Term Life Insurance Versus Whole Life Insurance

Navigating the world of insurance policies can be a daunting task, especially when it comes to choosing between term life insurance and whole life insurance. These two types of policies have distinct features and cater to different needs, making it crucial to understand their nuances before making a decision. In this comprehensive guide, we delve into the intricacies of both, offering a clear comparison to assist you in making an informed choice.

Term Life Insurance: A Comprehensive Overview

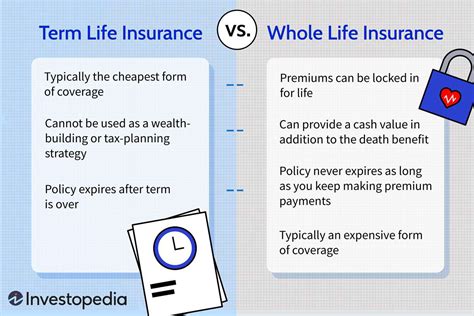

Term life insurance is a type of coverage that provides protection for a specific period, often ranging from 10 to 30 years. It is designed to offer financial support to your loved ones in the event of your untimely demise during the policy term. Here's a closer look at its key features and advantages.

Features and Benefits

Affordability: One of the primary advantages of term life insurance is its cost-effectiveness. Compared to whole life insurance, term policies offer a higher coverage amount at a significantly lower premium. This makes it an attractive option for individuals with budget constraints who seek substantial protection for their families.

Flexibility: Term life insurance policies come in various terms, allowing you to choose the coverage duration that aligns with your specific needs. Whether you're looking for coverage until your children reach adulthood, you retire, or you pay off your mortgage, there's a term length to match.

Renewability: Most term life insurance policies are renewable, meaning you can extend the coverage beyond the initial term. This provides flexibility and ensures you can maintain coverage even as your life circumstances change.

Convertibility: Many term life insurance policies offer the option to convert your term policy into a permanent life insurance policy, such as a whole life or universal life policy, without undergoing a medical exam. This feature can be beneficial if your financial situation or family needs evolve, allowing you to transition to a more comprehensive coverage type without facing potential health-related obstacles.

How Term Life Insurance Works

Term life insurance policies pay out a death benefit to your beneficiaries only if you pass away during the policy term. If you outlive the term, the policy expires, and no benefit is paid. It's important to note that term life insurance does not accumulate cash value, unlike whole life insurance, which we'll explore in the next section.

When to Choose Term Life Insurance

Term life insurance is an ideal choice for individuals with temporary financial needs or specific goals. For instance, if you have young children and want to ensure their financial security until they become independent, a term life insurance policy can provide the necessary coverage. It's also a suitable option for those who want to cover a mortgage or other debts that have a defined repayment period.

Whole Life Insurance: A Permanent Protection Plan

Whole life insurance, also known as permanent life insurance, offers lifelong coverage, ensuring your beneficiaries receive a death benefit whenever you pass away. Unlike term life insurance, whole life insurance policies accumulate cash value over time, making them a popular choice for those seeking both protection and an investment vehicle.

Key Characteristics of Whole Life Insurance

Guaranteed Protection: Whole life insurance policies provide lifelong coverage, guaranteeing that your beneficiaries will receive a death benefit regardless of when you pass away. This makes it an attractive option for individuals who want peace of mind knowing their loved ones are financially protected throughout their lives.

Cash Value Accumulation: One of the standout features of whole life insurance is its cash value component. A portion of your premium payments goes towards building up a cash value account, which grows tax-deferred over time. This cash value can be borrowed against or withdrawn to meet various financial needs, such as paying for college tuition, supplementing retirement income, or covering unexpected expenses.

Guaranteed Premiums: Whole life insurance policies offer guaranteed premiums, meaning the amount you pay remains the same throughout your life. This predictability can be beneficial for budgeting and long-term financial planning.

Understanding Whole Life Insurance Policies

Whole life insurance policies are structured with a combination of a death benefit and a cash value component. The death benefit is the amount your beneficiaries receive upon your passing, while the cash value grows over time, providing a savings element to the policy.

The cash value accumulation rate is typically lower than what you could achieve through other investment vehicles, but it offers the advantage of being guaranteed and protected. The policy also includes a cost of insurance (COI), which is the expense the insurance company incurs to provide coverage and manage the policy.

When to Opt for Whole Life Insurance

Whole life insurance is an excellent choice for individuals seeking long-term financial protection and an investment component. It's particularly beneficial for those who want to leave a legacy for their heirs, as the cash value can be passed on to beneficiaries tax-free. Additionally, whole life insurance can be a strategic tool for estate planning and business succession planning.

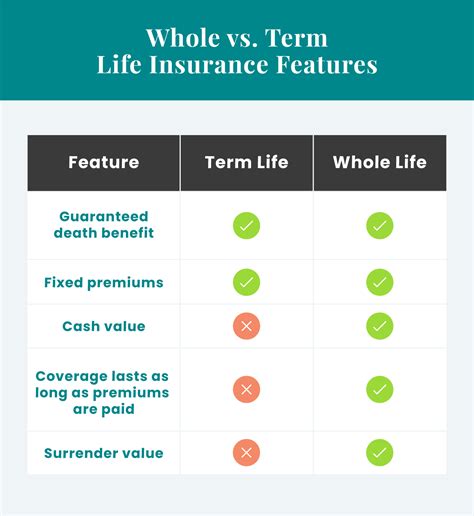

Comparing Term Life and Whole Life Insurance

Now that we've explored the features and benefits of both term life and whole life insurance, let's delve into a direct comparison to help you make an informed decision.

| Criteria | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | 10 to 30 years (renewable) | Lifelong coverage |

| Premium Cost | Lower initial cost | Higher initial cost |

| Cash Value | No cash value accumulation | Accumulates cash value |

| Flexibility | Flexible term lengths | Fixed coverage and premiums |

| Benefit Payment | Death benefit paid only if you pass away during the term | Death benefit paid whenever you pass away |

| Investment Component | None | Cash value acts as an investment vehicle |

| Suitable For | Individuals with temporary financial needs or specific goals | Those seeking lifelong protection and an investment option |

Choosing the Right Option for You

The decision between term life and whole life insurance depends on your unique financial situation, goals, and needs. If you have specific financial obligations that will expire over time, such as child-rearing expenses or mortgage payments, term life insurance may be the more cost-effective choice. On the other hand, if you're looking for lifelong protection and the opportunity to build wealth through an investment vehicle, whole life insurance could be the better fit.

It's essential to evaluate your financial goals, assess your risk tolerance, and consider your long-term plans when deciding between these two insurance types. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance tailored to your specific circumstances.

Frequently Asked Questions

Can I switch from term life insurance to whole life insurance later in life?

+Yes, many term life insurance policies offer a conversion option, allowing you to switch to a whole life or permanent life insurance policy without undergoing a new medical exam. However, the conversion must typically be done within a certain timeframe, so it's essential to review your policy's terms carefully.

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I outlive my term life insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you outlive your term life insurance policy, the coverage expires, and no death benefit is paid. However, if your policy offers a renewable option, you may have the opportunity to extend the coverage for an additional term, often at a higher premium.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I borrow against the cash value of my whole life insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, one of the advantages of whole life insurance is the ability to borrow against the cash value. This provides a flexible financing option, but it's essential to understand the potential tax implications and the impact on your policy's death benefit.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How does the cost of term life insurance compare to whole life insurance over the long term?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While term life insurance has a lower initial cost, whole life insurance's premiums remain the same throughout your life. Over a long period, whole life insurance can become more cost-effective due to its guaranteed premiums and the potential for cash value accumulation. However, this depends on individual circumstances and the specific policies in question.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits associated with whole life insurance policies?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, whole life insurance policies offer tax advantages. The cash value growth within the policy is tax-deferred, and if the policy is held until death, the death benefit is typically paid to beneficiaries tax-free. However, it's important to consult with a tax professional to understand the specific tax implications in your situation.</p>

</div>

</div>

</div>

Making a decision between term life and whole life insurance is a significant financial step. By understanding the unique features and benefits of each, you can choose the option that best aligns with your financial goals and provides the level of protection you desire for your loved ones.