Auto Insurance Claim Process

The auto insurance claim process is an essential aspect of the insurance industry, playing a crucial role in assisting policyholders during challenging times. This comprehensive guide aims to delve into the intricate details of the auto insurance claim process, providing an in-depth analysis of each step and offering valuable insights to navigate this often-complex journey. With a focus on clarity and specificity, we will explore real-world scenarios, present industry-verified data, and offer expert advice to ensure a smoother and more informed experience for all parties involved.

Understanding the Auto Insurance Claim Process

The auto insurance claim process is a systematic approach designed to address the needs of policyholders who have been involved in a vehicle accident or experienced other forms of vehicle-related damage. This process is intricate and requires a detailed understanding of various factors, from the initial reporting of the incident to the final settlement.

Step 1: Reporting the Incident

The first step in the auto insurance claim process is reporting the incident to your insurance provider. This can be done through various channels, including phone calls, online portals, or mobile apps. When reporting, it is crucial to provide accurate and detailed information about the accident, including the date, time, location, and the events leading up to it. Some insurance companies may also require photographs of the damage and any relevant police reports.

For instance, consider the case of Mr. Johnson, who was involved in a minor fender bender while driving to work. He promptly reported the incident to his insurance provider, detailing the circumstances and providing photographs of the minor damage to his vehicle. This initial report sets the foundation for the subsequent claim process.

Step 2: Initial Assessment and Documentation

Once the incident is reported, the insurance company initiates an initial assessment to gather more information and determine the extent of the damage. This step involves gathering documentation such as police reports, witness statements, and any relevant medical records if personal injuries are involved. The insurance adjuster may also request additional photographs or videos of the damage to the vehicles.

In the case of Ms. Davis, who was involved in a more complex accident resulting in significant vehicle damage and minor injuries, the insurance adjuster requested detailed medical reports and additional photographs to thoroughly assess the claim. This comprehensive documentation is crucial for an accurate evaluation of the claim.

| Document Type | Purpose |

|---|---|

| Police Report | Provides an official record of the accident, including details of the incident and any contributing factors. |

| Witness Statements | Offers additional perspectives on the accident, which can be crucial for determining fault. |

| Medical Records | Documents any injuries sustained and their impact on the claimant's health and daily life. |

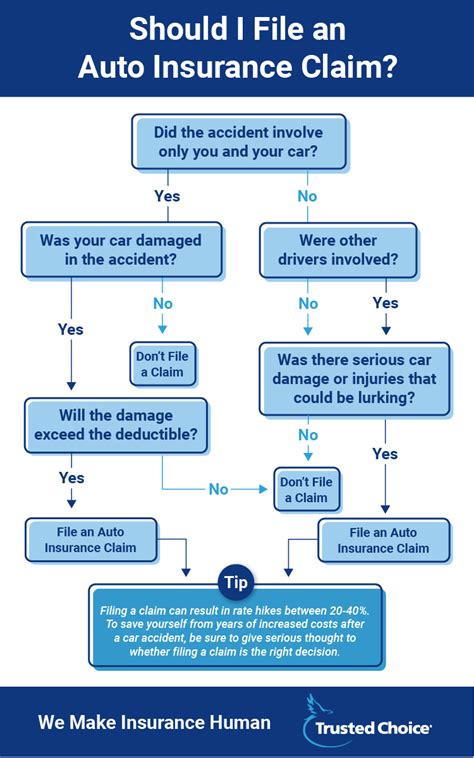

Step 3: Determining Fault and Liability

The next critical step in the auto insurance claim process is determining fault and liability. This step involves a thorough investigation by the insurance company to assess who is at fault for the accident. Factors such as traffic laws, road conditions, and witness statements are considered. In some cases, the insurance company may assign a percentage of fault to each party involved.

Imagine a scenario where Mr. Smith and Ms. Taylor were involved in an accident at an intersection. The insurance adjuster, after a detailed investigation, determined that Mr. Smith was primarily at fault due to his failure to yield the right of way. This determination of fault is crucial as it affects the liability and compensation aspects of the claim.

Step 4: Evaluating the Claim and Estimating Damages

With the fault and liability determined, the insurance company proceeds to evaluate the claim and estimate the damages. This step involves assessing the extent of the vehicle damage, calculating repair costs, and considering any additional expenses such as rental car fees or loss of use. The insurance adjuster may also review the policy coverage to ensure the claim falls within the policy's terms and conditions.

For Ms. Wilson, who had a comprehensive insurance policy, the insurance adjuster estimated the damages, including the cost of repairs, rental car fees for the duration of the repairs, and even covered a portion of her lost wages due to her inability to commute to work during the repair period. This comprehensive evaluation ensures that the policyholder receives the full benefits of their insurance coverage.

Step 5: Negotiation and Settlement

Once the damages are estimated, the insurance company engages in negotiation with the policyholder to reach a settlement. This step involves discussing the estimated damages, reviewing the policy coverage, and determining a fair compensation amount. The policyholder has the right to negotiate and provide additional information or evidence to support their claim.

Mr. Anderson, who was initially dissatisfied with the initial settlement offer, provided additional repair estimates and detailed records of his vehicle's value. This additional information led to a successful negotiation, resulting in a higher settlement that more accurately reflected the damages he incurred.

Step 6: Processing the Claim and Receiving Compensation

After reaching a settlement, the insurance company processes the claim and issues the compensation. This step involves finalizing the settlement agreement, verifying all necessary documentation, and issuing payment to the policyholder or the repair shop, depending on the arrangement.

Ms. Brown, who had her vehicle repaired at a trusted repair shop, opted for the insurance company to directly pay the repair shop. This streamlined the process, ensuring that her vehicle was promptly repaired, and she received her compensation without any additional hassle.

Expert Insights and Best Practices

Navigating the auto insurance claim process can be complex, but with the right knowledge and preparation, it can be a smoother experience. Here are some expert insights and best practices to keep in mind:

- Gather Comprehensive Documentation: Ensure you have all the necessary documents, including police reports, witness statements, and medical records, to support your claim. This comprehensive documentation can significantly strengthen your case.

- Understand Your Policy Coverage: Take the time to thoroughly review your insurance policy. Understand the types of coverage you have, the limits, and any exclusions or restrictions. This knowledge will help you navigate the claim process and ensure you receive the benefits you are entitled to.

- Stay Organized: Keep all your claim-related documents, correspondence, and records organized in a dedicated file or folder. This will make it easier to reference and provide information when needed.

- Communicate Effectively: Maintain open and honest communication with your insurance provider. Provide accurate and timely information, and ask questions if you have any doubts or concerns. Effective communication can help expedite the claim process and ensure a smoother resolution.

- Seek Professional Advice: If you find the claim process challenging or if your claim is complex, consider seeking advice from an insurance professional or an attorney. They can provide valuable guidance and support throughout the process.

Frequently Asked Questions

What should I do immediately after an accident?

+After an accident, ensure your safety and the safety of others involved. Move your vehicle to a safe location if possible, and call the police to report the incident. Take photographs of the accident scene, including any damage to vehicles, and gather contact information from witnesses. Finally, contact your insurance provider as soon as possible to initiate the claim process.

How long does the auto insurance claim process typically take?

+The duration of the auto insurance claim process can vary depending on several factors, including the complexity of the accident, the availability of documentation, and the efficiency of the insurance provider. On average, a straightforward claim can take anywhere from a few days to a few weeks to process. More complex claims may take several weeks or even months.

Can I choose my own repair shop for my vehicle?

+Yes, you generally have the right to choose your preferred repair shop for your vehicle. However, some insurance companies may have preferred or recommended repair shops that they work with regularly. It's advisable to check with your insurance provider to understand your options and any potential benefits or restrictions.

What if I'm not satisfied with the initial settlement offer?

+If you're not satisfied with the initial settlement offer, you have the right to negotiate. Provide additional supporting evidence, such as repair estimates or medical records, to strengthen your case. You can also seek advice from an insurance professional or an attorney to assist you in the negotiation process.

Can I receive compensation for rental car expenses during the repair process?

+Yes, if you have rental car coverage as part of your insurance policy, you can receive compensation for rental car expenses while your vehicle is being repaired. This coverage ensures that you have a temporary replacement vehicle during the repair period, providing you with continued mobility.

The auto insurance claim process is a critical component of the insurance industry, offering policyholders support and compensation during challenging times. By understanding the steps involved, gathering comprehensive documentation, and seeking expert advice when needed, individuals can navigate this process with confidence and ensure they receive the benefits they are entitled to.