Insurance For Rented Property

Protecting rented properties is a critical aspect of property management and ownership, ensuring the safety and security of investments. With the right insurance coverage, property owners can mitigate risks and safeguard their assets effectively. This comprehensive guide will delve into the intricacies of insurance for rented properties, offering valuable insights and practical advice.

Understanding the Risks: A Comprehensive Overview

When it comes to rented properties, various risks and liabilities come into play. From natural disasters and unforeseen accidents to tenant-related issues, property owners face a wide range of potential challenges. Here’s a detailed breakdown of the key risks associated with rented properties:

- Natural Disasters: These events, such as floods, earthquakes, or hurricanes, can cause significant damage to properties. While some regions may be more prone to specific disasters, it's essential to prepare for all possibilities.

- Fire and Smoke Damage: Fires can start from various sources, including electrical malfunctions, cooking accidents, or even arson. Smoke damage can also be a serious concern, affecting not only the affected unit but also neighboring spaces.

- Water Damage: Leaks, burst pipes, or heavy rainfall can lead to water damage, which can be costly to repair and may require extensive renovation.

- Vandalism and Theft: Unfortunately, acts of vandalism and theft are common risks for rented properties. These incidents can cause significant damage and financial loss.

- Liability Claims: Tenants or visitors may sustain injuries on the property, leading to liability claims. Slip-and-fall accidents, for instance, are a common source of such claims.

- Tenant Misconduct: Tenants' actions, such as negligence or intentional damage, can result in property destruction. This can include pet-related incidents or disregard for maintenance guidelines.

- Legal and Administrative Costs: Dealing with legal issues, tenant disputes, or eviction processes can incur substantial costs, often overlooked by property owners.

Insurance Coverage: A Tailored Approach

To effectively protect rented properties, a tailored insurance approach is necessary. Here’s an in-depth look at the various types of coverage available and how they can be customized to meet specific needs:

Property Insurance

Property insurance is the cornerstone of protection for rented properties. It covers the physical structure and its contents, including fixtures, appliances, and personal property owned by the landlord. Here’s a closer look at the key aspects of property insurance:

- Building Coverage: This insures the physical structure, including the walls, roof, and foundations. It's crucial to ensure that the coverage limit is adequate to rebuild the property in the event of a total loss.

- Personal Property Coverage: Landlords can opt for coverage for their personal property within the rental units, such as appliances, furniture, and equipment. This is particularly beneficial for furnished rentals.

- Loss of Use Coverage: In the event of a covered loss, this coverage helps cover the landlord's additional living expenses, such as temporary housing or rental income loss.

- Ordinance or Law Coverage: This provides coverage for the additional costs incurred when rebuilding to meet updated building codes and ordinances.

Liability Insurance

Liability insurance is vital to protect against claims arising from accidents or injuries on the property. It provides coverage for medical expenses, legal fees, and settlements in the event of a liability lawsuit. Here’s what you need to know about liability insurance:

- General Liability: This coverage safeguards against third-party claims, including slip-and-fall accidents, injuries caused by defective conditions on the property, or tenant injuries caused by the landlord's negligence.

- Landlord Liability: Specifically tailored for landlords, this coverage extends protection beyond general liability, including coverage for legal defense costs and potential settlements.

Additional Coverage Options

Beyond the standard property and liability insurance, there are several additional coverage options that property owners can consider to enhance their protection:

- Loss of Rent Insurance: This coverage reimburses the landlord for lost rental income due to a covered loss, ensuring a steady income stream even during repairs.

- Rent Guarantee Insurance: Provides protection against tenants who fail to pay rent, covering the landlord's loss of income and legal expenses related to eviction proceedings.

- Contents Insurance: Offers coverage for tenants' personal belongings, providing an extra layer of protection for both tenants and landlords.

- Earthquake and Flood Insurance: In regions prone to these natural disasters, specialized insurance policies can be crucial to mitigate potential losses.

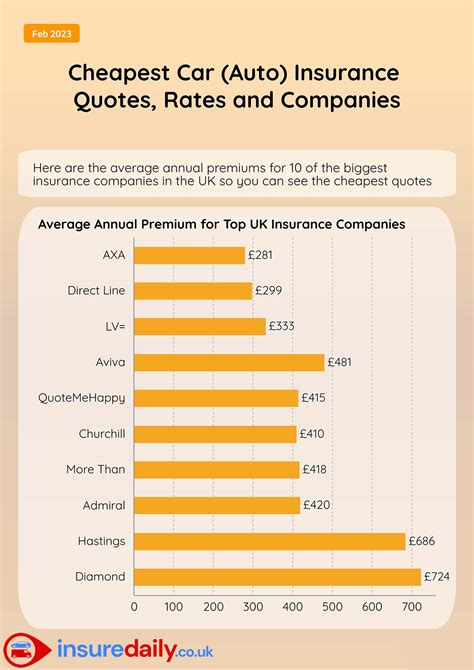

Factors Influencing Insurance Premiums

Insurance premiums for rented properties can vary significantly based on several factors. Understanding these influences is essential for property owners to make informed decisions about their coverage:

- Location: The geographical location of the property plays a significant role in determining insurance rates. Regions prone to natural disasters or with high crime rates may have higher premiums.

- Property Value: The value of the property, including the building and its contents, is a key factor. Higher-value properties typically require more extensive coverage, resulting in higher premiums.

- Claim History: Insurance companies consider the claim history of the property and the landlord. A history of frequent claims can lead to higher premiums or even denial of coverage.

- Deductibles: Choosing higher deductibles can reduce insurance premiums, but it's essential to strike a balance between affordability and adequate coverage.

- Security Features : Properties with advanced security systems, fire prevention measures, and other safety features may be eligible for premium discounts.

Claims Process and Best Practices

In the event of a covered loss, understanding the claims process and following best practices is crucial. Here’s a step-by-step guide to help property owners navigate this process effectively:

Step 1: Document the Damage

Immediately after a loss, thoroughly document the damage using photographs, videos, and detailed notes. This documentation will be crucial when filing a claim.

Step 2: Contact Your Insurance Provider

Notify your insurance company as soon as possible. They will guide you through the claims process and may assign an adjuster to assess the damage.

Step 3: Cooperate with the Adjuster

Work closely with the assigned adjuster, providing all necessary information and documentation. Be transparent and cooperative to ensure a smooth claims process.

Step 4: Review the Claim Estimate

Carefully review the adjuster’s estimate. If you disagree with any aspect, discuss it with the adjuster and provide supporting evidence.

Step 5: Proceed with Repairs

Once the claim is approved, initiate repairs promptly. Ensure that all work is done by licensed professionals and keep records of all expenses.

Step 6: Regularly Update Your Insurance

Periodically review your insurance coverage to ensure it aligns with your property’s current value and any changes in risk factors. Adjust your coverage as needed.

Case Studies: Real-World Examples

Understanding the impact of insurance coverage through real-world examples can provide valuable insights. Here are two case studies highlighting the importance of proper insurance for rented properties:

Case Study 1: Natural Disaster Recovery

In a coastal region prone to hurricanes, a landlord with a well-insured rental property faced significant damage due to a category 3 hurricane. Thanks to comprehensive insurance coverage, including windstorm and flood insurance, the landlord was able to rebuild the property and recover lost rental income.

Case Study 2: Tenant Liability Claim

A landlord with liability insurance faced a liability claim from a tenant who slipped and fell on a wet floor in the rental unit. The insurance provider covered the medical expenses and legal fees, protecting the landlord’s finances and reputation.

Conclusion: A Secure Future

Insurance for rented properties is not just a legal requirement; it’s a strategic investment in the security and longevity of your assets. By understanding the risks, customizing your coverage, and staying informed about the claims process, you can ensure a secure future for your rental properties. Remember, proper insurance is your safety net, providing peace of mind and financial protection in the face of unforeseen events.

What is the average cost of insurance for rented properties?

+The average cost of insurance for rented properties can vary widely depending on factors such as location, property value, and claim history. On average, property owners can expect to pay between 0.2% and 0.5% of the property’s replacement value annually for insurance. However, it’s crucial to obtain personalized quotes to determine the exact cost for your specific property.

How often should I review my insurance coverage for rented properties?

+It’s recommended to review your insurance coverage annually or whenever significant changes occur, such as property renovations, tenant turnover, or changes in risk factors. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs.

Can I combine insurance policies for multiple rented properties?

+Yes, combining insurance policies for multiple rented properties can often result in cost savings. This is known as a “blanket policy” or “umbrella policy.” By consolidating your coverage, you may benefit from lower premiums and streamlined administration.

What should I do if my insurance claim is denied?

+If your insurance claim is denied, it’s essential to understand the reasons for the denial. Review the policy terms and conditions, and consider seeking legal advice if necessary. You may also request a formal review of the decision or appeal the denial.

Are there any tax benefits associated with insurance for rented properties?

+Yes, insurance premiums for rented properties are typically tax-deductible expenses for landlords. Consult with a tax professional to understand the specific deductions available in your jurisdiction.