Cheap General Liability Insurance

In today's business landscape, safeguarding your company against unforeseen liabilities is essential. General liability insurance serves as a crucial protection net, covering a range of potential risks. This article aims to delve into the world of cheap general liability insurance, offering an in-depth analysis to guide you in making informed decisions for your business.

Understanding General Liability Insurance

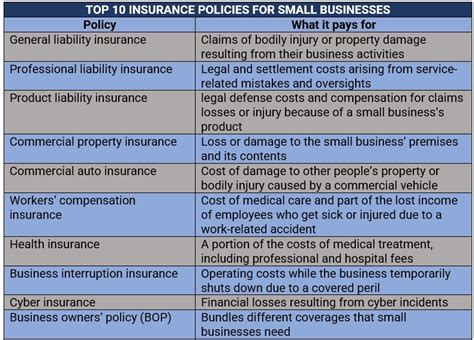

General liability insurance, often referred to as GL insurance, is a fundamental component of any business’s risk management strategy. It provides coverage for various types of claims, including bodily injury, property damage, personal and advertising injury, and medical expenses. By obtaining general liability insurance, businesses can protect themselves from the financial repercussions of unexpected incidents that may occur during the course of their operations.

This type of insurance is particularly valuable for businesses that interact directly with the public or engage in activities that could potentially lead to accidents or property damage. For instance, a slip and fall accident on your premises or a product defect that causes harm to a customer could result in costly lawsuits. General liability insurance steps in to cover these expenses, including legal fees, settlements, and judgments.

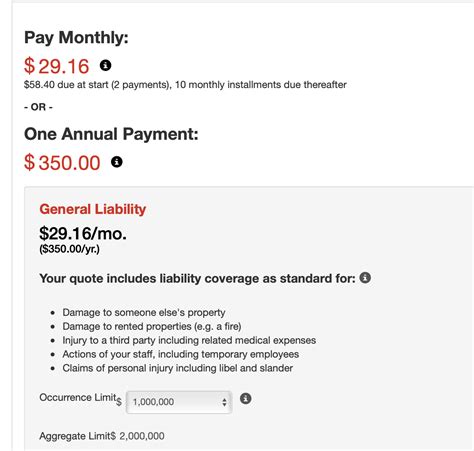

The Cost of General Liability Insurance

The cost of general liability insurance can vary significantly based on several factors. These factors include the nature of your business, the size of your operations, the number of employees, and the level of risk associated with your industry. Additionally, your insurance provider and the coverage limits you choose will also influence the premium you pay.

On average, small businesses can expect to pay between $500 and $1,000 annually for general liability insurance. However, it's important to note that this range is quite broad and can differ greatly depending on the aforementioned factors. Some businesses may find insurance rates as low as $300 per year, while others might pay upwards of $2,000 or more.

One key aspect to consider when seeking cheap general liability insurance is understanding the trade-off between cost and coverage. Opting for a lower premium often means accepting higher deductibles or lower coverage limits. It's crucial to strike a balance that aligns with your business's needs and risk tolerance.

Factors Influencing Insurance Costs

- Industry Risk: High-risk industries, such as construction or manufacturing, generally have higher insurance premiums due to the increased likelihood of accidents and claims.

- Business Size and Operations: Larger businesses with more employees and a broader scope of operations tend to pay higher premiums. This is because the potential for incidents and the resulting financial impact is greater.

- Claims History: Insurance providers consider your business’s past claims history. A clean record can lead to lower premiums, while frequent or significant claims may result in higher costs.

- Coverage Limits: The amount of coverage you choose directly impacts your premium. Higher coverage limits offer more protection but come at a higher cost.

- Deductibles: Opting for higher deductibles can reduce your premium, as it shifts more financial responsibility onto your business in the event of a claim.

Tips for Finding Affordable General Liability Insurance

Securing cheap general liability insurance requires a strategic approach. Here are some tips to help you navigate the process:

Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Obtain multiple quotes from different providers to compare rates and coverage options. Online insurance marketplaces can be a convenient way to gather quotes from various insurers in one place.

Bundle Your Insurance Policies

If you’re in the market for multiple insurance policies, consider bundling them together with a single provider. Many insurers offer discounts when you purchase multiple policies, such as general liability, property insurance, and business owners’ insurance (BOP) together.

Opt for Higher Deductibles

As mentioned earlier, choosing a higher deductible can lower your premium. However, it’s important to ensure that the deductible amount is manageable for your business in the event of a claim.

Review Coverage Options

Evaluate the coverage limits and exclusions offered by different insurers. Ensure that the policy aligns with your business’s specific needs and risks. While it’s tempting to go for the lowest premium, skimping on coverage could leave your business vulnerable.

Negotiate with Your Insurance Provider

Don’t be afraid to negotiate with your insurance provider. Many insurers are willing to work with businesses to find a suitable coverage and premium combination. Highlight your business’s strengths, such as a solid safety record or risk management practices, to potentially secure a better rate.

The Importance of Adequate Coverage

While finding cheap general liability insurance is important, it’s crucial not to sacrifice coverage in the process. Inadequate coverage can leave your business exposed to significant financial risks. Here are some key considerations when assessing your coverage needs:

Industry-Specific Risks

Different industries face unique risks. For example, a technology company may need to consider coverage for data breaches or cyber attacks, while a manufacturing business might prioritize coverage for product defects or workplace injuries.

Policy Limits and Deductibles

Ensure that your policy limits are sufficient to cover potential claims. A higher limit provides more protection but also comes with a higher premium. Similarly, while higher deductibles can reduce your premium, they shift more financial responsibility onto your business in the event of a claim.

Exclusions and Endorsements

Review the exclusions and endorsements in your policy carefully. Exclusions are situations or incidents that are not covered by the policy, while endorsements are additions or amendments to the policy that can broaden coverage. Understanding these aspects is crucial to ensuring your business is adequately protected.

The Role of Risk Management

Implementing effective risk management strategies can not only reduce the likelihood of incidents but also potentially lower your insurance premiums. Here’s how risk management can impact your general liability insurance:

Safety Measures and Training

Investing in employee safety training and implementing rigorous safety protocols can reduce the risk of accidents and injuries. This not only protects your employees but also lowers the chances of costly claims, potentially leading to lower insurance premiums.

Regular Policy Reviews

Periodically reviewing your general liability insurance policy is essential. As your business grows and evolves, so do your risks and coverage needs. Regular reviews ensure that your policy remains aligned with your current operations and helps identify any gaps in coverage.

Loss Control Measures

Implementing loss control measures, such as regular equipment maintenance, hazard identification, and employee safety incentives, can significantly reduce the likelihood of accidents and claims. These proactive measures demonstrate your commitment to safety and may result in lower insurance premiums.

The Future of General Liability Insurance

The general liability insurance landscape is continually evolving. As technology advances and new risks emerge, insurers are adapting their policies and coverage options. Here’s a glimpse into the future of general liability insurance:

Digitalization and Data-Driven Decisions

The insurance industry is increasingly leveraging technology and data analytics to assess risk and set premiums. Insurers are using advanced algorithms and predictive modeling to more accurately price policies based on a business’s specific risks and characteristics.

Telematics and Real-Time Risk Assessment

Telematics, the integration of telecommunications and informatics, is gaining traction in the insurance industry. This technology allows insurers to monitor and assess risk in real-time, providing more accurate and dynamic pricing. For instance, in the transportation industry, telematics can track driving behavior and vehicle performance to adjust premiums accordingly.

Emerging Risks and Coverage

As new technologies and business models emerge, so do new risks. Insurers are continually updating their policies to address these emerging risks. For example, with the rise of e-commerce and online businesses, insurers are offering coverage for cyber risks, data breaches, and online defamation.

Conclusion

General liability insurance is a vital component of any business’s risk management strategy. While finding cheap general liability insurance is important, it’s crucial to strike a balance between cost and coverage to ensure your business is adequately protected. By understanding the factors that influence insurance costs, implementing effective risk management strategies, and staying informed about the evolving insurance landscape, you can make informed decisions to safeguard your business’s future.

What is the average cost of general liability insurance for small businesses?

+Small businesses can expect to pay between 500 and 1,000 annually for general liability insurance. However, this range can vary significantly based on factors such as industry, business size, and claims history.

How can I lower my general liability insurance premium?

+To lower your premium, consider shopping around for quotes, bundling your insurance policies, opting for higher deductibles, and negotiating with your insurance provider. Additionally, implementing effective risk management strategies can also reduce your premium over time.

What factors influence the cost of general liability insurance?

+The cost of general liability insurance is influenced by factors such as industry risk, business size and operations, claims history, coverage limits, and deductibles. High-risk industries and larger businesses tend to have higher premiums.