Actual Cash Value Insurance Definition

In the world of insurance, understanding the different types of coverage is crucial for individuals and businesses alike. Among the various insurance policies available, Actual Cash Value (ACV) insurance stands out as a popular choice for many. This type of insurance policy is designed to provide financial protection by covering the actual cash value of an insured asset at the time of a loss or damage. Let's delve into the intricacies of ACV insurance, exploring its definition, how it works, and its key features and benefits.

Understanding Actual Cash Value Insurance

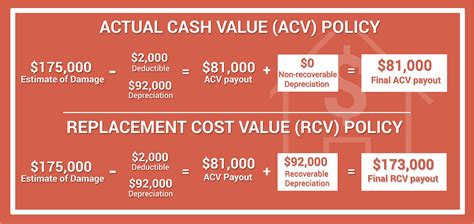

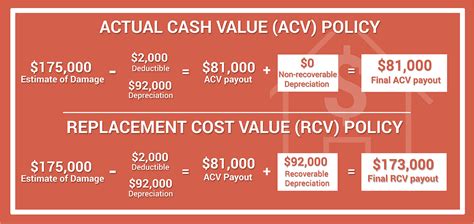

Actual Cash Value insurance, often referred to as ACV, is a form of insurance coverage that reimburses the policyholder for the actual cash value of their insured property in the event of a covered loss. This value represents the cost of replacing or repairing the damaged property, minus any depreciation that has occurred over time.

Unlike other insurance policies, such as replacement cost insurance, ACV takes into account the age and condition of the insured item. It considers factors like wear and tear, obsolescence, and any improvements made to the property, resulting in a lower payout compared to the original purchase price or the cost of a brand-new item.

How Actual Cash Value Insurance Works

When a policyholder files a claim under an ACV insurance policy, the insurance company assesses the damage and determines the actual cash value of the insured property at the time of the loss. This process involves several key steps:

- Damage Assessment: The insurer sends an adjuster to evaluate the extent of the damage and determine if it is covered under the policy.

- Determining Actual Cash Value: The adjuster calculates the ACV by considering the original purchase price, the age of the item, its condition, and any applicable depreciation.

- Payout Calculation: Once the ACV is established, the insurer subtracts any applicable deductibles and pays out the claim amount to the policyholder.

It's important to note that ACV insurance policies often have specific exclusions and limitations. These may include coverage for certain types of losses, such as wear and tear or intentional damage, as well as limits on the amount of coverage provided for certain items or perils.

Key Features and Benefits of Actual Cash Value Insurance

ACV insurance offers several advantages and features that make it an appealing choice for many policyholders:

Cost-Effective Coverage

One of the primary benefits of ACV insurance is its cost-effectiveness. Since the policy pays out based on the actual cash value of the insured item, it tends to have lower premiums compared to other types of insurance, such as replacement cost coverage.

Policyholders can enjoy adequate protection without incurring high insurance costs, making it an attractive option for those on a budget or with less valuable assets.

Flexibility and Customization

ACV insurance policies can be tailored to meet the specific needs of the policyholder. Insurers often offer a range of coverage options and limits, allowing individuals and businesses to choose the level of protection that suits their assets and financial situation.

This flexibility ensures that policyholders can find a balance between the cost of insurance and the level of coverage they require.

Simplified Claims Process

The claims process for ACV insurance is relatively straightforward. Once the damage is assessed and the ACV is determined, the insurer provides a clear payout amount, making it easier for policyholders to understand their reimbursement.

This transparency can expedite the claims process and reduce potential disputes or misunderstandings between the insurer and the policyholder.

Broad Coverage

ACV insurance policies typically provide coverage for a wide range of perils and losses. This includes common hazards such as fire, theft, vandalism, and natural disasters. The exact perils covered may vary depending on the policy and the insurer.

By offering broad coverage, ACV insurance ensures that policyholders have protection against a variety of potential risks.

Comparing Actual Cash Value to Other Insurance Types

When considering insurance options, it’s essential to understand how ACV insurance differs from other common types of insurance coverage.

Replacement Cost Insurance

Replacement cost insurance, unlike ACV, provides coverage for the cost of replacing the insured property with a new item of similar quality. It does not take into account depreciation, ensuring that policyholders receive the full replacement value.

While replacement cost insurance offers higher payouts, it typically comes with higher premiums as well. Policyholders must carefully consider their assets' value and their ability to afford the additional cost.

Agreed Value Insurance

Agreed value insurance is a specialized type of coverage often used for high-value items or unique assets. In this case, the policyholder and insurer agree on a specific value for the insured item, which remains constant throughout the policy term.

This type of insurance provides certainty in the event of a loss, as the agreed value is the amount paid out regardless of the actual cash value at the time of the claim. However, it may not be suitable for all assets and can be more expensive.

Real-World Examples of Actual Cash Value Insurance

To better understand how ACV insurance works in practice, let’s explore a few real-world scenarios:

Homeowner’s Insurance Claim

Imagine a homeowner with an ACV insurance policy on their residence. A storm causes significant damage to their roof, requiring a complete replacement. The insurer assesses the damage and determines that the ACV of the roof at the time of the loss is $10,000.

After applying the deductible, the insurer pays out $9,000 to the homeowner, allowing them to repair their roof and get their home back to its pre-loss condition.

Auto Insurance Collision Claim

A driver with an ACV insurance policy on their vehicle gets into an accident, resulting in extensive damage to the car’s body and engine. The insurer evaluates the damage and determines that the ACV of the vehicle at the time of the accident is $15,000.

Considering the deductible, the insurer offers the policyholder $14,000, which can be used to repair or replace the vehicle, ensuring they are back on the road promptly.

Business Property Insurance

A small business owner has an ACV insurance policy covering their office equipment, including computers and servers. A fire breaks out in their building, causing extensive damage to the insured property.

The insurer assesses the loss and calculates the ACV of the equipment, taking into account the age and condition of the items. The policyholder receives a payout based on the ACV, allowing them to replace or repair the damaged equipment and continue their business operations.

Performance Analysis and Future Implications

Actual Cash Value insurance has proven to be a reliable and popular choice for many policyholders, offering a balance between cost-effectiveness and adequate coverage. Its flexibility and broad coverage make it suitable for a wide range of individuals and businesses.

Looking ahead, ACV insurance is likely to remain a prominent option in the insurance market. Its simplicity and affordability make it accessible to a diverse range of policyholders, ensuring they have the protection they need without straining their finances.

Furthermore, with advancements in technology and data analysis, insurers may refine their ACV calculations, leading to more accurate assessments of the actual cash value of insured items. This could result in even more precise payouts, enhancing the overall customer experience.

Conclusion

In summary, Actual Cash Value insurance provides a cost-effective and customizable solution for policyholders seeking financial protection for their assets. By understanding the key features, benefits, and real-world applications of ACV insurance, individuals and businesses can make informed decisions when choosing their insurance coverage.

As the insurance landscape continues to evolve, ACV insurance remains a trusted companion for those navigating the complexities of asset protection.

How does depreciation affect the Actual Cash Value of an insured item?

+Depreciation is a key factor in determining the Actual Cash Value of an insured item. It represents the decrease in value over time due to factors like wear and tear, obsolescence, and market conditions. When an item depreciates, its ACV decreases, resulting in a lower payout in the event of a claim.

Are there any limitations or exclusions with ACV insurance policies?

+Yes, ACV insurance policies typically have limitations and exclusions. These may include coverage for certain types of losses, such as wear and tear or intentional damage. It’s essential to carefully review the policy documents to understand the specific exclusions and limitations applicable to your coverage.

Can I upgrade my ACV insurance policy to replacement cost coverage?

+In many cases, policyholders have the option to upgrade their ACV insurance policy to replacement cost coverage. This provides a higher level of protection, as it covers the cost of replacing the insured item with a new one of similar quality. However, it may come with higher premiums, so it’s important to weigh the benefits against the cost.