Proof Of Insurance Dmv

In the realm of transportation and vehicle ownership, understanding the significance of proof of insurance, especially when interacting with the Department of Motor Vehicles (DMV), is crucial. This document serves as a critical link between vehicle owners and the legal requirements of maintaining adequate insurance coverage. As we delve into the specifics, we will explore the various aspects of proof of insurance, its importance, and how it intersects with DMV procedures.

Understanding Proof of Insurance

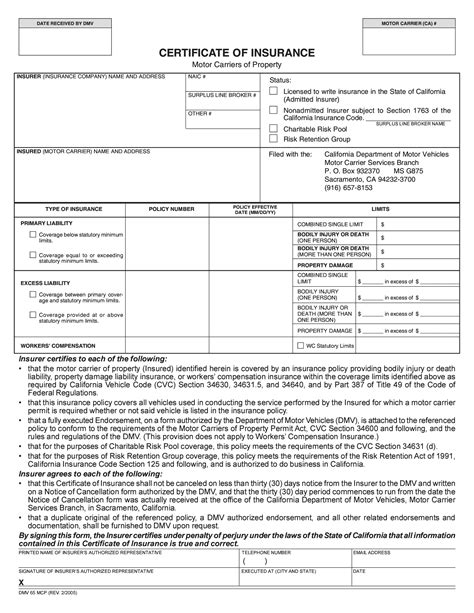

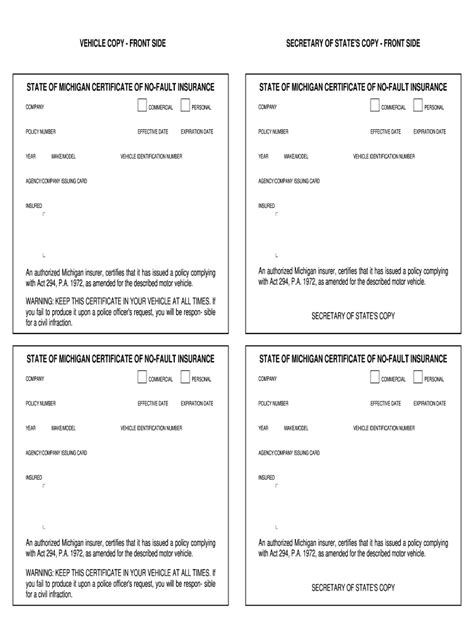

Proof of insurance is a legal document that confirms the existence of an active insurance policy covering a specific vehicle. It is a tangible representation of the financial protection provided by an insurance company to the vehicle owner in the event of accidents, theft, or other covered incidents. This document is essential not only for vehicle owners but also for law enforcement agencies and government bodies like the DMV.

The Purpose and Types of Proof of Insurance

The primary purpose of proof of insurance is to demonstrate compliance with state laws and regulations. Every state has its own minimum insurance requirements, and proof of insurance is the means by which vehicle owners can show they meet these standards. The most common types of insurance coverage include liability, collision, comprehensive, and personal injury protection (PIP), each catering to different scenarios and offering varying levels of protection.

| Insurance Type | Coverage |

|---|---|

| Liability | Covers bodily injury and property damage caused to others by the insured vehicle. |

| Collision | Pays for repairs to the insured vehicle after an accident, regardless of fault. |

| Comprehensive | Covers damage to the insured vehicle caused by events other than collisions, such as theft, fire, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for the insured driver and passengers, regardless of fault. |

While these are the standard types of coverage, the specifics can vary greatly based on state laws and individual insurance policies. It's essential for vehicle owners to understand the coverage types and limits included in their policy.

The Role of Proof of Insurance at the DMV

The DMV plays a pivotal role in ensuring road safety and compliance with insurance laws. Proof of insurance is a critical component of the DMV’s operations, as it is often a prerequisite for various vehicle-related services and procedures.

DMV Transactions Requiring Proof of Insurance

There are numerous interactions with the DMV that necessitate the presentation of proof of insurance. These include:

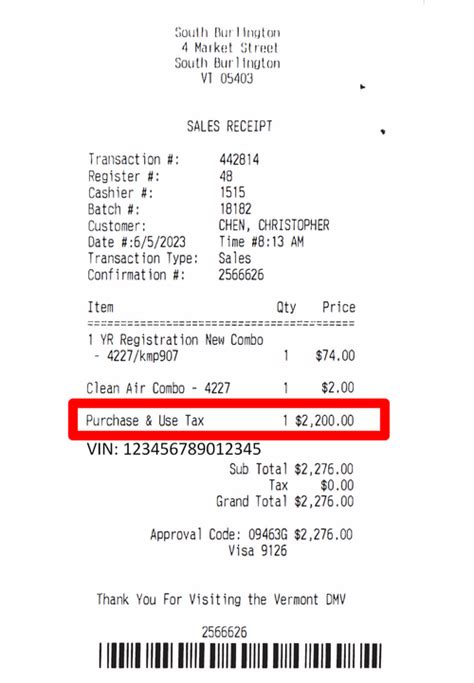

- Vehicle Registration: When registering a new vehicle or renewing an existing registration, proof of insurance is typically required. This ensures that all vehicles on the road have the necessary financial backing to cover potential damages.

- Driver's License Renewal: In some states, proof of insurance is also required when renewing a driver's license. This practice reinforces the importance of maintaining continuous insurance coverage.

- Title Transfers: When purchasing a vehicle from a private seller, providing proof of insurance is often a requirement to complete the title transfer process.

- Vehicle Inspections: In states that require regular vehicle inspections, proof of insurance may be requested alongside other vehicle-related documents.

The Consequences of Lack of Proof

Failing to provide proof of insurance during DMV transactions can lead to serious repercussions. These may include:

- Registration Rejection: The DMV may refuse to process vehicle registration or renewal if proof of insurance is not presented.

- Driver's License Suspension: In some states, driving without proof of insurance can result in the suspension of the driver's license.

- Fines and Penalties: Law enforcement officers can issue citations for driving without insurance, which often carry hefty fines.

- Legal Action: In extreme cases, individuals may face legal action for repeated offenses or for causing an accident without insurance.

The Future of Proof of Insurance and DMV Interaction

As technology advances, the way proof of insurance is presented and verified is evolving. Many states are moving towards digital proof of insurance, allowing vehicle owners to present their insurance information electronically, often through mobile apps or digital wallets. This shift towards digitization aims to streamline processes and enhance efficiency in DMV transactions.

Benefits of Digital Proof of Insurance

Digital proof of insurance offers several advantages:

- Convenience: Vehicle owners can easily access their insurance information from their smartphones or digital devices, eliminating the need to carry physical documents.

- Real-Time Updates: Digital platforms can provide real-time updates on insurance policies, ensuring that the information presented is always current.

- Data Security: Digital systems often employ advanced security measures to protect sensitive insurance information.

- Environmental Sustainability: By reducing the reliance on paper documents, digital proof of insurance contributes to environmental conservation efforts.

Potential Challenges

Despite the benefits, the transition to digital proof of insurance is not without its challenges. These include ensuring widespread access to digital platforms, addressing concerns related to data privacy and security, and providing alternatives for individuals who may not have access to digital devices.

Conclusion

Proof of insurance is an indispensable aspect of vehicle ownership and road safety. Its role in DMV procedures underscores the importance of maintaining adequate insurance coverage. As we navigate the evolving landscape of transportation and technology, understanding the current and future roles of proof of insurance is crucial for vehicle owners, insurance providers, and government agencies alike.

FAQ

Can I provide a digital proof of insurance instead of a physical document to the DMV?

+Yes, many states now accept digital proof of insurance. However, it’s essential to check with your local DMV or insurance provider to ensure that your digital proof is valid and accepted.

What happens if I don’t have proof of insurance when registering my vehicle at the DMV?

+If you don’t provide proof of insurance during vehicle registration, your registration may be rejected. You may also face fines or penalties for driving without insurance.

Are there any exceptions to the proof of insurance requirement for vehicle registration?

+In some states, there may be exceptions for certain types of vehicles or situations. For instance, some states exempt classic cars or vehicles that are not driven on public roads from insurance requirements. However, these exceptions vary widely by state, so it’s crucial to check your local regulations.