Insurance Of The Car

In the vast world of automotive ownership, one crucial aspect that often weighs heavily on the minds of car enthusiasts and everyday drivers alike is insurance. It is a necessary financial protection measure that can make or break one's peace of mind on the road. The process of choosing and managing car insurance is not merely a formality; it involves a deep understanding of one's needs, a careful evaluation of various policies, and a strategic approach to securing the best coverage. This comprehensive guide aims to unravel the intricacies of car insurance, providing an in-depth analysis to help you navigate this complex landscape with confidence.

Understanding the Basics of Car Insurance

Car insurance is a legal agreement between you and an insurance provider, designed to protect you financially in the event of an accident, theft, or other vehicle-related incidents. This coverage is a mandatory requirement in most regions, ensuring that all road users have some level of financial responsibility. The basic premise of car insurance is to provide a safety net, offering compensation for damages and losses incurred during an unfortunate event.

At its core, car insurance operates on a risk-sharing principle. The insurance company assesses the potential risks associated with your vehicle and driving habits, then calculates a premium that you pay to obtain coverage. This premium is a regular, typically monthly, payment that maintains your insurance policy. The insurance company, in turn, agrees to compensate you or a third party for damages or losses according to the terms of your policy.

Types of Car Insurance

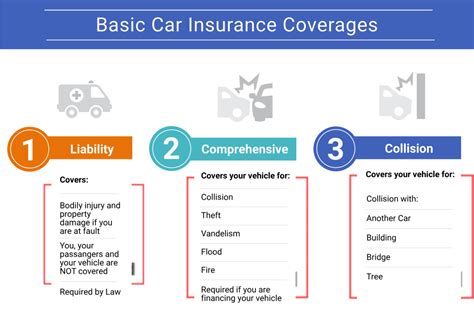

Car insurance policies can be broadly categorized into three main types: liability, collision, and comprehensive. Each type serves a distinct purpose and offers varying levels of coverage.

- Liability Insurance: This is the most basic form of car insurance and is often mandatory by law. It covers damages and injuries you cause to others in an accident. It does not, however, cover damages to your own vehicle or injuries you sustain.

- Collision Insurance: As the name suggests, this type of insurance covers damages to your vehicle resulting from a collision, regardless of fault. It is particularly beneficial for newer or high-value vehicles, as it can provide financial protection against costly repairs or replacements.

- Comprehensive Insurance: Comprehensive coverage goes beyond collision, providing protection against a wide range of non-collision incidents such as theft, vandalism, fire, and natural disasters. It is an all-encompassing policy that offers peace of mind for vehicle owners.

Factors Influencing Insurance Premiums

The cost of your car insurance, known as the premium, is determined by several factors. These include your age, driving record, the make and model of your car, the area where you live, and even your credit score. For instance, younger drivers or those with a history of accidents or traffic violations may be considered higher-risk, leading to higher premiums.

Additionally, the type of car you drive can significantly impact your insurance costs. High-performance vehicles or luxury cars, for example, are often more expensive to insure due to their higher replacement and repair costs. Similarly, living in an area with a high incidence of accidents or car thefts can push up insurance premiums.

| Insurance Factor | Impact on Premium |

|---|---|

| Age | Younger drivers often pay more |

| Driving Record | Accidents and violations increase costs |

| Vehicle Type | Luxury or high-performance cars are more expensive |

| Location | High-risk areas lead to higher premiums |

| Credit Score | A good credit score can reduce insurance costs |

The Process of Choosing the Right Car Insurance

Selecting the appropriate car insurance policy is a critical decision that requires careful consideration. It involves a delicate balance between the coverage you need and the premium you can afford. Here’s a step-by-step guide to help you make an informed choice.

Assess Your Needs

Start by evaluating your specific needs. Consider factors such as the value of your vehicle, your financial situation, and your personal risk tolerance. If you own an older car with a low market value, you might opt for liability-only coverage to keep costs down. On the other hand, if you have a newer or more expensive vehicle, you’ll likely want more comprehensive coverage to protect your investment.

Research Insurance Providers

Next, research various insurance companies. Look for providers with a solid reputation and financial stability. Check online reviews and ratings to gauge customer satisfaction and the quality of their services. Consider asking friends and family for recommendations, as personal experiences can provide valuable insights.

Compare Policies and Premiums

Obtain quotes from several insurance companies to compare policies and premiums. Pay attention to the coverage limits and exclusions in each policy. Ensure you understand what is and isn’t covered to avoid any unpleasant surprises later. Remember, the cheapest policy might not always be the best option; consider the overall value and reliability of the insurance provider.

Consider Additional Coverages

In addition to the standard liability, collision, and comprehensive coverages, many insurance providers offer a range of optional coverages. These can include rental car reimbursement, roadside assistance, or coverage for custom parts and equipment. Evaluate your needs and consider adding these coverages if they provide valuable protection for your specific situation.

Understand Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. It’s important to understand how deductibles work and how they can impact your overall costs. Higher deductibles typically result in lower premiums, but they also mean you’ll pay more if you need to make a claim. Choose a deductible amount that balances your financial comfort and the level of risk you’re willing to take.

Maximizing Your Car Insurance Coverage

Once you’ve selected your car insurance policy, there are several strategies you can employ to maximize your coverage and potentially reduce your premiums.

Safe Driving Practices

Maintaining a clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid traffic violations and accidents, as these can lead to higher premiums or even policy cancellation. Additionally, consider taking a defensive driving course, which can sometimes result in a discounted rate.

Bundle Your Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurance companies offer discounts for customers who combine policies, so this can be a cost-effective strategy.

Take Advantage of Discounts

Insurance companies often offer various discounts to their customers. These can include safe driver discounts, multi-car discounts, loyalty discounts, or discounts for certain occupations or memberships. Be sure to ask your insurance provider about the discounts they offer and see if you qualify for any.

Maintain Your Vehicle

Proper vehicle maintenance can not only improve your car’s performance and longevity but can also impact your insurance coverage. Well-maintained vehicles are less likely to break down or be involved in accidents, which can lead to fewer claims and lower premiums. Regularly service your car, keep it in good condition, and ensure all safety features are in working order.

The Future of Car Insurance

The car insurance landscape is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of car insurance and how it might impact you.

Telematics and Usage-Based Insurance

Telematics is a technology that uses sensors and GPS to track and record a vehicle’s movement and driving behavior. This data is then used to assess risk and set insurance premiums. Usage-based insurance, or pay-as-you-drive insurance, is a concept that utilizes telematics to offer insurance based on actual driving behavior rather than traditional risk factors. This could potentially benefit safe drivers by offering more affordable premiums.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is set to revolutionize the insurance industry. With self-driving cars, the risk of human error is significantly reduced, potentially leading to a decrease in accidents. This could result in lower insurance premiums for autonomous vehicle owners. However, the liability landscape may also shift, as the responsibility for accidents could move from drivers to vehicle manufacturers or software providers.

Digitalization and Online Insurance

The insurance industry is increasingly moving online, with many providers offering digital platforms for policy management and claims processing. This shift towards digitalization provides convenience and efficiency for customers, allowing them to manage their insurance policies from anywhere. It also opens up opportunities for real-time data analysis and more personalized insurance offerings.

Conclusion

Car insurance is a vital aspect of automotive ownership, offering financial protection and peace of mind. By understanding the basics, carefully selecting your policy, and employing strategic methods to maximize your coverage, you can navigate the complex world of car insurance with confidence. Remember, the right car insurance policy is tailored to your unique needs and circumstances, providing the perfect balance of protection and affordability.

How much does car insurance typically cost?

+The cost of car insurance varies widely based on individual circumstances and the type of coverage chosen. On average, liability-only insurance can range from 500 to 1,500 annually, while full coverage (including collision and comprehensive) can cost 1,000 to 3,000 or more per year. However, these are just estimates, and your actual premium will depend on various factors as discussed earlier.

Can I get car insurance if I have a poor driving record?

+Yes, you can still obtain car insurance with a poor driving record, but it may be more expensive. Insurance companies often charge higher premiums for drivers with accidents or violations on their record, as they are considered higher-risk. However, over time, a clean driving record can help reduce these increased costs.

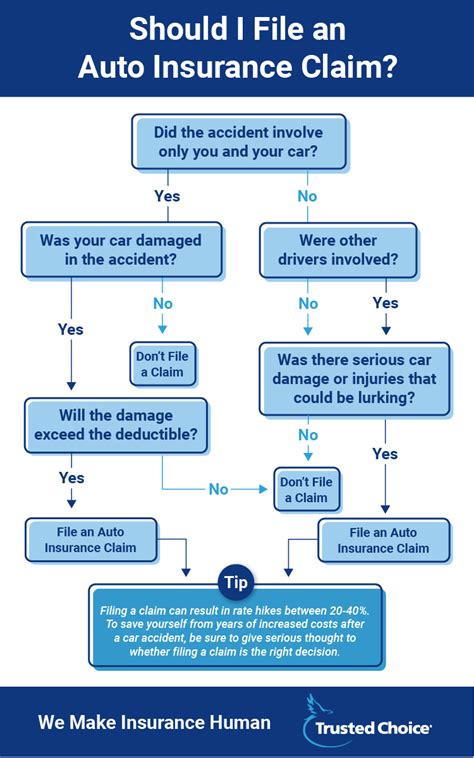

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of all involved. Call the police to report the accident and obtain a police report. Exchange information with the other driver(s), including names, contact details, and insurance information. Take photos of the accident scene and any damage to vehicles. Then, contact your insurance company to report the accident and initiate the claims process.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change. This allows you to ensure your coverage is still adequate and that you’re not paying for unnecessary coverages. Reviewing your policy regularly also gives you an opportunity to take advantage of any discounts you may qualify for.