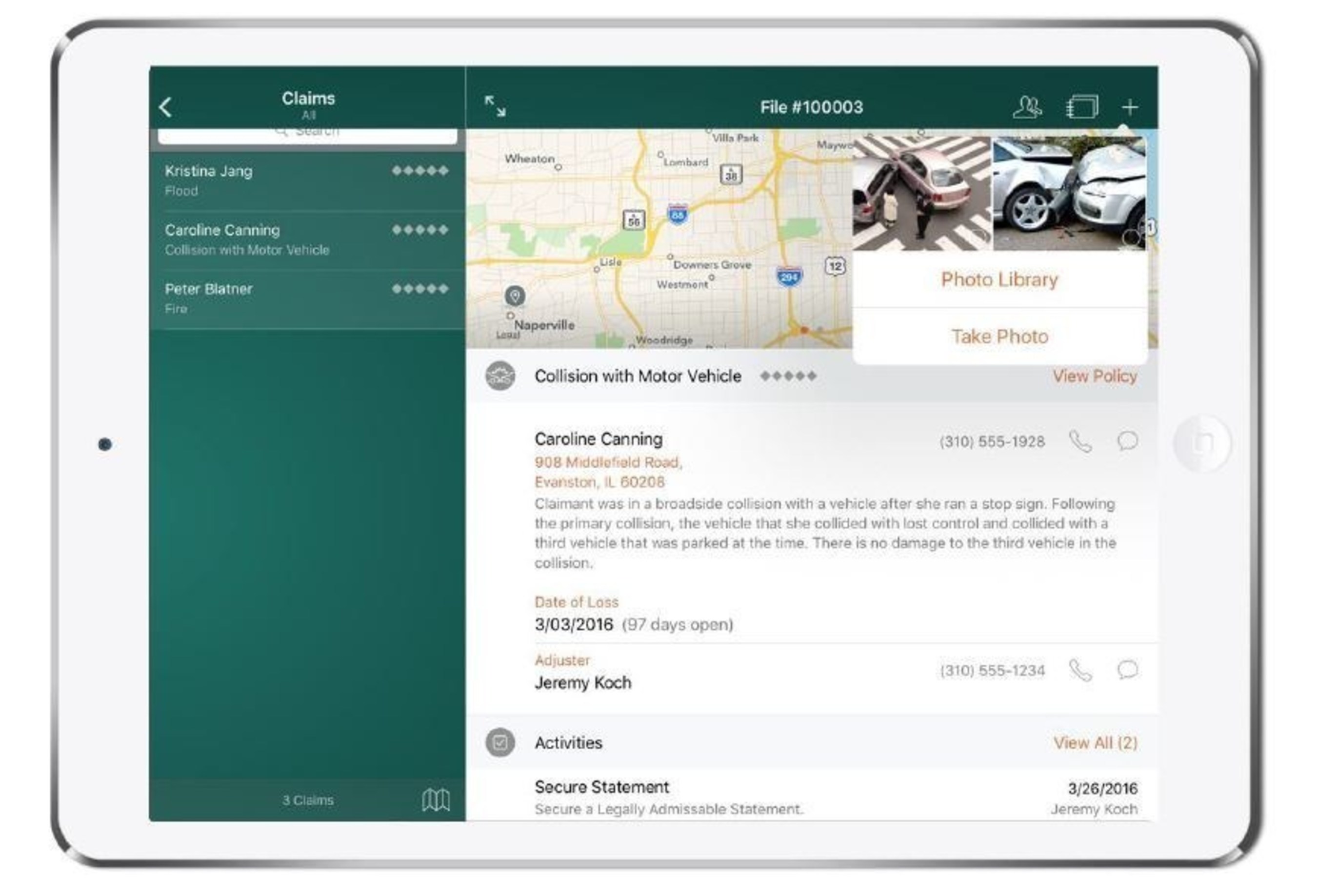

The exchange operates as a digital platform, accessible via the website access.ga.gov, where users can create accounts, browse through a range of insurance plans, and enroll during the annual open enrollment period or special enrollment periods based on qualifying life events.

One of the key advantages of the Georgia Medical Insurance Exchange is its focus on transparency. The exchange provides a user-friendly interface, enabling individuals to compare plans based on factors such as premiums, deductibles, and coverage details. This level of clarity empowers users to make informed decisions about their healthcare coverage.

Navigating the Enrollment Process

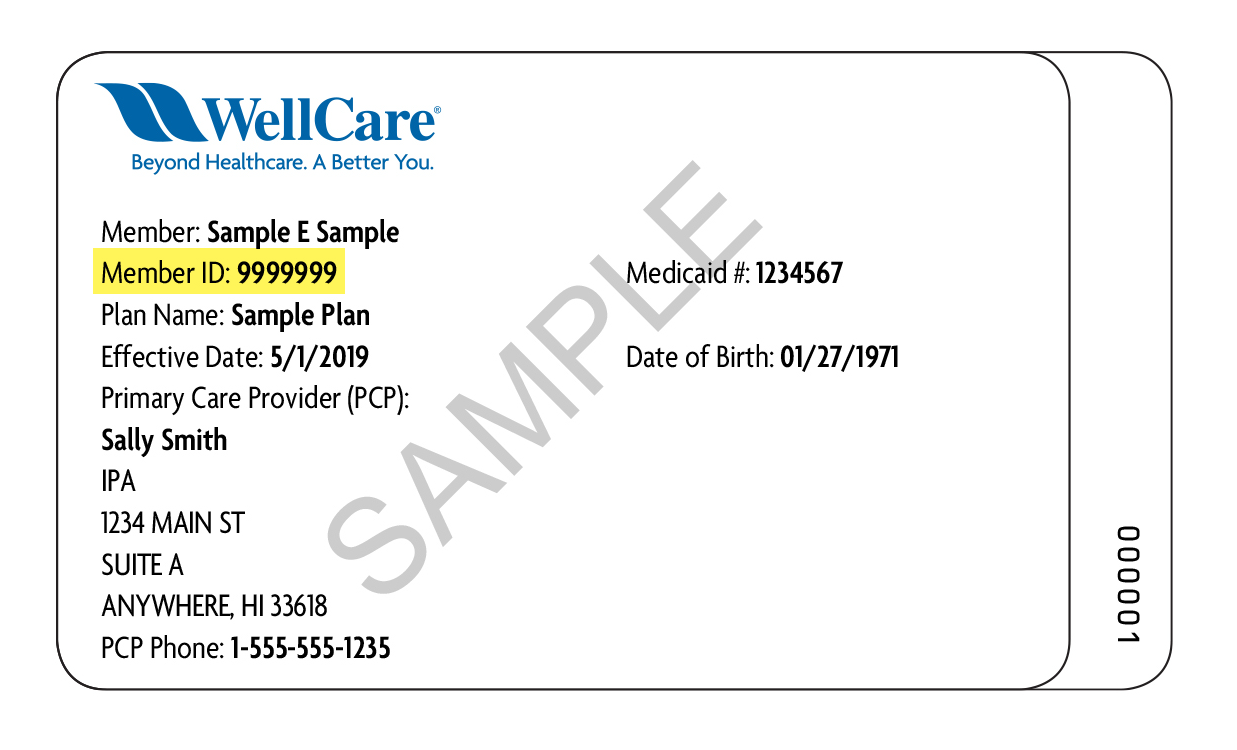

Enrollment on the Georgia Medical Insurance Exchange is a straightforward process. Individuals begin by creating an account, where they provide basic personal information and household details. The exchange’s system then determines eligibility for premium tax credits and cost-sharing reductions, which can significantly reduce the cost of coverage.

During the open enrollment period, typically spanning a few months each year, users can compare plans and select the one that best suits their needs. The exchange offers a range of options, including bronze, silver, gold, and platinum plans, each with varying levels of coverage and cost.

For those facing life changes, such as marriage, divorce, loss of employment, or the birth of a child, the exchange provides a special enrollment period. This ensures that individuals can access coverage outside of the regular open enrollment window, offering flexibility and continuity of care.

Plan Options and Coverage

The Georgia Medical Insurance Exchange offers a diverse range of health insurance plans from various carriers. These plans typically cover essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services, and more.

In addition to these standard benefits, some plans may offer additional coverage options, such as dental, vision, and supplemental insurance. The exchange provides detailed plan summaries, allowing users to understand the specific services and treatments covered by each plan.

| Plan Type | Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Bronze | $400/month | $6,000 | $7,500 |

| Silver | $550/month | $3,500 | $6,800 |

| Gold | $700/month | $2,500 | $5,000 |

| Platinum | $850/month | $1,500 | $4,000 |

Impact on Healthcare Access

The establishment of the Georgia Medical Insurance Exchange has had a significant impact on the state’s healthcare landscape. By providing a centralized platform for residents to compare and purchase health insurance, the exchange has increased access to affordable coverage, particularly for those who may have previously been uninsured or underinsured.

The exchange's role in facilitating enrollment and providing clear plan comparisons has been instrumental in ensuring that individuals and families have the information they need to make informed decisions about their healthcare. This has led to improved health outcomes and a more robust healthcare system in Georgia.

Assisting Vulnerable Populations

One of the key strengths of the Georgia Medical Insurance Exchange is its focus on assisting vulnerable populations. The exchange prioritizes reaching out to communities that may face barriers to accessing healthcare, such as low-income individuals, those with pre-existing conditions, and those who are uninsured due to various circumstances.

Through outreach programs, community partnerships, and targeted marketing efforts, the exchange ensures that these vulnerable populations are aware of their options and can access the coverage they need. This proactive approach has helped bridge the gap in healthcare access and contributed to a more equitable healthcare system.

Continuous Improvement and Innovation

The Georgia Medical Insurance Exchange is dedicated to continuous improvement and innovation. The exchange regularly assesses its processes, technology, and user experience to identify areas for enhancement. This commitment to evolution ensures that the exchange remains a reliable and efficient platform for residents to access healthcare coverage.

In recent years, the exchange has implemented several improvements, including enhanced plan search tools, simplified enrollment processes, and expanded outreach efforts. These initiatives reflect the exchange's dedication to meeting the evolving needs of Georgia's residents and ensuring that healthcare coverage remains accessible and affordable.

Conclusion: Empowering Healthcare Choices

The Georgia Medical Insurance Exchange stands as a vital resource for residents seeking to navigate the complex world of health insurance. Through its user-friendly platform, transparent plan comparisons, and focus on accessibility, the exchange empowers individuals and families to make informed decisions about their healthcare coverage.

As the exchange continues to evolve and adapt to the changing healthcare landscape, it remains a cornerstone in Georgia's efforts to ensure that all residents have access to quality, affordable healthcare. By leveraging the exchange's tools and resources, Georgians can take control of their healthcare choices and secure the coverage they need to lead healthy lives.

How do I enroll in a health insurance plan through the Georgia Medical Insurance Exchange?

+To enroll in a health insurance plan through the Georgia Medical Insurance Exchange, follow these steps: Visit the exchange website at access.ga.gov, create an account, provide the necessary personal and household information, compare the available plans, and select the one that best suits your needs. Remember to enroll during the open enrollment period or qualify for a special enrollment period due to a qualifying life event.

What are the different types of health insurance plans offered on the Georgia Medical Insurance Exchange?

+The Georgia Medical Insurance Exchange offers a range of health insurance plans, including bronze, silver, gold, and platinum plans. These plans vary in terms of premiums, deductibles, and coverage levels. Bronze plans typically have lower premiums but higher deductibles, while platinum plans offer the highest level of coverage but at a higher cost.

Can I qualify for financial assistance to lower the cost of my health insurance plan?

+Yes, many individuals and families may qualify for financial assistance, such as premium tax credits and cost-sharing reductions, to lower the cost of their health insurance plans. The Georgia Medical Insurance Exchange’s enrollment process includes a determination of eligibility for these benefits, based on factors like income and family size.

What happens if I miss the open enrollment period for the Georgia Medical Insurance Exchange?

+If you miss the open enrollment period, you may still be able to enroll in a health insurance plan through the Georgia Medical Insurance Exchange if you experience a qualifying life event. Qualifying life events include marriage, divorce, loss of employment, or the birth of a child. These events trigger a special enrollment period, allowing you to enroll outside of the regular open enrollment window.