Cheap Car Insurance Car

In today's world, finding affordable car insurance is a top priority for many vehicle owners. With the rising costs of living and the ever-increasing expenses associated with vehicle ownership, getting cheap car insurance has become a crucial aspect of financial planning. This comprehensive guide aims to explore the world of affordable car insurance, providing expert insights and practical tips to help you secure the best coverage at the most economical rates.

Understanding Cheap Car Insurance

Cheap car insurance refers to policies that offer adequate coverage at a lower premium compared to standard insurance plans. While the term “cheap” might suggest inferior coverage, it is essential to understand that affordable car insurance can provide comprehensive protection without breaking the bank. The key lies in knowing how to navigate the insurance market, understand your specific needs, and make informed choices.

The insurance landscape is diverse, with numerous providers offering a wide range of policies. By researching and comparing these options, you can identify the best deals that align with your coverage requirements and budget constraints.

Factors Influencing Insurance Rates

Insurance premiums are determined by a variety of factors, each playing a significant role in the overall cost of your policy. Understanding these factors can help you make strategic decisions to reduce your insurance expenses.

- Vehicle Type and Usage: The make, model, and year of your vehicle impact insurance rates. Additionally, the purpose for which you use your car (e.g., personal, commercial, or pleasure) can also influence premiums. For instance, vehicles used for business purposes may attract higher rates due to increased risk exposure.

- Driver Profile: Your age, gender, driving history, and location are key considerations for insurance providers. Younger drivers, especially those under 25, often face higher premiums due to their perceived higher risk. Similarly, individuals with a history of accidents or traffic violations may also be charged more.

- Coverage Options: The level of coverage you choose directly affects your premium. Comprehensive coverage, which includes protection for various scenarios like accidents, theft, and natural disasters, typically costs more than basic liability coverage. It's crucial to strike a balance between your coverage needs and your budget.

- Discounts and Rewards: Many insurance companies offer discounts to incentivize certain behaviors or to reward loyal customers. Common discounts include safe driving incentives, multi-policy discounts (when you bundle car insurance with other policies like home insurance), and loyalty rewards for long-term customers.

Tips for Finding Affordable Car Insurance

Securing cheap car insurance requires a combination of research, strategic planning, and an understanding of your specific needs. Here are some expert tips to help you navigate the process effectively:

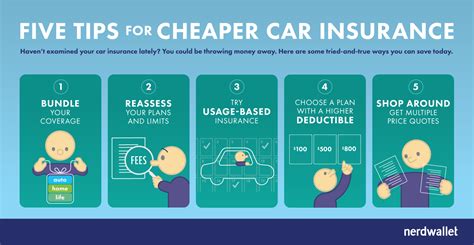

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five insurers can give you a good range of options to choose from. Online comparison tools and insurance brokers can streamline this process, making it easier to compare policies and premiums.

Understand Your Coverage Needs

Before seeking insurance quotes, take the time to understand your specific coverage needs. Consider factors like your vehicle’s value, your financial situation, and the potential risks you face. For instance, if you own an older vehicle, you might opt for liability coverage instead of comprehensive coverage, as the latter may not be cost-effective for an older car.

Explore Discount Opportunities

Insurance companies often offer a variety of discounts to attract and retain customers. Some common discounts include safe driver discounts, good student discounts (for young drivers with good academic records), and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for specific professions or membership in certain organizations. Explore these opportunities to see if you qualify for any savings.

Consider Higher Deductibles

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a higher deductible, you essentially share more of the financial risk with your insurer, which can result in lower premiums. However, it’s important to choose a deductible amount that you can afford in the event of a claim.

Bundle Your Policies

If you have multiple insurance needs, such as car, home, or renters’ insurance, consider bundling these policies with the same insurer. Many insurance companies offer multi-policy discounts, which can result in significant savings. Bundling your policies not only simplifies your insurance management but also ensures that you receive coordinated coverage and potentially better rates.

Maintain a Good Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or violations may result in higher rates or even non-renewal of your policy. Maintaining a safe driving record not only helps you save on insurance but also contributes to your overall safety on the road.

Review Your Policy Regularly

Insurance needs can change over time, so it’s essential to review your policy annually or whenever your circumstances change. Life events like getting married, buying a new car, or moving to a different location can impact your insurance requirements. Regularly reviewing your policy ensures that your coverage remains adequate and that you’re not paying for unnecessary coverage.

The Role of Technology in Affordable Insurance

Advancements in technology have revolutionized the insurance industry, making it easier for consumers to access affordable car insurance. Online platforms and mobile apps offer convenient ways to compare policies, obtain quotes, and manage your insurance needs.

Telematics and Usage-Based Insurance

Telematics technology, which uses devices or smartphone apps to track driving behavior, has introduced a new approach to car insurance known as usage-based insurance (UBI). With UBI, insurance premiums are determined based on your actual driving habits, such as mileage, driving speed, and braking patterns. This data-driven approach rewards safe drivers with lower premiums, as it takes into account their individual driving behavior rather than relying solely on demographic factors.

Digital Tools for Policy Management

Digital tools and platforms have made it simpler to manage your car insurance policy. Many insurers now offer online portals or mobile apps where policyholders can view their coverage details, make payments, file claims, and access policy documents. These digital tools enhance convenience and efficiency, allowing you to manage your insurance needs at your fingertips.

Online Comparison and Education

The internet has empowered consumers by providing easy access to a wealth of information about car insurance. Online resources, including comparison websites and educational platforms, offer valuable insights into insurance coverage, policies, and industry trends. These resources can help you make informed decisions and understand the factors that influence insurance rates, ensuring you get the best value for your money.

Future Trends in Affordable Car Insurance

The car insurance landscape is continually evolving, driven by technological advancements, changing consumer needs, and regulatory developments. Here are some future trends to watch out for in the quest for affordable car insurance:

Increased Personalization

Personalization in car insurance is expected to become more prevalent. Insurers are increasingly leveraging data analytics and machine learning to offer tailored insurance products that meet the unique needs of individual policyholders. This shift towards personalized insurance can lead to more efficient risk assessment and potentially lower premiums for policyholders.

Adoption of Autonomous Vehicles

The rise of autonomous vehicles (AVs) is likely to have a significant impact on car insurance. As AV technology advances and becomes more widespread, the risk profile of car ownership may shift. With AVs potentially reducing the number of accidents caused by human error, insurance rates could decrease over time. However, the transition to AVs will also present new challenges and opportunities for the insurance industry, such as the need to insure the technology itself.

Integration of Health and Wellness Data

Insurers are exploring ways to integrate health and wellness data into car insurance policies. By understanding the health and lifestyle factors of policyholders, insurers can offer more accurate risk assessments and potentially provide incentives for healthier lifestyles. This integration of health data could lead to more personalized insurance plans and, in some cases, lower premiums for policyholders who maintain healthy habits.

Sustainability and Green Initiatives

The push for sustainability and environmental consciousness is expected to influence the car insurance industry. Insurers may offer incentives or discounts to policyholders who adopt green practices, such as driving electric or hybrid vehicles or participating in carpooling initiatives. This trend aligns with the growing global focus on sustainability and could encourage more environmentally friendly behaviors among car owners.

| Insurers | Premiums |

|---|---|

| Insurer A | $450/month |

| Insurer B | $520/month |

| Insurer C | $380/month |

Conclusion

Securing cheap car insurance is a multifaceted process that involves understanding your needs, researching the market, and making informed choices. By leveraging the power of technology, exploring discount opportunities, and staying abreast of industry trends, you can navigate the insurance landscape effectively and find affordable coverage that meets your requirements. Remember, the key to cheap car insurance is not just about low premiums but also about finding the right balance between cost and comprehensive protection.

Can I get cheap car insurance with a poor driving record?

+While a poor driving record can lead to higher insurance premiums, it’s still possible to find affordable coverage. Some insurers specialize in providing insurance for high-risk drivers, offering competitive rates despite past violations. Additionally, improving your driving record over time can lead to reduced premiums.

How often should I review my car insurance policy?

+It’s advisable to review your car insurance policy annually or whenever your circumstances change. Regular reviews ensure that your coverage remains adequate and that you’re not paying for unnecessary features. Life events like getting married, buying a new car, or moving to a different location can impact your insurance needs.

What are some common car insurance discounts I should look for?

+Common car insurance discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. Additionally, some insurers offer discounts for specific professions or membership in certain organizations. It’s worth exploring these opportunities to see if you qualify for any savings.

How can I get cheap car insurance if I’m a young driver?

+As a young driver, you may face higher insurance premiums due to your perceived higher risk. However, you can still find affordable coverage by maintaining a clean driving record, exploring good student discounts, and considering usage-based insurance (UBI) options. UBI policies reward safe driving habits with lower premiums.

What is the role of technology in helping me find cheap car insurance?

+Technology plays a significant role in making cheap car insurance more accessible. Online platforms and mobile apps offer convenient ways to compare policies, obtain quotes, and manage your insurance needs. Additionally, telematics technology and usage-based insurance (UBI) policies use data-driven approaches to reward safe drivers with lower premiums.