Inexpensive Workers Compensation Insurance

Securing Affordable Workers' Compensation Insurance: A Comprehensive Guide

Workers' compensation insurance is an essential safeguard for businesses, ensuring that employees receive financial support and medical coverage in the event of work-related injuries or illnesses. However, for small and medium-sized enterprises, the cost of this insurance can often be a significant concern. This comprehensive guide aims to provide valuable insights and strategies to secure inexpensive workers' compensation insurance, empowering businesses to protect their workforce without breaking the bank.

In today's competitive business landscape, finding cost-effective solutions is crucial for long-term success. This article will delve into the intricacies of workers' compensation, offering practical tips and expert advice to help you navigate the insurance market and make informed decisions. By the end of this guide, you'll have a clear understanding of how to obtain affordable coverage, tailored to the unique needs of your business.

Understanding Workers' Compensation Insurance

Workers' compensation, often referred to as workman's comp, is a type of insurance mandated by state laws to protect employees in the event of on-the-job accidents or illnesses. This coverage ensures that employees receive medical treatment, compensation for lost wages, and rehabilitation services without having to file a lawsuit against their employer. In return, employers are shielded from costly legal battles and potential financial liabilities.

The benefits of workers' compensation are extensive. It provides a safety net for employees, ensuring they can access the necessary medical care and financial support to recover from work-related incidents. For employers, it offers a sense of security, knowing that they are compliant with state regulations and have a system in place to handle workplace injuries efficiently.

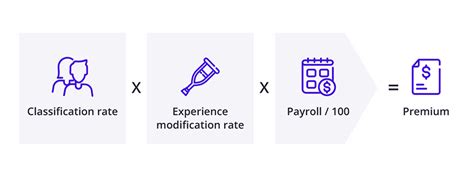

However, the cost of workers' compensation insurance can vary significantly based on several factors, including the industry, the size of the business, and the claims history. For businesses operating in high-risk industries or with a higher claims rate, the insurance premiums can be particularly expensive. This is where understanding the intricacies of workers' compensation and exploring cost-saving strategies becomes crucial.

Strategies for Obtaining Inexpensive Workers' Compensation

1. Shop Around and Compare Quotes

One of the simplest yet most effective strategies to secure inexpensive workers' compensation insurance is to shop around and compare quotes from multiple insurance providers. Each insurer has its own underwriting guidelines and risk assessment methods, which can result in varying premium rates for similar coverage. By obtaining quotes from at least three to five reputable insurers, you can identify the most competitive rates for your business.

When comparing quotes, pay close attention to the coverage details. Ensure that the policies offer the necessary benefits, such as medical expenses, lost wages, and rehabilitation services. Additionally, consider the insurer's financial stability and reputation. A financially stable insurer is more likely to have the resources to pay out claims promptly, providing peace of mind for both you and your employees.

2. Improve Workplace Safety Measures

Insurance providers often reward businesses with lower premiums if they demonstrate a commitment to workplace safety. By implementing comprehensive safety measures, you can reduce the likelihood of accidents and, consequently, the number of claims. This not only benefits your employees but also leads to cost savings in the long run.

Start by conducting a thorough safety audit of your workplace. Identify potential hazards and implement measures to mitigate them. This may involve providing proper training to employees, ensuring adequate safety equipment, and establishing clear safety protocols. Regularly review and update these measures to stay current with industry best practices and regulatory requirements.

Moreover, consider investing in technology that can enhance workplace safety. For instance, you could install advanced security systems, implement ergonomic solutions to reduce physical strain, or utilize software that tracks and analyzes safety data to identify areas for improvement. By demonstrating a proactive approach to safety, you can impress insurers and potentially secure lower premiums.

3. Utilize Safety Groups and Associations

Safety groups and associations offer an effective way to access group insurance rates, which are often more affordable than individual policies. These groups bring together businesses with similar safety records and claims histories, allowing them to pool their resources and negotiate better rates collectively. By joining a reputable safety group, you can benefit from the group's purchasing power and access more favorable insurance terms.

Research and identify safety groups or associations that align with your industry and business size. Look for groups that have a strong track record of success in negotiating lower insurance premiums and providing valuable resources to their members. Additionally, consider the group's size; larger groups may have more negotiating power and access to a broader range of insurance providers.

4. Explore Discounts and Incentives

Many insurance providers offer discounts and incentives to businesses that meet certain criteria. These incentives are designed to encourage safer practices and can lead to significant cost savings. Some common discounts include:

- Safety Discounts: Insurers often reward businesses with a proven track record of implementing and maintaining effective safety programs. Demonstrating your commitment to workplace safety can lead to reduced premiums.

- Loss Control Discounts: These discounts are provided to businesses that actively work to reduce the frequency and severity of workplace accidents. Insurers may offer incentives for implementing loss control measures, such as safety training programs or ergonomic improvements.

- Early Payment Discounts: Some insurers offer discounts for prompt payment of premiums. By paying your premiums early, you can save on administrative fees and potentially receive a percentage off your total premium.

When comparing insurance quotes, ask about the availability of these discounts and how you can qualify for them. By understanding the criteria and taking proactive steps to meet them, you can maximize your savings.

5. Leverage Technology for Risk Assessment

In recent years, technology has revolutionized the insurance industry, including workers' compensation insurance. Insurers now utilize advanced analytics and data-driven models to assess risk more accurately. By leveraging technology, you can provide insurers with detailed information about your business, helping them understand your unique risk profile and potentially secure more favorable rates.

Consider investing in software that can track and analyze workplace safety data. This data can include information on accidents, near-miss incidents, and safety training completion rates. By providing insurers with comprehensive and accurate data, you can demonstrate your commitment to safety and potentially negotiate lower premiums.

Additionally, explore the use of wearable technology and IoT devices to monitor and improve workplace safety. These devices can track employee movements, identify potential hazards, and provide real-time alerts to prevent accidents. By implementing such technologies, you not only enhance workplace safety but also demonstrate your proactive approach to insurers, which can lead to cost savings.

6. Maintain a Positive Claims History

Insurance providers heavily consider a business's claims history when determining premiums. A positive claims history, characterized by a low number of claims and low claim severity, can lead to more favorable insurance rates. On the other hand, a high number of claims or severe claims can significantly increase your premiums.

To maintain a positive claims history, it's crucial to implement effective claims management strategies. This includes promptly reporting all incidents, even minor ones, to your insurer. By doing so, you can ensure that the insurer is aware of the situation and can guide you through the claims process effectively. Additionally, work closely with your insurer to develop a comprehensive return-to-work plan for injured employees, which can help reduce the severity and duration of claims.

Case Study: Success Stories of Affordable Workers' Compensation

To illustrate the effectiveness of the strategies outlined above, let's explore a few real-world success stories of businesses that have secured inexpensive workers' compensation insurance.

1. Small Business in the Construction Industry

A small construction company, with a team of 15 employees, was facing high insurance premiums due to the inherent risks of the industry. To address this issue, the company implemented a comprehensive safety program, including regular safety meetings, on-site safety audits, and mandatory safety training for all employees. They also invested in advanced personal protective equipment (PPE) and utilized digital tools to track and analyze safety data.

By demonstrating their commitment to workplace safety and providing insurers with detailed safety data, the construction company was able to secure a 20% reduction in their workers' compensation premiums. This not only saved them a significant amount of money but also contributed to a safer work environment for their employees.

2. Medium-Sized Manufacturing Business

A medium-sized manufacturing business, with a workforce of 50 employees, had a history of high insurance premiums due to a few severe claims in the past. To improve their situation, the business decided to join a safety group comprised of other manufacturing companies with similar safety records. By pooling their resources, they were able to negotiate more favorable insurance rates and access group purchasing power.

Additionally, the manufacturing business invested in ergonomic solutions to reduce workplace injuries. They implemented a comprehensive ergonomic program, including training sessions and the provision of ergonomic equipment. As a result, they saw a significant decrease in the number of musculoskeletal disorders among their employees, leading to a reduction in claims and, consequently, a 15% decrease in their workers' compensation premiums.

3. Large Retail Chain

A large retail chain, with hundreds of stores across the country, was facing challenges in managing their workers' compensation insurance costs. To address this, they implemented a centralized claims management system, allowing for better tracking and control of claims. They also established a return-to-work program, ensuring that injured employees could resume their duties as soon as they were medically cleared.

Furthermore, the retail chain utilized technology to enhance workplace safety. They implemented a mobile app that allowed employees to report safety concerns and near-miss incidents in real-time. This data was then analyzed to identify trends and potential hazards, enabling the company to take proactive measures to prevent accidents. As a result of their comprehensive approach to safety and claims management, the retail chain was able to reduce their workers' compensation premiums by 10% over a two-year period.

Future Implications and Conclusion

The strategies outlined in this guide provide a solid foundation for securing inexpensive workers' compensation insurance. By actively implementing these measures, businesses can not only save on insurance costs but also create a safer and more productive workplace. However, it's important to note that the insurance landscape is constantly evolving, and staying informed about the latest trends and regulations is crucial for long-term success.

As the business world continues to embrace digital transformation, insurers are likely to further integrate technology into their risk assessment and underwriting processes. Staying ahead of these trends and leveraging technology to enhance workplace safety and claims management can give businesses a competitive edge in the insurance market. Additionally, keeping up with industry-specific best practices and safety standards is essential to maintain a positive claims history and access the most favorable insurance rates.

In conclusion, securing inexpensive workers' compensation insurance is not only a cost-saving measure but also a strategic decision that contributes to the overall success and sustainability of a business. By combining proactive safety measures, effective claims management, and a keen understanding of the insurance market, businesses can protect their workforce while maintaining a healthy bottom line. As you embark on this journey, remember that knowledge is power, and staying informed is the key to unlocking the best insurance deals for your business.

How often should I review my workers’ compensation insurance policy?

+It is recommended to review your policy annually or whenever significant changes occur in your business, such as expansion, acquisition, or changes in workforce size. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

What are some common mistakes businesses make when purchasing workers’ compensation insurance?

+Common mistakes include neglecting to shop around for the best rates, failing to thoroughly understand the policy terms and conditions, and not implementing effective safety measures to reduce the likelihood of claims. It’s crucial to approach the insurance process with diligence and seek expert advice when needed.

Can I negotiate my workers’ compensation insurance premiums with my insurer?

+Yes, negotiation is possible, especially if you have a strong track record of implementing safety measures and maintaining a positive claims history. Insurers often appreciate businesses that take proactive steps to reduce risks, and they may be willing to offer more favorable rates in recognition of these efforts.