Is Cigna Good Health Insurance

When evaluating the quality of health insurance providers, it's essential to delve into the specifics and consider various factors that can impact your overall healthcare experience. In this comprehensive analysis, we will explore the offerings of Cigna, a prominent player in the health insurance industry, and assess whether it can be considered a "good" choice for your health coverage needs.

Understanding Cigna’s Role in the Healthcare Industry

Cigna, a global health service company, has been in the business of providing health insurance and related services for decades. With a presence in over 30 countries, it caters to a diverse range of individuals and businesses, offering a comprehensive suite of health insurance plans and wellness programs.

Cigna's mission is to improve the health, well-being, and peace of mind of its customers. They strive to achieve this through innovative products, personalized services, and a network of healthcare providers that aim to deliver quality care.

The Quality of Cigna’s Health Insurance Plans

Cigna offers a wide array of health insurance plans designed to cater to different demographics and needs. These plans can be broadly categorized into:

- Individual and Family Plans: Tailored for individuals and families, these plans offer flexibility and comprehensive coverage, including access to a network of doctors and specialists.

- Group Health Plans: Cigna provides insurance solutions for employers, offering customized plans to meet the specific needs of their workforce.

- Medicare and Medicaid Plans: Cigna also offers plans for individuals eligible for Medicare or Medicaid, ensuring access to essential healthcare services.

- Student Health Plans: Recognizing the unique needs of students, Cigna provides plans that offer affordable coverage for higher education institutions.

The specific features and benefits of Cigna's plans vary depending on the type of coverage and the region. However, some common advantages include:

- Network of Providers: Cigna maintains an extensive network of healthcare professionals, ensuring that policyholders have access to a wide range of doctors and specialists.

- Wellness Programs: Cigna promotes preventive care and overall well-being through various wellness initiatives, encouraging healthy lifestyle choices.

- Online Tools and Resources: The company provides digital platforms and apps to help members manage their health and insurance needs efficiently.

- Pharmacy Benefits: Many Cigna plans include prescription drug coverage, offering savings and convenience for policyholders.

Performance and Customer Satisfaction

Cigna’s performance and reputation in the market are key indicators of its quality as a health insurance provider. Here’s a closer look at some aspects:

Financial Stability

Financial stability is crucial for any insurance company. Cigna has consistently demonstrated strong financial performance, with a solid credit rating and a track record of managing its resources effectively. This ensures that policyholders can rely on Cigna’s ability to pay claims and provide long-term stability.

| Rating Agency | Credit Rating |

|---|---|

| Standard & Poor's | A (Strong) |

| Moody's | A2 (Good) |

| AM Best | A+ (Superior) |

Customer Service and Claims Processing

Cigna places a strong emphasis on customer service, offering multiple channels for support, including phone, email, and online chat. The company aims to make the claims process as seamless as possible, providing resources and guidance to policyholders.

Customer feedback and reviews indicate a generally positive experience with Cigna's customer service. While there may be occasional complaints, Cigna actively works to resolve issues and maintain a high level of satisfaction.

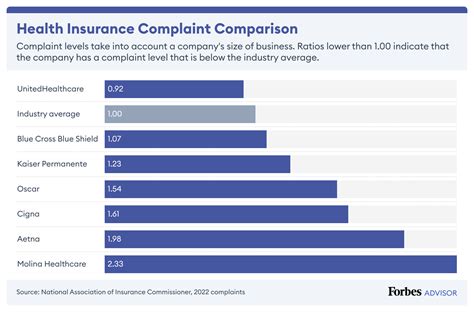

Complaints and Regulatory Actions

Like any large insurance provider, Cigna has faced complaints and regulatory actions in the past. However, it’s important to note that these are relatively infrequent and often resolved in a timely manner. Cigna maintains a commitment to compliance and transparency in its operations.

Comparative Analysis: Cigna vs. Competitors

To truly assess Cigna’s standing as a “good” health insurance provider, it’s beneficial to compare it with other leading companies in the industry. Here’s a brief overview of how Cigna stacks up against its competitors:

Plan Options and Customization

Cigna offers a diverse range of plan options, allowing individuals and businesses to tailor their coverage to their specific needs. This level of customization is comparable to what other major insurers provide, ensuring that customers can find a plan that suits their preferences and budgets.

Network of Providers

Cigna’s network of healthcare providers is extensive, covering a wide geographic area. While some competitors may have slightly larger networks, Cigna’s offering is still highly competitive and ensures that policyholders have access to a broad range of healthcare professionals.

Wellness Programs and Preventive Care

Cigna’s focus on wellness and preventive care is a notable strength. The company’s initiatives in this area are well-developed and comprehensive, rivaling or even surpassing those of its competitors. This commitment to promoting healthy lifestyles can be a significant advantage for policyholders.

Digital Tools and Member Engagement

In today’s digital age, insurers are increasingly leveraging technology to enhance the member experience. Cigna has invested in developing robust digital platforms and apps, making it easier for policyholders to manage their health and insurance needs. This aspect is a competitive advantage, as it demonstrates Cigna’s innovation and responsiveness to modern consumer expectations.

Conclusion: Is Cigna a Good Choice for Health Insurance?

Based on the comprehensive analysis presented above, it is evident that Cigna is a reputable and reliable health insurance provider. With a strong financial foundation, a commitment to customer service, and a focus on wellness and innovation, Cigna offers a compelling suite of health insurance plans.

However, it's essential to remember that the "goodness" of a health insurance provider is subjective and depends on individual needs and preferences. While Cigna excels in many areas, it's crucial to carefully review the specific plan options, network coverage, and additional benefits to ensure they align with your unique healthcare requirements.

In summary, Cigna stands out as a "good" choice for health insurance, offering a balanced approach that combines financial stability, a robust provider network, and a focus on member well-being. As with any major decision, it's advisable to thoroughly research and compare multiple options before making a final choice.

How does Cigna’s cost compare to other insurers?

+Cigna’s pricing can vary based on the plan and region. It’s best to obtain a personalized quote to compare Cigna’s costs with other insurers in your area.

What additional benefits does Cigna offer besides standard coverage?

+Cigna provides a range of additional benefits, including wellness programs, digital tools for health management, and pharmacy discounts. These add value to the standard coverage.

How does Cigna’s customer service compare to competitors?

+Cigna’s customer service is generally well-regarded, offering multiple support channels and a commitment to timely claim processing. While there may be occasional complaints, Cigna actively works to address them.