Are Insurance Premiums Deductible

In the complex world of taxes and financial planning, understanding the deductibility of insurance premiums is a crucial aspect for individuals and businesses alike. This comprehensive guide aims to unravel the intricacies of insurance premium deductibility, providing clarity and insight into this often-confusing topic.

Understanding Insurance Premium Deductibility

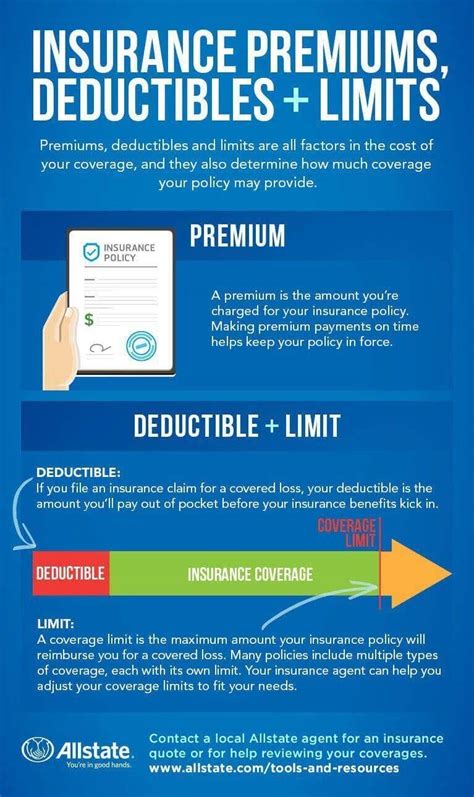

Insurance premiums are payments made to insurance companies to secure coverage for various risks, such as health, life, property, or liability. Whether these premiums are deductible from one’s taxable income depends on the type of insurance, the nature of the policyholder, and the tax regulations of the jurisdiction.

In many cases, insurance premiums are considered a personal expense and are not deductible. However, there are specific scenarios where insurance premiums can be claimed as a tax deduction, offering significant financial benefits to the policyholder.

Health Insurance Premiums

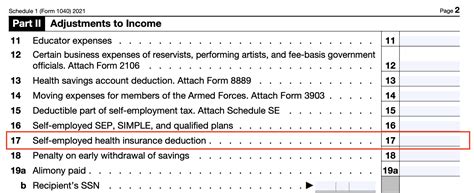

Health insurance premiums are a common concern for individuals and families. In the United States, the deductibility of health insurance premiums largely depends on whether the insurance is obtained through an employer-sponsored plan or purchased individually.

For employer-sponsored health insurance, the premiums are typically paid with pre-tax dollars, meaning they are not included in the employee's taxable income. This is a benefit provided by many employers and is often a significant advantage for employees.

On the other hand, if health insurance is purchased individually, the deductibility rules can vary. In certain situations, individuals may be able to deduct a portion or all of their health insurance premiums from their taxable income, especially if they are self-employed or have certain medical conditions. However, these deductions are subject to specific conditions and limitations set by the Internal Revenue Service (IRS) and may change annually.

| Health Insurance Type | Deductibility |

|---|---|

| Employer-Sponsored | Premiums paid with pre-tax dollars, not deductible |

| Individual Plans | May be deductible for self-employed individuals or those with specific conditions; subject to IRS guidelines |

Life Insurance Premiums

Life insurance premiums are generally not deductible for individuals. However, there are exceptions for certain types of life insurance policies, particularly those that are considered business expenses.

For instance, if a business owner purchases a life insurance policy on themselves or their employees as a form of business protection or as an employee benefit, the premiums may be deductible as a business expense. This is especially true if the policy is part of a pension or profit-sharing plan.

Additionally, if a business owner takes out a life insurance policy as collateral for a business loan, the premiums can be deductible as an interest expense. These deductions are subject to IRS guidelines and specific conditions, and it's essential to consult a tax advisor for personalized guidance.

Property and Liability Insurance Premiums

Property and liability insurance premiums can be deductible for businesses and, in some cases, for individuals. For businesses, these premiums are often considered ordinary and necessary business expenses and can be deducted from taxable income.

For individuals, property insurance premiums, such as homeowners or renters insurance, are typically not deductible unless the property is used for business purposes. In such cases, the portion of the property used for business can make the insurance premiums deductible as a business expense.

Similarly, liability insurance premiums, such as those for personal liability or umbrella policies, are generally not deductible for individuals. However, if the liability insurance is directly related to a business activity, the premiums may be deductible as a business expense.

| Insurance Type | Deductibility for Individuals | Deductibility for Businesses |

|---|---|---|

| Life Insurance | Generally not deductible; exceptions for business-related policies | Deductible as a business expense in certain cases |

| Property Insurance | Not deductible unless used for business purposes | Deductible as a business expense |

| Liability Insurance | Not deductible unless related to business activity | Deductible as a business expense |

Tax Strategies and Planning

Understanding the deductibility of insurance premiums can significantly impact tax planning strategies. For individuals, deducting insurance premiums can lower taxable income, resulting in potential tax savings. For businesses, deducting insurance premiums can reduce the overall tax burden, providing more capital for growth and operations.

However, it's essential to note that deducting insurance premiums is subject to strict IRS guidelines and regulations. Misunderstanding or misapplication of these rules can lead to penalties and interest charges. Therefore, it's crucial to seek professional advice when considering the deductibility of insurance premiums.

Professional Advice

Tax laws and regulations are complex and subject to frequent changes. To ensure compliance and maximize potential tax benefits, it’s advisable to consult with a qualified tax professional or accountant who specializes in insurance premium deductibility. They can provide personalized guidance based on your specific situation and ensure that you’re taking advantage of all applicable deductions.

Record Keeping

Proper record keeping is essential when claiming insurance premium deductions. This includes maintaining accurate records of premium payments, policy details, and any supporting documentation. These records can be crucial in supporting your tax deductions and may be required if your tax return is selected for an audit.

Conclusion

Insurance premium deductibility is a complex but vital aspect of tax planning. By understanding the deductibility rules for different types of insurance premiums, individuals and businesses can optimize their financial strategies and potentially save on taxes. However, given the intricacies and frequent changes in tax laws, seeking professional advice is highly recommended to ensure compliance and maximize benefits.

Can I deduct health insurance premiums if I pay them myself and not through an employer-sponsored plan?

+Yes, in certain circumstances, you may be able to deduct a portion or all of your health insurance premiums if you purchase an individual plan. However, this is subject to specific conditions set by the IRS and may change annually. It’s advisable to consult a tax professional for guidance.

Are life insurance premiums ever deductible for individuals?

+Generally, life insurance premiums are not deductible for individuals. However, there are exceptions for certain types of life insurance policies, particularly those that are considered business expenses. It’s important to consult a tax advisor to understand the specific conditions and guidelines.

Can I deduct my property insurance premiums as an individual if I rent an apartment for personal use?

+No, property insurance premiums for personal use are typically not deductible. However, if you use a portion of your property for business purposes, the corresponding portion of your insurance premiums may be deductible as a business expense.